US stocks gave back their early week gains post the release of red-hot inflation numbers on Thursday. The released CPI report showed a year-over-year rise of 7.5%, making it the largest gain since 1982. The 10-year Treasury yield jumped above 2% afterwards, when it started at 1.51% barely two months ago.

Short-term rates spiked even more in a sign that investors were expecting the FED to keep inflation from becoming entrenched. The 2-year yield gained more than 26 basis points in its biggest single day move since 2009 and continued to rise on Friday.

The FED’s announcement about an emergency meeting on 14 February further stoked fears that the FED would raise interest rates even before its regular March meeting.

With the market already expecting a 50bps increase at the March meeting, and a 61% chance that the FED will hike seven times this year, a sudden call for a meeting on Monday is sending chills down traders’ spine.

Further to that, geo-political risk escalated on Friday after President Biden urged Americans to leave Ukraine as soon as possible as Russia could invade Ukraine anytime. This added to an already fearful sentiment, causing stocks to tank further on Friday. During the week, the Dow fell by 1%, the S&P lost 1.82% and the Nasdaq dropped 2.18%.

With escalating fears of war causing the black gold to surge on Friday, Oil became the winner recouping all its losses made in the previous four days to clock a new high of $92.40. Oil gained 1.6% overall and continues to move higher, hitting a high of $93.40 in early Asian trading.

Precious metals were also bided higher as a safe haven play. Gold gained 2.8% to $1,860 while Silver went up a good 4.8% and reached $23.60. Silver is starting the new week on a good note, gaining 0.7% in early Asian trading while Gold remains flatlined.

Strangely, cryptocurrencies did not trade like the safe havens they were touted to be, with the prices caving in as the stock market plunged late week.

The BTC price lost about 5% on Friday, mirroring the performance of stocks which fell by about 2.5% on the same day. Expectation of impending aggressive interest rate increases is denting the allure of cryptocurrencies as a store of value. While BTC and ETH lost only about 5% each on Friday, the damage was felt more intensely by altcoins, which lost an average of about 20%.

Early Week Cheers Caved In To Big Pullback In Altcoins

The week started on a strong note for crypto, with BTC bouncing to a high of $45,500 after the Canadian branch of KPMG said they bought an undisclosed amount of BTC and ETH to add to their balance sheet. The firm went further to say that they are also interested in other crypto assets like Defi, NFTs and the Metaverse, and would consider other innovative investment opportunities in the future. This sent the prices of altcoins soaring, causing short liquidations to increase.

However, that feel-good factor was lost on Tuesday when the US Department of Justice announced that it had seized around 120,000 BTC from a 2016 BTC hack. The price of BTC and the broad crypto market fell as traders began to worry that the 120,000 BTC, worth around $4.5 billion at current market price, would be sold in the market when the rightful owners would get the asset. However no details are yet available as to when these coins will be returned to the exchange and who will distribute the BTC back to their rightful owners as of press time.

However, after Bitfinex revealed that it would not be returning the BTC to affected users, but will instead offer to buy-back its atonement token LEO, which had been given to affected users, the price of BTC stabilised at around $44,000. Traders liked the assurance that the 120,000 BTC would not be sold for fiat in the open market which would depress the price, while the price of LEO rallied more than 50% overnight on this revelation.

Banking giant Wells Fargo, who manages around $1.9 trillion, added to the optimism by issuing a bullish report on cryptocurrencies, predicting global crypto adoption could soon hit a hyper-inflection point similar to the internet at the turn of the century. The team, part of Wells Fargo Investment Institute, are hopeful that greater regulatory clarity in 2022 will bring higher quality investment options for investors keen to invest in the space, which will bring about an explosion in adoption.

However, all that cheer could not save the crypto market from the contagion of the falling stock markets. As the FED announced an emergency meeting slated on 14 February and coupled with tensions escalating fast in the Russia-Ukraine situation, fears of an outbreak of war gave stocks a beating, dragging the crypto market down with it. While BTC has only fallen around 10% off its high of $45,500 made midweek, altcoins were seen to be shedding more than 20%.

Even though the crypto market has become a casualty of the current risk-off situation, it has to be said that its fundamentals are continuing to improve as more traditional financial firms are reporting an increase in investor interest. Hence, should the time come when the market wishes to focus on fundamentals, there is a chance for cryptocurrencies to decouple from the stock market. It is also possible for both stock and crypto to resume their upward trajectory as a result of a change in interest rate expectations because, however bad the headlines are, BTC metrics are not particularly bearish.

Institutions Continue To Show Bullishness

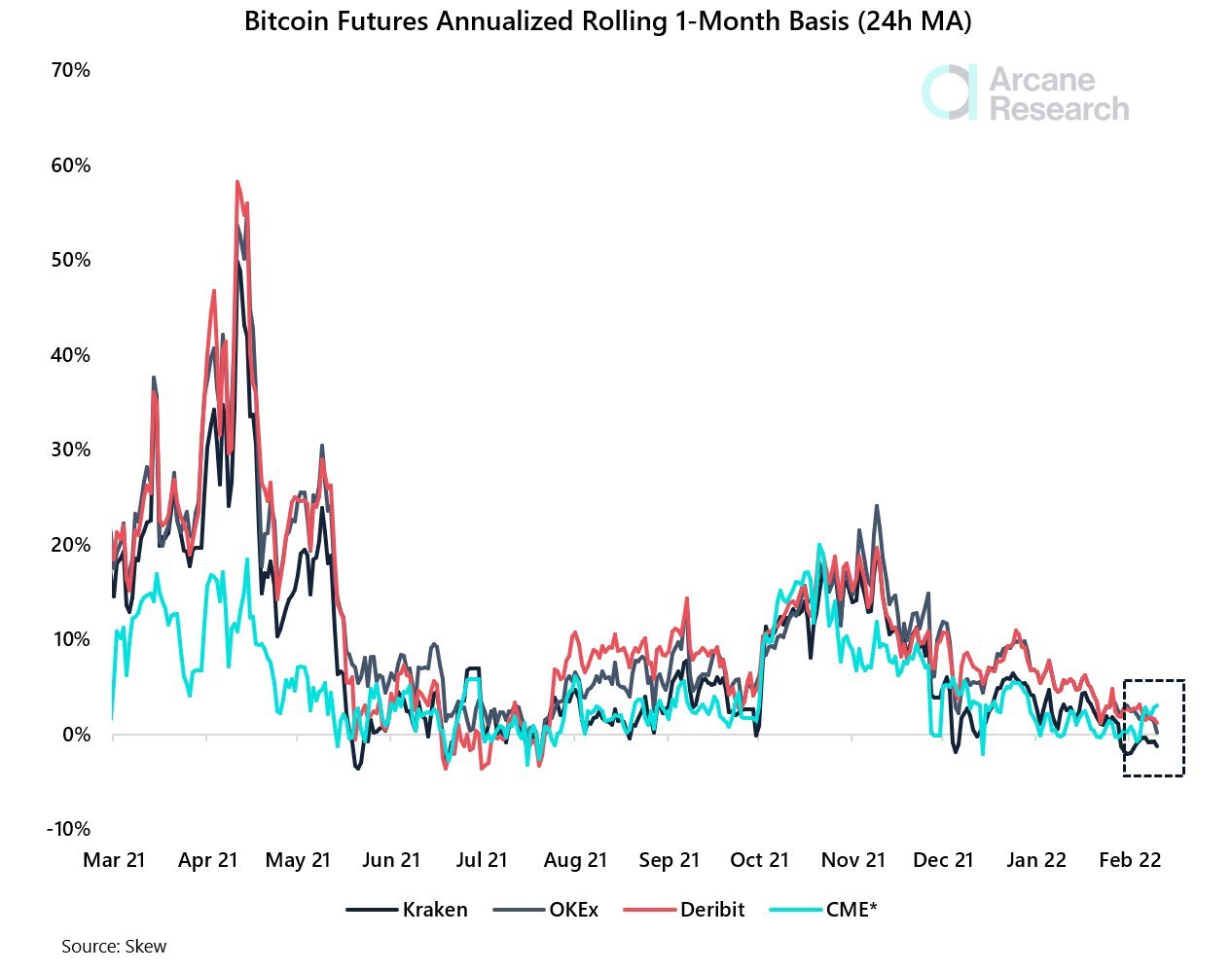

As more traditional finance firms give a positive outlook, institutional interest in crypto continues to increase. It is even beating that of retail investors as the basis on the BTC Futures listed on CME has shown an uptick, meaning forward prices there are moving higher, opposed to a declining basis for BTC Futures listed on retail platforms. This shows that institutions are more bullish than retail investors at the moment, which is usually a good sign.

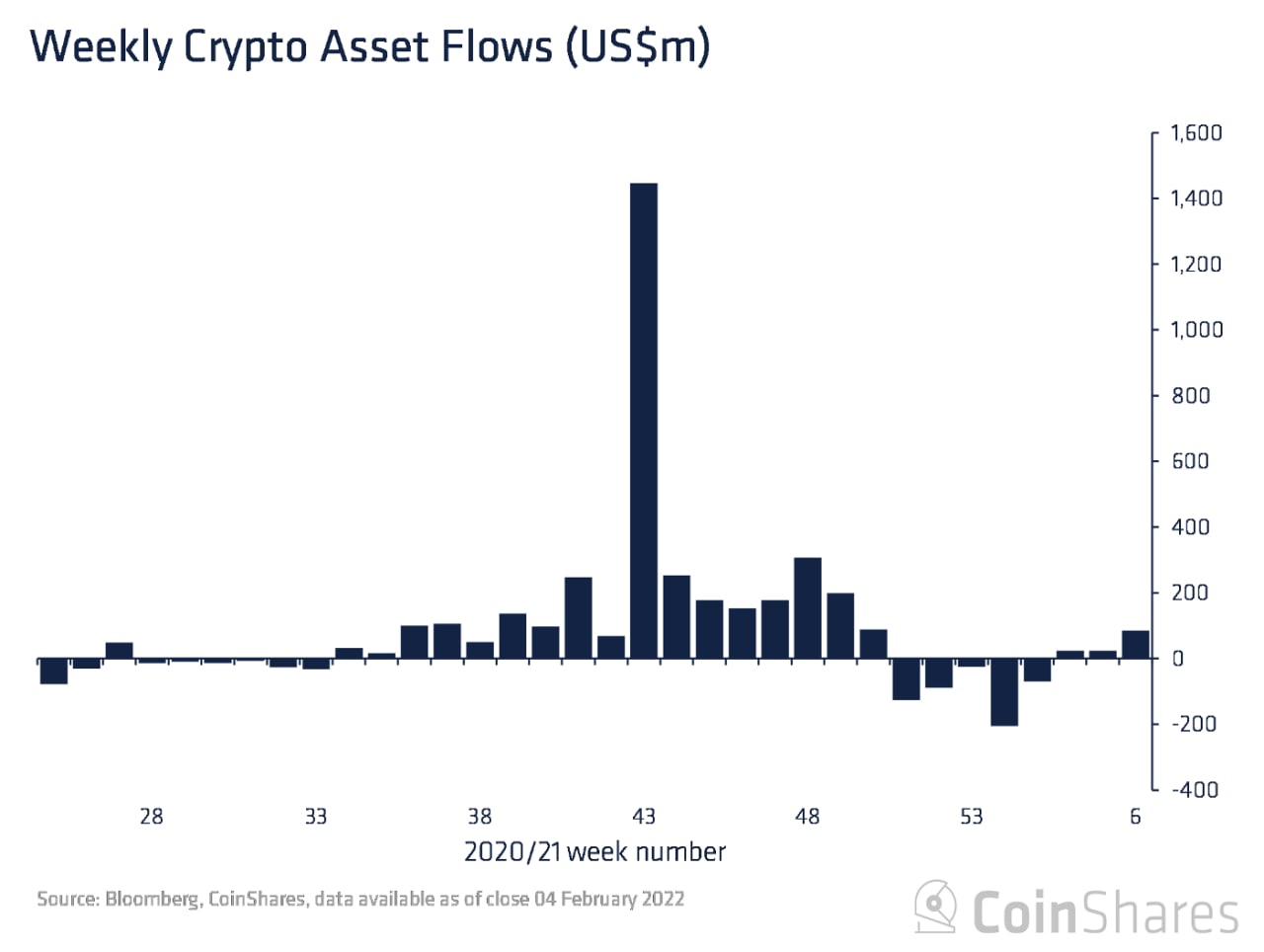

Other than CME players, other crypto funds have also seen its 3rd week of inflows totalling US$85m. BTC continued to lead the inflows with US$71m, the largest mark since early December. A broad set of altcoins also saw inflows, such as: SOL, DOT and ADA which saw inflows totalling US$2.4, US$2.2m and US$1.1m respectively.

LUNA also saw its first significant inflows totalling US$1.4m.

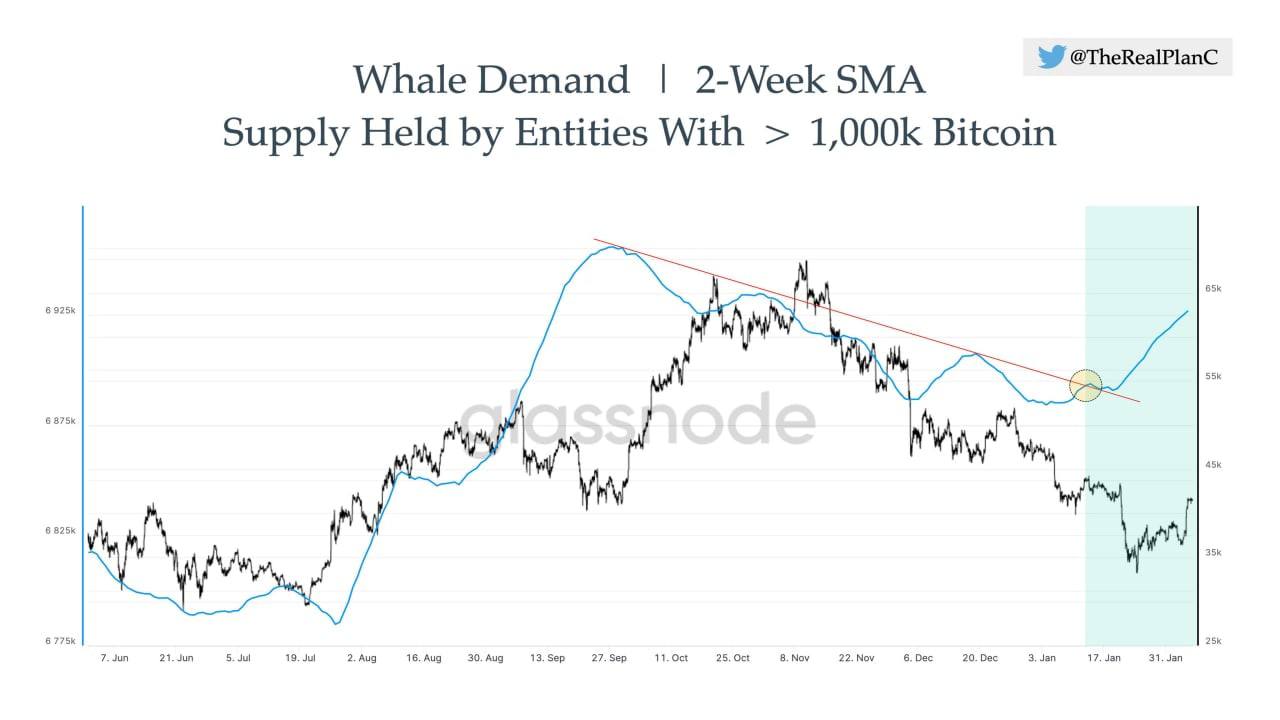

BTC Whale and Other Metrics Show Bullish Trend

Large BTC whales are also back to buying after a selling spree started in November 2021 when BTC made a new ATH. BTC supply held by entities with more than 1,000 BTC have reversed into an uptrend as can be seen in the diagram below. The whale demand downtrend broke on 12 January 2022. Since then, whales have added more than 50,895 BTC. Previously when whale demand for BTC increased, the price of BTC moved up in tandem shortly after.

The BTC Stablecoin Supply Ratio Oscillator (SSR), which shows times of correction and impulse, also appears to be heading towards an impulse upswing in the not-too-distant future.

BTC’s current SSR trajectory is similar to pattern 2, which can be interpreted as a potential impulse stage. Could BTC be starting a bullish impulse stage 5 in the coming weeks?

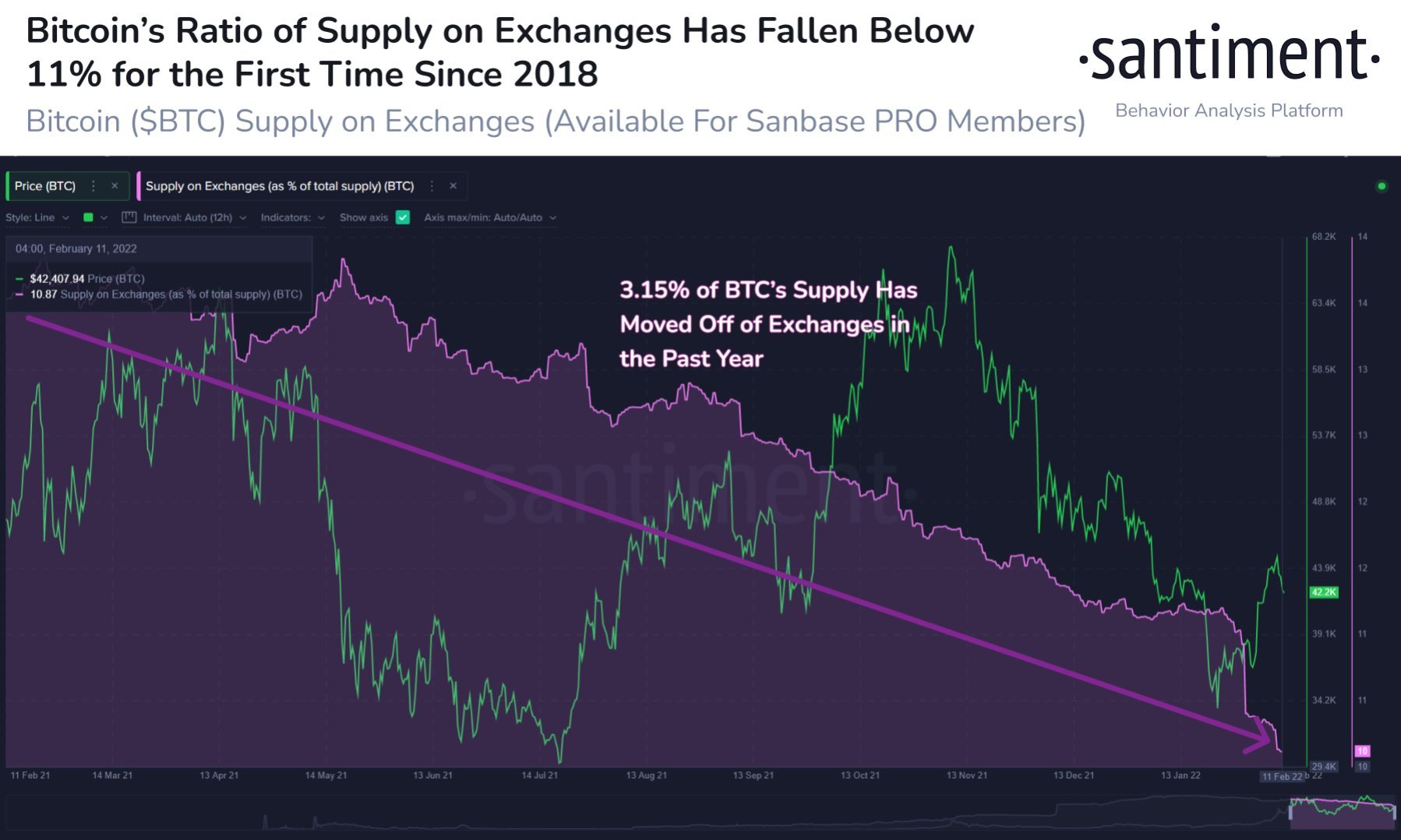

BTC Exchange Reserve Falls Sharply

The amount of BTC moving off exchanges also gives reason to be optimistic. With the recent price fall, almost 10,000 units of BTC have been bought and withdrawn from exchanges, showing the aggressive extent of the accumulation. As a result, BTC supply on exchanges is now down to just 10.87%, the lowest percentage seen since December 2018. Generally, this continued trend of coins moving off of exchanges limits the risk of big price falls.

Fear of The Unknown Overrides Fundamentals

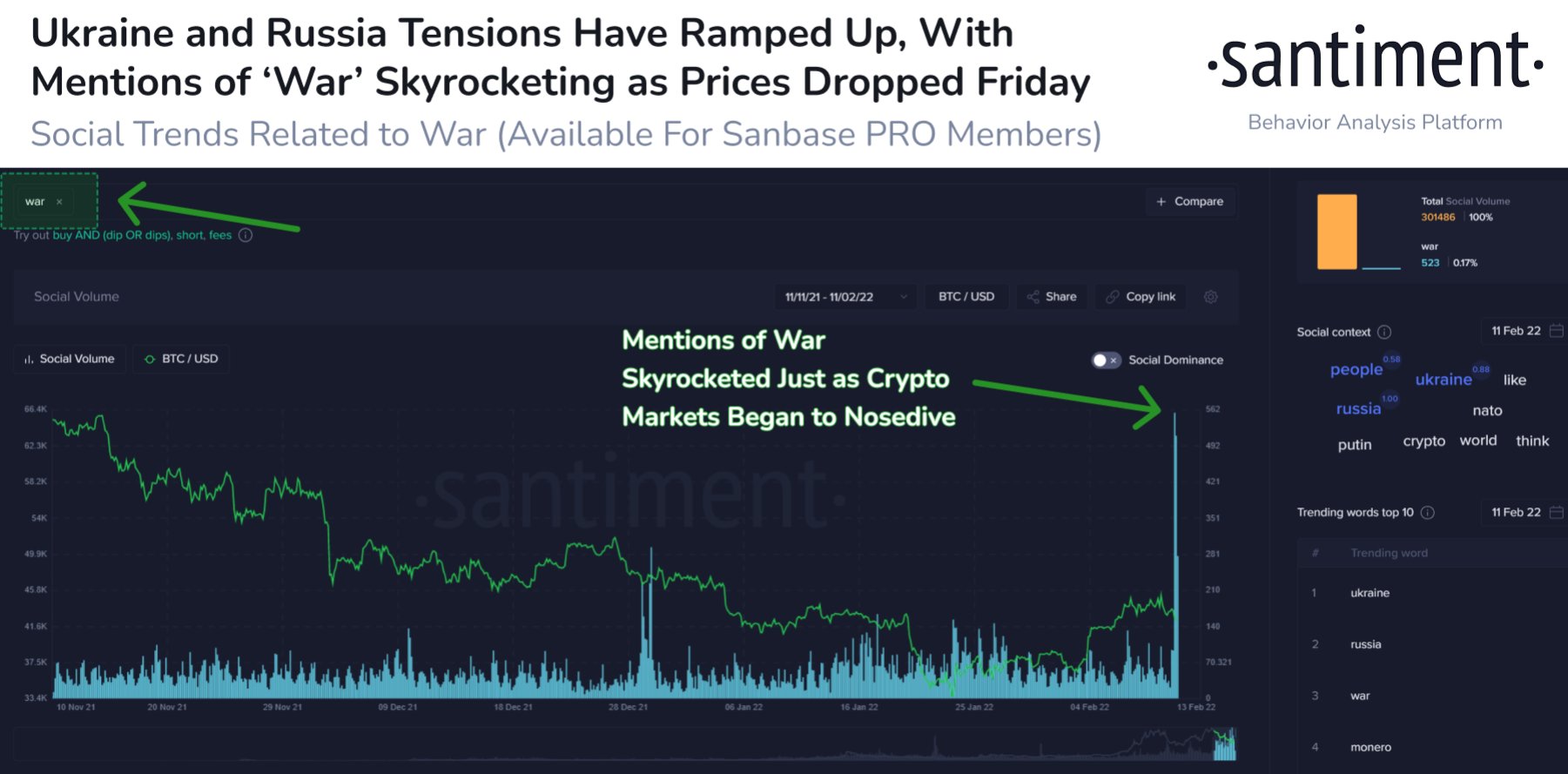

The crypto market is currently adversely affected by the risk-off sentiment on Wall Street as mentions of war skyrocketed on social media on Friday. Hence, while onchain data shows optimism, the market is continuing to show signs of weakness in the short-term as a double whammy dose of fear has taken centre-stage. While on the one hand traders are worried about an outbreak of war between the USA and Russia, they are equally, if not, more worried about an aggressively tightening FED.

After news reported that US President Biden and Russian President Putin had a good phone conversation on Saturday which may avert an outbreak of war in the near-term, the crypto market stabilised a little on Sunday. However, the moment the Asia markets opened on Monday, prices fell as traders started selling because of panicking about the FED meeting.

Hence, until the Monday FED meeting is done and dusted with, traders could remain on tenterhooks.

XRP Rises On Positive Development in Lawsuit

Even though prices came off last week, not every coin got affected as some of them rely heavily on their own fundamentals. For example, XRP managed to hold on to some of its early week gains despite the market selling off at the end of the week.

XRP had one of its best days in recent times after a US District ruled that documents sealed in Ripple’s court battle with the SEC over whether the token was issued and sold as an unregistered security should be opened. The documents are said to contain information from unidentified lawyers who concluded XRP tokens were not securities when Ripple sought legal advice back in 2012.

The turn of events led many traders to believe that Ripple could be on its way to winning the lawsuit soon, resulting in buying the XRP token. Even though XRP has retraced from its spectacular gain of 35% when it hit a high of $0.91, it is still trading at a higher price than the week before.

As other coins get battered by the risk-off environment, coins like XRP which have a compelling story developing could turn out to be one of the less risky bets for traders wanting to build long positions.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.