After a solid performance in 2023, Ethereum has pushed back above the $2000 psychological level and is closing in on a yearly high at $2475.

Key Takeaways:

- Ethereum’s value is rising, reaching over $2000 with a market cap of $286 billion, showing strong growth.

- Positive outlook for 2024 with potential boosts from Ethereum ETF approvals and network upgrades.

- Challenges may arise from market conditions or tighter regulations, but these could also bring new investments.

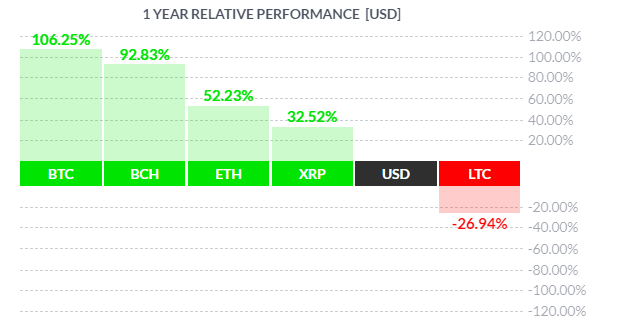

Second, only to Bitcoin in market capitalization, Ethereum’s market cap has soared to $286 billion, showcasing robust growth and potential for further expansion. This figure stands in contrast to Bitcoin’s $845 billion, and while Bitcoin is still king, Ethereum remains the leader of the altcoins.

Seen as more than a cryptocurrency and store of value, Ethereum is a platform for developers to create other cryptocurrencies, trade non-fungible tokens, run smart contracts, and develop decentralized finance apps. Ethereum’s utility and decentralization have helped it dominate.

ETH/USD and cryptocurrencies are volatile and unpredictable, so forecasting its future performance accurately is challenging. However, there are certain events that investors can watch out for that could impact the ETH/USD price in 2024.

ETH/USD price information

| DATE | ETH/USD PRICE |

| 52-WEEK LOW | $1369 |

| 52-WEEK HIGH | $2717 |

| ALL-TIME HIGH | $4865 |

Ethereum’s Bullish Prospects: Potential Surge in 2024 Amid ETF Approval and Network Upgrades

2024 has the potential to be another strong year for ETH/USD, given the number of tailwinds for the cryptocurrency.

Spot ETH ETF

The most significant Ethereum catalyst could be the anticipated approval of spot Ethereum ETFs by the Securities and Exchange Commission. After the SEC approved BTC-ETFs last month, optimism is rising that it won’t be long until the spot ETH ETF gets a seal of approval. This approval could bring specific benefits such as increasing liquidity, opening the doors to more institutional and retail investors, lifting demand, and further boosting Ethereum’s potential for growth. BTC/USD rallied in the run-up to ETF approval – a similar move could be expected in ETH/USD.

Network upgrades

Network upgrades in 2023 acted as a tailwind to the Ethereum price in 2023, which could continue this year. Two major network upgrades, Dencun in March and Petra in Q4, will also likely support the Ethereum price as developers work hard behind the scenes to improve the network. Duncan, the first of this year’s upgrades will bring a significant improvement called proto-dank sharding or EIP 4844, lowering transaction fees.

Meanwhile, Petra, which is set to go live at the end of the year, is still being tested but looks set to ensure equal access to the network’s services, safeguarding the platform’s fundamental principle of a decentralized and open ecosystem.

Monetary policy

Further gains in 2024 could also depend on monetary policy. The market expects the next move by the Federal Reserve to be a rate cut, although the exact timing of the first cut remains unclear. Loser monetary policy at the Federal Reserve could be supportive of risk assets such as cryptocurrencies like ETH and would also be USD negative.

Potential Risks Could Impact ETH/USD in 2024

While the outlook for 2024 is optimistic, downturns are still possible this year. These could be triggered by weaker, broader market conditions or a worsening regulatory environment.

The Securities and Exchange Commission cracked down on crypto markets in 2023 amid the risk of fraud, market manipulation, and security vulnerabilities, which has, at times, limited the upside in cryptocurrencies. A continued ramping up of such regulation could hamper ETH/USD gains this year. However, the focus on regulation is not necessarily all bad news. Instead, tighter regulation could open the door to more inflows by institutional and retail players into the crypto market, particularly if it goes hand in hand with the spot ETF approval.

Conclusion

There are many reasons to believe that the positive ETH/USD price momentum could continue in 2024, including ETF approval, network development, and US interest rate cuts. Meanwhile, weaker broader market conditions and increased regulation could hamper gains.

Sources

McGimpsey, P. (2024, February 8). Ethereum Price Prediction In 2024: Can Crypto’s Bridesmaid Stake Its Claim? Forbes. https://www.forbes.com/advisor/au/investing/cryptocurrency/ethereum-price-prediction/

Ethereum price prediction 2024. (2024, February). USA Today.https://www.usatoday.com/money/blueprint/investing/cryptocurrency/ethereum-price-prediction/

Chiang, S. (2023, September 14). Ethereum co-founder says ‘clear heads will prevail’ in the SEC’s legal battles with crypto firms. USA Today. https://www.cnbc.com/2023/09/14/ethereum-co-founder-on-sec-crypto-crackdown-clear-heads-will-prevail.html

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.