Among one of PrimeXBT’s many goals, a primary focus of ours is arming traders with tips, training, and other first-hand knowledge that will assist them on their journey toward profitability. We have produced a plethora of helpful guides and reference material in both our help center and on our blog.

Whether you are an experienced trader with years across many different markets, or a novice testing the waters for the first time, the opportunity is equal for all. What separates top traders who regularly book profits from those who only stack losses is patience, a strong hand, a lack of emotions and bias, and the right tactics and strategies that can be applied to any market.

Market Timing And Greed Are A Recipe For Disaster

One of the most important and difficult lessons that nearly all traders learn the hard way, is attempting to time market tops and bottoms. The problem isn’t the market itself, although that is working against you at nearly every turn – the main issue is greed.

Greed is a nasty emotion and one of the Seven Deadly Sins as defined by Dante’s Inferno. Greed can blind a trader to what is right before their very eyes, and lead them down a path of destruction.

Greed is what fuels traders to try and time markets, and take risks that are far too great or simply too improbable for success.

Technical analysis is about probability and risk management is about further setting up the probability for success, while preventing loss. This all goes out the window when trying to time tops and bottoms perfectly.

Any trader that has opened their charting software and drawn their first trend line can easily see how much profit could be made by attempting to perfectly time each top and bottom with swing trades.

For new traders, that reward proves to be too tempting to pass up, and many mistakes and losing trades are made trying to achieve the impossible – or at the very least, the highly improbable. These traders are stuck managing stressful positions for sometimes days or even weeks, only to later get stopped out at a loss because they failed to take profit while waiting for a bottom that they either missed or never arrived.

Over time, by the way of lost capital and significant stress, these traders will eventually realize their ways were wrong and either give up entirely or try again but this time ditching the idea of timing tops and bottoms.

Active Trading For Quick Profits Leads To More ROI In Less Time

For a trader to truly find success, all emotion – especially greed – must be removed and an unbiased, stoic sensibility must be maintained when approaching a trading plan. Going for the game-winning touchdown, the home run, or the equivalent trade is always more glorious sounding than becoming the greatest ever through tiny stats.

But when it comes to profiting from trading, all egos need to be left aside. Always striving for a perfect trade is not only improbable, but it is also a fool’s game. With the right risk management strategy, an active trader only needs to be successful even just half of the time to become profitable.

For example, a trader who only risks just 1% of their account can make 100 losing trades before running out of capital, while just ten successful trades would grow an account by 10%. And with tools like 1000x leverage offered by PrimeXBT, that 10% gain could become 10,000% while still only ever putting 1% account capital on the line.

Active traders are less likely to risk it all with just one big swing trade, and won’t hold out looking for a top or bottom. Instead, active traders quickly jump in and out of trades using a strict set of guidelines, tools, or parameters as part of the trading strategy.

These traders are always looking for the next setup, and have an exit in mind before they ever make a trade. By having a strategy and plan up front, there’s no waiting for tops or bottoms as only the current moment and position is considered.

Trades aren’t ever held onto for longer than they should be, so there’s less likelihood the market reverses on you and goes against your position. And when it does, the chances are, you already booked your profits anyway as an active trader.

How Waiting For Tops Or Bottoms Can Lead to Lost Opportunity

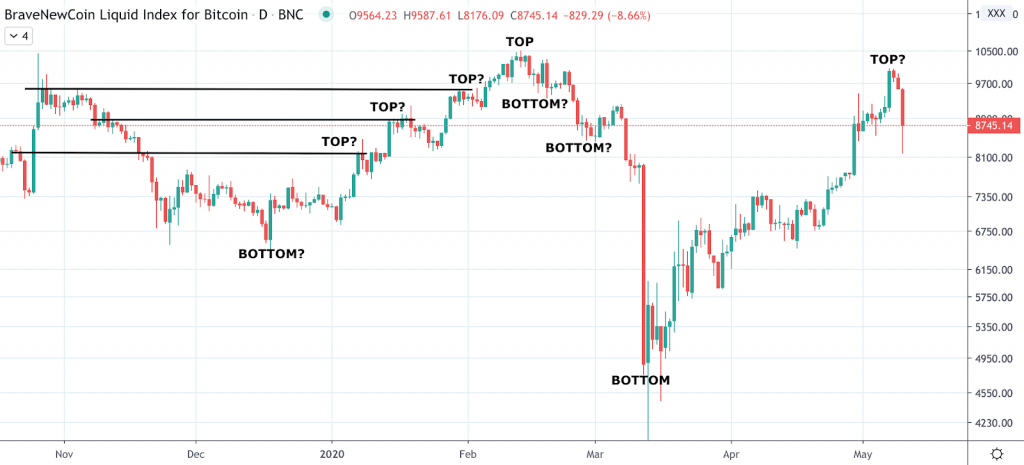

In the below example, a Bitcoin trader who thought they had longed the bottom at $6,400 in December 2019 and didn’t close any profits thinking a new bull market was starting, would have later been stopped out on Black Thursday 2020 when Bitcoin hit $3,800.

After the $6,400 false bottom, three potential tops formed before the final top was actually put in. Before the $3,800 bottom was reached, there were multiple stops on the way where traders thought it was the bottom, and took another long trade.

These traders would have been wiped out in the massive market collapse in mid-March. Worse yet, nobody truly knows if either those “tops” or “bottoms” are really so. Tops and bottoms are only in, far in hindsight.

And as they say, hindsight is 20/20 which is why all traders can so clearly see the profit potential that massive swing trades offer. It is only the wisest traders that know the allure is too good to be true.

Proof Is in the Profit: Active Trading Is Best

In fact, a long trade at $6,400 to $10,500 would have been roughly a 60% return, and then the fall from $10,500 to $3,800 was another 60% for 120% ROI on traders who perfectly timed the top and bottom of just these two moves. It sounds like a profit opportunity of a lifetime, doesn’t it?

However, an active trader that took advantage of all the twists and turns in between each of those massive swings, could have increased their ROI to over 740% during the same timeframe, had they switched their technical analysis to shorter timeframes and focused on quick, in-and-out, high frequency day trading.

The more active the trader, the more profit opportunities are found, all without waiting to time markets. The strategies they employ focus on smaller swings, but profits are regularly booked. Oftentimes, take profit orders are triggered before positions can ever be manually managed if the right plan is in place.

PrimeXBT also rewards active traders with a progressive fee discount system, with the most active trades receiving up to a 50% discount off all trading fees on the platform – across all 50+ trading instruments.

The key to active trading is to not only consider higher time frames such as daily and weekly for larger overall trends but to pay close attention to time frames ranging from 1 minute to 6 hours, for shorter duration, high frequency trade opportunities.

Learning to utilize a variety of trading indicators such as the RSI, MACD, and more across all of these various timeframes can turn any active trader into a profit-generating machine with time, practice, and avoiding emotions like greed that lure you to make poor decisions.

Next time you think you’ve longed the bottom or shorted the top, make sure you have a plan to take profits if you do happen to get so lucky. If and when it does lead to losses once again, remember to focus on active, day trading across shorter timeframes and see if it increases your success rate and capital growth.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.