It was a hectic week once early de-escalation cheers of the situation at Ukraine turned into anxiety when tension between Russia, Ukraine and the USA took a turn for the worst towards the end of the week.

Following the phone call with US President Biden last week, Russia’s President Putin ordered the returning of about half of their deployed troops from the Ukraine borders on Tuesday, cooling geopolitical tensions that have knocked the stock market down in the week before.

This brought cheers to the market, with stock indices jumping on average 2% to celebrate the much-needed news, while Oil price retreated by more than 3%.

While Wednesday’s FED meeting showed that the FED was ready to front load interest rate increases, markets shrugged it off as this has already been priced in by market participants.

However, things degraded on Thursday after the Russian media reported that Ukraine had broken a ceasefire agreement. Coupled with warnings from US officials that the situation was at a moment of peril, and that an impending attack from Russia would happen at any moment, the markets gave up all of its early week gains and tanked on the last two days of the week.

The already declining situation got worse after Russian officials announced that they would move to Saturday nuclear weapons exercises which had been previously scheduled to take place later in the year. This was mostly interpreted by the West as a show of defiance, especially when Putin was said to be personally overseeing the drill.

Friday was particularly volatile with trillions of dollars in options and futures on stocks, indexes and ETFs set to expire. Option expiration days, which generally occur on the third Friday of the month, can cause the market to swing in a wide range as these positions are closed out.

As a result, all US indices notched their second losing week, with the Dow losing 1.9%, the S&P 500 falling by 1.6% and the Nasdaq declining by 1.8%.

US Treasuries eased a little, with the 10-year benchmark back below 2%, closing at 1.927%.

Gold was the best performer, with its safe-haven play taking its price up by 2%, while Silver’s price remained the same. Oil lost a bit after traders took profit on Tuesday when Russian tension eased, but was bided up again at the end of the week closing at $90.60.

With leading crypto asset BTC trading more like a tech-stock rather than the safe-haven asset it was made out to be, it came as no surprise that cryptocurrencies declined together with the stock market.

BTC lost about 10% after an early week gain, breaking the psychological $40,000 mark after several failed attempts to rise on Friday and Saturday.

Even though the $40,000 level has cracked, instead of a quick move lower, the BTC price merely drifted slowly downwards. This could be due to the weekend’s low volume, or it could even imply that there is a certain level of resilience to further downside due to dip buyers.

Recent political events happening in the Western world are indirectly showing the benefit of BTC, possibly bringing in more dip buyers than usual. One such event is the freezing of COVID protestors’ bank accounts ordered by Canada, which made some people consider having savings in censorship resistant cryptocurrencies.

The Russian threat of war has also increased the attractiveness of cryptocurrencies to Ukrainian people, since, on top of being censorship resistant, cryptocurrencies are also borderless.

Last week, the Ukrainian parliament passed a new Ukraine Virtual Assets Law officially legalizing crypto exchanges and cryptocurrencies. Many market watchers attribute the move to Russia’s threat of invasion which would threaten to make the Ukraine currency, the Hryvnia, lose a lot of its value or even become worthless in case Russia succeeds.

BTC Whale Accumulation Continues Despite Risk-off Environment

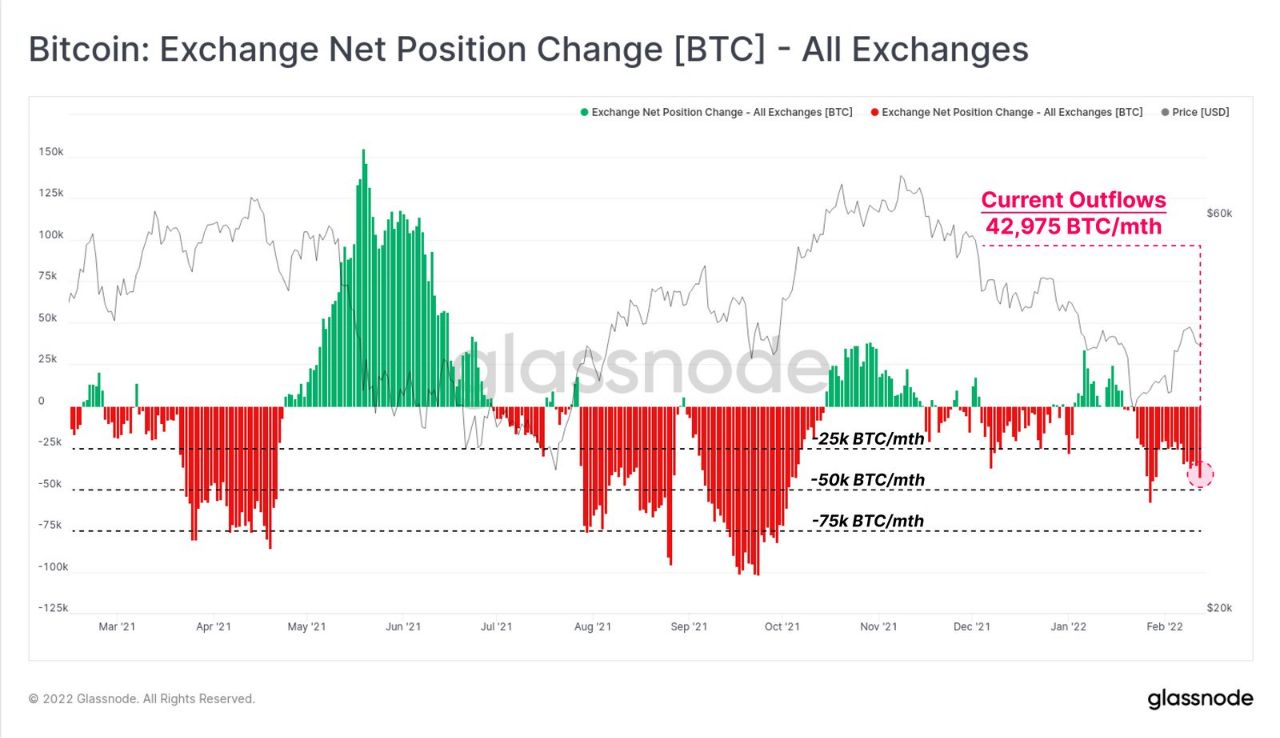

Despite asset prices falling in the current risk-off environment, the demand for BTC is not abating. In fact, a larger number of BTC is still flowing off of centralised exchanges – a clear sign that dip buyers are aplenty and continue to scoop up BTC whenever a good opportunity arises.

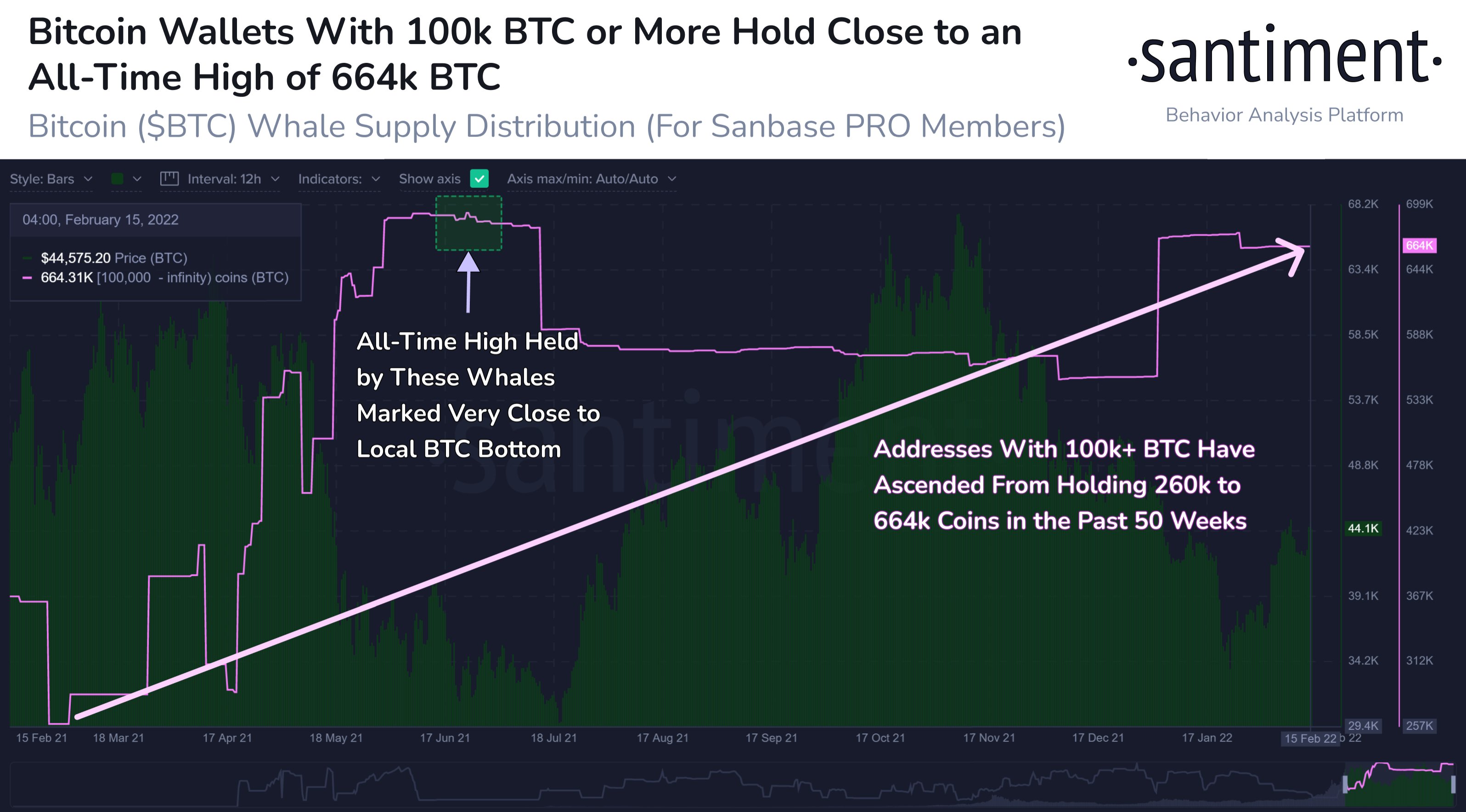

Another metric that shows BTC is continuing to be bought is the BTC whale wallet holdings.

BTC’s top addresses with more than 100,000 coins currently hold an aggregated 664,000 BTC, meaning that these whales bought around 404,000 additional BTC since February 2021. A spike in the number of BTC accumulated was seen in the second half of January, which brought their aggregated holdings very near to the ATH of 693,000 registered in June 2021. In the 5 months following this, the BTC price doubled from $30,000 to its ATH of almost $70,000.

BTC Network Health Improves Despite Price Correction

Even though the BTC price has come off rather significantly since its ATH last November, the health of the BTC network has been improving. Metrics clearly show a more secure and stable network which could eventually materialise into higher prices in the long-term.

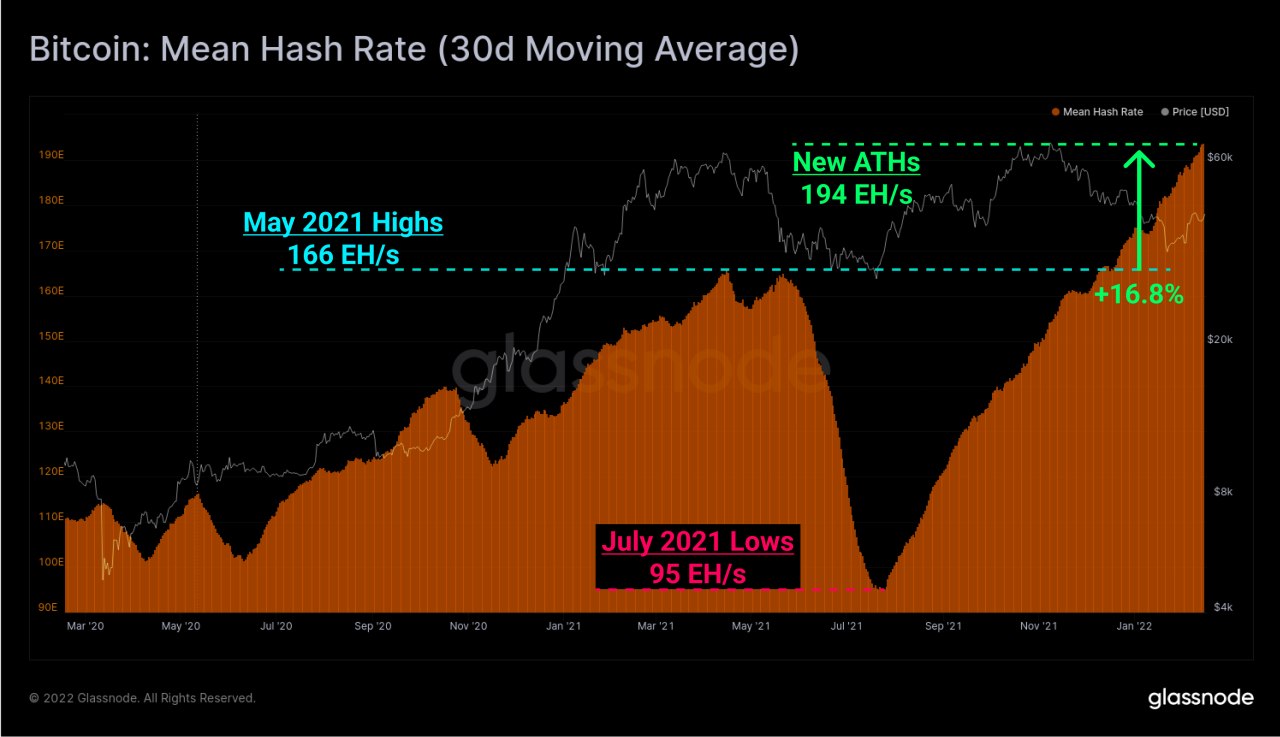

One such metric is BTC’s hash rate, which saw a deep decline after China’s mining ban last May. After reclaiming all of its losses over the last year, BTC’s hash-rate has continued to climb in 2022, pushing to a new ATH of 194EH/s on a 30-day moving average basis, 16.8% higher than its ATH of 166EH/s before the China ban.

Usually, price precedes hash rate and with the hash rate consistently moving higher, it could be a matter of time when the BTC price follows. However, that may not happen in the short-term since other macroeconomic headwinds like rising interest rate expectations and geopolitical tensions are putting pressure on BTC’s price.

While most altcoins await BTC’s lead, there are a few altcoins that could possibly outperform BTC as their own news flow could overshadow the headlines from Ukraine, until of course, a war breaks out. One such altcoin is XRP.

XRP Sees 2nd Largest Whale Accumulation

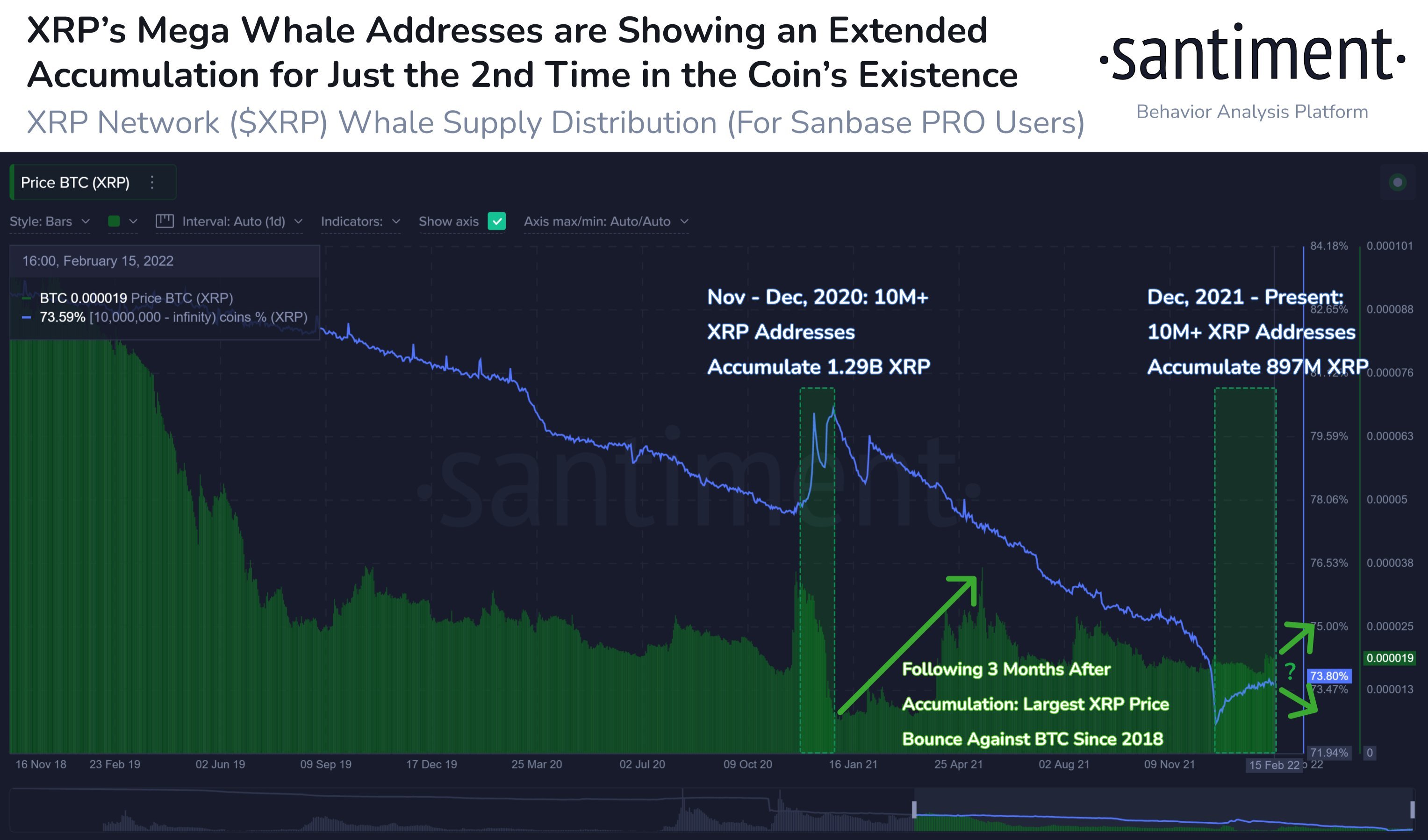

According to data, crypto whales have been on a XRP accumulation spree since the beginning of this year, representing the second-largest accumulation of the XRP token during the past 5 years. This may indicate that whales are being optimistic of a favourable outcome in the ongoing lawsuit between Ripple and the SEC.

There are currently 336 XRP Network addresses holding about 10 million XRP, and top whales have accumulated 897 million XRP since December 2021. During the largest accumulation between November and December 2020, the price of XRP saw a significant rise in price in the following 3 months. Hence, there is a high chance that a similar large accumulation if happening again could give a similar result.

Furthermore, late on Friday, the two legal memos that would contain Ripple’s legal opinion back in 2012 were unsealed by the court, which set off discussions on social media. This surge in social media mentions of the case is likely to continue into the early part of the new trading week and could bring some interesting volatility to the XRP token as traders try to speculate on the outcome of the lawsuit, while most other altcoins continue to wait for the lead from BTC.

Another altcoin with worth-mentioning news is DOGE. The Doge-Father, aka Elon Musk, revealed in a tweet on Saturday that the Tesla charging station will soon support DOGE as a payment method. Elon also dropped a hint earlier about Starlink, Elon’s internet company, possibly accepting DOGE as payment. However, with market sentiment badly affected due to the Russia-Ukraine situation, the DOGE price only moved 1% higher.

In conclusion, while the fundamentals of cryptocurrencies remain positive, the BTC price and most other cryptocurrencies remain at the mercy of news from Ukraine as the situation continues to worsen.

With the Winter Olympics in China having ended yesterday, officials from the USA claim that an attack by Russia is almost a certainty and would happen in a matter of days. Despite the firm assertion, it was announced that US President Biden has agreed to meet with Russia President Putin regarding Ukraine as long as Russia does not invade Ukraine, putting chances of an invasion in the near-term to almost zero.

The welcoming news quickly sent risky-assets bouncing off their lows made during early trading in Asia, while Oil and Gold, which had been rising due to the prospect of war, retraced.

With the US traditional markets closed for President’s Day holiday on Monday, traders may need to wait till Tuesday before they get to see the impact of the latest peaceful update on the US stock market. In the meantime, stocks in Asia are bouncing off their lows, with the Nikkei 225 erasing a more than 2% loss earlier in the session.

The cryptocurrency market is also showing signs of life, with BTC jumping by more than 3% to $39,000. However, whether this is merely a technical rebound or a bottom remains to be seen.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.