- Ether surged 30% over the past 7 days

- PEPE rises as investors look to gain exposure to ETH

- PEPE rises to ALT and flips Litecoin to the 20th largest altcoin.

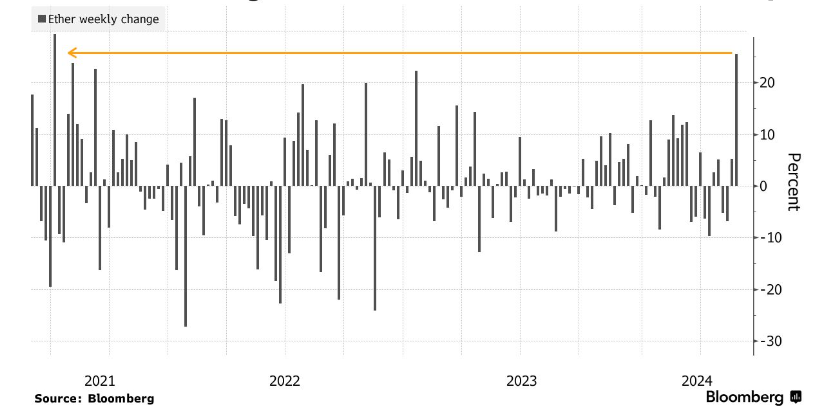

Ether, despite trading slightly lower today, has retained the bulk of its gains following a remarkable 30% surge over the past week. This surge, which saw ETH climb from $3050 to a peak of 3973, was largely driven by the market’s optimism surrounding the Securities and Exchange Commission’s approval of the spot Ether ETF. Notably, this surge represents the largest weekly advance for the second-largest cryptocurrency since the 2021 crypto bull market, underscoring its significance in the current market landscape.

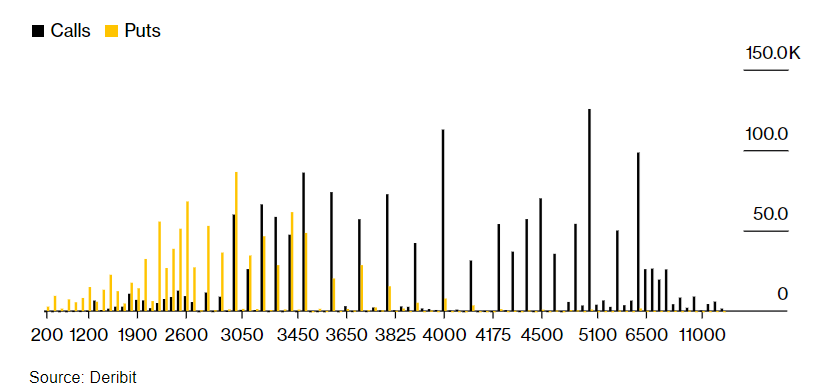

While further SEC approvals are still required for issuers like BlackRock and Fidelity Investments to launch ETH ETF products, this regulatory process has not deterred some traders. In fact, data indicates that a significant number of bullish options bets are being placed, suggesting a potential rise in Ether’s value to $5000 or even higher. This demonstrates the market’s anticipation of the future impact of SEC approvals on the cryptocurrency market.

That said, if demand for futures on the CME Group is viewed as insight into potential US institutional demand for regulated crypto exposure, it is worth noting that the level of open interest is rising for Ether futures but is still much smaller than for Bitcoin futures. This suggests that ETH ETFs will likely see a lower level of participation, too.

PEPE rises to an ATH

Amid the surge in Ether, Ethereum ecosystem tokens, PEPE, and MOG rose to fresh all-time highs yesterday as investors looked at alternative ways of gaining exposure to the spot Ether approval.

Frog-themed PEPE jumped 11% at the start of the week. The third largest mem coin has been up over 80% over the past seven days and trades over 135% higher over the month.

Trading volumes for Pepe across spot and futures rose above $1.8 billion, compared to usual volumes within the $400 million to $600 million range. This was well above meme coin leaders Dogecoin and Shiba Inu, whose trading volumes collectively hit $1 billion.

Data showed that open interest in PEPE-tracked instruments soared on Monday, rising to $720 million from $550 million last week. Increasing open interest is considered a sign of new money entering the market. Data from Santiment reported a surge in active address holdings from 3,600 to 12,000 at the start of last week when expectations of SEC spot ETH ETF approval suddenly jumped.

The rally in PEPE saw the market cap rise to over $7 billion, flipping well-known altcoins such as Litecoin and Uniswap and, at one point at the intra-day trading high, even flipping Polygon.

PEPE’s price has experienced a strong upward trajectory, breaking above some key resistance levels to hit $0.00001725 ATH. However, the chart shows it is deep in overbought territory, which could warrant some caution from buyers at these levels.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.