Margin trading allows traders to borrow funds from their broker to open larger positions than their initial deposit would allow. This can significantly amplify profits, but it also increases risk, including potential margin calls and interest costs on borrowed funds.

Understanding how margin trading works, its benefits, and its risks is crucial for making informed decisions.

What Is Margin Trading?

When trading on margin, traders deposit collateral (margin) with a broker to cover potential losses. Brokers like PrimeXBT offer negative balance protection, ensuring that losses never exceed the trader’s deposit.

By borrowing funds, traders can take larger positions than their actual account balance allows. The margin required depends on the market and leverage offered.

🔹 Leverage Explained:

Leverage amplifies your buying power, allowing you to control larger positions with a smaller deposit.

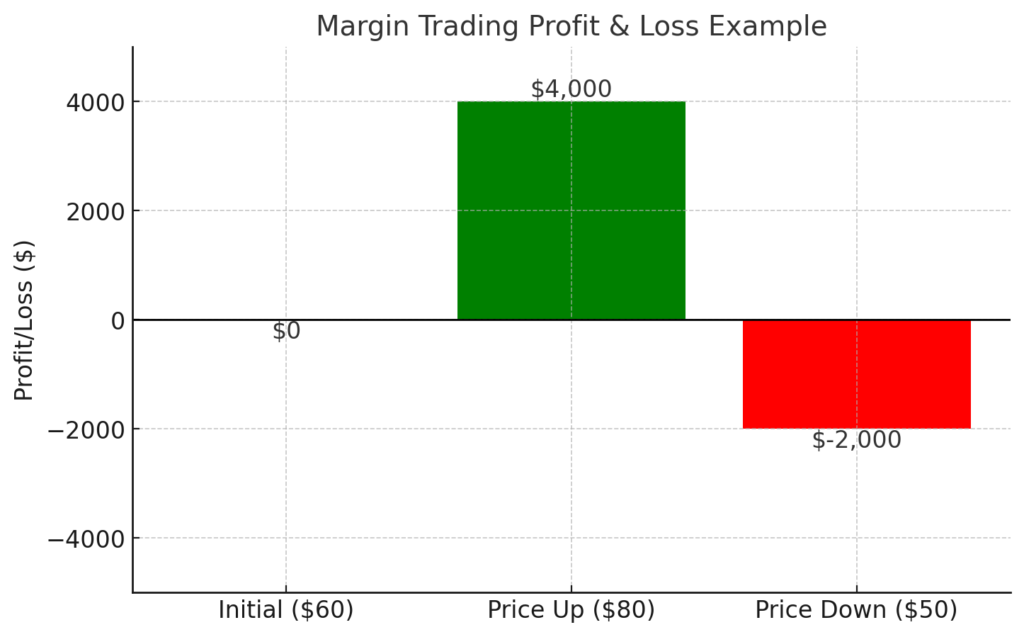

Example of Margin Trading in Action

Let’s say a trader wants to buy 200 shares of a stock priced at $60 per share but only has $6,000.

- By investing $6,000 of their own funds and borrowing $6,000 from their broker, the trader creates a $12,000 position.

- If the stock price rises 33% to $80, the position value increases to $15,960.

- After repaying the $6,000 loan, the trader keeps $9,960, making a $3,960 profit.

Without leverage, the trader’s profit on a $6,000 investment would have been only $2,000.

However, losses are also magnified:

- If the stock price drops to $50, the total position value falls to $9,960.

- After repaying the loan, only $3,360 remains—a 44% loss on the original investment.

💡 Key Takeaway: Margin trading enhances gains but also increases risk, making risk management essential.

Margin Trading vs. Short Selling

While margin trading and short selling both involve borrowing, they serve different purposes:

| Feature | Margin Trading | Short Selling |

|---|---|---|

| Purpose | To open larger positions | To profit from price declines |

| Borrowing | Funds to increase trade size | Assets to sell and buy back cheaper |

| Market Direction | Long (buy) or short (sell) | Always short (sell first, buy later) |

Both require careful risk management and a clear trading strategy.

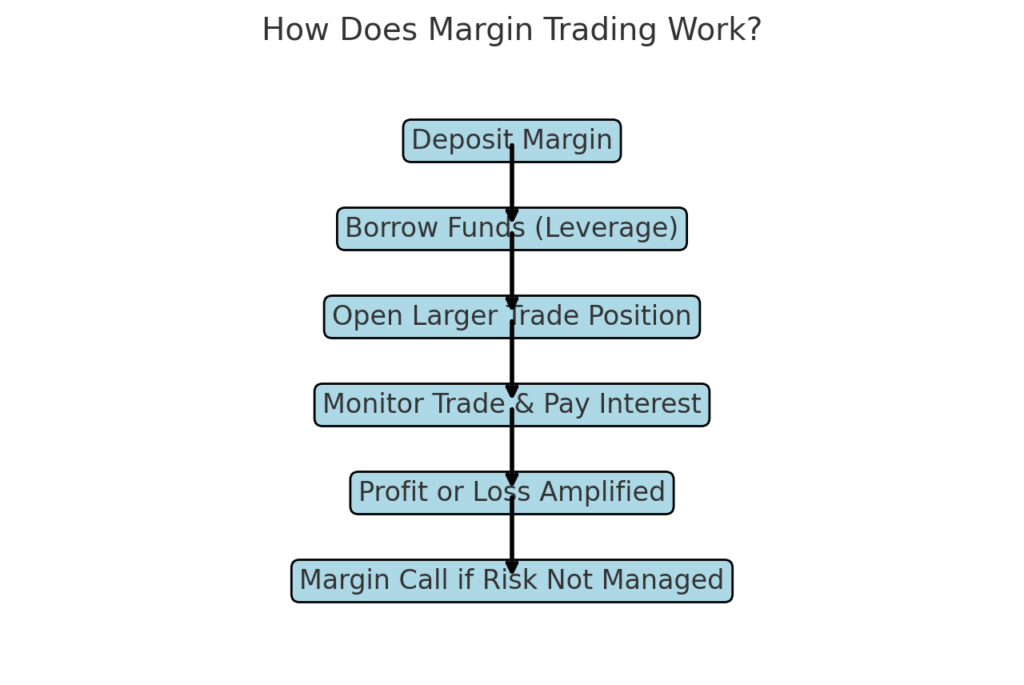

How Does Margin Trading Work?

When trading on margin, traders borrow against a margin account (collateral). Brokers charge interest on borrowed funds, which varies depending on the market and asset type.

At PrimeXBT, traders can access up to 1000x leverage in some markets. This means a $1,000 deposit could control $1,000,000 in certain assets.

However, traders must factor in interest costs, as they can reduce profitability, especially for long-term positions.

When engaging in margin trading, a trader borrows against a margin account, which serves as collateral, enabling access to larger position. The broker charges an interest rate on the borrowed amount, which can vary based on the market and the asset being traded. Similar to other investments, margin accounts might carry fees and costs, which investors need to account for when calculating returns.

For example, with $1,000 cash in a PrimeXBT account, you can trade 1,000 times that amount in certain markets. Traders must consider interest rates carefully, as they can erode profitability, especially for long-term positions.

Margin Interest: What You Need to Know

Borrowing funds to trade on margin incurs costs in the form of interest rates. These rates are typically lower than those on credit cards but vary based on the asset and brokerage. For traders holding positions over the long term, understanding the implications of interest rates is crucial to maintaining profitability.

The margin for trading has a much smaller amount of interest attached to it than something like a credit card, but it is still something that you need to pay attention to if you are hanging on to a position for longer-term moves. There is no payment schedule, you simply pay the interest as you go along, when you open and close a trade. Typically, the interest is charged at a monthly rate, divided by the time involved.

What Are the Benefits of Margin Trading?

Margin offers several advantages, including:

Increased Market Exposure: Control larger positions with a small initial deposit.

Portfolio Diversification: margin trading allows traders to spread their investments across multiple assets.

Flexible Leverage: Adjust your exposure to market conditions while being mindful of associated interest rates.

There are a host of benefits when it comes to margin trading, not the least of which would be the ability to trade in much bigger positions than would normally be the case. By putting up a small amount of margin, you can trade as much as 1000 times that deposit depending on the market here at PrimeXBT.

Margin trading by extension also gives you the ability to take on more positions than you normally would, because the amount of leverage that you have via a deposit means that you can split up your portfolio into many more positions than without the ability to use leverage.

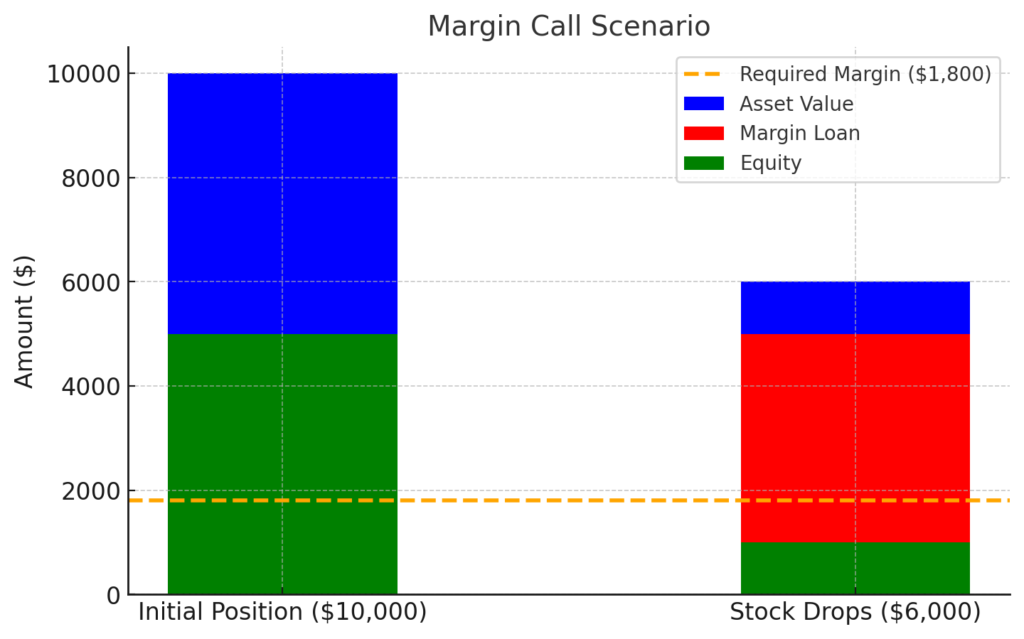

What Is a Margin Call?

A margin call happens when your account’s equity drops below the required margin, prompting the broker to intervene by either requesting additional funds or liquidating positions to cover losses. Trading platforms, like PrimeXBT, automate this process to prevent accounts from going negative

What Are the Drawbacks of Margin Trading?

Margin has the potential to significantly boost your profits but can just as easily amplify your losses, underscoring the importance of strategic risk management. A disciplined approach is vital to navigating these risks effectively.

- Amplified Losses: Leverage enhances both gains and losses, increasing the stakes of every trade.

- Financing Costs: Interest on borrowed funds can chip away at profitability over time, especially for long-term positions.

- Margin Calls: Failing to meet a margin call can trigger automatic liquidation of positions, potentially depleting your account balance.

If you do not meet a margin call

If you do not meet a margin call, this triggers an automatic liquidation of your position until there is enough margin left in your account to cover any credit risks. This is done automatically most of the time with brokerages, although some will contact you to suggest that you should put in more margin in your account. At PrimeXBT, we protect your account by liquidating whatever is necessary before losses overwhelm you.

💡 Example:

- A trader opens a $10,000 position, using $5,000 of their own funds and $5,000 borrowed (margin loan).

- If the asset price falls, reducing the position to $6,000, the trader’s equity shrinks to $1,000.

- If the broker requires at least $1,800 in equity, a margin call is issued. The trader must add funds or positions will be liquidated.

How to Avoid a Margin Call

While margin trading allows for larger positions, poor risk management can quickly lead to forced liquidations. Here are some key strategies to avoid a margin call:

Getting a margin call is one of the more demoralizing things a trader can face. The forced liquidation of the account is very difficult to overcome. Therefore, you must avoid a margin call at all costs. The good news is that it is quite easy to avoid a margin call, with just a bit of caution and common sense.

- Use stop-loss orders: Using a stop-loss order is the most important thing you can do to avoid getting a margin call triggered. By accepting when your trade has not worked out, you can “fight to live another day.

- Watch position sizing: You need to watch your position size, because going “all in” right away as there is very little in the way of room to let the market move back and forth.

Trade with the trend: Although some traders are successful in countertrend trading, the reality is that markets do tend to trend for a very long period. By going with the trend and not against that, you increase your odds of success. - Test your system: Make sure that you have tested your system through historical data to understand whether or not it is profitable in the long term. Unless it is, you should not use margin on it or even trade it.

- Understand leverage: You must make sure that you understand how leverage works, and its potential advantages and disadvantages. Jumping into leveraged trading is a mistake that can be very costly if not taken with professionalism.

Conclusion: Is Margin Trading Right for You?

While margin can unlock opportunities for greater profits, it requires careful management of risks, such as amplified losses and the impact of interest rates. By adopting disciplined strategies and understanding key concepts, traders can navigate margin trading effectively,While margin trading can unlock opportunities for greater profits, it requires careful management of risks, such as amplified losses and the impact of interest rates. By adopting disciplined strategies and understanding key concepts, traders can navigate margin trading effectively.

Margin might be a great tool if you have a profitable trading system. Furthermore, you need to be very cautious about the amount of margin that you use on any particular trade because it does influence whether your gains or losses get magnified. The more leverage used, the more dangerous or beneficial it can become. The trading of leverage offers a lot of opportunities but is to be used professionally.

When you look at the benefits of margin you should be aware that they can offer significant gains over what would normally be the case, but at the same time, if you are not careful with the amount of margin that you take out, you may find yourself on the losing end of a much bigger than anticipated trade. Understanding how margin works is crucial.

At PrimeXBT, we offer negative account protection, meaning that we constantly monitor any positions that threaten both parties involved in the loan to keep disaster at bay. By having negative account protection, you know that you will never owe more than your initial deposit. That being said, you should be very cautious and never get to the point where you have a margin call.

Is margin trading a good idea?

Margin trading can be a good idea for experienced traders who understand leverage and have a solid risk management strategy. It allows traders to amplify their potential returns but also increases the risk of losses. Beginners should approach margin trading cautiously and start with small amounts

Is margin trading good for beginners?

Margin trading can be risky for beginners due to its complexity and potential for amplified losses. Beginners are advised to first practice with a margin trading simulator and fully understand how leverage works before trading with real money

Can you make money from margin trading?

Yes, traders can make money from margin trading by leveraging their capital to amplify gains. However, this also increases the potential for significant losses, especially in volatile markets. Success requires a well-planned strategy and disciplined risk management

How long can you hold a margin trade?

The holding period for a margin trade depends on your broker's policies and the interest charged on borrowed funds. While some trades are held for short durations due to high financing costs, others may be held longer if profits outweigh these costs. Always monitor your account balance to avoid margin calls

When should you use margin?

Margin should be used when you have a high-confidence trade with clear risk management in place. Examples include opportunities where the potential reward significantly outweighs the risk. Margin trading is not advisable during high market volatility or without a clear trading strategy

What happens if you lose a margin trade?

If you lose a margin trade, your broker may issue a margin call requiring you to deposit additional funds to maintain your position. If you cannot meet the margin requirement, your broker may liquidate your position, potentially leading to significant losses, even exceeding your initial investment

Which broker has the lowest margin rates?

Different brokers offer varying margin rates depending on the asset class and region. It's important to compare brokers like PrimeXBT, Interactive Brokers, and others to find the lowest rates for your needs. PrimeXBT, for example, offers competitive rates for CFD trading with low spreads

How is margin trading taxed?

Taxation on margin trading depends on your country of residence. In many regions, profits from margin trades are taxed as capital gains, while losses can sometimes be written off to offset other gains. Consult a tax advisor for specifics.

How much money do you need to open a margin account?

The minimum amount to open a margin account varies by broker. Some brokers require as little as $2,000, while others may have higher requirements. PrimeXBT offers flexible options for opening a margin trading account with minimal initial funding

What is a margin trading simulator?

A margin trading simulator is a tool that allows users to practice margin trading in a risk-free environment using virtual funds. These simulators replicate real-world market conditions, enabling beginners to learn how leverage works without risking real money

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.