Margin trading or investing is all about balance. Balancing your potential profit to your potential market exposure – known in the world of financial markets as the risk-to-reward ratio. Balancing your ambitions with your available initial margin.

What if I told you that you could remove that last consideration?

Margin trading can increase the size of your positions beyond the actual funds available in your account, but it can also increase your market exposure.

Keep reading to learn the benefits of margin trading and the difference between isolated vs cross margin trading and how to use one of these to prevent the liquidation of every single position.

Margin Trading: An Overview

Margin is similar to collateral, the same way leverage is similar to a small loan issued to the investor from the broker. When an isolated margin position exhausts its available margin, that position is closed.

The higher the leverage, the more margin is required and the more sensitive the position is to market movements. Although this may seem like an effective way to manage risk, it has drawbacks.

Leverage “amplifies” market movements. A small movement against your leveraged position may exhaust the margin assigned to it, causing it to close without fulfilling its full profit potential.

When used correctly, a sufficiently margined position will amplify positive market movements, multiplying potential profits.

Additionally, it allows you to use your trading capital to open multiple positions instead of dedicating your entire balance to a single trade, increasing your market exposure. For example, say you have $1000 in your account, and access to leverage of 10:1. This means you can (theoretically for the sake of this demonstration) open 10 positions of $1000 with just $100 of capital per position.

Delving Deep: What is Cross Margin?

Defining Cross Margin

Cross margin trading is a great way to avoid small market price movements that would have closed a position with isolated margin. Instead of having a predefined amount of funds for margin, which may close your trade if exhausted, your entire account balance can be used as margin.

Brokers such as PrimeXBT actually automatically adjust your available balance and margin to prevent liquidation i.e. a trader’s position from closing. It will also apply realised profits if needed to keep positions open. This means open positions can see their maximum potential, even if the market experiences a movement against the trade.

This can be extraordinarily beneficial on a spot market that moves frequently and rapidly, like the currency or crypto market.

Key Features of Cross Margin

As mentioned above the main feature and benefit of cross margin compared to isolated margin is the ability to keep a trade open by using the account balance and realised P/L as its margin allocated, even if the market moves against it temporarily. Another benefit of cross margin is when taking a long position, i.e. holding a position open for an extended period of time. Long positions with leverage are the most vulnerable to being liquidated as there is a higher chance market conditions can change over a longer timeframe.

Unpacking the Concept: What is Isolated Margin?

Defining Isolated Margin

Isolated margin is predefined and locked in. The benefit of this type of margin trading is that trading fees, and position value are more easily calculated. The disadvantage is that isolated margin has a higher liquidation risk.

A practical example would be trading a 100:1 leveraged position. With just a 1% market move, you could either double your position’s value or liquidate it with isolated margin. Now think about how frequently active markets like cryptos or currencies make moves much more impactful than 1%.

Cross margin on the hand and specifically the automatic cross margin PrimeXBT offers, considering you have the available funds, will allow your leveraged position to remain open even if the market moves against you.

Of course, the disadvantage is that if markets move against you, it can negatively affect your remaining capital or realised P/L.

Unique Attributes of Isolated Margin

Isolated margin positions have another function. They can protect your account and other open positions as the position will automatically close when your position hits its margin call. The disadvantage is that this can also limit your positions’ profit potential. Cross margin on the other hand, doesn’t limit your position, but requires more monitoring.

With cross margin trading though, there are essentially no margin requirements, your entire balance and realised P/L can be used to keep a highly leveraged position open. As the market moves against your position the trading platforms PrimeXBT offers will add margin to keep that single position or existing positions open.

Comparison: Cross Margin vs Isolated Margin

Risk Management Implications

As mentioned above cross margin is a very different tool than isolated margin trading. Cross margin allows a losing position to recover without being stopped out. Isolated margin, will close an open position when the position margin is exhausted due to a margin call, as the only margin available is what the initial margin was.

Cross margin trading is ideal for a long position i.e. one held for a longer time since the margin balance is both the account balance and realised P/L. It is more challenging to calculate the initial margin requirements without predicting the market, this isn’t as important if your open position has high leverage applied to it and is extremely sensitive to market movements.

Efficiency in Profit and Loss Scenarios

In isolated margin mode, the maintenance margin needed for 100:1 leverage is just 1% away from the price you opened your trade at. This might not be an issue with small positions but if you have a significant position, that number will increase substantially – and these are funds that you can’t use to trade.

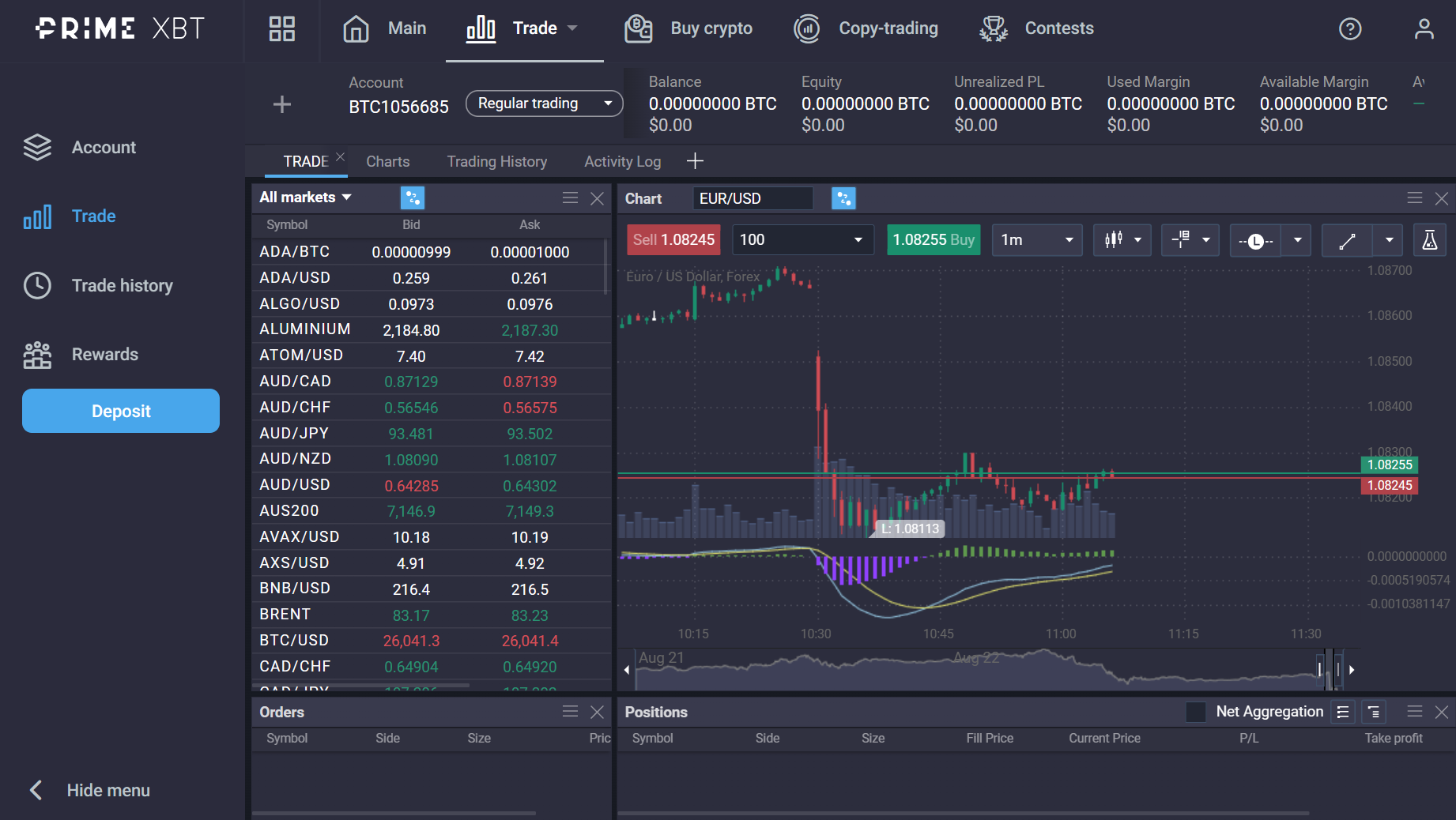

At current rates of EUR/USD at 1.08235 that means a move from 1.08235 to 1.0931735 or from 1.08235 to 1.0715265. These rates are not the average daily range, but an unexpected event may cause the pair to move more than 1%.

In cross margin mode, this changes since the total of all your account and your realised P/L can be used to trade and be your margin allocation simultaneously. If an additional margin is required, it will automatically be taken from your account.

Analyse how each margin system can either magnify profits or intensify losses, providing scenarios for both.

Flexibility in Trading

Most types of leveraged trading have an initial margin requirement. Choosing the conditions that best fit your trading strategy, your trading plan, available balance, and your financial goals is most important. As mentioned previously, cross margin trading is great for holding and keeping a losing position from closing. This is also more appropriate for experienced traders that can monitor and analyse the market effectively.

Isolated margin mode is safer, applied by setting a hard stop on losses by closing the trade when the minimum amount of margin is reached. This happens when the market moves in the opposite direction of the trade or position you opened. This may be more appropriate for novice traders.

Additionally, in isolated margin mode, the funds in a trading account allocated to margin can not be used to trade with until positions are closed.

Common Misunderstandings and Pitfalls

The most straightforward mistake is not being aware of the type of margin trading you are using. Assuming you are cross margin trading, but realising that you are using isolated margin mode as your trades close due to margin stop out, can be catastrophic. The opposite scenario is true too, thinking you are opening an isolated margin trade, resting easy that if markets move against you it will be stopped out, but realising you have opened a cross margin position, without stop loss and you are completely exposed to a negative market movement. Also cross margin is more appropriate for experienced traders that monitor markets a bit closer and have the skills to perform fundamental and technical analysis.

Cross Margin and Isolated Margin in Different Market Conditions

Performances in Bull Markets

If you are taking a short position in a bullish market expecting a trend reversal, then cross margin with a stop loss order might be a better choice, as it will allow the trade to remain open as it moves into the range you expect the reversal to happen. If you are trend trading – i.e. just following the trend, then either isolated margin mode or cross margin mode should work with the appropriate risk management measures.

Implications in Bear Markets

Again if you are spot trading and opening a short position in anticipation of a price reversal, using cross margin mode with a stop loss order can help you avoid momentary corrections or slightly missing the range at which the reversal will happen. If you are following the trend then again, both margin types should work well with the addition of the appropriate risk management measures.

Real-life Examples: Cross and Isolated Margin in Action

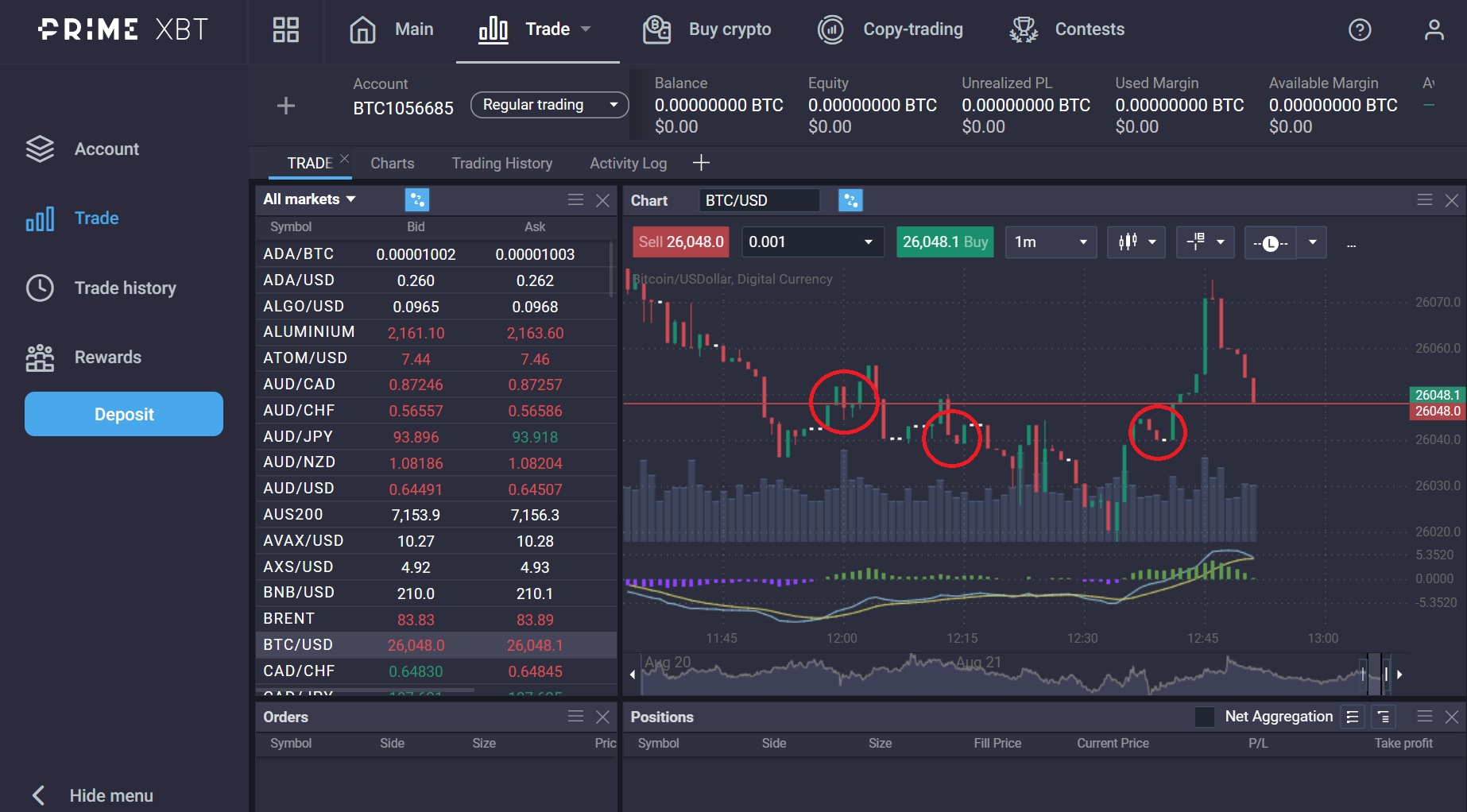

If you are spot trading, opening short positions against a trend, only to find out that the trend is continuing then an isolated margin account will help you avoid your account being affected. On the other hand, in the same scenario – if you are unsure of the range at which a reversal will happen, cross margin should keep your position open long enough to capture that reversal. If the market is reacting like the image above, with small intraday dips, then cross margin should work the best.

Conclusion: Choosing the Right Margin for Your Trading Style

As mentioned previously, you should choose the margin type that best fits your speculative trades or investments.

What is the primary advantage of using Cross Margin?

The ability to keep an open position from being closed due to margin stop out.

How does Isolated Margin protect my other positions?

It closes a losing position when it reaches the margin requirements.

When should a trader opt for Cross Margin over Isolated Margin?

That depends on the trader's strategy and financial goals.

How do market conditions influence the choice between Cross and Isolated Margin?

Market conditions play a significant role when choosing between cross margin and isolated margin.