Markets are heating up once again, causing investors and traders to pay closer attention to subtle changes in market structure to best understand if a long-term trend change is taking place. To better assist our traders with intricate analysis, we’re putting together this new, detailed market report, based in part on data provided by Arcane Research and exclusive internal PrimeXBT market data.

Bitcoin: Is The Bull Market Ready For A Comeback?

Bitcoin price opened the weekly price candle at $8,700 but has since fallen to lows of $8,200 where the leading cryptocurrency by market cap has found support and is now trading in the middle of the range at $8,450.

Bitcoin found “logical support” at the middle Bollinger Band, according to the indicator’s creator, John Bollinger.

False Breakout: Where Does Bitcoin Go Next?

Holding support here is critical for Bitcoin’s trend reversal, however, there are signs that the rally may be short-lived and already beginning to wane.

Bitcoin has fallen back into its downtrend channel after a false breakout. The point of control lies at $8,000, which also coincides with where the 100-day moving average is currently trending. Holding above the point of control would likely result in a test of resistance at $10,000 while losing the level would result in a retest of $7,000 support.

Volume and Volatility Dropping in Bitcoin Markets

Further bearish signals include Bitcoin falling to the lowest trading volume seen in the past three weeks, and has been trending downward ever since the crypto asset topped in late June at $14,000.

Daily volume on January 22, was just $306 million, the lowest record during 2020 thus far. Such a drop in volume is said to be “concerning.”

However, Bitcoin volatility has been in a slow and steady uptrend but is still not reaching highs that the crypto asset is known for. The reducing volume could lead to a spike in volatility, according to research.

Less Kids on the Blockchain

Blockchain activity shows that while transaction value has skyrocketed this year, increasing by over 45%, last week saw a drop by as much as 25% week over week. The number of transactions itself has also seen a decrease of between 1 and 2%.

Altcoins: Ethereum, Ripple, Litecoin, EOS & More Rally Over 50%

A major rally in the altcoin market may have been partly responsible for helping to drag crypto market sentiment into the neutral territory and pushing Bitcoin higher.

Ethereum and Ripple Outperform BTC

The number two and three top cryptocurrencies by market cap, Ethereum (ETH) and Ripple (XRP) significantly outperformed Bitcoin last week.

Altcoins throughout the top ten cryptocurrencies by market cap went on massive rallies that brought traders as much as 40% or higher ROI over the last 30 days. Bitcoin SV rallies as much as 400% before retracing and closing at a 226% gain.

Best Performing Altcoins

The best-performing assets last week, however, were Tezos, Ethereum Classic, NEM, Stellar, and HedgeTrade.

Mid-cap altcoins are still up 48% in January, and many other altcoins are holding recent gains, suggesting that the bottom may be in for altcoins.

Breakout and Boost in Buy Volume

A break of downtrend resistance across the total altcoin market was also accompanied by the largest weekly buying volume ever recorded, prompting some analysts to say that those who buy now could eventually see “life-changing wealth” generated.

The strength in altcoins has seen Bitcoin lose almost a full percent of market share and dominance this past week.

Crypto Market Sentiment: Returning to Neutral, But Greed Is Building

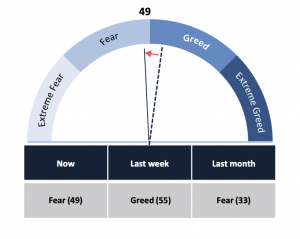

Crypto Fear and Greed Index Returns to Neutral

Because the crypto market is driven primarily by speculation and sentiment, there exists a Fear and Greed Index that gauges the psychological state of the overall market and its participants. After spending the second half of 2019 at high levels of fear, the gauge has been trending back toward neutral – and is sitting at neutral currently. Depending on where the crypto market goes from here will determine if sentiment falls back towards levels of fear, or towards greed once again.

Institutional Traders Are Especially Bullish

BTC Futures premiums are up for June 2020, suggesting institutional traders are bullish on the cryptocurrency in the mid-term. On CME alone, the premium has reached nearly 5% for June 2020. However, short term contracts suggest for January 2020 and March 2020 indicate that more bearish price action is expected.

In general, CME traders continue to have a more bullish outlook on the first-ever cryptocurrency than on other platforms. Annualized premium rates on CME are now equal for both March and June contracts, as can be seen in the chart below.

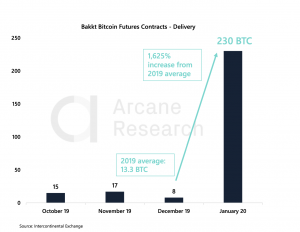

Bakkt Makes Comeback

It’s not just CME showing an increasing interest in Bitcoin. Bakkt, the trading platform launched in late September 2019 to abysmal trading volume, has increased its delivery of physically settled Bitcoin futures contracts by over 1,600% in January 2020. In the three months at the tail end of 2019 after the platform launched, it traded an average of 13.3 BTC, and in January 2020 ЛЛalready has traded 230 BTC. The increase is speculated to be a result of two Bitcoin funds launched late last year by the Mike Novogratz-led Galaxy Digital.

The Week’s Most Important News: Ripple IPO, Bitcoin Halving, & More

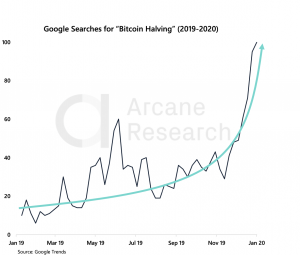

Bitcoin Halving Search Volume Trending on Google

Interest in Bitcoin’s upcoming halving – an event that sees the block reward miners receive in BTC slashed in half – has been accelerating on Google lately. Google searches for the term can be seen steadily growing since January of 2019, but have since exploded and gone parabolic at the end of 2019. Bitcoin’s halving is coming in May 2020 and is expected to cause a steep rise in value in the crypto asset. This expectation could be fueling the early sentiment change and the recent rally in the crypto market.

Ripple To Launch IPO

Ripple CEO Brad Garlinghouse has indicated that the firm could go public within the next 12 months and expects many other crypto firms to follow suit.

Fidelity Hiring Bitcoin Mining Engineer

With over $7 trillion in assets under management, Fidelity seeking anything related to Bitcoin is notable. A job listing suggests that Fidelity is planning to build and maintain a Bitcoin mining operation.

Six Central Banks Explore Digital Currencies

Six of the world’s major central banks have joined forces to form a working group to explore the use cases around central bank-issued digital currencies. China is planning to launch its own digital currency soon, and Japan has recently begun discussing launching a digital currency of its own to compete with China and stay ahead of the pack.

Vodafone Hangs Up on Facebook Libra Association

The UK-based telecom firm is now the eight company to separate themselves from the Libra Association that would govern Facebook’s native cryptocurrency project, the Facebook Libra.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.