- Inflation is cooling but not as quickly as initially hoped

- Central banks are not reducing interest rates as quickly as hoped

- Bitcoin trades rangebound while the S&P 500 hits an ATH

- Nvidia becomes the world’s most valuable company at $3.3 trillion

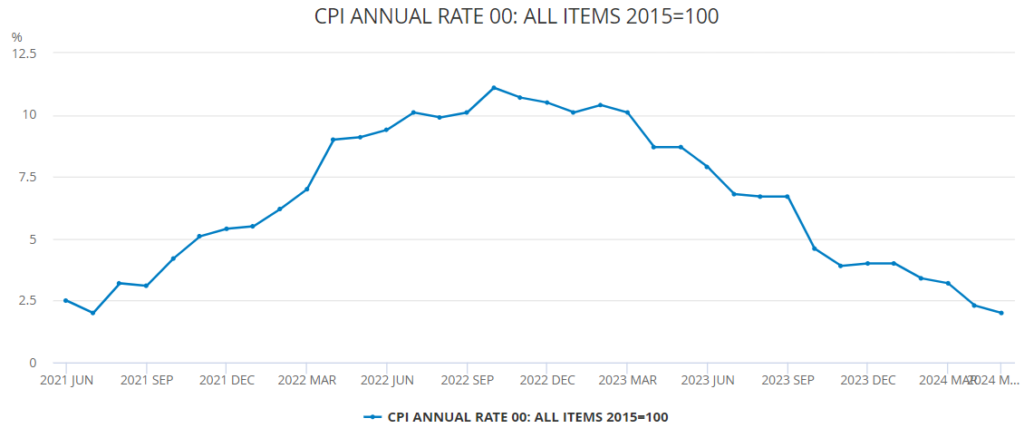

UK inflation cooled to 2% YoY in May, down from 2.3% in April, reaching the BoE’s target level for the first time since July 2021. Inflation has cooled considerably from the lofty peak of over 11% in 2022. However, service sector inflation cooled by less than expected to 5.7% amid solid wage growth, two areas that the BoE will want to see cool before cutting interest rates.

Meanwhile, in Europe, inflation rose to 2.6% YoY in May, up from 2.4% in April. The tick higher comes as unemployment is at a record low, and Q1 wage growth was stronger than expected. The ECB cut rates by 25 basis points earlier this month, but the timing of the next cut is unclear.

Finally, US inflation cooled on a monthly basis but remained at 3.4% annually, which is still well above the Federal Reserve’s 2% target. In the latest meeting, the Fed left rates unchanged and lowered forecasts to just one rate cut this year, down from 3 projected in July.

So, while inflation is falling, it is doing so at a slower pace than expected, and central banks are not cutting rates as quickly as was previously hoped.

What does this mean for Bitcoin?

Bitcoin can be considered a hedge against inflation because it is a finite resource and because of its decentralised nature.

Bitcoin has a maximum supply of 21 million bitcoins available, and these are being mined at a slower pace owing to the halving event every four years. The latest halving event in April reduced the mining reward to 3.125 coins, down from 6.25 coins rewarded per block previously.

With inflation cooling, demand for inflation hedges such as Bitcoin is easing. A similar pattern of cooling demand has been seen for Gold, another traditional inflation hedge.

However, at the same time, central banks aren’t moving as quickly as initially expected to cut rates, meaning rates stay high for longer, bringing less liquidity to the crypto market.

After surging across the second half of 2023 and the first quarter of 2024, taking Bitcoin to a record high in March, Bitcoin has traded within a familiar range of 60k – 70k. This period of consolidation comes as the market weighs up the prospect of higher rates for longer.

AI or Bitcoin?

At the same time that Bitcoin is trading within a familiar range, AI stocks such as Nvidia have surged ahead. The AI chip maker and darling of Wall Street have topped Microsoft and Apple to become the most valuable company in the world.

Nvidia has surged 170% this year alone and 40% in the past month, helping the S&P 500 and the Nasdaq 100 reach record highs. This explosive growth in AI stocks and record highs on the stock market could be luring investors away from Bitcoin.

This doesn’t mean that we should bet against Bitcoin, but it does mean that it might be worth waiting for a move out of the current range before picking sides.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.