Oil trading is one of the most popular ways to play the global economy, as the oil market is considered to be the “life’s blood” of economic growth. Being so important to economic activity has made exposure to oil very attractive to many investors.

Exposure to the oil market can be achieved in a variety of ways, as there are multiple financial instruments that you can use to speculate or hedge price. Learning how to trade oil can greatly enhance your opportunities as an investor.

What is oil trading?

Discover the basics of oil trading and why it’s a key market for investors.

Oil trading refers to the buying and selling of financial derivatives, either on an exchange or through a broker, with the intent of speculating on the future price of the commodity. Oil is a very liquid and highly-traded commodity that offers excellent trading opportunities with its powerful and long-lasting trends.

Oil is the main source of energy in today’s economy and has been used in the production of almost any product, including plastics, cosmetics, and pharmaceuticals.

Oil, also known as the “black gold”, is the main source of energy in today’s economy and has been used in the production of almost any product, including plastics, cosmetics, and pharmaceuticals. Most of the oil extracted from global crude oil wells is further refined into petroleum, diesel, and heating oil.

Depending on your personal trading style and strategy, oil trading is perfectly suited for both short-term and long-term trading. Many market participants are large oil producers and refiners that want to hedge their oil exposure and hedge funds that speculate on future price movements. However, in recent years, retail traders are also joining the market in growing numbers.

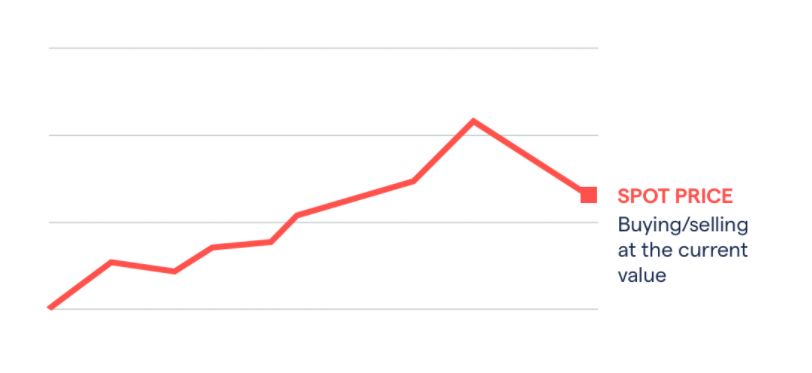

What is the Oil Spot Price

Understanding the current market price of crude oil.

The oil spot price refers to the current market price of crude oil with immediate settlement. This is the price of a barrel that you have to pay at that exact moment of time, which is why spot oil trading is often the favorite choice of short-term traders.

The spot price of oil is continuously adjusted based on liquid oil futures contracts with the nearest expiry dates. Trading oil on the spot market doesn’t have an expiry date and you can open and close your positions at any time when the markets are open.

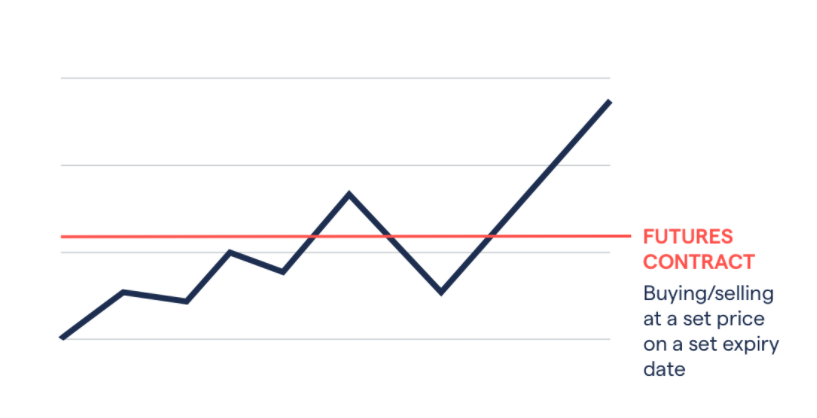

What Are Oil Futures?

Explore how oil futures contracts work and their role in the market.

Oil futures are financial derivative contracts and standardized agreements to exchange the commodity for a pre-specified price on a set future date. Oil futures are widely-traded instruments on the New York Mercantile Exchange and Intercontinental Exchange, especially among professional speculators and oil producers.

On the expiry date, buyers of oil futures can settle the contract either in cash or take physical delivery of oil. Most futures contracts are used for hedging and speculation purposes and are therefore cash-settled.

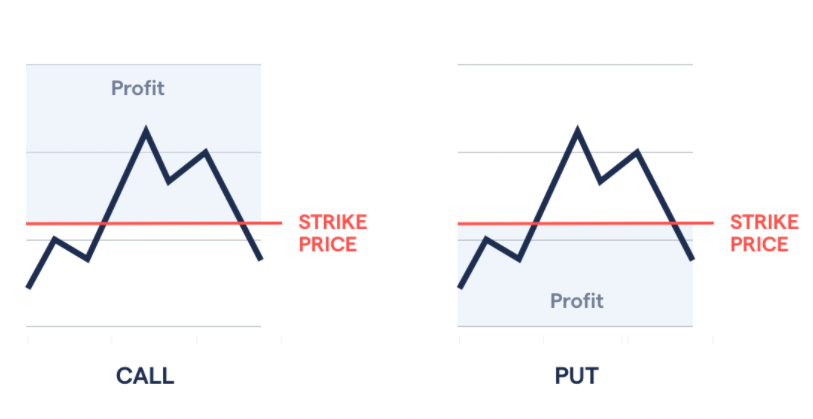

What are oil options?

Learn the difference between options and futures in oil trading.

Oil options are another popular derivative that, unlike futures contracts, give the buyer the right (but not an obligation) to settle the contract at a pre-specified price on a set future date. For this convenience, options buyers pay a small fee in the form of an option commission.

Just like futures, options are predominantly used to speculate on the future price movements of oil. There are two main types of options contracts: put and call options. Put options allow the buyer to sell oil at the pre-specified price (also called “strike price”).

Conversely, call options allow buying oil at the pre-specified price. Again, there is no obligation to actually exercise an oil option, in which case the contract expires worthless.

Why trade crude oil?

Key benefits and opportunities in trading crude oil.

Trading crude oil can be quite lucrative given its price volatility and its unique position in the world’s economic system. Being the main energy source for billions of people around the world, demand for oil has been constantly rising in the last decade. Emerging economies have also played a key role in the rising demand for the commodity.

Oil markets offer attractive trading opportunities as the global economic landscape is constantly changing. Imbalances in the supply and demand for crude oil, political and economic turmoil, and global economic growth can all create strong forces that drive the price of oil up or down.

What oil markets can you trade?

A guide to the main oil benchmarks: WTI and Brent Crude.

When talking about oil trading, you need to be aware that there are many different types of oil. Some of them are more liquid than others and have different qualities that also determine their price on the market.

Most of the time, when you see the daily price of crude oil in the news, that price refers to a certain type of oil or oil benchmark. The two most important oil benchmarks in the world are West Texas Intermediary (WTI) and Brent crude.

- West Texas Intermediary (WTI) – This is a light, sweet type of oil with low Sulphur and API contents. It’s extracted and produced in North America, predominantly in the states of Texas and Louisiana. WTI futures are very liquid and traded on the New York Mercantile Exchange (NYMEX), a division of the Chicago Mercantile Exchange.

- Brent Crude – The other major oil benchmark is Brent crude, produced in the North Sea and across the Middle East. Brent crude futures are traded on the Intercontinental Exchange and represent the major oil benchmark for European, African, and most Asian markets. Brent extracted in the Middle East is heavier than WTI, which makes its refinement to petroleum or diesel more cost-intensive.

How do oil markets work?

The fundamentals of global oil markets and price influencers.

Being the largest commodity market in the world, crude oil is mostly traded through futures contracts on regulated exchanges. Oil producers and refiners, hedge funds, and large speculators exchange futures contracts in order to hedge their exposure and lock in future delivery prices or to speculate on price movements.

Trading oil with futures can be quite risky and expensive. Oil futures are standardized contracts that cover around 1,000 barrels of oil, with a minimum price movement of $0.01. That’s why smaller retail traders are better suited with other trading products, which will be covered later in this article.

The main forces that impact the price of oil are global supply and demand.

The main forces that impact the price of oil are global supply and demand. Since 2004, global oil production and supply have been constantly falling as oil reserves become depleted and explorations more expensive. On the other hand, demand has been steadily picking up, particularly with the rise of emerging market economies such as China and India.

The basic economic principle, that also applies to oil markets, is that falling supply and increasing demand push prices higher. However, transitory imbalances in the supply and demand for oil (e.g. pipeline damages or economic recessions and expansions) can have strong short-term impacts on the oil market and cause strong trends in either direction.

What moves the price of oil

Key factors impacting oil prices, including OPEC and global economics.

The price of oil is influenced by a number of key factors. Just like with other commodities and assets, the most essential forces that affect the price of crude oil are supply and demand. Market conditions where oil supply exceeds demand cause a fall in price, whereas conditions where demand exceeds supply lead to rising prices.

Here are the most important market-moving factors that oil traders need to be aware of.

Oil storage

The number of barrels stored as inventories is another important barometer of global oil demand. Every Wednesday, the US Energy Information Administration (EIA) publishes the change in the number of barrels of crude oil held in inventory during the past week.

An increase in oil inventories is often considered as a signal that demand is slowing down, which in turn can have negative effects on oil prices. However, other asset classes also react to the report, such as currencies and equities.

The push for alternative energy sources

Recent breakthroughs in electric vehicles and the global push for green and renewable energy can all have a strong impact on oil demand in the coming years. However, it will likely take decades until oil gets completely eliminated as a major energy source in our world.

The influence of OPEC

Headquartered in Vienna, Austria, the Organization of the Petroleum Exporting Countries, also known as OPEC, is an international organization of oil-producing countries. The 13 members of OPEC accounted for almost a half of the global oil production in 2018 and hold around 82% of the world’s oil reserves, making OPEC a major player in the oil market.

OPEC countries meet regularly throughout the year to discuss global conditions of the oil market and regulate supply, which in turn has a significant impact on the price of oil. However, with the arrival of fracking technology in the US, OPEC’s power to control global oil prices has somewhat diminished.

Oil traders need to be aware of all OPEC meetings and closely analyze all statements published by the cartel. The price of oil can fluctuate heavily around the release of those statements.

Global economic performance

Another major influence on crude oil prices is the global economic performance. When the economy is doing well, demand for oil increases, and prices rise. Conversely, economic recessions and slowdowns lead to lower demand for oil and lower prices.

Traders may find that following leading economic indicators, such as retail sales, housing starts, or industrial production, can be an important predictor of future oil prices. Always have a look at an economic calendar and note when important economic indicators are expected to hit the markets.

How to Trade Oil in 5 Steps

Step-by-step guide to start trading oil like a pro.

Trading oil is quite simple and very similar to trading other asset classes. The key is to perform your analysis and determine whether prices have a higher probability of going up or down. Then, you simply “buy” or “sell”, and your broker takes care of the rest.

Nevertheless, before placing your first oil trade, there are some mandatory steps you need to take.

Step 1: Pick your instrument. To retail traders, oil trading is available via futures, options, and CFDs. Futures trading is quite expensive and comes with large standardized contracts (although there are also some mini oil futures), while options have an expiry date and are more suitable to more experienced traders. CFDs are leveraged and allow short-selling, which is most likely to suit most average traders.

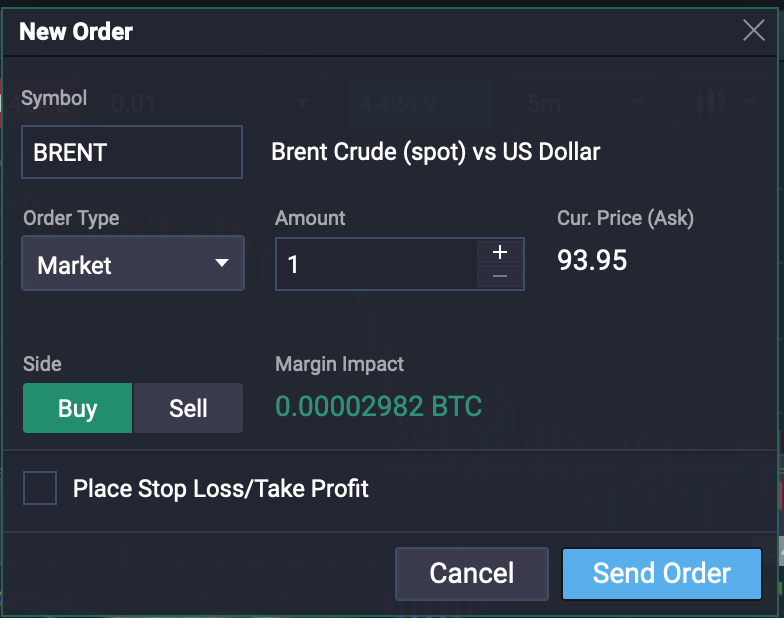

Step 2: Open an account. Before you can start trading on crude oil, you need to have a brokerage account. You can open a live account in less than a minute with PrimeXBT and start trading right away, or choose a demo account first to practice your skills before putting real money on the line.

Step 3: Get acquainted with your trading platform. PrimeXBT features an award-winning platform that caters to both beginners and seasoned traders. Play with some of the options and get familiar with the advanced charting tools before hitting the “buy” or “sell” buttons.

Step 4: Analyze the market. Oil markets can be extremely volatile at times, which offers plenty of trading opportunities. However, trading without analyzing the market beforehand can be very risky and lead to unexpected losses. We’ll cover the main ways of analyzing the oil market further below.

Step 5: Develop a strategy and keep a trading journal. Last but not least, placing bets without a strategy is more gambling than trading. Develop your own trading strategy that suits your personal trading style and always keep a trading journal with all of your trades, including entry and exit levels, and the main reasons why you took a trade.

How to make a strategy for oil trading

Develop a winning oil trading strategy by analyzing key drivers.

Developing a well-round strategy for oil trading is a crucial step in your journey as a commodity trader. As mentioned, there are many factors that influence the price of oil on global markets, and understanding how to analyze the market can make or break a trader.

Understand the main drivers of oil prices

The essence of price changes in all financial markets can be boiled down to supply and demand dynamics. If there are more buyers than sellers, prices tend to rise, and if there are more sellers than buyers, prices tend to fall.

The same applies to the crude oil market. Always follow economic calendars and read reports that cover leading economic indicators, such as retail sales, housing starts, business and consumer confidence surveys, and industrial production.

When leading indicators rise and beat market expectations, there is a big chance that rising economic activity will lead to higher demand for oil, hence increasing its price. The opposite is true when leading indicators are missing market expectations and the economy faces a recession – this is when oil prices tend to fall.

Since oil is denominated in US dollars, any change in the value of the currency directly impacts the pricing of the oil. That’s why FOMC meetings and monetary policy decisions can also affect global oil markets. As a rule of thumb, a stronger US dollar pushes oil prices down, and a weaker US dollar sends them higher.

Understand the big market players

Unlike many other markets, the oil market is mostly dominated by large oil companies and hedge funds. Oil-producing companies are constantly some of the largest companies in the world by market capitalization, so it pays to follow their footprints in the market and trade accordingly.

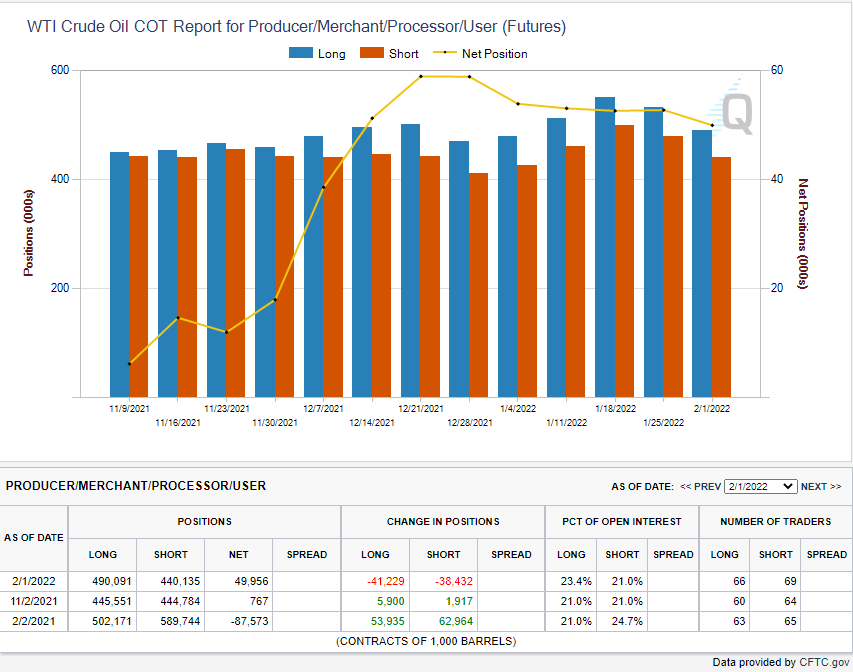

The CFTC publishes the Commitment of Traders (COT) report each Friday. In the report, you can see any changes in positions in the oil futures markets and other commodities made by large producers, commercials, asset managers, and leveraged (smart) money compared to the prior week.

However, bear in mind that not all of them are participating in the market to make money. Commercials, for example, aim to hedge their market exposure and lock in future oil prices, which is why they’re often trading against the trend. Knowing this information can prepare you to make more informed trading decisions.

Brent vs WTI: What’s the Difference?

Choose the right benchmark for your trading needs.

Brent crude and WTI are the two main benchmarks of the global oil market. Brent crude was first extracted in the North Sea and is heavier than WTI, making it more expensive to refine. Brent is also the main benchmark for European, African, and Middle Eastern countries. WTI is lighter than Brent and the dominant benchmark of North America.

Brent crude is often considered a better indicator of the global oil market, even though WTI is sometimes more heavily traded (“CL” ticker on NYMEX). New technologies, such as fracking technology, can create certain price-divergences between those two benchmarks. But, in the end, both benchmarks are perfectly fine for trading and highly liquid.

Keep an eye on the long-term picture

As the main energy source of our global economy, the price of crude oil tends to follow the ebbs and flows of worldwide economic activity. To understand where the price of oil is heading, it’s helpful to assess the current state of the economy.

Is the global economy expanding or contracting? What does the yield curve look like? What is the current phase of the business cycle? Answers to those questions can provide you with a significant edge in the commodites markets.

Diversify your oil trading

In addition to making directional bets in the oil market, you can also diversify your exposure to oil with the help of different asset classes. For example, investing some of your funds in oil companies or ETFs that track the energy sector can prove to be a smart decision to diversify your holdings.

Some of the largest oil ETFs include the SPDR Energy Select Sector Fund (XLE), the VanEck Vectors Oil Services ETF (OIH), and the iShares U.S. Energy ETF. Besides investing in ETFs, you can also gain indirect exposure to the oil market by trading currencies of oil-producing countries, such as the Canadian dollar and the Mexican peso.

When does the oil market open?

The Chicago Mercantile Exchange allows you to trade oil futures around the clock, six days a week, with a 60-minute break each day. If you choose to trade CFDs, which are an over-the-counter product and not traded on exchanges, oil can be traded Sunday through Friday, 21 hours a day with a three-hour break.

Tips for Successful Oil Trading

Practical advice for risk management and market analysis

- Start small. Oil markets can be very volatile which can lead to large losses, especially when trading on leverage and with large position sizes. If you’re new to oil trading, start with smaller positions and add to them as you gain experience.

- Don’t overtrade. Trading with too much leverage can quickly blow your account. Although leverage is extremely useful when combined with proper risk management practices, don’t overtrade and don’t chase the market. There will always be new trading opportunities around the corner.

- Follow correlated markets. All financial markets are connected to each other. By following correlated markets, like equities (stocks of large oil producers), commodity currencies (Canadian dollar, Mexican peso, Australian dollar, Russian ruble), the bonds (the yield curve can provide important clues about future economic prospects), you’ll be well prepared as a commodity trader.

- Analyze OPEC meetings. The 13 OPEC countries hold regular meetings to discuss current conditions in the crude oil market and adjust supply if necessary. Oil can become extremely volatile around those meetings.

- Use technical analysis. Once you’ve identified the most probable direction for the oil price, it’s time to add some technical analysis to the mix. Find important technical levels and place your stop-loss and take-profit orders around those levels.

Why Trade Oil with PrimeXBT?

Learn how PrimeXBT supports traders with advanced tools and features.

PrimeXBT is a leading CFD broker that offers a wide range of tradable assets, including cryptocurrencies, oil, metals, forex, and stock indices. When trading oil with PrimeXBT, you can take full advantage of all the correlated asset classes and analyze them on the broker’s award-winning trading platform.

Whether you’re a beginner trader or seasoned professional, PrimeXBT features the complete toolbox to succeed in the markets. Margin trading with CFDs allows you to magnify your trading results and to bet on falling prices on the oil market through short-selling.

If you don’t feel confident enough to hit the trigger and place a live trade on the oil market, take a look at PrimeXBT’s copy trading module where you can replicate the trades of professional traders and reap all the benefits – even without any trading experience.

What is the best way to trade oil?

Oil can be traded with futures contracts, options, and CFDs. Futures and options are derivative contracts that cater to professional traders, while CFDs are much more accessible to retail traders. Plus, they offer attractive leverage and short-selling capabilities.

How do I start oil trading?

The first step in becoming an oil trader is opening a live trading account. This takes less than a minute and allows you to start trading as soon as your account gets approved. If you want to sharpen your trading skills first, consider opening a demo account.

How is oil bought/sold and traded?

The most comfortable way to buy, sell, and trade oil is with the help of CFDs, futures, and options. The process is simple – after you’ve done your analysis, simply hit the “buy” or “sell” button, and your order gets executed.

Can you make money trading oil?

Oil is the most liquid energy product on the financial markets, with millions of contracts exchanging hands each day. With its attractive price volatility, there are always profitable trading opportunities in the market.

Can you buy crude oil stock?

Crude oil is mostly traded in the form of futures contracts and CFDs. However, there is a way to gain indirect exposure to crude oil with stocks. Simply buy a stock of an oil-producing/refining company, or of a company that is related to the global energy sector.

How much money do you need to trade oil futures?

The standard oil futures contract represents 1,000 barrels of oil with a minimum price tick of $0.01. This means each tick is worth around $10. Decide how much you can afford to invest in order to respect your risk management rules (e.g. with a 2% risk-per-trade)

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.