The Breakout strategy is common among active traders and investors that look into entering trades at early stages of major price action.

If managed with due technical analysis and proper risk management the reward to risk ratio of the set-out strategy could allow one to yield maximum profits from trading opportunities on the market.

What makes the Breakout and Retest strategy unique?

The distinctive feature of this method among other trading strategies is the ability to apply it within any style of trading, either its intraday, day trading or other.

This is closely associated with the fact that price action occurs on the market on a daily basis allowing you to take advantage of these price breaks at various time frames.

Given the fact that this strategy works within all possible market conditions, its universal concept should be reckoned with and considered for implementation and use.

Implementing the Breakout and Retest strategy on the Forex market

Ability to resort to this strategy not only on Cryptocurrency but also on the Forex market makes it much more valuable and appealing.

Forex traders often utilise this technique to identify potential support and resistance levels providing them with useful insights to make weighted decisions for entry points and/or when to best exit trades.

The mechanics of the Breakout and Retest strategy

In order to master the Break and Retest strategy it is vital to understand its general concept and know what essential tools, like technical indicators, are required for its application.

The Break and Retest strategy consists of two vital eponymous components: Break and Retest. The two are a required to occur for the strategy to prove its sustainability.

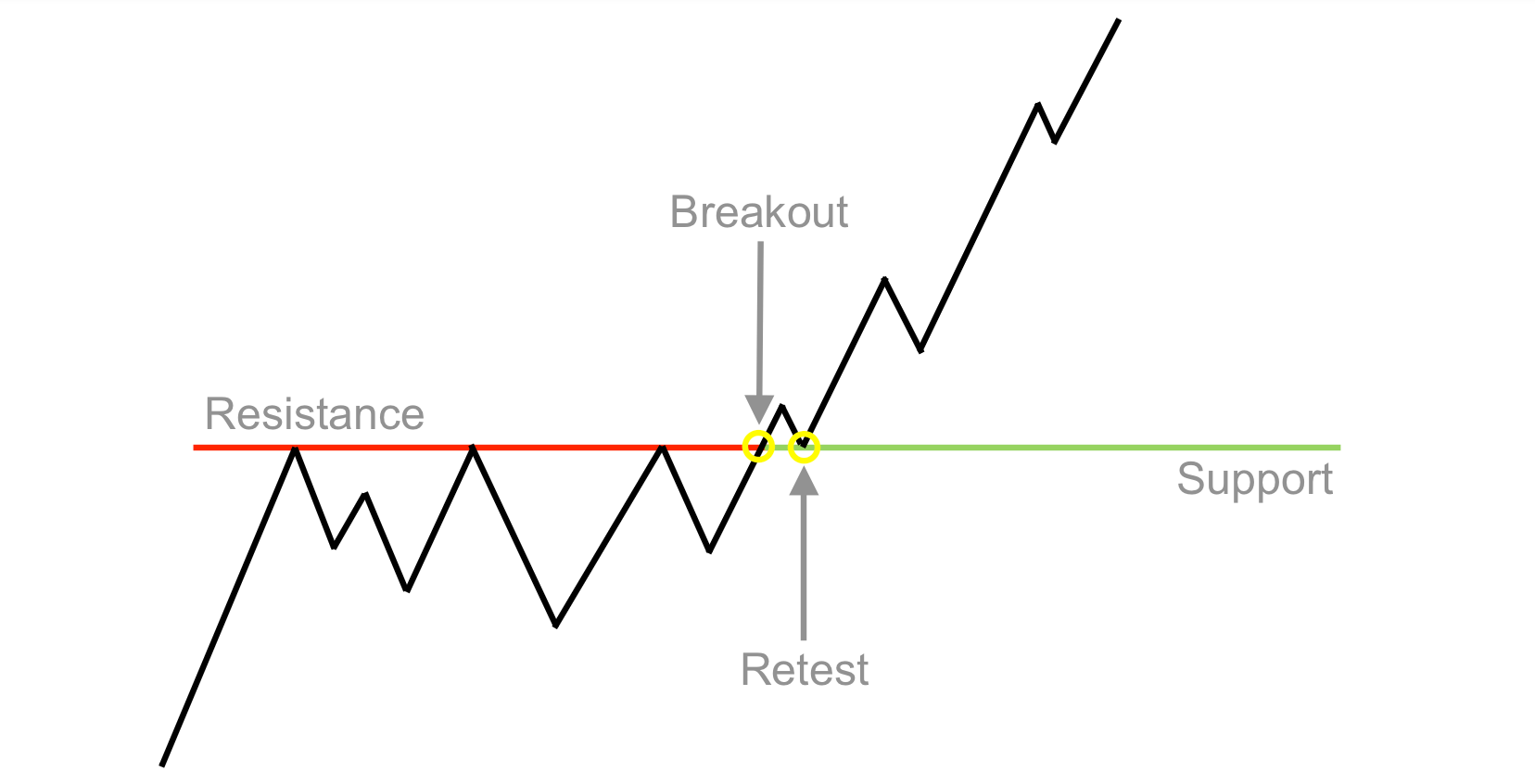

The mechanism begins its movement when an assets price peaks in momentum and breaks either the support or resistance level. High trading volume accompanies the event.

- When monitoring the chart you may encounter a bullish or a bearish breakout. A bullish breakout occurs when the price exceeds the resistance level. And vice-versa, a bearish one happens when the asset drops in value below the support level.

Next crucial step for the strategy to unfold is the retest phase. Once the chart pattern reflects a retrace of the assets price back to the support or resistance level, an opportunity to enter a trade and yield some profit arises.

The retest pattern is considered complete and confirmed only when the price retraces once again, now facing in the opposite direction from the support/resistance levels reflecting continued movement of the spotted trend before the break occurred.

- Alike any other strategy, the Break and Retest sequence does not provide a solid guarantee a successful pattern will emerge.

Price action may not always be predictable enough and fail to retrace as expected. Such events are known as false breakouts. A premature decision could result in a losing trade, which is why waiting for a retest to validate itself is key.

Key chart patterns in Breakout and Retest trading

In search of a perfect entry point, it is essential to identify candlestick patterns that will begin to form on the chart. They provide necessary information about the market conditions you need to consider to evaluate and place the trade.

Typically the most common candlestick patterns the Break and Retest strategy works with are:

- The Wedge pattern represents converting trend lines within a narrowing price range. Wedges can be rising and falling. Whilst the rising ones indicate to a weakening uptrend, falling suggest a weakening downtrend.

- Consolidation refers to a horizontal price range. This patterns is used to identify indecision and any breaks below or above could signal about a possible entry point.

- Triangles. This pattern branches into three types: ascending, descending and symmetrical. The first two types point to upward and downward breaks, while the symmetrical one can indicate a potential break in either of the two directions.

- The Channel patterns represent parallel trend lines. These lines form the support and resistance levels. A break in any direction would signal about a corresponding trend and a trade opportunity.

In addition to candlestick patterns, technical analysis can be complimented by indicators like MACD or RSI. These technical indicators serve as a good tool to confirm the direction of the emerging trend you are scoping out.

Steps for executing the Breakout and Retest strategy

Trading breakouts is no easy task regardless of the fact that this methodology is quite popular and prevails over some strategies.

Here are a few thing you could consider when practically applying the Break and Reset strategy:

Identifying Breakout and Retest opportunities

Monitoring the support and resistance levels is a must to identify break patterns. The more times price returns to these levels the more validity you have to proceed setting up a trade.

Tracking volatility with the help of corresponding indicators like ATR, Volume, Bollinger bands and others provide more vision of the momentum.

Determining optimal entry and exit points

Entry points are easier to estimate and are best to execute once a retest occurs. As soon as you have spotted a valid retest, entry with a buy or a sell order into the market will now depend on its direction.

Exit points are slightly harder to determine yet are manageable. It is vital to understand if the trade has succeeded or failed. Following reasonable profit objectives and realistic expectations of loss opens the opportunity to extract maximum benefit or bear less damage.

Utilising backtesting to validate your strategy

Another great way to ensure you are moving in the right direction with the outset strategy is to backtest it on historical data. Such platforms like TradingView, Forex Tester or MT5 can simulate a trade based on your strategy criteria.

The results received after the backtest is another crucial piece of information you should analyse to assess the sustainability and performance of your strategy.

A number of metrics like win rate, profit factor or risk-reward ratio can signal about an open opportunity to apply the strategy or to abandon it.

The pros and cons of using the Break and Retest strategy

Trading the selected strategy has its share of ups and downs. A weighted decision is always a blend of theoretical studies and practical analysis.

Despite the due diligence performed there are external and internal factors that may take their tool on the way of things. For good or for the worst.

Advantages of the Breakout and Retest approach

The greatest benefit of the Break and Retest strategy is its applicability to countless market occasions and conditions in a combination with practically any trading style you have adopted.

In addition to that, the Break and Reset strategy greatly compliments trading on several markets, including Crypto, Forex and others, allowing traders to diversify their portfolios.

Another upside of this approach is the ability of less experienced and novice traders to learn and use it while they make their way to mastering more complex and sophisticated strategies.

Potential downsides and risks

Most common downsides of the Break and Retest strategy are unexpected price fluctuations. At times price breakouts may not live up to expectations.

A failed validation of a retest or even worse – subsequent price rush in an unpredicted direction can put you at a loss or simply have you miss a great trading opportunity.

Common pitfalls and how to avoid them

As easy as it is to face conjugated risks and bear the consequences, it is equally easy to miscalculate your patience and get carried away chasing trades that you feel you’re missing out on while waiting for the right moment to enter.

As a result overtrading the market in unfavourable conditions with greater exposure and transaction costs can reduce your profit potential and substantially increase the risk on reward ratio. One must always practice proper risk management to avoid losses he is not willing to take.

Conclusion

The Break and Retest strategy is a popular and very affective method to assess the market, take advantage of volatility and yield potential profits by proper implementation of technical analysis.

On the other hand, this strategy implies inherited risks that may occur in unpredicted conditions. Along with emotions that make take their toll if patience is underestimated and improper risk management is practised.

Balanced trading decisions, realistic objectives, and a pre-determined risk appetite can help you reach your set-out goals while minimising associated risks.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.