- Meme coins track meme stock GameStop lower

- Dogecoin falls 2.4% & PEPE -12.5% over the past 24 hours

- GameStop has fallen over 50% in 2 days

- Weak earnings & a disappointing stream from @RoaringKitty hurt the share price

The bloodbath in meme stocks is continuing on Tuesday as Bitcoin also experiences declines.

Bitcoin trades -3%, Ether -3.7%, and Solana -3.7% over the past 24 hours. Popular meme continues were also under pressure, extending the recent selloff.

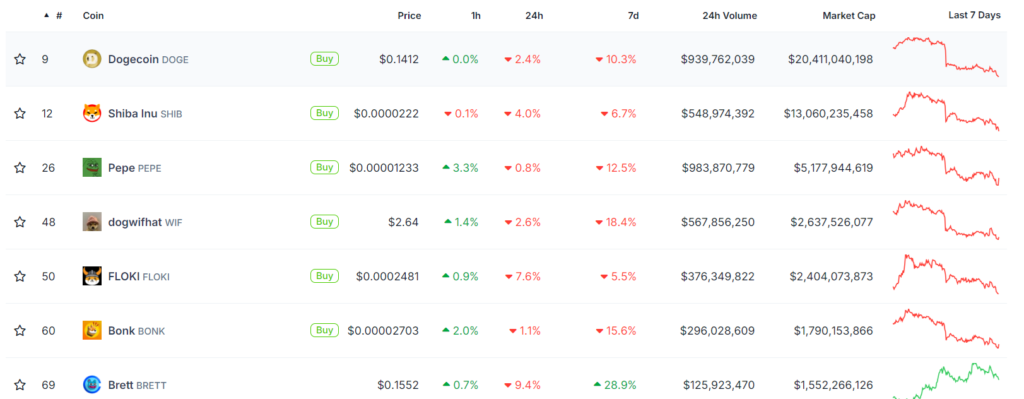

Popular meme coins, such as Dogecoin, fell 2.4%, Shiba Inu was down almost 4%, and Pepe traded 1% lower over the past 24 hours.

Elsewhere, FLOKI was down 7.6% and Brett, which has experienced strong gains in recent sessions, was down over 9% on Tuesday.

The sell-off in meme coins comes as the original meme stock – GameStop has booked losses of over 50% in the past two sessions. Meme stocks often track movements in GameStop, considered the original meme stock.

According to data from CoinGecko, GameStop-related tokens like roaring Kitty and some cat-themed tokens, which had previously risen alongside the GameStop share price, lost around 10% on average.

GME posts weak Q1 earnings & Keith Gill disappoints

GameStop closed 39% lower on Friday and extended those losses, closing 12% lower yesterday after the company reported fiscal Q1 earnings ahead of schedule and after roaring Kitty, also named Keith Gill, produced a live stream that disappointed investors.

Keith Gill, AKA @RoaringKitty, confirmed significant investment in GameStop, saying that he still believed that the struggling video retailer’s management team could turn it around. Still, his remarks couldn’t prevent the company’s share price from plunging.

His appearance came hours ahead of GameStop’s quarterly results, which showed that such a turnaround still had some way to go.

GameStop reported net sales of $881.8 million, down from $1.237 billion last year and behind analysts’ expectations of $995.3 million. The video game retailer also reported a loss per share of $0.12, missing consensus estimates of a loss of $0.09. The retailer’s core business has been in decline, with store numbers on the decline in recent quarters.

In addition to the weak earnings, GameStop also announced that it would be selling 75 million shares, days after making $933 million by selling 45 million shares—a move that didn’t go down well with GameStop shareholders.

Meme stock volatility continues

Meme stock GameStop has experienced wild moves since late May after Keith Gill’s return to social media. He was a key figure in the stock’s short squeeze rally three years ago in 2021, and investors were hoping that his reappearance would spark a similar response.

GameStop’s share price rose sharply from $20 to $64 in mid-May before returning to $20 by the end of May. The share price then surged again to $48 last week before falling back to current levels of $25.

Increased volatility in GameStop and other meme stocks often translates into increased volatility in meme coins.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.