Cross-margin on Crypto Futures now supports user-defined leverage caps, so effective leverage is always capped by the lower of your chosen limit and the platform band. Already available on web, this update is now available on mobile.

Traders can benefit from upgraded control, clarity, and flexibility in managing exposure, which is part of PrimeXBT’s ongoing development of transparency and risk management tools.

What’s changed

Cross-margin on Crypto Futures now allows traders to set a maximum leverage cap for each instrument. The platform applies the lower of the user’s cap and the position-size leverage band, so traders see their effective leverage in real time before placing or enlarging positions.

How bands and caps work – examples

Here are two simple examples of how margin bands and personal caps interact in practice:

| Position size (BTC) | Band leverage (before) |

| 0–5 | 1:500 |

| 5–15 | 1:200 |

| 15–45 | 1:75 |

| 45–150 | 1:20 |

| 150+ | 1:5 |

If a user sets a personal cap of 1:80, effective leverage will be:

up to 1:80 for portions of the position that fall within bands allowing more than 1:80 (e.g. 0–5 and 5–15 BTC),

and the band limits (e.g. 1:75, 1:20) for portions of the position where the available leverage is already lower than the cap.

| Position size (BTC) | Band allowance | User cap | Effective leverage |

| 0–5 | 1:500 | 1:80 | 1:80 |

| 5–15 | 1:200 | 1:80 | 1:80 |

| 15–45 | 1:75 | 1:80 | 1:75 |

Cleaner cross ↔ isolated switch window

The margin switch window has been redesigned to show updated liquidation price, free margin, and margin allocation before confirming a change between cross and isolated. That means traders can verify the margin impact and liquidation risk up front.

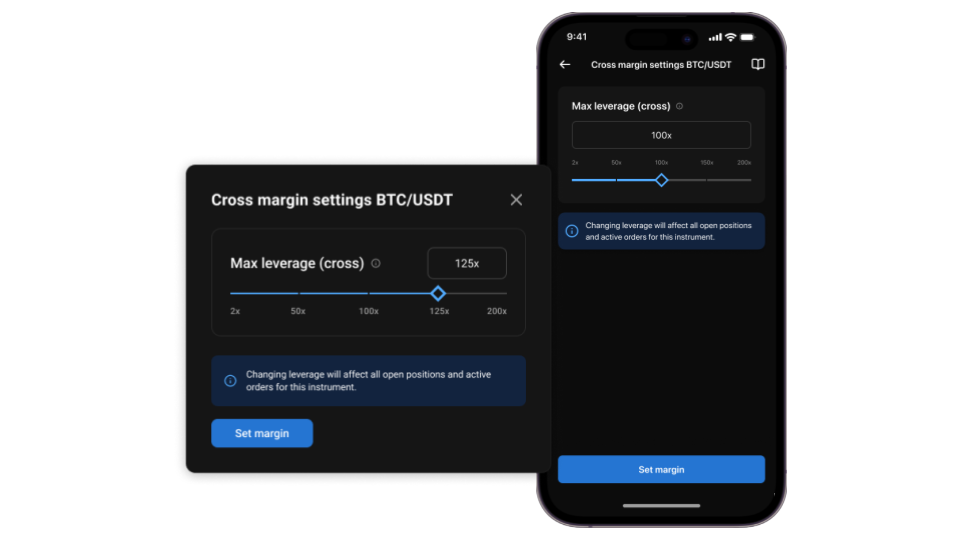

How to set your leverage cap

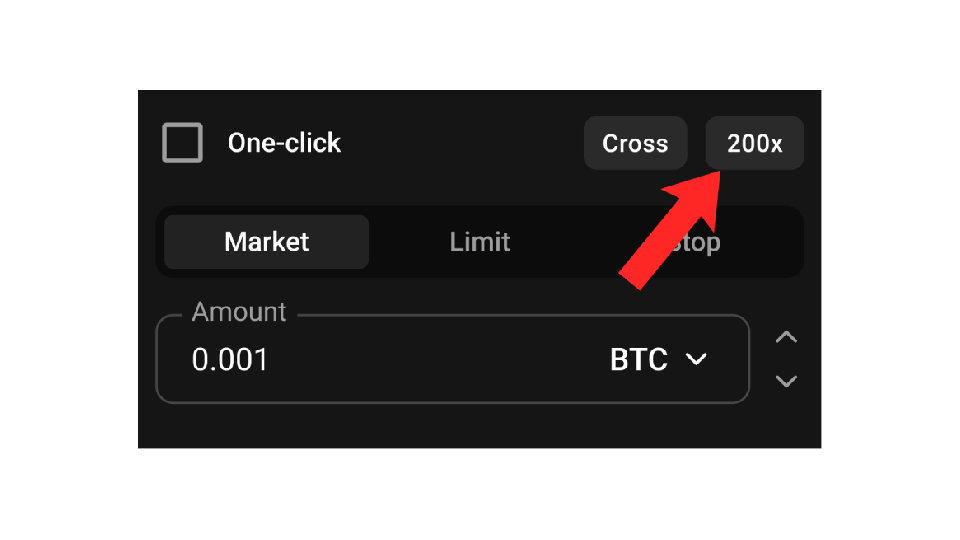

Step 1: Open Crypto Futures for the desired instrument.

Step 2: Click the leverage control above the order form and use the slider or type a maximum leverage cap (for example, 5x, 10x, 50x, 100x, 200x, 500x).

Step 3: Depending on the size of all open positions, the UI will display the effective leverage (and, if lower, the reason for the lower leverage), the updated liquidation price, and the free margin in real-time.

Why this matters

This update empowers traders with risk control by allowing a personal maximum leverage limit, and it increases transparency by showing how cross-margin affects liquidation and free margin before any change is confirmed. It is designed for traders who want clearer limits on their exposure and those who frequently switch between margin modes.

Important note: Adjustable caps are a tool to help manage risk; they do not eliminate it. Trading with leverage increases exposure and can lead to rapid losses; ensure position sizing matches your risk tolerance and financial situation.

FAQ

Still have questions? Here are quick answers to the most common inquiries about this update:

What is adjustable leverage in cross-margin?

It lets you set a personal maximum leverage cap for each Crypto Futures instrument. The system applies the lower of your cap or the position-size band, so your effective leverage is always limited and transparent.

Why would I use it?

Some traders prefer lower leverage for risk management. By setting a cap (e.g., 10x, 50x), you can avoid unintentionally taking on higher leverage exposure in small positions.

Does this change how margin bands work?

No. Margin bands remain the same. Your chosen cap simply prevents leverage from going above your preferred limit. If a band offers lower leverage than your cap, the band limit applies.

Trading involves risk.

Support is always available

Thank you for choosing PrimeXBT. If you need help, our support team is available 24/7 via live chat, or you can visit the Help Center for detailed guides. You can also email [email protected].

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.