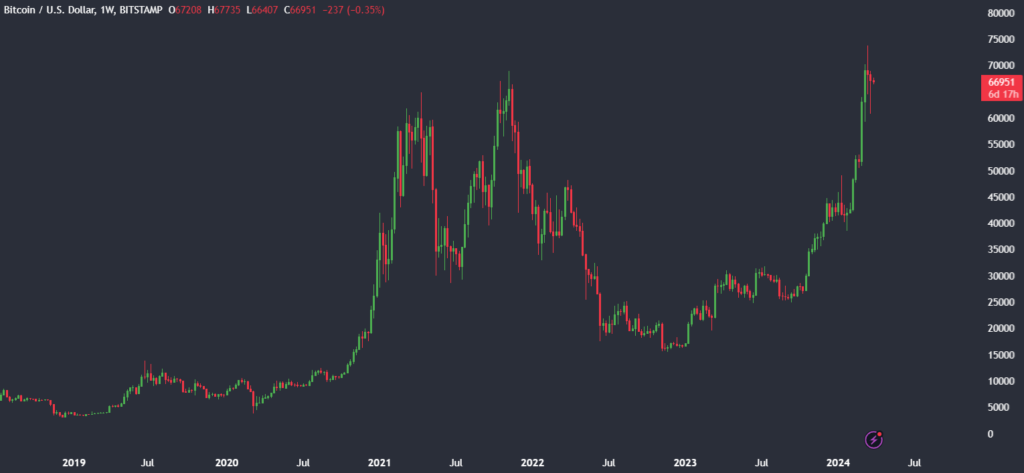

Last week was a tough week for Bitcoin. At one point, the cryptocurrency’s price dropped to a low of 60,700, falling from a record high of 73,000 earlier in the month.

- Bitcoin fell to 60,700 last week on BTC ETF net outflows

- BTC/USD rebounds at the start of the week

- Less than a month to the halving event

- Central Bank’s kick off the easing cycle

Volatility in the crypto market has been high, and on Friday, the Bitcoin price once again tumbled below 63,000 from 67,000 in just a few hours. The selloff was not just in Bitcoin but rippled out across the broader crypto market, with Solana dropping 10% at one point.

Friday’s fall in Bitcoin came after a 10% rally on Wednesday after a more dovish than expected Federal Reserve meeting. Despite hotter-than-expected inflation for the previous two months, the Fed still signaled three rate cuts this year. However, the improved market mood and record highs in equity markets weren’t sufficient to sustain the cryptocurrency rally. Bitcoin fell shy of 2% last week, its second straight week of losses.

BTC ETF outflows

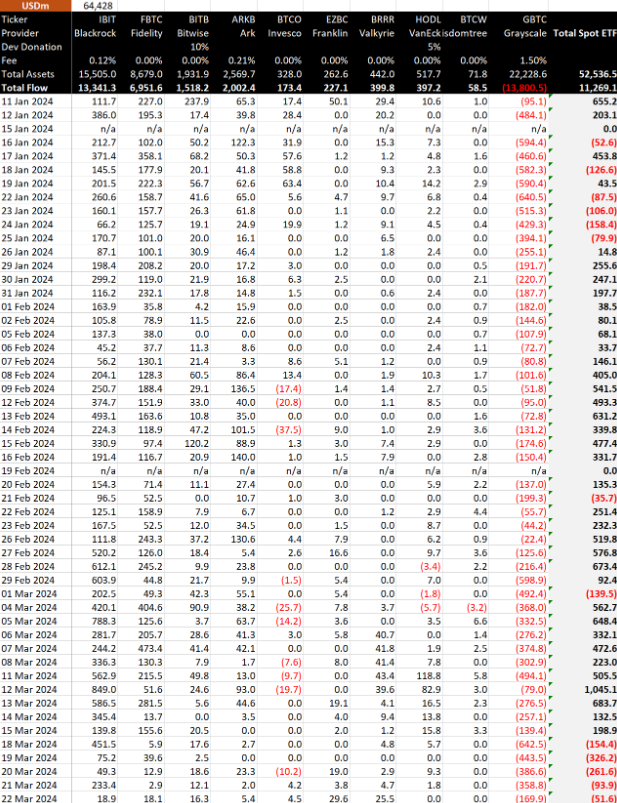

Inflows into Bitcoin ETFs, which had helped drive the Bitcoin price to a record high, reversed last week. At its maximum, investor demand saw the ETF set a new record for trading exchange-traded funds in the US. However, the ETFS set a negative record of five straight days of outflows, outdoing the four-day run seen in January.

According to BitMEX Research, the ETFs posted outflows of $154.4 million, $326.2 million, $261.6 million, $261.6 million, $93.1 million, and $51.6 million. To clarify, all the funds except for Grayscale Bitcoin Trust (GBTC) saw inflows, but these were insufficient to offset the vast outflows from GBTC, which set a new record for the most daily outflows. Last Monday, the GBTC, the world’s largest crypto asset manager, saw a record high redemptions of over $642 million.

Grayscale has seen daily outflows since its launch, so the moves out of Grayscale last week weren’t that surprising. What was more attention-grabbing was the weak inflows into other spot ETFs, such as Blackrock and Fidelity. These ETFs’ huge inflows had previously offset outflow from GBTC. The data suggests that institutional investor interest could be waning,

Can Bitcoin price recover to fresh record highs?

The critical question is whether BTC/USD can recover to record highs. The price is starting the week off on the front foot. However, continuing outflows from spot Bitcoin ETFs could keep pressure on Bitcoin price.

After the strong outflows last week, the coming days could be critical in determining Bitcoin’s next move. The ETFs have seen the initial pent-up capital that has come in; what happens next could be vital in understanding the longer-term demand outlook.

A further decline in the price is still possible, but the lower price could reignite demand, giving the next leg higher.

Halving & Easing

The rebound in Bitcoin’s price back to 67,000 at the start of this week could be anticipated by the halving event. With the event now less than a month away, halving optimism and FOMO could help drive the price back towards all-time highs.

It’s also worth remembering that Bitcoin is likely being supported by macro factors that appear to be aligning bullishly. The Swiss National Bank unexpectedly cut rates the previous week, kicking off the global easing cycle. The Central Bank of Mexico cut rates as well. The Fed, BoE, and ECB have also laid the groundwork for an easing cycle to begin in the coming months, which should support risk sentiment and demand for riskier assets.

Sources

https://twitter.com/BitMEXResearch/status/1771465855680823612/photo/1

https://cointelegraph.com/news/bitcoin-etf-demand-could-rise-as-prices-drop-crypto-analyst-suggests

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.