Bitcoin has risen throughout the week despite the hotter-than-expected US inflation data as the market gears up for the Bitcoin halving event.

Bitcoin rounded from a low of 67,600 earlier in the week as whales bought the dip, helping the price recover, even as other risk assets continued to fall. While Bitcoin and other cryptocurrencies such as Ethereum and XRP booked gains, stocks on Wall Street tumbled lower, and the USD rose to a 5-month high versus its major peers.

US inflation (CPI) was hotter than expected, rising for a third straight month, causing the market to push back Fed rate cut bets. This hit risk sentiment across the board. However, Bitcoin has staged a notable recovery, thanks in part to optimism surrounding the upcoming halving event.

- Bitcoin rebounds from US inflation data selloff

- Bitcoin rises across the week while other risk assets fall

- BTC halving is due to occur around April 20

- Previous halving cycles have resulted in strong price gains

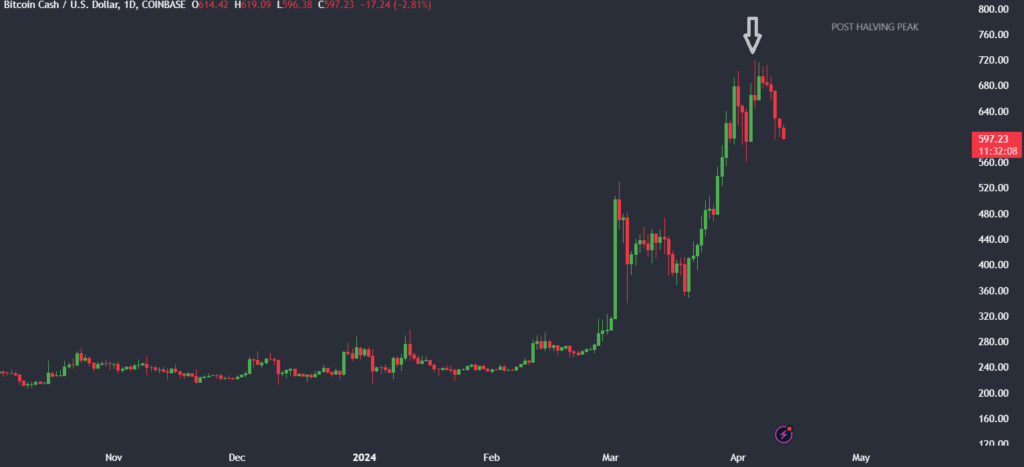

- Bitcoin Cash has fallen from its post-halving peak

Halving event April 20

In previous cycles, the halving event was celebrated by just the earliest crypto followers. However, this time is different. Thanks to the approval of spot Bitcoin ETFs at the start of the year, Bitcoin is drawing the attention of big institutions as well as retail investors.

The technical event, which occurs every four years when an additional 210,000 blocks have been added to the chain, is due to take place around April 20, although this date could move depending on when the 840,000 block height is reached. The process by which miners’ rewards are halved, cutting the supply of the cryptocurrency, creates a scarcity effect, making it like digital gold.

Strong demand following the ETF approval, combined with the halving event, which typically results in fresh all-time highs in the following cycle, could pave the way for explosive gains in Bitcoin.

How will Bitcoin perform after the halving?

After the halving events in 2012, 2016, and 2020, the Bitcoin price surged 93x, 30x, and 8x, respectively, from the halving price to its following cycle’s peak. Past performance isn’t indicative of future returns.

However, there is also an argument that the Bitcoin bull cycle has already kicked in with the ETF approval in January. This could mean that if there was ever a halving event to be a little bit more optimistic about, this may be the one.

Bitcoin Cash has fallen from its post-halving peak.

However, it is worth noting the recent price movement in Bitcoin Cash, the offshoot of Bitcoin. The rally in BCH following its halving event ran out of steam pretty quickly, and open interest in Bitcoin Cash has collapsed by 70% to $376 million. If Bitcoin Cash is seen as a proxy for the upcoming Bitcoin halving, then BTC/USD could also drop in a classic sell-the-news type of move.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.