It has been a rather troubling week across all markets. Not only has Bitcoin taken a tumble to fall below the prized $50,000 mark, dragging with it most of the cryptocurrency space, there are also fears from traditional risk assets as US President Joe Biden unveiled his capital gains tax proposal.

Risk assets sold off from the get-go last week, with the stock market already showing signs of exhaustion before Biden unveiled his capital gains tax proposal. Things got worse after Biden’s proposed new tax rule which would almost double the tax wealthy individuals would be paying on their capital gains.

On closer scrutiny, however, the increase in tax would actually only affect 1% of the population – those with more than $1 million in assets, or earning more than $400,000 per year. Despite this, the markets took it as an opportunity to sell-off, even if the chances of the tax proposal being passed is slim.

While stocks recouped losses on Friday, with the three main indices ending the week mostly unchanged from the week before, carnage was seen all across the cryptocurrency market which witnessed selloffs in much bigger magnitude.

BTC has broken below $50,000 and broken a trendline that has kept prices moving up since the start of the year, while most other altcoins bled between 10-50% off their highs.

The USD remained weak, with the DXY breaking below 91 to 90.70. The EURUSD was the main gainer of the week, rising above $1.21 after ECB kept its interest rate and asset purchase program unchanged during its regular policy meeting last Thursday.

Gold and Silver also closed the week unchanged after falls on Wednesday and Thursday wiped out gains made earlier in the week. Gold opens the new week at around $1,780 while Silver is above $26.00.

Oil closed slightly weaker after Covid cases saw a resurgence in many parts of the world, causing traders to sell Oil in anticipation of weaker demand should countries start to impose lockdown restrictions again. However, Crude remains well-bid above $60 and currently trades slightly above $62.

This week will be extremely busy for the stock markets with a third of the S&P 500 companies reporting earnings, a Federal Reserve meeting, and we get to see White House’s response to Biden’s capital gains tax proposal.

While the Fed is not expected to take any action, experts expect it to defend its policy to let inflation run hot, which may help stocks, commodities, and perhaps, cryptocurrencies.

Mayhem In Crypto Markets As Big Sell-Off Worsens

Post the first selloff early last week, the price of BTC remained lackluster and did not manage to stage any meaningful rebound. Prices went another notch lower after Biden’s proposed tax plan sent investors rushing to the exit, sending the prices of most cryptocurrencies plummeting by around 25% on average. Retail crowd favorites like XRP and DOGE fell even more, retracing more than half of their meteoric rise the week before.

The plunge brought BTC back below the $50,000 mark, breaking an upward sloping trendline, the 50-day MA, and the 100-day EMA. However, after falling for almost nine straight days, BTC is in an oversold region which may see its price rebound in the coming days.

While the technical picture looks somber now, there may still be a chance BTC stages a strong comeback, as it has done several times before. Hence, it is still too early to brush BTC off.

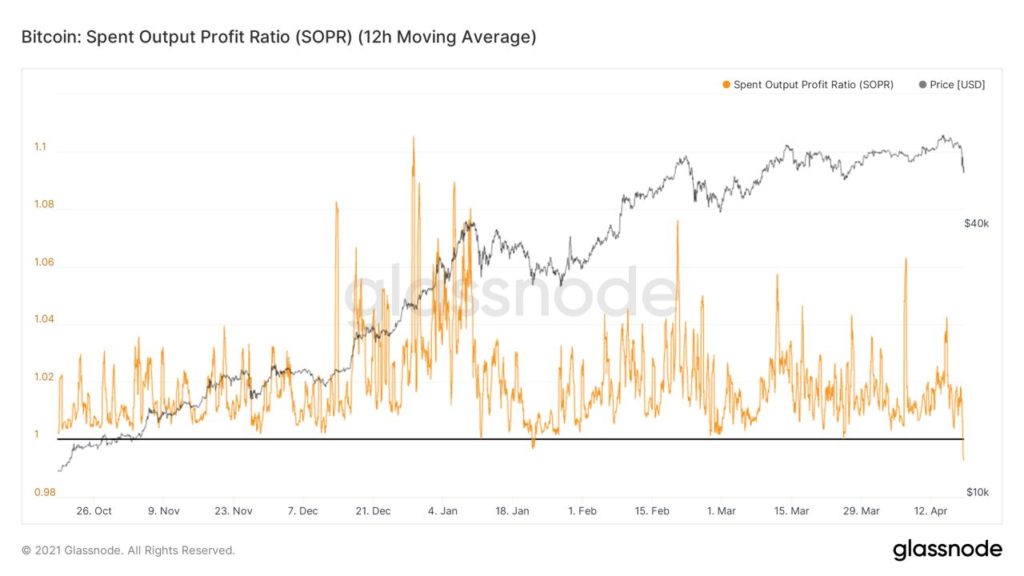

With the price drop, the Spent Output Profit Ratio (SOPR) for BTC has gone negative, implying that recent buyers of BTC are nursing losses.

Good News Still Abounds Despite Sell-Off

All is not lost, however, as good news which may help BTC price recover still abounds.

The most impactful good news for BTC and the crypto market came unexpectedly from China. After the well-known crypto crackdown launched by the Chinese government four years ago, it seems there is now a change in the tone from the country’s central bank. During a panel hosted by CNBC at the Boao Forum for Asia, Chinese government representatives are now calling BTC and cryptocurrencies a good alternative investment for the first time since the crackdown.

Officials also mentioned that they may explore potential changes in their current water-tight regulations. This change of stance will be very beneficial to cryptocurrency as an investable asset class in China and bring more liquidity into the crypto market in the future.

Other good news came in the form of adoption. Crypto adoption is gaining traction as more large companies are also beginning to accept crypto as payment. Venmo will let customers buy, hold and sell cryptocurrency within its app, while WeWork is the latest company to accept crypto as payment for services, and will not be selling the collected crypto and instead will hold them on its balance sheets.

The third good news came in the form of data showing that long-term BTC holders do not seem inclined to sell into the price decline at all. The amount of non-moving BTC supply, (in cold storage/custody) last moved/bought three to six months ago has grown to 2.5 million BTC, a sign that the institutions that bought in the last 3-6 months aren’t selling.

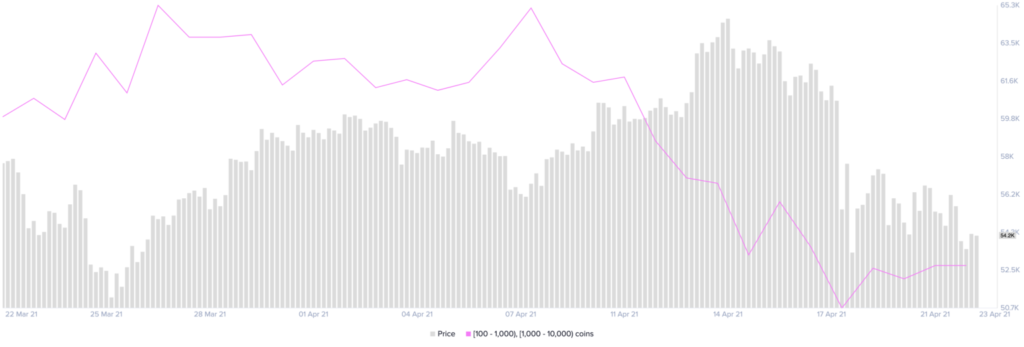

New Whales Spotted Accumulating While Short-Term Traders Sell

In fact, many large investors took the opportunity to accumulate BTC when most retail traders trembled in fear. BTC’s supply distribution chart shows that the number of large whale addresses increased during this period as prices dropped.

Roughly 16 new whales holding 100 to 10,000 BTC have joined the network within such a short period.

The sellers responsible for the bulk of the selling seems to be short-term traders as evidenced by the distribution map below, where red is most recent holders, while further up north in blue and purple shaded areas shows the change in long-term holders.

While the change in BTC holdings for long-term players remains largely unchanged, that of short-term players is on the decline, implying that these new positions are the ones contributing to the fall in price.

Select Altcoins Hit ATH Despite Meltdown

While BTC and many altcoins experienced their worst sell-off this year, the same cannot be said of some altcoins. Despite blood in the market, not all altcoins are faring badly. For instance, the second-largest cryptocurrency, ETH, with its token-burn mechanism finally having a launch date on 14 July, has seen its price shoot to a new ATH of $2,665 before giving back some profit.

Other tokens with increasing adoption also saw good gains. SOL and CAKE made good rebounds post selloff to make ATHs of $48.60 and $35 respectively.

With ETH’s upgrade imminent, positivity also spread to ETH-based DeFi projects like MKR and COMP, which saw prices hitting ATHs before retracing together with the rest of the market. These names, however, remain well supported and are staging decent recoveries.

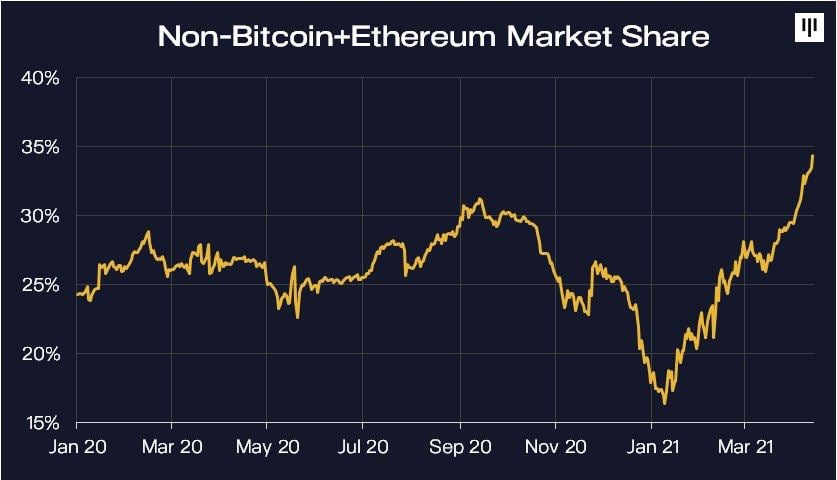

As a result of better performance in altcoins, BTC dominance has set a 3-year low, falling below 50%. The market share of altcoins excluding BTC and ETH is now close to 35% of the total market, a sign that funds are moving into smaller altcoins in search of better yields as BTC struggles.

Institutional Inflows Spike, XRP Sees First Institutional Investment Since Lawsuit

Institutional XRP inflows surge as AUM nearly doubles. Institutional investors have rallied around XRP and other altcoins, with nearly $33 million being injected in XRP investment products after the token surged to highs not seen in three years after a series of small wins by Ripple in the courtroom.

The re-rating of XRP is expected to continue despite a pullback of around 50% of its meteoric rise the week before as more investors reconsider adding XRP back to their portfolio as more favourable news emerges from the lawsuit.

According to reports, last week was the most bullish for institutional crypto products since early March, with $233 million injected in institutional funds.

Altcoins saw renewed market action overall, with $65 million allocated to Ether (ETH) products, while Binance Coin (BNB) funds took in $3 million, Bitcoin Cash (BCH) saw $4 million, Polkadot’s DOT received $5 million, and Tezos (XTZ) attracted $7 million worth of inflows. Roughly $6 million was invested into multi-asset products, while XRP attracted $33 million, the highest amount among the smaller altcoins.

In addition to large inflows, institutional trade volume also surged, gaining 59% week-over-week to tag $4.8 billion. AUM of crypto investment products also soared to record highs above $64 billion.

Transaction Volume and Active Address Spike Send ETH Price Up

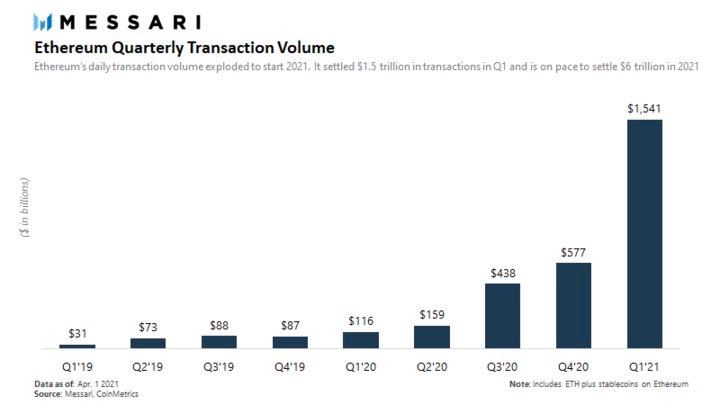

ETH, with the highest amount of inflow among altcoins, performed particularly well, rebounding one of the most amongst the large-cap coins. This could be due to data showing explosive growth in transaction volume on the ETH blockchain last quarter, which has fuelled investor confidence.

In line with the huge increase in transaction volume, the number of ETH active addresses also spiked in 1Q21, hitting an ATH of 771,000, surpassing the previous record set in November 2020 of 739.000.

Other news positive for sentiment surrounding ETH last week was the launch of three ETH ETFs on the Toronto Stock Exchange.

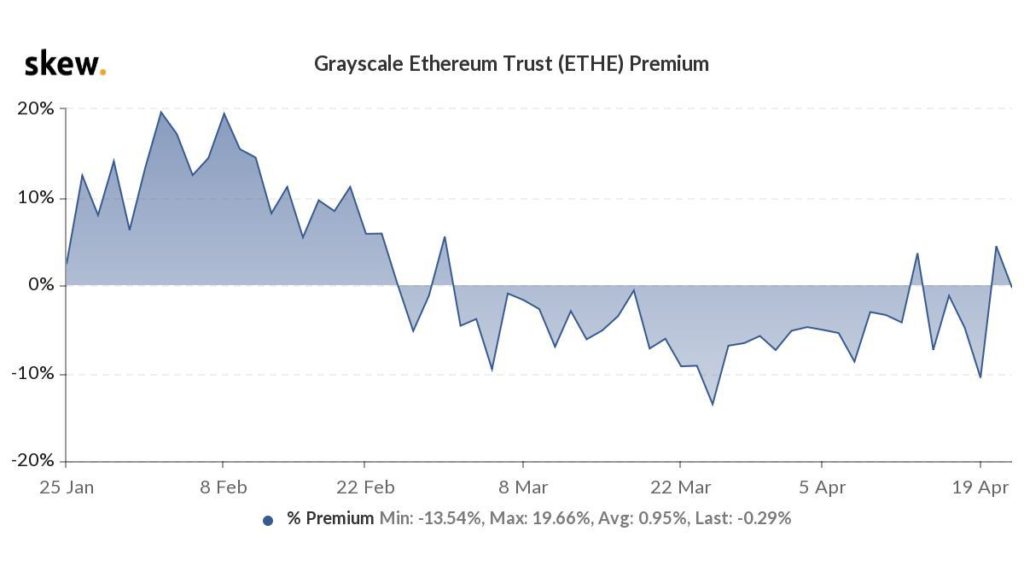

Interestingly, after Rothschild announced their $4.75m purchase of ETHE Trust, the Grayscale Premium for their ETHE Trust recovered back into positive territory, underscoring the more positive sentiment on ETH than on BTC by institutional investors, which saw the price of ETH break ATH before a broad market sell-off dragged prices back down.

ETH Could Become Deflationary Sooner Than Expected

With time, as ETH 2.0 progresses, ETH could become a deflationary asset sooner than expected. In the latest tweet, a data provider anticipates that ETH’s net token issuance could drop to 0 by the end of 2022 due to the token burn upgrade part of EIP-1559 that is expected to launch this 14 July. This could be the main reason why ETH investors have been piling into ETH recently, leading to its outperformance over BTC.

As we begin the new week, cryptocurrencies are attempting to rebound from the selloff, with smart-contract blockchain tokens looking stronger than the rest of the market. As we move further into the week, eyes will be on BTC to see if it manages to recoup its losses. The level around $55,000 will be closely eyed for hints if BTC will be able to reclaim its near-term uptrend or if it sinks into a period of consolidation. Investors’ reaction to the Fed meeting midweek may provide some clue as to how markets may move towards the end of the week.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.