Meme coins are rallying despite sluggish moves in Bitcoin as the meme-stock phenomenon returns.

- Meme coins & meme stocks rally as Roaring Kitty returns.

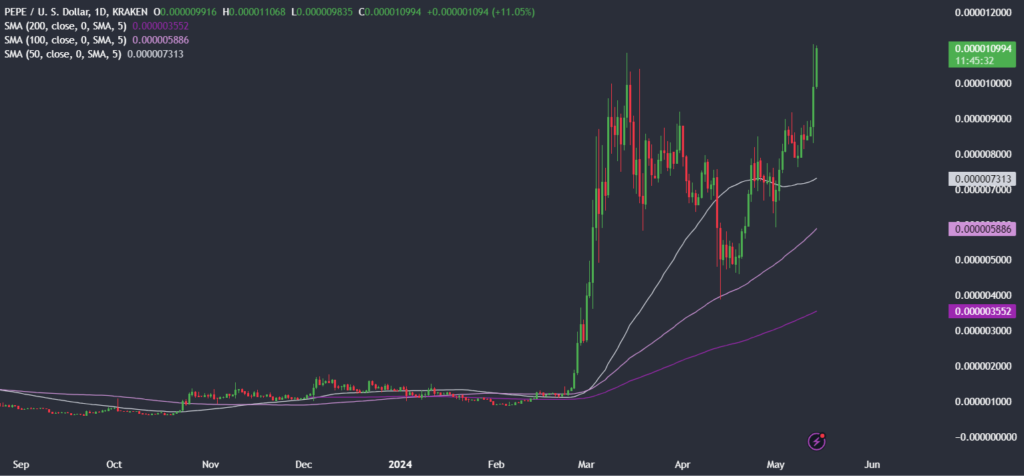

- PEPE rises to an ATH.

- Meme coins & Bitcoin decouple.

- US inflation and Fed Chair Powell are in focus.

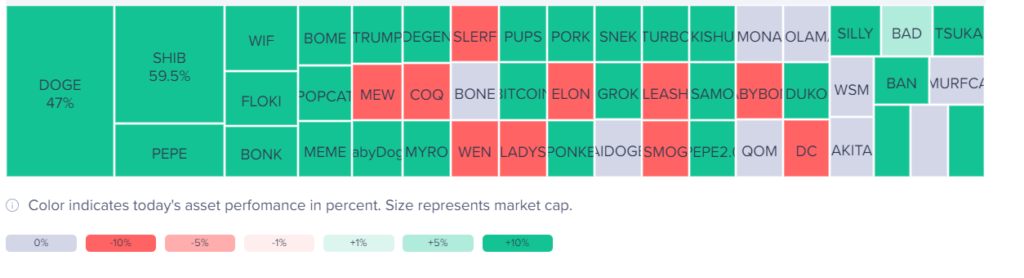

PEPE has risen to an all-time high, rising 20%. Other meme coins, such as DODGE and FLOKI, have risen 3.5% and 10%, respectively. Meanwhile, Popocat has jumped 25% and $MOG is on the rise as meme coin mania shows early signs of a return.

The surge in meme coins comes as social volumes of these coins surge. Social media mentions have increased for PEPE by 168% and for FLOKI by 560% as the coins see trading volumes soar.

Why are meme coins rallying?

The jump in interest and the rally in the price of meme coins have come amid signs of a revival of meme stocks as GameStop rose 74% yesterday and is set to open 50% higher today. Other meme stocks, such as AMC Entertainment and Blackberry, also rallied higher.

Traders are piling into meme coins and meme stocks following Keith Gill’s return to social media. Gill, under the name Roaring Kitty, drove the meme-stock mania of 2021. Three years ago, using social media, Gill rallied day traders to buy into GameStop to squeeze short sellers. The stock ended the year over 1000% higher as retail traders looked to outperform institutional traders. Not only did this make Gill a significant amount of money, but it also supported the dream that a single trader could take down a hedge fund in a modern-day David and Goliath. His account was dormant for three years before his return yesterday.

The return of Roaring Kitty is being perceived as bullish for meme coins because the market remembers that much of the meme-stock mania of 2021 spilled over into DOGE and other meme coins.

Bitcoin – Meme coins decouple

Interestingly, the surge in meme coins comes as Bitcoin trades 2% lower in but remains within a firmly established trading range as the focus is squarely on US inflation data and a speech by Federal Reserve Chair Jerome Powell.

Today, the US Producer Price Index, which measures inflation at the factory gate level, will be released. This index is considered a lead indicator for tomorrow’s more closely watched consumer price index.

These readings, along with comments from Federal Reserve Chair Jerome Powell, will provide more clues over the possible timing and scale of Fed rate cuts this year.

Hotter than forecast inflation would support the view that the Fed will keep interest rates high for longer. This bodes poorly for cryptocurrencies such as Bitcoin, which performs better in low-rate environments with high liquidity.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.