It was a week for the small investors, as main street beat wall street in the small capitalisation stocks segment. A group of traders from the Reddit forum WallStreetBets (WSB) started buying up heavily shorted stocks, causing massive losses in the region of $50 billion for Wall Street hedge funds, Hedge funds who shorted heavily on stocks like AMC and Gamestop made hefty losses on their short bets as the price of the stocks rallied significantly, making headlines in financial news worldwide.

The main stock market indices however, closed the week lower on COVID fears and on a reduced confidence in the stock market system after the Gamestop saga. The Dow and S&P closed down 2% on the week, while Nasdaq was the worst performer, falling 5%, or 700 points from the peak of 13,500 due to shaken confidence in the tech sector after a large retail broker banned their clients from buying the said stocks to stop them from going up, sending the stocks plummeting. However, much damage has already been done to the hedge funds as they had already cut losses. This sequence of events created big losses for both the hedge funds as well as traders who bought the stocks later. This phenomenon is a very unique one, with traders ganging up together to buy up many heavily shorted stocks on Wall Street. Many experts raised caution about the situation being made possible by extended leverage, and warned of potential large losses since these companies, as well as the stock market, is overvalued and that the Gamestop mania is a sign of a large bubble about to burst. A number of lawmakers also called for an investigation into the chaotic trading. Overall, it was a roller-coaster week for the stocks in question, since after rallying many times over, the halt by brokers caused the stocks in question to fall significantly, and thereafter rising again after the curbs were lifted on Friday.

Silver Rallies on WSB Proposed Plan to Cause a Short-Squeeze

Gold and Silver took cue from WSB and made their biggest gain since start of the year. Silver in particular, rose more than 15% since Thursday after the WSB group mentioned that they are going to cause a short-squeeze on Silver next. Whether they manage to do to that remains to be seen, but it definitely started a buying spree on Silver as its price jumped significantly higher, breaking the $26.00 resistance that has been keeping prices down. That resistance has turned into support and Silver has opened the week popping up $2.00 to $29.00. Even though it has pulled back a little, the price of Silver is now very near its ATH of $29.85 made last year and should the $30.00 level be taken out; the resultant rise may be very exciting.

Meme Token DOGE Soared 800% in a day, BTC Rallied 20% Before Falling Back

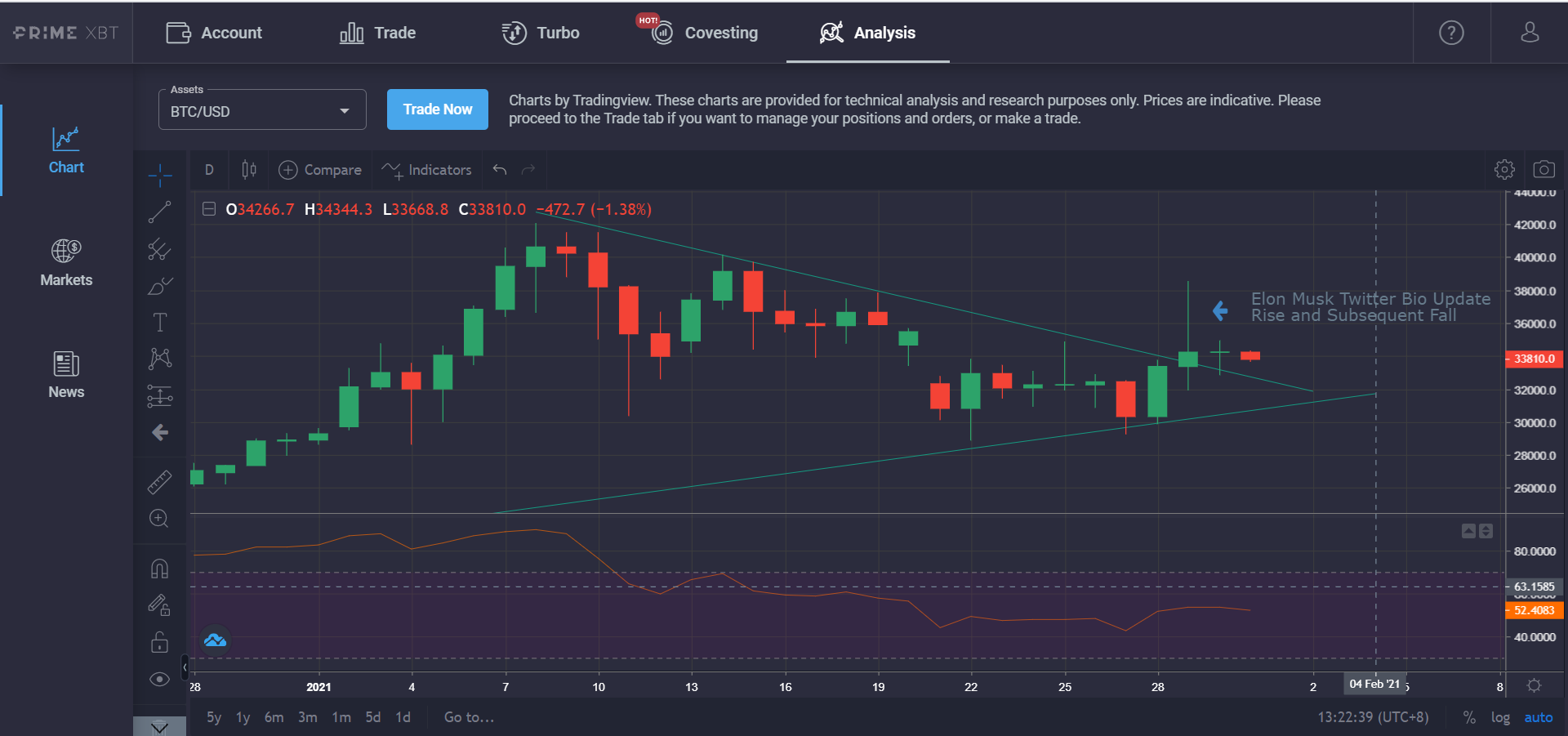

The action also rubbed off on to the cryptocurrency market, with favourite meme token DOGE rising 800% in 1 day on Thursday after Elon Musk posted a picture hinting at the token on his twitter account. The Tesla founder has been very vocal supporting the activities of WSB, and took the chance to show support for BTC too by putting the Bitcoin name onto his Tweeter Account Bio Page on the early hours Friday, sending the price of BTC surging 20% within 30 minutes. The surge is one of the biggest squeezes in BTC price in recent times, aiding BTC to break out of its downtrend that has plagued it for weeks, and liquidated around $558m worth of shorts.

The surge in DOGE and BTC caught the attention of many stock investors who started to take an interest in trading cryptocurrencies, with many rushing to open cryptocurrency accounts, creating bottlenecks at many cryptocurrency exchanges. Almost all exchanges reported outages as huge volumes of trades as well as new entrants trying to set up an account surged in a short span of time, making trading impossible for most traders. Cryptocurrency channels on Reddit also saw an astronomical increase in new subscribers.

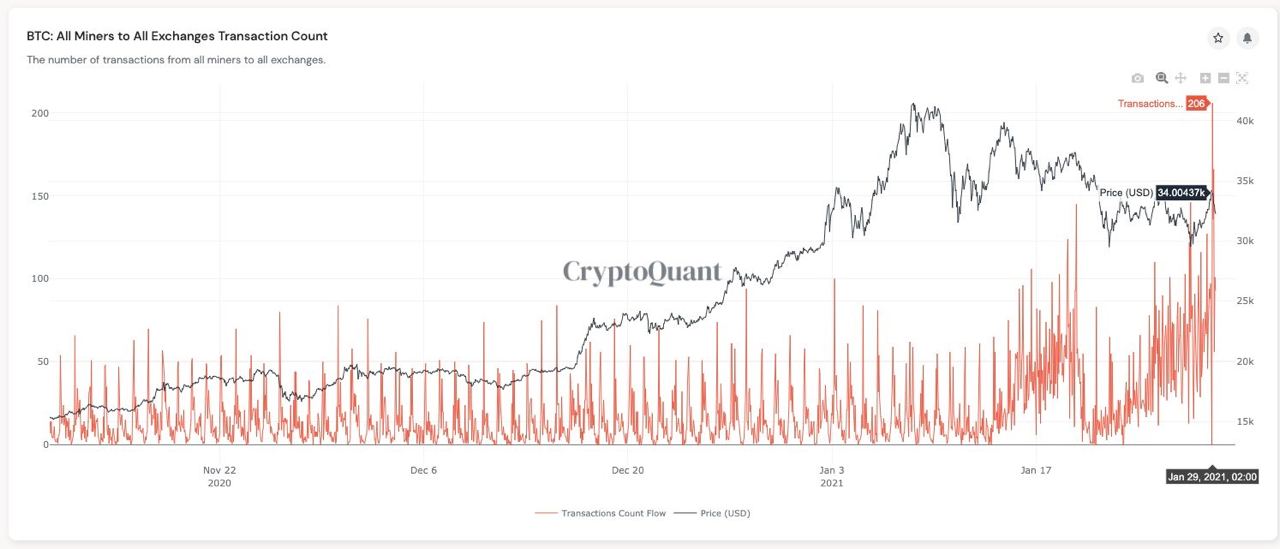

Miners Selling Caused BTC Price to Fall Back

However, BTC quickly retreated back down due to massive selling by miners. Many attributed miners selling due to the upcoming Lunar New Year holidays as the price of BTC was always weak leading up to the Lunar New Year since 60% of miners are Chinese and that they often take profits ahead of the new year. Miners deposits to various exchanges hit an 8-month high on Friday, making them the likely culprits for sending the price of BTC back down to $33,000 after Musk’s tweet sent it up to $38,000.

Even though the price of BTC retreated lower, the price is expected to recover over time as demand for it continues to gather pace from institutional investors, with Bridgewater Associate, the largest hedge fund in the world, singing praises of BTC and revealing that they are setting up a crypto fund to buy BTC. Also, according to One River Capital, who has already bought $600m worth of BTC last year, they are receiving an astounding number of BTC inquiries from big credible institutions, a sign that more and more large funds are on the way.

Meanwhile, altcoins took the opportunity to rise. In particular, the DeFi tokens were the biggest gainers, even as the price of DOGE dropped 60% after an astounding run. DeFi hot favourites like AAVE, COMP, UNI, SUSHI etc, continued to rotate and make 20-40% weekly gains.

All Eyes on XRP next as WSB Movement Led XRP Community to Do the Same

With the newly found camaraderie spirit within the trading fraternity, the community of XRP appealed to WallStreetBets to help raise the price of the cryptocurrency. While WSB did not respond, XRP did carve out some fantastic gains since, more than doubling its price in just two days. However, things have since taken a downward turn from there.

Some volunteers in the XRP community organized their own campaign to pump up the price of XRP, with the main action to buy together on 1 February 8.30 am EST, as a protest to the SEC for wrongly accusing XRP of being a security when it is not. Telegram Groups and Facebook Groups were set up to help gather more people to buy XRP and not sell it to make its price “moon.” The price did indeed moon but has since crashed back down considerably. From the low of 24 cents, XRP spiked to as high as 75 cents per token before immediately plunging by 50% back to 37 cents.

The community has some fundamental reasons to back up their campaign, as compared with the pump and dump of other tokens like DOGE. The campaign is to buy and hold XRP tokens to keep its price high as a show of power. But prices are already beginning to retreat ahead of any chance of winning against the SEC.

With regards to the lawsuit, this past Friday, Ripple filed their defense in response to the SEC lawsuit. In the 93-page filing, Ripple responded to each of the SEC’s allegations. In its affirmative defenses, Ripple stated that XRP is not a security or investment and the firm’s sales or distributions of XRP are likewise not investment contracts. In addition, Ripple also filed a Freedom of Information Act request for documents from the SEC on how it determined that BTC and ETH are not securities.

The fact that Ripple appears to be putting up a strong defense, and with other financial experts supporting Ripple’s claim that XRP is not a security, gave supporters confidence in the token to somewhat recover. But it ultimately may not be enough to sustain positive price momentum further.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.