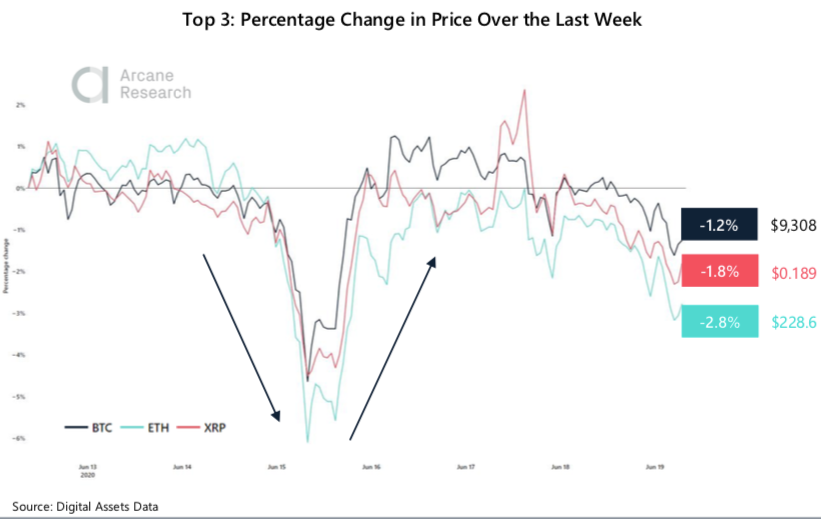

It has been a rather plain and straightforward week for the price of Bitcoin and the other top cryptocurrencies as the trading was mostly sideway barring a midweek dip that was quickly recovered. Bitcoin has again struggled to break past $10,000 but it has also not fallen below $9,000.

Towards the end of the week however there has been a bit of a slide as the top three coins by market cap, not including Tether, are all down by a few percent from their close at this time last week. BTC is down just over a percent while Ethereum has lost three percent after climbing well for the past few weeks.

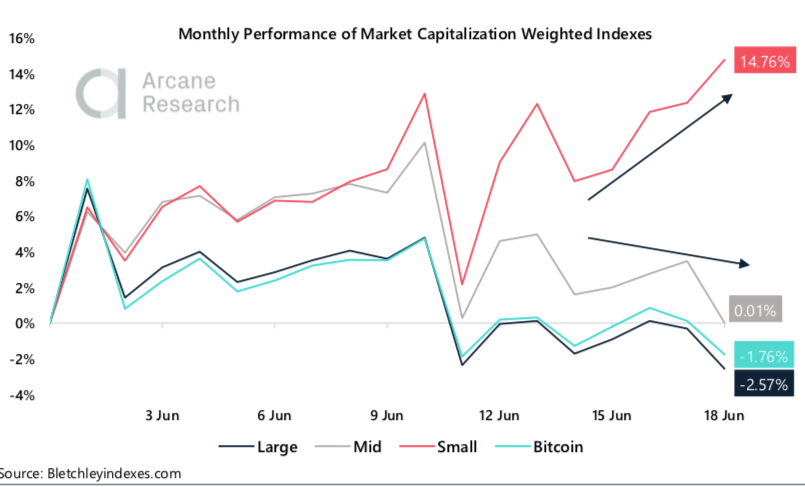

It appears as if there is a bit of an altcoin market growing though as some of the smaller, lesser known coins are continuing their successful month thus far. Small cap coins have broken away from the other categories and are trending upward while the rest — including Bitcoin, are down for the month.

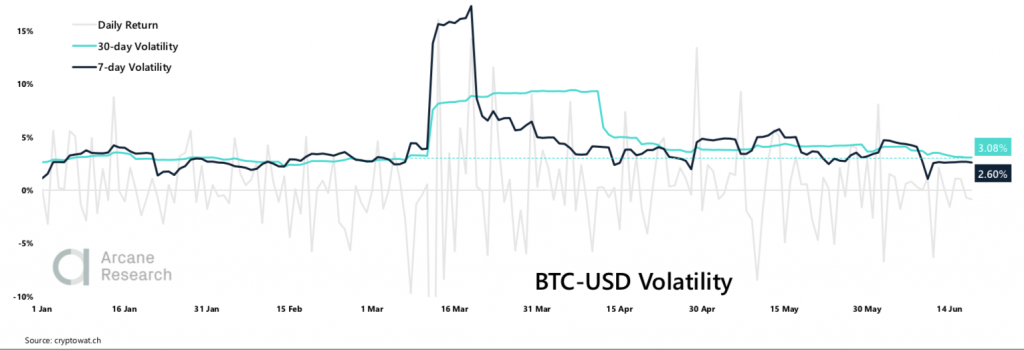

Fear and Greed has not moved much as the market sentiment remains the same and even the Bitcoin trading volume is moving sideways. These additional parallel metrics have helped the volatility drop down to pre-crash levels before March.

The markets may be pretty stale as it stands, but there is a lot brewing in the cryptocurrency ecosystem as a survey of millennials has found that the majority of them trust Bitcoin over Big Banks, and there is still more evidence of Big Banks and financial players looking into the digital asset.

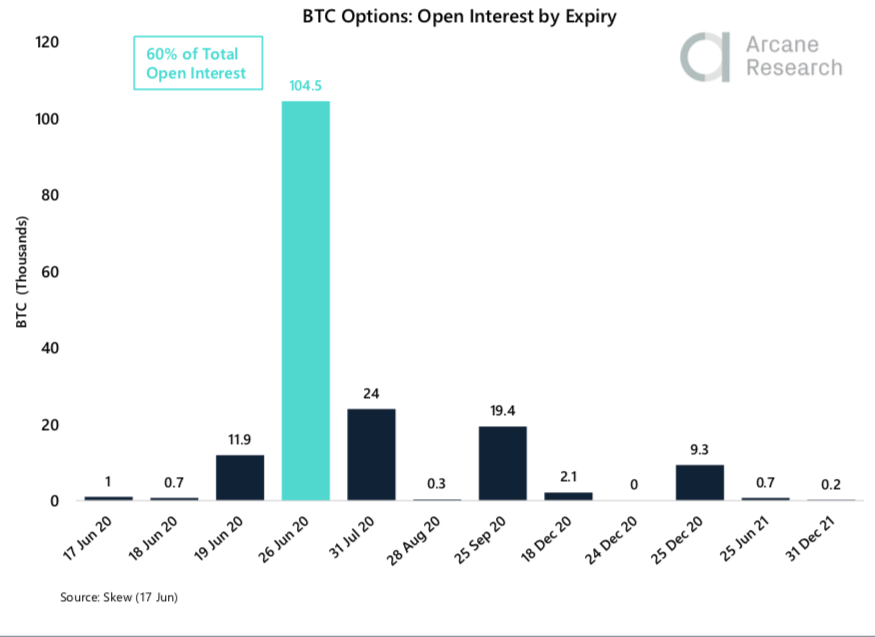

Next week is expected to be a little more wild as the Bitcoin Options market will have its say. As much as 60 percent of Bitcoin options are due to expire next week — which equates to about $1 billion.

For the network itself, there was a massive mining difficulty jump as the mining system still looks to find its feet after the halving. The difficulty dropped in line with the halving but this allowed miners to come back on, and as such sent the mining difficulty right up again.

Bitcoin Beats The Dip To Stay Flat

The price action this week for the top three coins that are prone to movement have seen very sideways movement ending in a slow fall towards the week’s end. The market managed a v-shaped recovery after the stock market turnaround on Monday that saw a correction after the traditional markets gained back their March losses.

Bitcoin showed it was still correlated to the stocks as it fell steeply at the same time as the stock market correction, but it then also sharply rebounded on the same day to the same levels before the fall. Since then there has been very little action.

Slowly, the market is deflating towards the weekend and this is the first time that Ethereum is the worst performer of the top three for some time as it has been driving upwards in anticipation of Ethereum 2.0.

This range for Bitcoin has been going since the beginning of May and for that reason a number of traders are anticipating a big move in the coming weeks. The big movers this week have all only managed single digit growth as Hedera is up nearly eight percent with nano and Augur having sic percent gains.

In terms of losses, there are big falls for Maker and IOTA with Ziliqa also falling heavily after it was launched on one of the biggest exchanges and clearly heavily shorted.

Altcoin Season Brewing?

While Bitcoin has been range bound for almost two months now, there has been some action brewing with the smaller capped coins. Many of these lesser known projects have seen their coin’s value double, or even triple, and as a collective they are up nearly 15 percent for the month of June.

Up until last week, the smaller capped coins were moving in time with the others, and Bitcoin, but with bigger moves upwards. However, the graph is now showing a break in this correlation as they have broken in a clear upward trend.

Meanwhile, medium capped coins are trading the same as when the month opened, but Bitcoin and the larger capped coins are down around two percent each. It appears that the price action is coming to smaller capped coins as the more risky investors look for potential volatile gains elsewhere.

Not Much Movement Means Low Volatility

It is not only the price action of Bitcoin and the general cryptocurrency market that has been flat, there is very little action in regards to market sentiment, and trading volume. This has, however, helped lower the volatility to a place that was last seen before the massive Mid-March crash.

The Fear & Greed Index dropped back down in the fear area last week and has been flat since. This is unsurprising seeing as it is heavily linked to the price of the coin.. The Index is now at 39 and holds essentially in the Neutral zone.

The Bitcoin trading volume that was starting to fall downward has now leveled off as there is also not a lot happening in the futures market either. The daily volume last Saturday was the lowest since late February.

Still, this means that Bitcoin has been incredibly stable in regards to volatility — especially considering the exceptional circumstances around the global markets.

The 7-day volatility dropped to the lowest level so far in 2020 last week. This week, the 30- day volatility dropped down to levels we haven’t seen since before the market crashed in March. Even the stock market volatility was not enough to affect Bitcoin’s but, with the monthly close coming up next week, more volatility is likely to be around the corner.

A Trusted Financial Tool

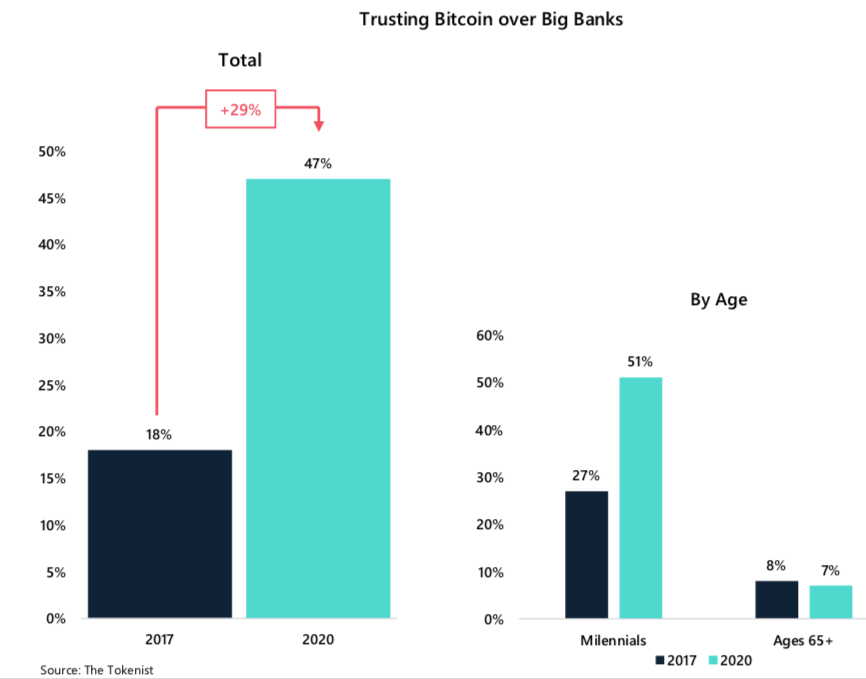

However, all of this stability has many millennials looking at Bitcoin as a more trusted system for their money compared to Big Banks. The Tokenist recently conducted a survey that showed trust in Bitcoin over big banks has risen sharply over the past 3 years.

A survey conducted in 2017 showed that 18 percent of those who took it said that they trusted Bitcoin over banks. This has risen by 29 percent, reaching as high as 47 percent in the recent Tokenist survey.

Most of the millennials questioned — 51 percent — stated that they trust Bitcoin over banks, growing from 27 percent in 2017. But, for the elder generation — those 65 and above — the trust was much more towards the Big Banks

The growth in trust is also teamed up with the desire to own as 44 percent of millennials said that they are likely to own Bitcoin within five years and 14 percent said that they already own Bitcoin.

Bitcoin Options Expire Soon

The calmness seen this week may be the calm before the storm as the month end will see an important date for the derivatives market with monthly, and quarterly, contracts set to expire. On June 26, contracts with $1 billion will expire — which accounts for 60 percent of the total open interest in the BTC options market.

With this kind of wave building, there is often an incentive to try and move the spot price of an asset like Bitcoin in order to make the contracts successful, but the options market for BTC are a lot smaller than the futures and spot market — only about 1 percent — so perhaps the move won’t be as significant.

Mining Gets Harder

As anticipated following the third Bitcoin mining reward halving, the difficulty adjustment of Bitcoin has been all over the show. It began with the difficulty dropping substantially as the incentive to mine was cut by 50 percent, but things are righting themselves again.

As the mining difficulty dropped, those machines that were put out of work by the halving were able to make profit again which meant the next difficulty adjustment was a big one. This week, it rose by 15 percent which is the largest positive jump since January 2018.

The period since the last difficult adjustment has seen an average block time of 8m 42s, as the hast rate has been increased. It is now back to pre- halving levels as highlighted last week.

Bitcoin’s largest jump in mining difficulty was on Oct 14, 2013, when it increased by nearly 30 percent.

In the News

Trump Wanted to ‘Go After’ Bitcoin Back in 2018

In June 2019 President Donald Trump Tweeted his dislike of Bitcoin and other cryptocurrencies, but he already had an eye on it in 2018, and showed similar dislike. In a new book, it has been revealed that Trump told Treasury Secretary Steve Mnuchin to try and clampdown on Bitcoin as it was, in his opinion, being used to bolster China.

Reddit Looks to Scale the Community Points System Which is Based on Ethereum

Having recently launched its ‘Community points’ system, popular social media site Reddit is already looking to scale it’s Ethereum-based model in anticipation of a growth user base and audience.

A New Bitcoin ETF Proposal Put Forward By WisdomTree

The New York-based asset manager WisomTree is looking to launch a fund that could invest as much as 5% of its net assets in Bitcoin futures traded on the Chicago Mercantile Exchange. This is part of its proposal now put forward with the Securities and Exchange Commission.

Information provided in PrimeXBT’s market report includes data provided by Arcane Research, in addition to other internal market research.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.