The road back to Bitcoin’s all time high, and beyond, seems to be back on track as the coin managed to reclaim the $58,000 mark. Now, ahead of it lies $60,000 and then $62,000 and more.

However, it is not just Bitcoin making moves as Ethereum has crossed an all important mark, as it managed to break $3,000. A lot of this is down to internal factors, but there is also big regulatory news coming out of Europe.

Last week’s glut of economic and corporate data also showcases the incredible progress the US economy has made in a short passage of time since partial reopening. However, worse-than-expected economic data from the eurozone and China, coupled with headlines of a worsening COVID situation in India sent traders worrying about the longevity of the recovery.

Stocks were sold into on Friday after all indices touched ATHs on the back of better results from major companies like Tesla and Amazon. The Dow and S&P were unchanged for the week, while Nasdaq traded 1.4% lower. Volatility remains quite absent in the stock markets as traders fail to find a catalyst for the next big move.

With economic weakness seen in other economies, the USD is trading higher, with the DXY rising around 1% to 91.50 to close the week. With a stronger USD, Gold and Silver are retreating a little, however, both precious metals are still hovering around $1,770 and $26.00. The USD however is starting the new week an inch lower, falling to 91.20.

Oil was strong throughout last week but saw profit-taking on Friday after weaker economic numbers from Europe and China dampened hopes of sustainable economic progress that would drive demand for oil. It however remains well-bid above $62.00, at $63.60.

Most actions centred around the cryptocurrency market again, with the altcoin segment on fire with price increases of more than 100% seen on many altcoins. BTC, which wasn’t doing much for most of the week, rose around 10% on Friday after a $4.5 billion options expiry.

News out of Europe started sending crypto prices higher on Thursday when a dovish Fed failed to inspire traders the day before. In Germany, a new legislation enabling managers of the most popular institutional investment funds—the so-called Spezialfonds—to allocate 20% of funds to crypto-assets is set to come into force on July 1.

This is significant as the Spezialfonds have AUM of around $1.8 trillion, and 20% of it would translate to around $450 billion that would be coming into the crypto market beginning 1 July – around 20% of the current total crypto market cap, which is a huge amount. This led to the crypto market bursting out of its early week lacklustre performance when both BTC and the market struggled to find direction.

Uber Whales Accumulate More BTC Despite Selloff

Post selloff, BTC has been in consolidating mode, not doing very much except range trade between $53,000 and $57,000 the most of last week.

Despite the quiet appearance, data shows that BTC whales holding 10,000 BTC or more are still accumulating the flagship cryptocurrency amid a deep correction. Around 60,000 BTC have been added since its ATH on 14 April, with a total of 90,000 units added since 5 April, suggesting that these uber whales are still very bullish on BTC. Now, the top addresses hold a combined 14% of BTC, reducing the supply available for buy and sell further.

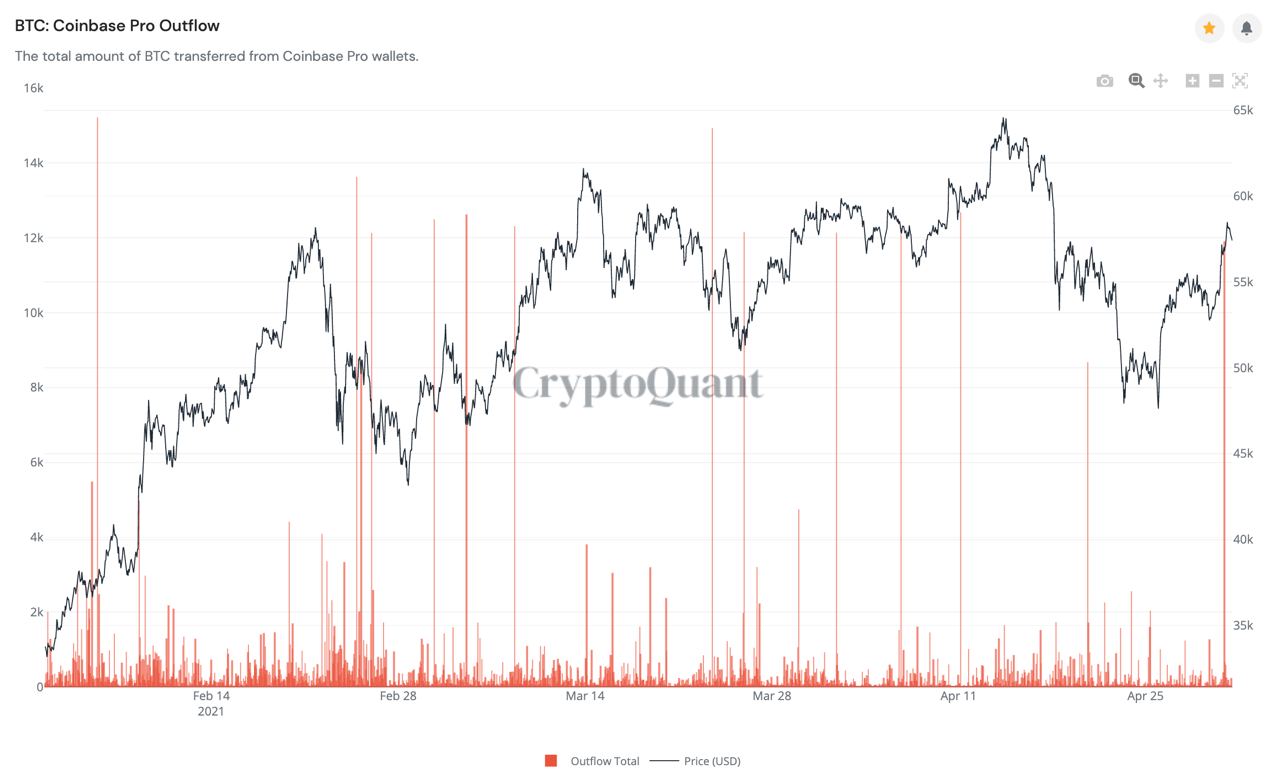

Coinbase whales are also continuing to purchase and remove BTC from circulation. Another large block of 11,800 BTC was withdrawn from Coinbase at the end of last week.

Miner Activity Shows Very Bullish Signs

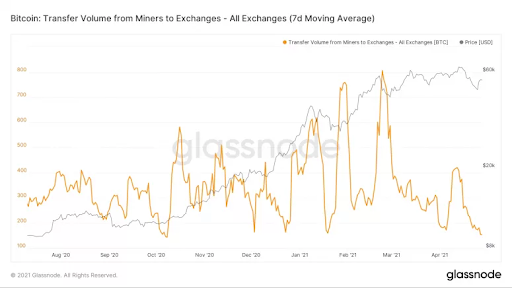

Another group sending positive signals are the BTC miners. The 7-day moving average of the daily volume of coins transferred from miners to exchanges fell to 152.77 BTC (-1.78%) last Wednesday, the lowest since 8 Oct. The metric has declined by 80% since topping out at 805 BTC on 23 Feb.

This means that miners are selling less and less of their mined BTC. Miners typically need to sell their mined BTC to fund business operations and the fact that they are not selling shows that, like the uber whales, they are very bullish.

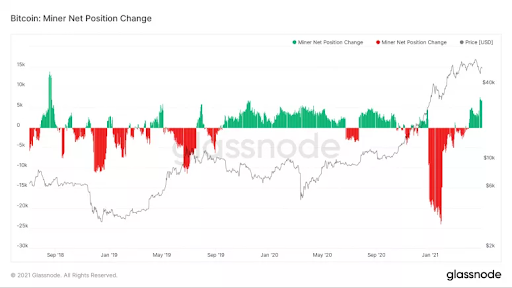

In fact, other than not selling, miners are buying more and more BTC. The Miners Position Index has shown that miners are buying BTC in increasing quantities, a definite bullish sign.

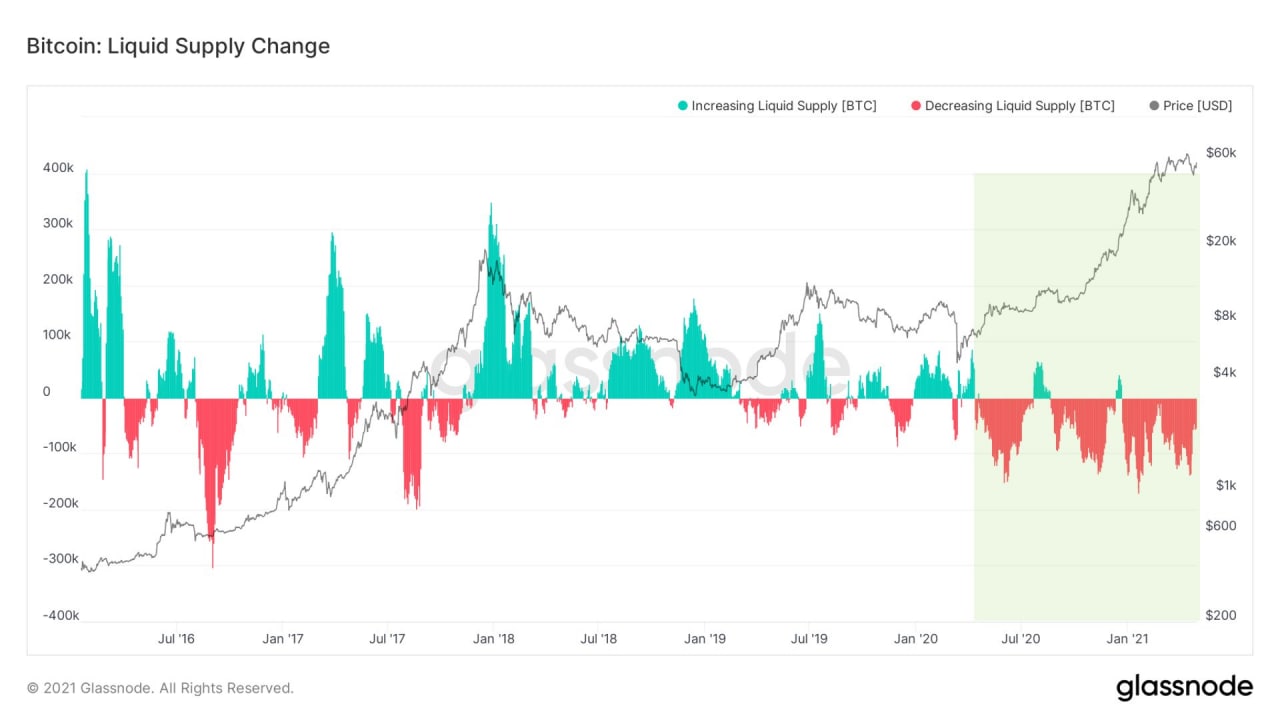

The resultant purchases by these 2 distinct groups have caused the liquid supply of BTC to drop more drastically, implying that more BTC were being removed from the market even as prices dropped. Wallet addresses that have never sold any BTC before were observed to be the largest buyers during the dip, which will inadvertently intensify BTC’s supply crisis further going forward, which may cause price to rise more sharply in the event a large buyer appears.

In addition to old hodlers, more new buyers are emerging. Last week saw another new corporate BTC buyer in Nexon, an online gaming company listed on the Tokyo Stock Exchange. Nexon said it acquired 1,717 Bitcoins at an average price of about $58,226 each, including fees and expenses.

The purchase represents less than 2% of Nexon’s total cash and cash equivalents on hand, and is the largest-ever purchase of digital currency made by a company traded in Tokyo. This shows the trend of buying BTC as a treasury reserve is still very much alive. Meanwhile, the leader of all corporate buyers, MicroStrategy, interestingly saw its business improve a great deal after the company’s BTC purchase.

The company reportedly saw an astounding surge of 50% yoy growth in revenue in Q1, nine months after its first high-profile BTC purchase. The company said it will continue to add more BTC to their reserve as it feels having more BTC can increase value creation for its shareholders.

With more large buyers come more brokers, with the latest being JP Morgan. JPM has allowed its clients to invest in cryptocurrencies for the first time through a BTC fund that will be actively managed and offered to its private wealth clients.

However, JPM seems more bullish on ETH than on BTC, with their flagship crypto report arguing that ETH should outperform BTC over the long run, citing that ETH is the backbone of the crypto-native economy, while BTC is merely viewed as a store of value. Their sentiments are strongly echoed by other market participants who call ETH the currency of the world’s computer.

ETH Cruises To $3,000 On Surge in DeFi Activity, Outperforms BTC

Following ETH’s deployment of the “Berlin” upgrade on 15 April, ETH users have noticed that gas prices have dropped considerably. This thus ramped up DeFi action on ETH-based platforms, with the TVL on ETH-based DeFi platforms recovering after falling for the past month.

This has led to popular ETH-based DeFi project tokens going up, with UNI and COMP hitting new ATHs of $44 and $880 respectively. COMP is the first DeFi platform that saw its individual TVL exceed $10 billion last week, which led to its token surging 35%.

As a result, the price of ETH has outperformed that of BTC, with ETH touching $3,000 while BTC remained in the shadows until after the expiry of $4.2 billion worth of options on Friday sent traders back in to purchase BTC again, sending its price back above $58,000.

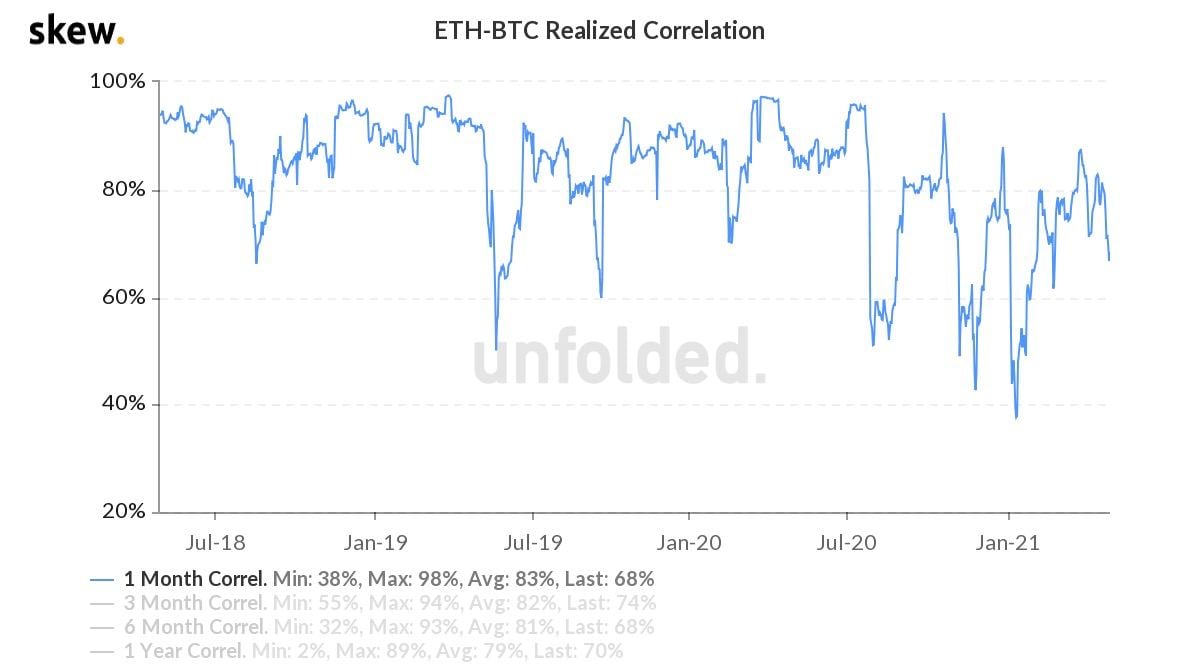

This divergence has caused ETH price to decouple from that of BTC. The price correlation between ETH and BTC has been falling from 85% a month ago to 68% currently, with the near-term still pointing towards a downtrend, meaning ETH will increasingly continue to chart its own path not affected by BTC.

It is not just ETH correlation with BTC declining. That of altcoins is also falling as alt season rages on. Many altcoins are faring much better than BTC, with DeFi-supporting blockchain tokens taking centre stage. Other than ETH itself, ETH Layer-2 scaling solution Polygon (MATIC) also saw its price rocket 300% to a high of $0.95 on the back of a huge increase in projects moving onto the blockchain, as well as an increase in TVL locked on MATIC platforms.

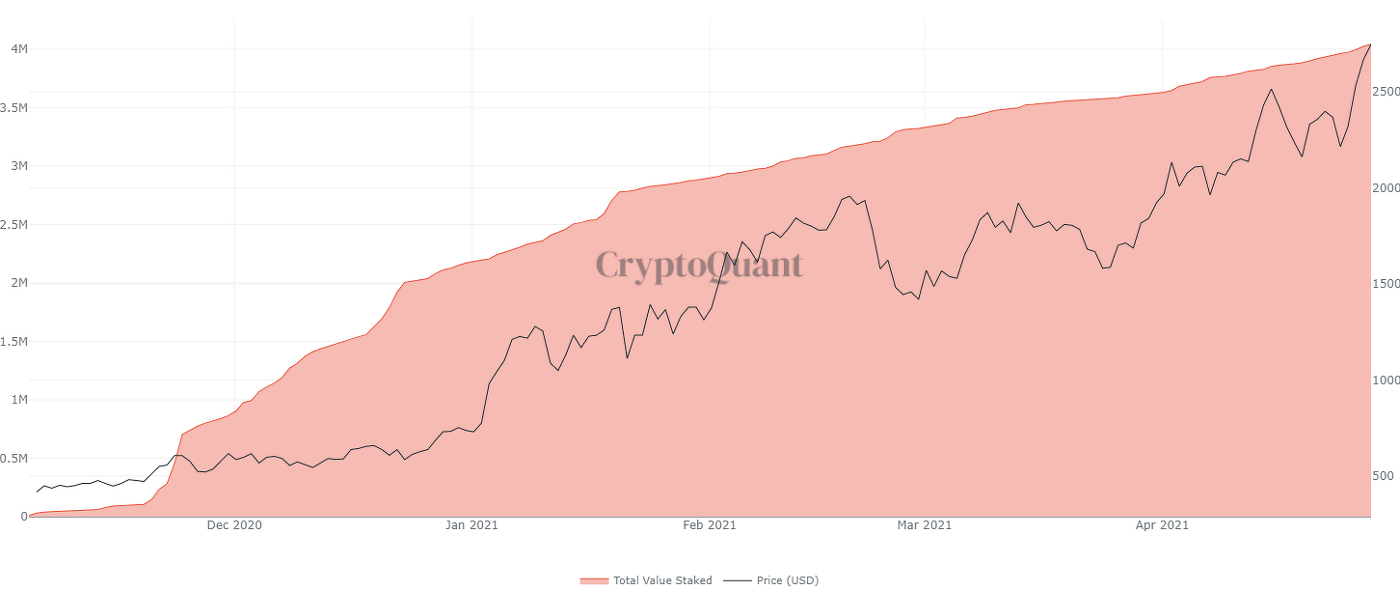

With more positive sentiments surrounding ETH, sophisticated investors are increasingly interested in ETH staking, as can be seen in the number of ETH staked in the contract address.

That number has been steadily climbing to more than 4 million units now, representing around $11 billion of valued staked. This trend is likely to continue for the foreseeable future, locking up more and more ETH out of circulation. As demand increases and supply decreases, the price of ETH is on track to increase beyond $3,000. Some experts are calling out for ETH to hit $10,000 by the end of this year.

Last week also saw one of the world’s biggest asset managers, WisdomTree, listing its new ETH ETP on Deutsche Borse’s Xetra market in Frankfurt and on the Swiss Stock Exchange in Zurich, highlighting ETH to more new investors in Europe.

The WisdomTree ETH ETP (ETHW) is currently the cheapest available ETH-derivative product in Europe with an expense ratio of just 0.95%. This lower cost may bring in more new investors who previously shied away due to the concern of high management fees.

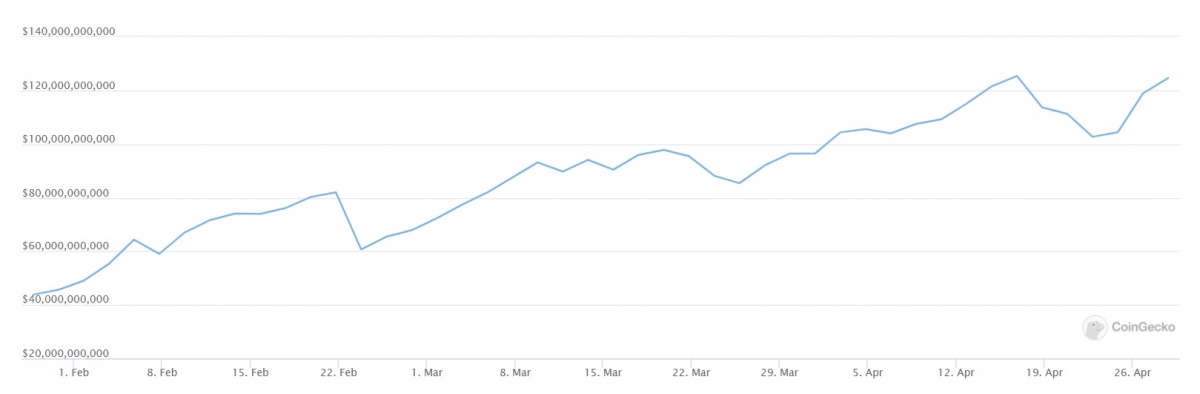

Altcoins Take Turn to Hit ATH, DeFi TVL Crosses $120 billion

The altcoin market fireworks are aplenty, with many tokens rallying a second or third round to exceed previous ATHs. Many experts are of the opinion that all season has only just begun and expect higher prices ahead.

Leading the altcoin rally are the DeFi-related tokens, as the TVL in the whole DeFi segment has crossed $120 billion, with ETH still the leading blockchain with around $66 billion locked in ETH-based projects. BSC comes in second with around $43 billion, but is seeing incremental growth at a much faster pace than ETH. While projects on ETH took 4 years to hit their first $1 billion aggregate TVL, projects on BSC only took 6 months.

With TVL in DeFi growing at such high speed, DeFi-related tokens should continue to grow exponentially and this DeFi Summer is expected to be much bigger than the one last year. Already, BNB and CAKE on BSC, SOL and SRM on the Solana blockchain, are repeatedly smashing ATHs before Summer even sets foot.

Not to be outdone, everyone’s favourite memecoin DOGE continues to be in the limelight after Elon Musk tweeted that he would be hosting 8 May’s Saturday Night Live talk show as Dogefather. The price of DOGE surged 30% after the tweet and is very actively changing hands around $0.40.

New Whales Seen Accumulating XRP

Meanwhile, after finding support at $1.00, XRP is back to resume its uptrend as price has broken the $1.47 resistance. Whales are back actively buying XRP, with data revealing that 19 new addresses with more than 1,000,000 XRP have joined the network since April 23, a definite bullish sign.

Ripple’s largest external shareholder also revealed last week that the company intends to go public after wrapping up the SEC lawsuit and this could add a lot more hype to XRP’s price should the lawsuit eventually settle in Ripple’s favour.

XRP Whale, Santiment Data

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.