The cryptocurrency market continues to be mostly flat, thanks to primary market movers Bitcoin and Ethereum ranging sideways for several months now.

The only real action in the crypto market over the last few weeks has been the explosive rise of decentralized finance applications, which has now set a new record for the total value locked up. It’s only been a small handful of altcoins, primarily DeFi tokens, that have shown any positive performance recently.

However, an early morning Bitcoin breakout may be the beginning of the end of boring sideways price action for the first-ever cryptocurrency, and a return to the asset class’s signature volatility.

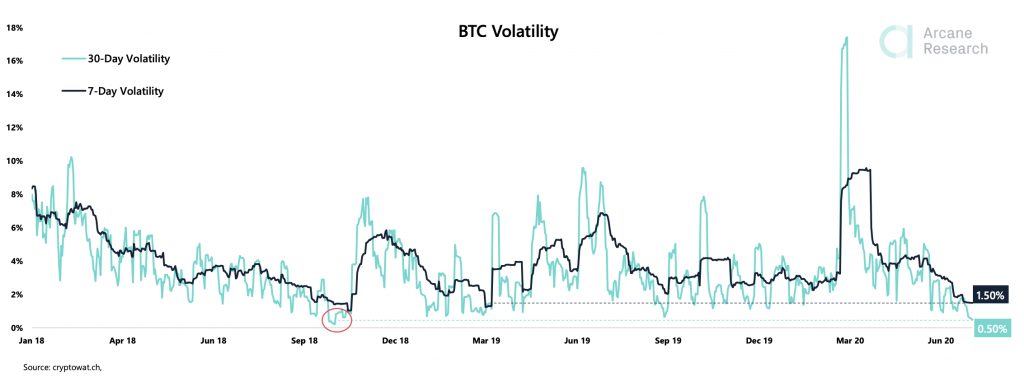

For now, that very volatility that the asset class is known for is reaching historical lows, potentially preceding a major breakout. Could the crypto market sideways trend finally come to an end?

Breakout in Bitcoin (BTCUSD) Following Record Low Volatility Could Lead To Explosive Move

Bitcoin price has been in a short-timeframe downtrend since a rejection from resistance above $10,200. Additional attempts to run highs have been rejected, resulting in lower lows on daily BTCUSD price charts. However, today, Bitcoin broke through the downtrend resistance.

If the leading cryptocurrency by market cap can close above the trend line and confirm the breakout with a rise in volume, we may finally see a return to the asset’s notorious volatility. A retest of $10,200 is possible if Bitcoin can reclaim $9,500 on the daily. Above there, its possible the cryptocurrency is on its way to set new local highs.

Any higher high could result in a stronger push to retest $14,000. The crypto asset has an extreme amount of pressure built up from three months of sideways consolidation. But a false breakout leading to a breakdown could be disastrous for the asset on the cusp of a new bull market.

When any asset spends this much time consolidating, and volatility falls this low, it results in a powerful move. Data shows in Bitcoin these moves can range from 50% to 85%, and another similar type of move is expected when this range finally gives out.

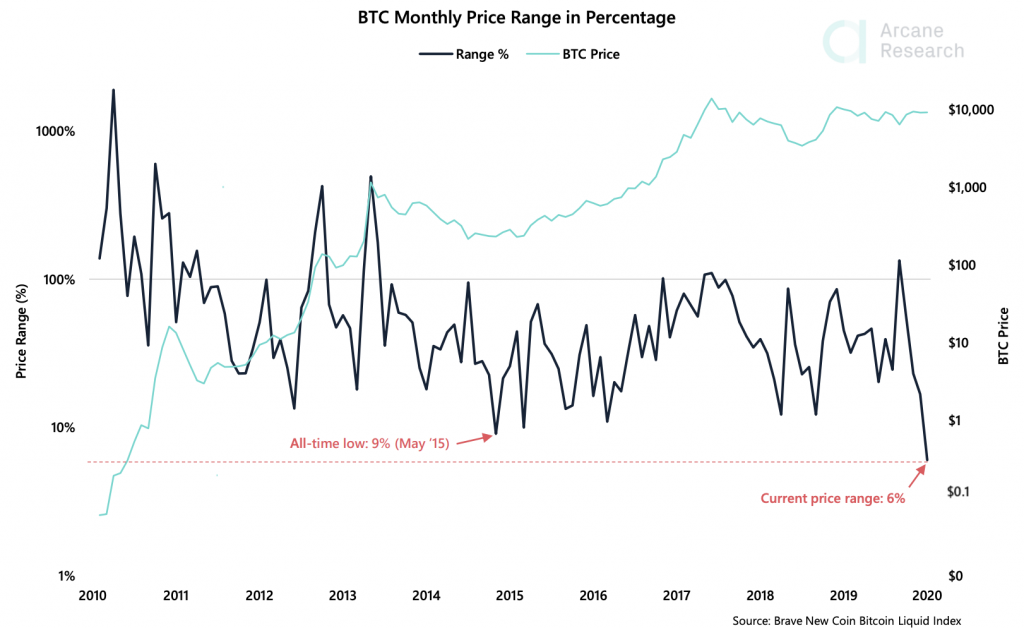

The price range is so tight, on monthly timeframes, it is the tightest range in the asset’s entire over decade-long history.

The historic lows are now even tighter than the price range at the bottom of Bitcoin’s last bear market in 2015 and 2016. Following that breakout, the cryptocurrency skyrocketed from well below $1,000 to $20,000. Another explosive bull market could follow a breakout, but only if Bitcoin can first reclaim resistance above $10,000.

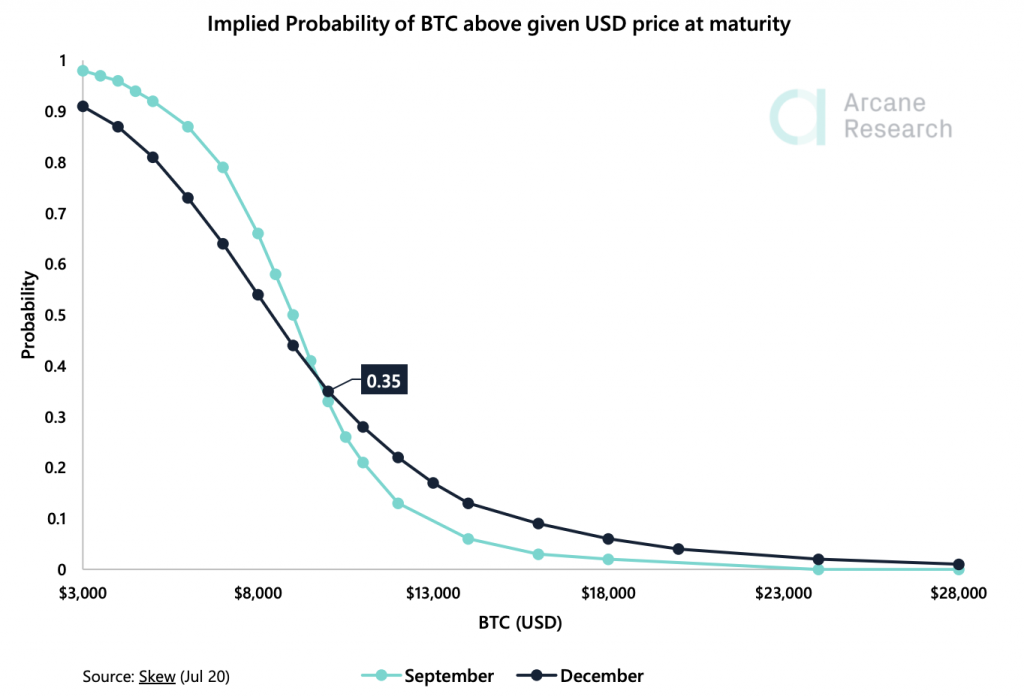

Data from Bitcoin options traders and pricing shows that there’s only a 35% probability that Bitcoin price will be above $10,000 by December. The figure is less than $1,000 away at this point, and the crypto asset has touched that resistance level several times in the past – why then are traders giving the likelihood of Bitcoin trading there or above so low?

The continued economic impact of the COVID outbreak could be to blame. Whatever the reason, if traders aren’t expecting Bitcoin to trade above $10,000, then what is going to bring the demand that pushes the asset higher from here?

Sideways Bitcoin Leads To Stagnant Crypto Market Metrics, Even Fear and Greed Remains Flat

The boring sideways price action has the crypto market confused and uncertain of which position to take. The impasse has resulted in sidelined traders and most market metrics remaining flat week over week. As the price range analysis above implies, volatitly continues to decline in the first-ever crypto asset.

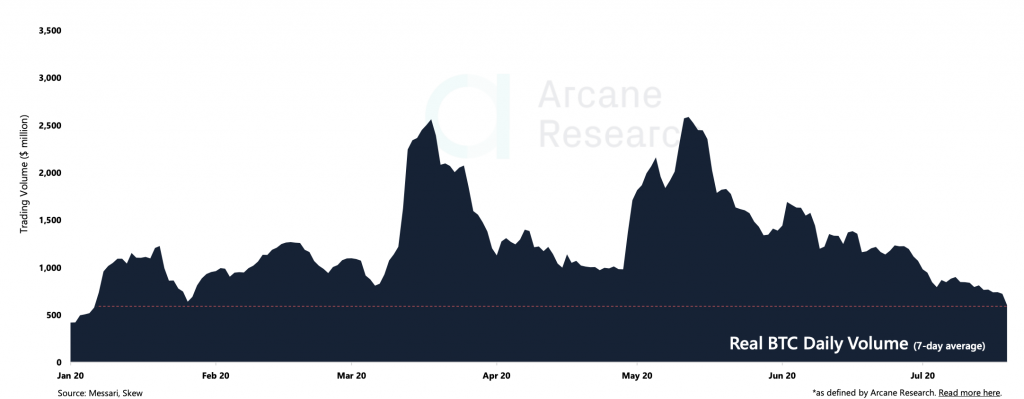

In addition to a continued drop in 7-day and 30-day volatility, trading volumes in BTCUSD are also plummeting and falling further into a downtrend. Even today’s surge hasn’t resulted in the volume necessary to support a trend change or a breakout. But volume could still soon come. Although volume typically precedes price, as the saying goes, so anything is possible.

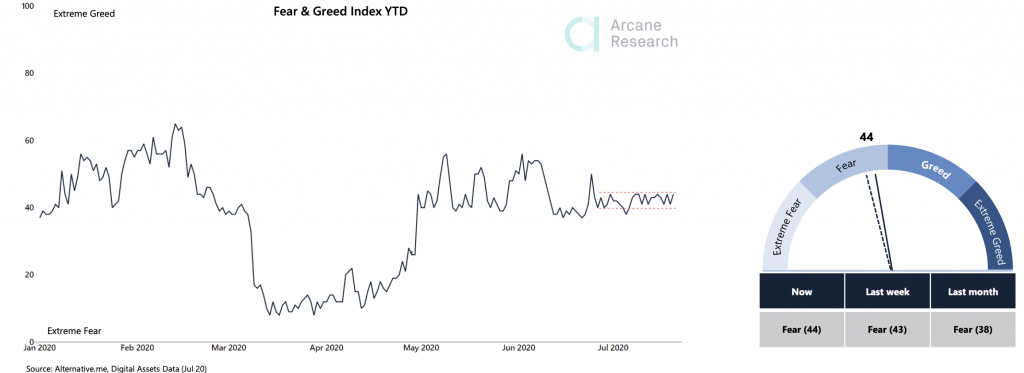

The fear, uncertainty, and doubt has left the market sentiment trending sideways also. The crypto market Fear and Greed Index is slowly ticking back toward greed, but the movement is barely noticeable. Even the Fear and Greed Index itself is ranging in a tightening trend.

When Bitcoin finally breaks out, these metrics are in for a major shakeup. Which way will it go? More towards fear, or a long-awaited return to extreme greed?

Ethereum Options Explode, While DeFi Altcoins Keep Crypto Price Action Interesting

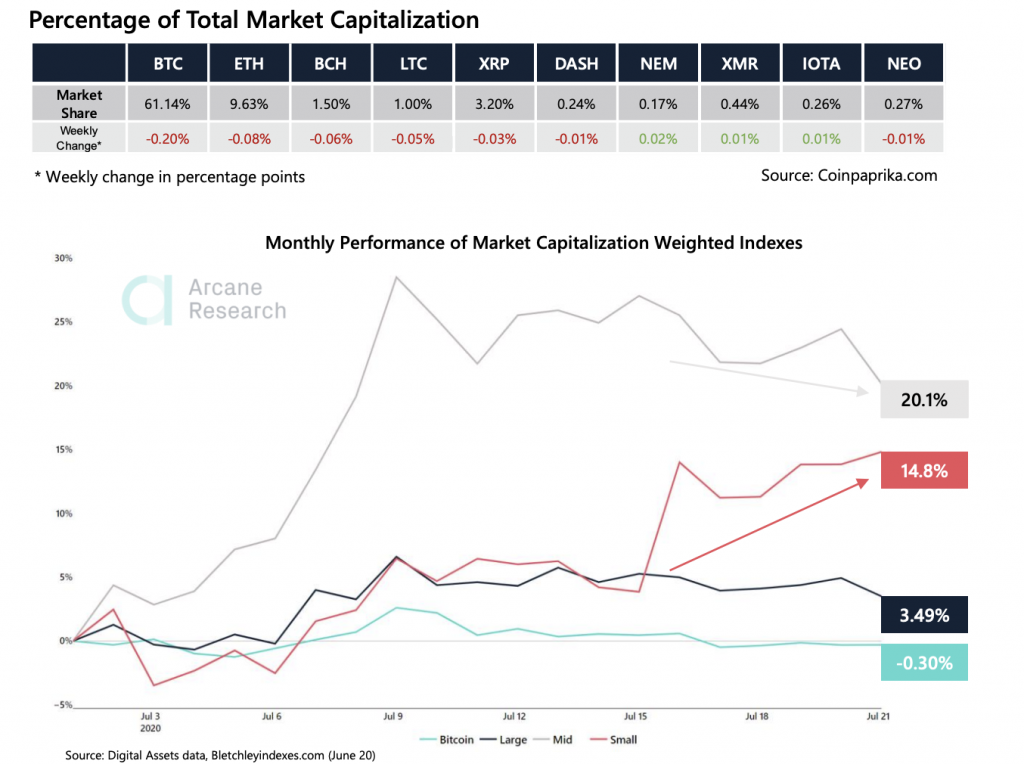

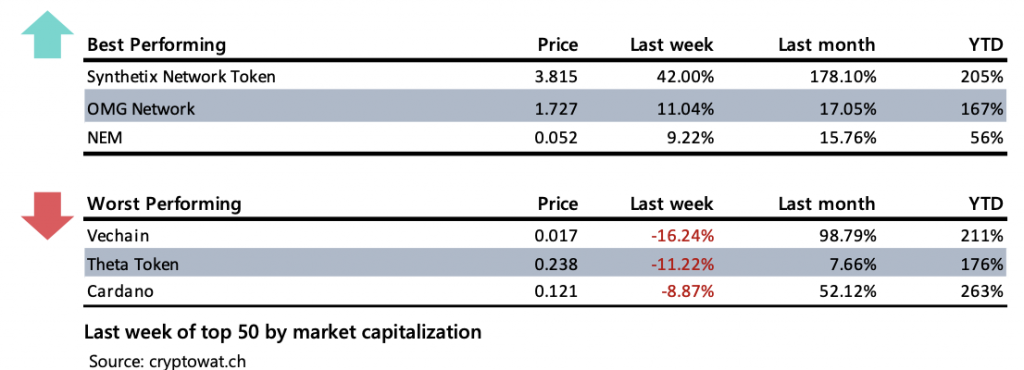

Small-cap altcoins are starting to catch up to mid-cap coins now that Dogecoin, Cardano, VeChain, and others have cooled off, and money has begun to cycle down into smaller market cap coins.

Large-cap altcoins are beating out Bitcoin in performance, thanks in part to a recovery in XRP, XLM, and other majors. XLM was added to Samsung’s Blockchain Keystore application, causing a surge in the altcoin’s price against USD and BTC.

A relatively new breakout crypto market all-star Synthetix Network Token was the week’s best performer with 42% returns on the week, 178% returns on the month, and 205% ROI year to date. The token is used to create synthetic ERC20 tokens based on stocks, commodities, and more.

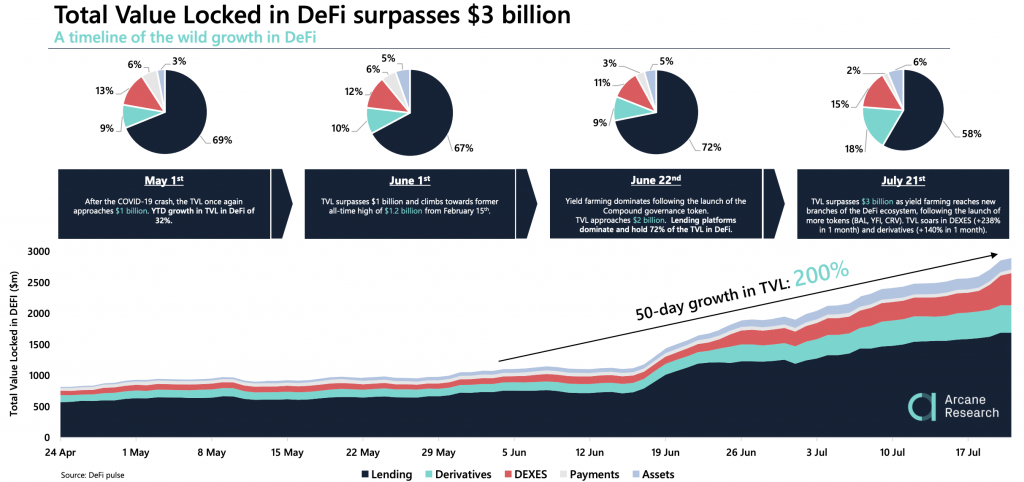

Small and mid-cap altcoins have thrived over the last several weeks due to the continued surge in the DeFi movement. The total value locked up in decentralized finance applications has now pushed passed $3 billion and climbing. 50-day growth has exceeded 200%.

Ethereum, the token that was central to the DeFi trend kicking off, and the platform that these ERC20 tokens are built on, has been as boring as Bitcoin.

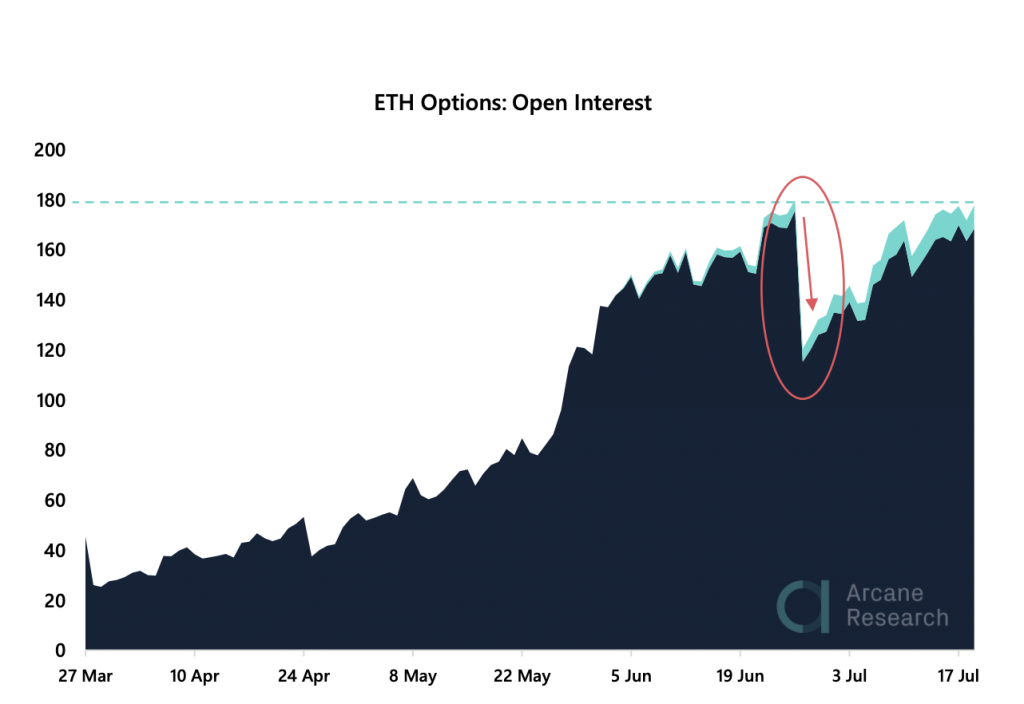

The total combined market caps of all ERC20 tokens have now surpassed the market cap of Ethereum, suggesting the altcoin is extremely undervalued by comparison. The undervaluation has ETH options trading open interest returning to its highest point. A new record could be set here if Ethereum doesn’t follow Bitcoin’s breakout soon.

In The News

High-Profile Twitter Hack Targets Joe Biden, Kim, Kanye, & More To Steal Bitcoin

This past week, the Twitter accounts of major celebrities like Kanye and Kim Kardashian West, CEOs like Jeff Bezos, Bill Gates, and Elon Musk, and politicians like Joe Biden. The accounts were used to promote a Bitcoin scam that resulted in over $120,000 in BTC stolen.

Paxos To Supply PayPal With Crypto-Centric Services

Paxos, the company behind the stablecoin the Paxos Standard, is reportedly supplying the crypto-infrastructure for PayPal and Venmo’s foray into the world of crypto.

Samsung Enables Support For Stellar On Blockchain Wallet

Samsung has enabled support for Steller’s XLM crypto token on the smartphone maker’s native Blockchain Keystore application. It acts as a crypto wallet for Ethereum, ERC20 tokens, BTC, and now XLM.

Information provided in PrimeXBT’s market report includes data provided by Arcane Research, in addition to other internal market research.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.