Bitcoin has gone weeks and weeks without much price action to speak of — neither up nor down. The major cryptocurrency by market cap seemed to get trapped in the lower $9,000 range and traded sideways on that mark. However, things have finally kicked off this week as the coin has sprung into action to reach $10,000 and cruise above that.

This return of volatility will more than likely be welcomed by traders and holders alike as the rally seems to be persistent and growing. Having crossed $10,000, Bitcoin has pushed on towards $11,000. This is good news for Bitcoin, but also for major altcoins that were rallying before Bitocin started taking off again.

Ethereum is one such coin that has managed to take its good gains and amplify them this week. The second-largest coin by market cap has posted weekly gains of 34 percent this week and also looks like its rally won’t be stopping.

Ethereum is benefiting from the Bitcoin boost, but also from increased growth of DeFi, and its impending upgrade towards ETH 2.0. Other altcoins are in a similar boat in terms of rallies, which leads to the question if there will be a full market climb in the coming weeks and months.

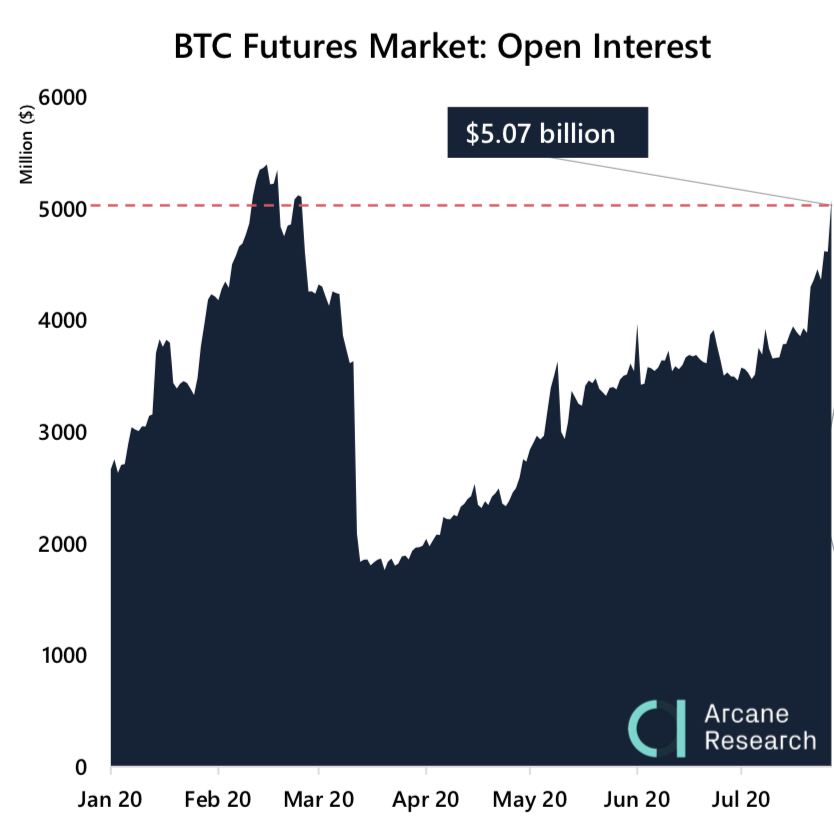

With Bitcoin back in the action, there has been a notable increase in futures premiums with both retail and institutional premiums converging towards annual premium rates of 12.8 percent. This is also partnered with the fact that Open Interest in BTC futures is also nearing a yearly high, posting at over $5 billion.

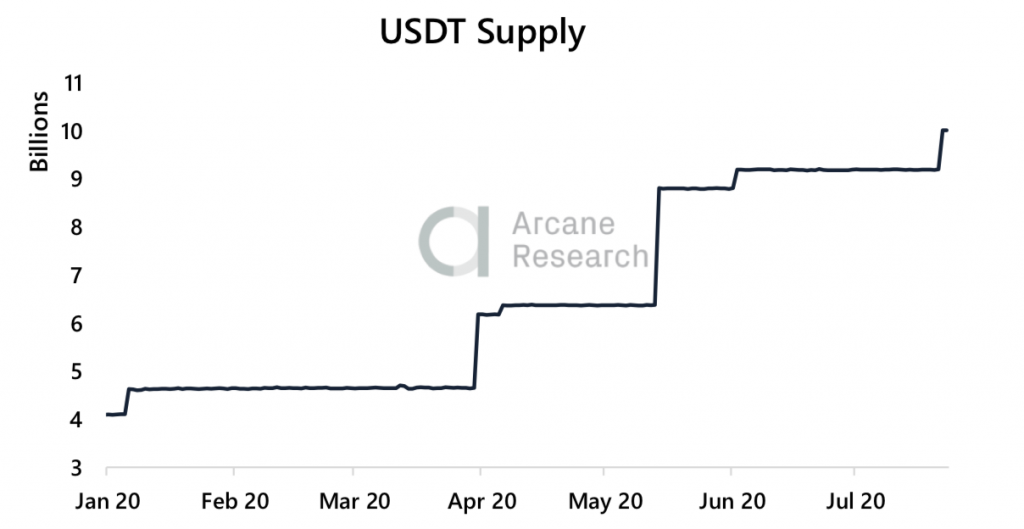

Even away from the bout of volatility, there is good news for Tether, the major stablecoin has racked up a supply of over $10 billion, adding 139 percent to its total supply since the beginning of the year.

Bitcoin Booming Again

It has been hard to keep track of how quickly Bitcoin has boomed this week as the coin started rallying properly on Sunday as it broke out of the resistance level of $9,500. Now, just a few days later, Bitcoin is above $11,000.

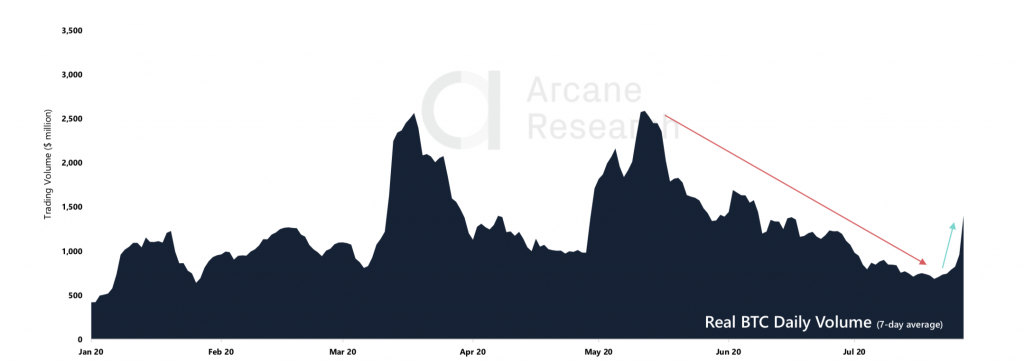

This rally has all the signs of a strong and lasting one, and potentially an ongoing one as a number of key metrics are ticking all the right boxes. Firstly, the Bitcoin volume has surged with this rally — always a good sign.

Monday saw the 4th highest real daily volume recorded this year at $3.7 billion. Volume has been on a downward spiral for months, but as BTC picked up pace and smashed through its yearly highs, the volume is now finally trending upwards again.

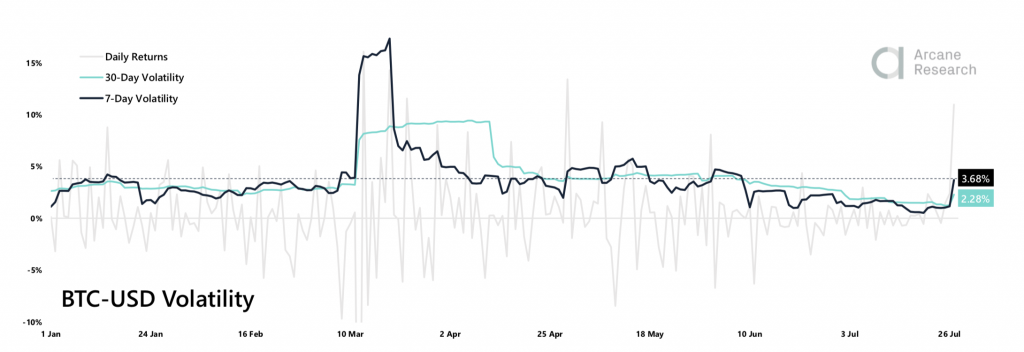

Along with this increase in volume, there is of course a boom in the volatility of Bitcoin — another metric that has been reaching new record lows of late. Volatility is always seen as a double edged sword, but the recent weeks of near no price action means there has been a yearning for some volatility — which has returned in force.

Last week, Bitcoin was on its way to its flattest month ever recorded in terms of volatility, but seeing as Bitcoin is now posting double-digit gains, the previous record remains intact. The 7-day volatility has risen to 3.68% from last week’s lows of 0.50% and is currently on par with the average 7- day volatility seen throughout the year. The 7-day volatility also flipped the 30-day volatility, indicating that the trend of low volatility is about to change.

Perhaps an even better metric to show that Bitcoin is indeed back in the minds of those who want to trade crypto is that open interest is approaching yearly highs. As many know, open interest in the futures market took a massive hit when the price of BTC collapsed in March, but since then it has been a steady climb back up.

Before the March fall, BTC open interest reached its high, but that figure could be bested as the OI at the moment is $5.07 billion. Interest in BTC futures means there is excitement in the market again and traders are opening positions as they await the next move from the coin.

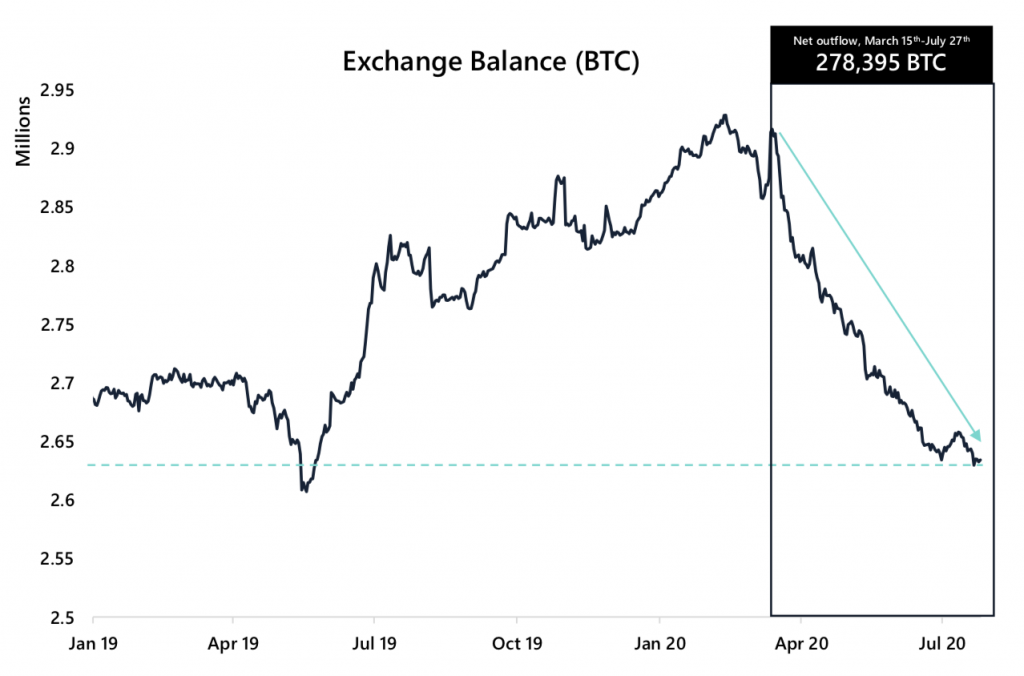

Another interesting metric to look at in this time of a Bitcoin price rally is the BTC balances on exchanges. The number of Bitcoin deposits at major exchanges has dropped significantly since April and is still at its lowest level since May 2019.

The current BTC exchange balance is at 2.6 million BTC, 227,532 BTC lower than the exchange balance at the beginning of the year. This suggests that market participants are moving their bitcoins to private wallets which can lead to lower selling pressure in the upcoming months.

While money is leaving the exchanges, there is growing adoption of Bitcoin by individuals as the active Bitcoin addresses have reached a two year high as well. As of Friday, there were 1,081,981 active addresses. Only 29 days have seen more usage than Friday and all of them were in late 2017/early 2018.

Ethereum Driving Large Cap Coins

Attention may be shifting to Bitcoin and its sudden resurgence, but the major coin has nothing on Ethereum and a number of other large cap coins that look to be driving the potential of an altcoin season. Ethereum is up 34 percent this week alone, and has overtaken its yearly highs — now sitting at $320.

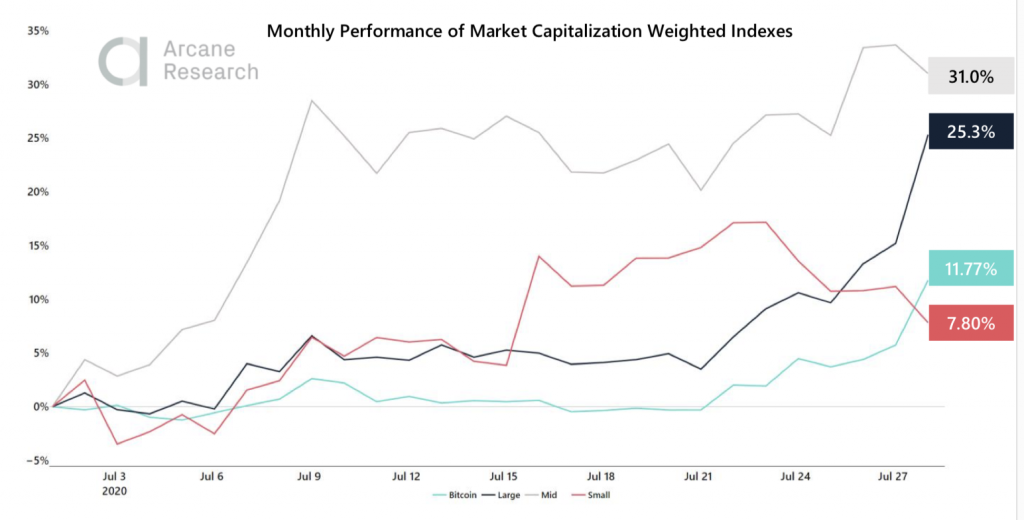

Ethereum, as well as some other major coins, have thus helped make the large cap coins the ones to follow since the beginning of the month. This collection of coins is up 25 percent this month alone with most of that coming from Ethereum. But actually, it is the medium cap cons running this month as they are up over 30 percent — but they have been mostly flat this week.

The small caps coins spiked in the middle of the month, but have struggled to maintain their momentum as the larger crypto assets have made their moves. TSmall caps enjoyed flat weeks from Bitcoin, as traders had a risk-on approach, seeking returns in more volatile assets.

With Bitcoin and Ethereum on the move, the Small Caps Index has fallen as investors have reallocated their exposure back into the large caps.

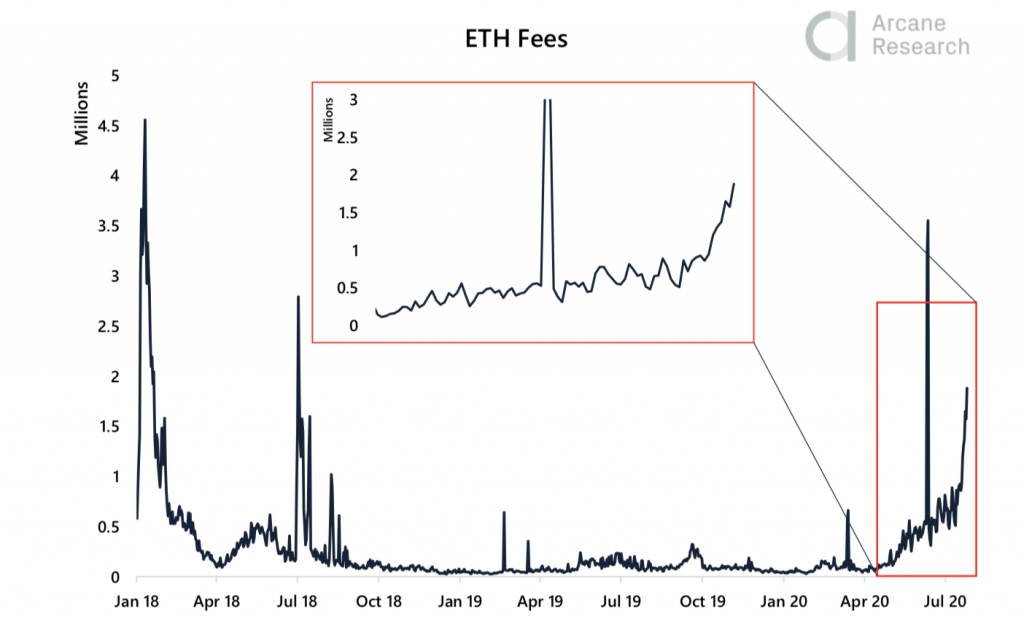

Ethereum fees are also on the rise alongside Ethereum as DeFi helps busy the network and drive the price of the fees. Currently, the fees on Ethereum are the highest seen in two years. Daily transaction fees this weekend reached $1.8 million with a median fee of $0.72 — that is 10 times higher than the median fee of April.

This has a lot to do with the growing DeFi space and Ethereum’s key role in it. The total value locked is DeFi currently is $3.6 billion, an increase of 230% in the last two months.

It is not only the volatile altcoins that are having a good month as Tether, the most popular stablecoin, added to its supply as it managed to cross the $10 billion supply mark. In fact, since the start of the year where its supply was $5 billion, Tether has reached as high as $12 billion.

Tether currently accounts for 82.8 percent of the entire stablecoin supply. In addition to Tether, USDC is another one of the major drivers of the stablecoin supply growth, as its market cap recently surpassed $1 billion. USDC currently accounts for 9.2 percent of the entire stablecoin supply.

In the News

Visa Showing More Signs of Future Digital Currency Projects

One of the world’s most well known payments networks, Visa, has been making the news in cryptocurrency circles of alte because of its drive in the space. Now, a blog posts hints at the company redoubling its efforts to “shape and support” cryptocurrency’s place in the “future of money.”

US Bank Regulators Permits Cryptocurrency Custody

Bitcoin got further legitimized in the eyes of the US banking sector this week when a letter from the Office of the Comptroller of the Currency (OCC) indicated that cryptocurrency custody may well be permitted in the US, a country with a complex relationship with crypto.

Grayscale Investments Sees a Surge in Interest

Grayscale Investments LLC is known for bringing institutional cryptocurrency trusts to the market but they have seen a great rise in interest as in the second quarter, the company nearly doubled its previous quarterly high bringing total assets under management to over $4 billion.

Information provided in PrimeXBT’s market report includes data provided by Arcane Research, in addition to other internal market research.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.