You should already be familiar with what a bull and bear market or trend is. If you’re not, a bullish chart pattern is when a price is moving upwards, and a bearish chart pattern happens when the price is going down.

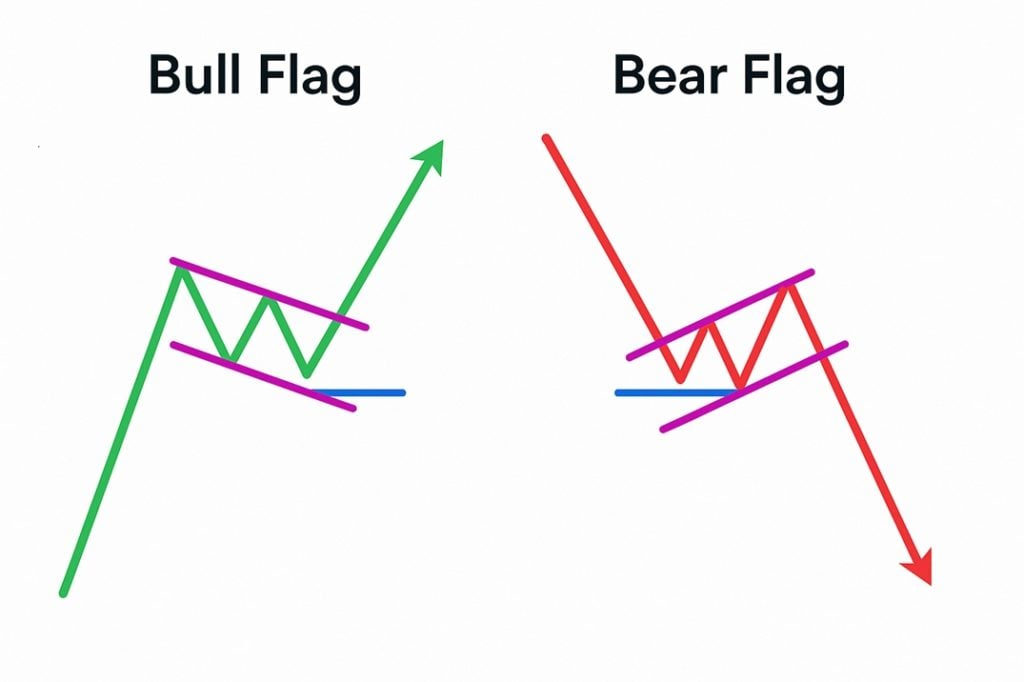

A flag pattern is created by a flagpole, a strong upwards or downward trend, and a flag, a sideways movement with a slight angle.

These two patterns can give you a lot of information about the market. Keep reading to find out how.

What are flag patterns?

Flag patterns are considered trend continuation patterns, and are usually preceded by a significant trend in the opposite direction, with price breaks in the same direction as the preceding trend.

This creates immense opportunities for traders, especially if they are trading CFDs, allowing them to trade in both directions.

The chart pattern created is considered a continuation pattern, with prices “bouncing” between two parallel trend lines. The direction depends on whether it is a bear flag formation or a bull flag formation.

The basics of bull flag patterns

Anatomy of a bull flag

Both patterns have two primary components – the initial flagpole and the flag. The flag pole is the preceding uptrend or downward trend, and the flag is the area delineated by parallel lines, which the price pattern tests.

In a bull flag pattern, the first part of the pattern is an upward trend. This trend, called the flagpole, is marked in green on the chart below,

Then, we can see a price consolidation phase, marked in magenta on the chart above, and this is the flag portion of the price pattern. This will usually have a slight downward angle but can also move horizontally.

During the flag formation, there’s usually a temporary pause in buying and increased profit taking lowering the previous high volume.

Once the flag pattern is completed, the bullish trend continues, the breakout point being the flag’s upper trend line, as shown by the blue line above.

Significance and interpretation

So why is the bull flag pattern important when using technical analysis to trade? Because it can show you where to set your profit target, breakout entry point, and take profit target or exit price.

It is usually recommended to set your entry point after the pattern is confirmed, i.e. when the flagpole and flag pattern are completed and the price action crosses the upper trend line.

As with other types of indicators, the size of the subsequent trend is the same size as the flag pole leading up to the flag.

If you’re trading bull flags, or any other candlestick patterns for that matter, like descending or ascending triangles, trend channels or pivot points, then make sure that you can see all individual parts of the pattern.

For the bullish flag that includes the initial move, the counter trend move through the consolidation channel, the breakout and finally, the continuation pattern.

You can also use a momentum indicator like RSI to further confirm the trend after the breakout.

The basics of bear flag patterns

A bear flag pattern is basically an upside down version of the bullish flag pattern. It has all the same components, including the flagpole and flag, but the price breaks happen at the lower trend line instead of the upper channel line.

Another difference is that the bearish flag pattern indicates the continuation of a downward trend instead of an upward trend.

The flag pole preceding bear flags is an abrupt drop in the price of the asset you are looking at, and the bearish flag usually has an upward angle or counter to the previous and consecutive price trend.

Anatomy of a bear flag

The bull and bear flag patterns have the same exact characteristics, but one moves in the opposite direction. They both have the flag pole and price consolidation period or flag, and the breakout point.

Bear flags channel is usually pitched upwards instead of downwards like the bull flag pattern. As the name implies, it is a bearish indicator, the market will likely continue its downward movement after the price breaks below the lower trend line.

Significance and interpretation

When traders use the bear flag pattern, they will wait to see the flag pattern develop and the price to break through the lower channel line as confirmation that the market will continue the bearish trend.

This is the safest way to trade both the bull and bear flag; wait for the breakout and use the trend lines as stop outs.

The upper line would be lower risk since it is closer to the current price, whereas the second line could be considered a second support, making it a riskier stop out.

If you want to be extra cautious, some use the bear flag chart pattern with RSI and exit their position when they see momentum slowing down.

Bull Flag vs Bear Flag Pattern: key differences between bear and bull flags

The bullish flag pattern happens during an uptrend, and the bear flag pattern happens during a downtrend.

Their flags are also usually pitched in the opposite direction of the preceding trend. Bull and bear flags are pitched downwards and upwards, respectively.

Direction

Bull flags signal a continuation of an up trend, and the bear flags show a continued downtrend.

Volume

You may notice increasing volume directly after the price breaks through the flag’s resistance level (the top line of the channel) but a drop in volume when the price is banded by the two lines of the flag.

Timeframe

Although the timeframe is usually relative, in the case of both the bear flag pattern and bull flag formation, they are more effective in the short term.

As such these chart patterns are the most reliable continuation signals for rapidly moving markets such as Foreign Exchange and Cryptocurrencies.

How to trade bull flag patterns

Technical traders create trading strategies to ensure they do not surpass their exposure limits or risk more than the equity they have available for each trade.

The strategy can also set a price target for single trades, the timeframe and even the type of trading.

For breakout trading, there are few more reliable continuation patterns than the bull and bear flags.

Entry points

First, you will need to wait for your asset to be moving in an upwards direction, test the limits of the flag pattern at least twice, and reach its lowest point and break through the upper line of the flag. Ideally. Make sure this flag chart pattern isn’t a potential price reversal. Using a momentum indicator can help.

Although volume does drop during the consolidation phase, it remains strong enough to continue pushing the asset’s price down.

If you are a more aggressive trader, your entry point can be the moment the price breaks through the upper limit of the flag.

Exit points

Exit points can be calculated by projecting the length of the flagpole onto future prices.

Risk management

When trading the financial markets, risk management is a must. Luckily when using the bearish flag pattern or the bullish equivalent, then the flags upper and lower lines can be used.

It is generally advised to set your stop out 3-10 pips above or below the limit that was broken through.

How to trade bear flag patterns

Entry points

The entry point of the bear flag pattern is usually after the price breaks through the flags lower limit.

Exit points

Your exit point can be 3-10 pips below the projected magnitude of the preceding flag pole.

Risk management

Depending on your risk appetite, your stop loss can be set slightly below the lower limit of the flag or slightly below the upper limit of the flag.

Common mistakes and how to avoid them

The most common mistake when using the bearish flag is misidentifying a signal for a continuing bearish trend that ends up being a price reversal.

This can be avoided by confirming that the volume and momentum is enough to keep the trend going after consolidation.

Confirmation bias

Be careful of convincing yourself that a flag pattern is there when it isn’t. Make sure to wait for the pattern too be confirmed before acting.

Ignoring overall market conditions

Using a momentum indicator can help you avoid this.

Technical indicators to combine with flag patterns

As mentioned previously, momentum indicators work well with flag patterns. This includes RSI, OBV or MAs.

Moving Averages

Using multiple MAs of different time intervals can help you confirm a flag pattern.

RSI (Relative Strength Index)

RSI shows momentum. High volume means a trend is likely to continue.

Conclusion

They say when the only tool you have is a hammer, everything is a nail. This is why flag patterns are valuable tools, but should be used with other indicators and even approaches to analysis.

What is the difference between a bear flag and a bull flag?

The bull flag signals a downtrend, the other the opposite.

Can a bear flag be bullish?

No.

What is the difference between a bear flag and a bullish channel?

The bull has a downward pitch, the bear an upwards one.

How reliable is a bear flag pattern?

It is extremely reliable when confirmed.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.