Gold surged to a record high on Friday as the US dollar fell to a 2024 low, and investors weigh up expectations surrounding a Federal Reserve interest rate cut next week.

At the time of writing, gold is trading 0.4% higher at $2569 after hitting a record high of $2571 ahead of the European open. Gold is on track to gain around 3% across the week.

Rising gold prices come as the US dollar falls to a weekly low, making USD-denominated precious metals cheaper for buyers of other currencies.

Fed rate decision

Attention is squarely on next week’s Federal Reserve interest rate decision, where the Fed is expected to cut interest rates. The only question is by how much? Earlier in the week, following hotter-than-expected US core inflation data, expectations for a 50 basis point rate cut by the Federal Reserve had eased.

However, overnight, an article by Nick Timiraos, AKA the Fed whisperer, for accurately predicting the Fed’s interest rate decisions since 2022, when the central bank raised interest rates to a 22-year high and kept them there for 14 months. In his latest Wall Street Journal article, Timiraos said the Fed is nervous about keeping rates high for too long, and the central bank faces a dilemma over whether to cut by 25 or 50 basis points.

The decision comes amid signs of a cooling labour market but not one that was collapsing and some signs of sticky inflation. However, with the next Fed meeting two days after the US elections, will the Fed be looking to front-load rate cuts to avoid any political backlash in November? Or could a 50-basis point cut act as a cushion to a Trump win, given his inflationary policies?

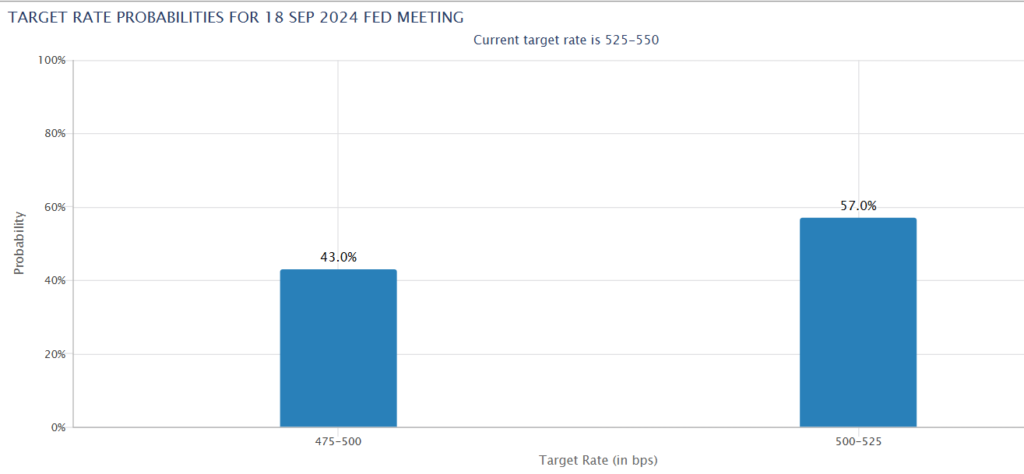

50 basis point rate cut expectations rise

The Fed fund rates are now pricing in a 43% probability of a 50 basis point rate cut, up from 28% yesterday. Gold is rising following the market’s re-pricing of Fed rate cut expectations because a lower interest rate environment is beneficial for non-yielding gold.

In addition to rate cut expectations, the precious metal is also finding support from other sources, including continued physical buying by central banks and safe haven demand owing to heightened geopolitical risks.

Will gold rise to $3000?

The prospective gold reaching $3000 is far from unrealistic, particularly given that central banks are only just starting their rate-cutting cycles and as central bank Gold buying is expected to continue given heightened economic and geopolitical uncertainty.

However, markets rarely rise in a straight line, and the path to the $3000 target is likely to be a bumpy one. In the near term, given that the $2500 level has been taken out, $2600 is the next logical target for now, while $2500 is the near-term support.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.