At one point, Dogecoin had reached just over $0.75 during the crypto bubble. That said, just as much, if not more money, has been shorting Dogecoin since then. The market should be approached from two directions, not simply “buying and holding.” We will take a look at benefiting from falling prices.

What Does Shorting Dogecoin Mean?

Shorting Dogecoin means that you are betting on the price of Dogecoin falling. It’s not an easy thing to do in the institutional or spot market, but luckily there is what is known as the contracts for difference market (CFDs).

By “shorting” Dogecoin, you are selling it to somebody else with the idea of buying that position back at a lower price. Luckily, PrimeXBT offers the CFD market, meaning that you are speculating on the price without taking custody of the actual asset.

In traditional finance, you must borrow a stock or other asset to sell to another trader. In the CFD market at PrimeXBT, you can take advantage of the price action without all the other extra headaches involved. For example, if you “short” Dogecoin at $0.25 and close the position at $0.21, you have made $0.04 per coin. Alternately, if the price rises, you then lose on the trade.

Can You Short Dogecoin?

Yes, you can short Dogecoin. There are several different ways to do so, but the easiest way will be the CFD market. However, some places offer DOGE/USDT as a pair if you choose to step into the futures market. Unfortunately, futures markets are not as flexible as CFD markets because they are standardized contracts. Depending on the size of your trading account, it may make no sense to use futures.

Futures also use leverage as the CFD market but typically offer less. Dogecoin futures generally are run by the exchange itself and are not centralized like the Bitcoin futures market in Chicago. In other words, you must trust that the broker matches up genuine orders. There have been some examples in the past of brokers working against their clients.

At PrimeXBT, you can match short CFD orders with buyers in about any increment you choose. This allows you much more flexibility with position sizing and risk management. Beyond that, you do not have to “borrow” Dogecoin as you would in the futures market and then reconvert when you close out your position. On the PrimeXBT platform, it’s simply a matter of clicking “sell” and then clicking “buy” to close out your trade.

Shorting Dogecoin Example

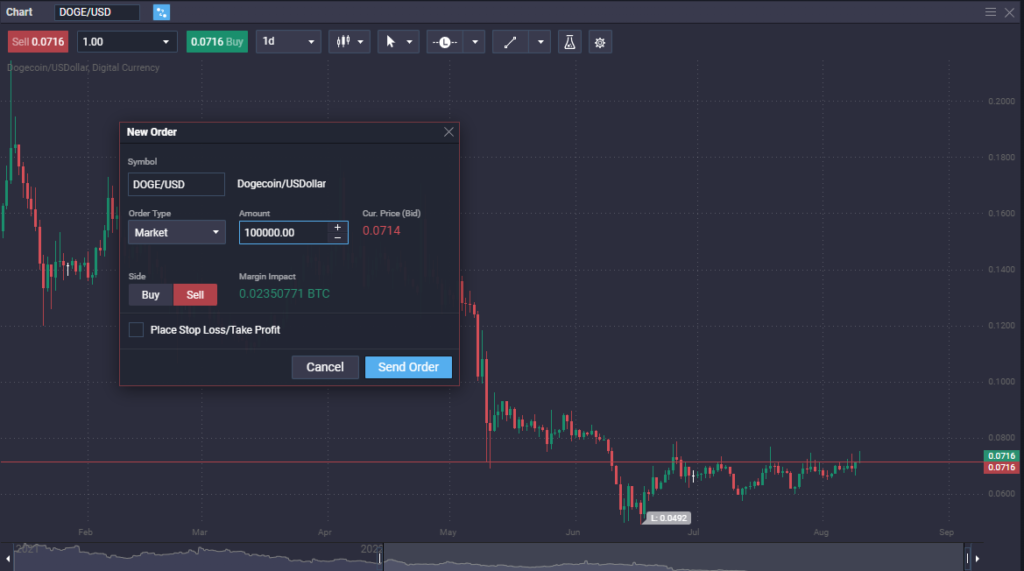

An example of a trader shorting Dogecoin may clarify the idea of shorting this asset. In this simple example, the trader decides on the CFD market at PrimeXBT. Dogecoin is currently trading at $0.0717, and the trader wants to short 100,000 coins.

The trader then closes out the trade at $0.0517, gaining $0.02 on the trade. By leveraging the trade via CFDs, the margin required was just a bit over $600, while the gain of $0.02 was good for $2000. This shows the power of both leverage and shorting.

Shorting Vs. Margin Trading

Now that you understand shorting and how to go about it, you know that it sounds similar to margin trading. Selling a cryptocurrency that you do not own is known as shorting it. Margin trading is when you borrow money from your broker to buy a cryptocurrency. The main difference is that when you borrow money to purchase a cryptocurrency, you must pay interest on the money that you borrowed. When you short a cryptocurrency, there’s typically only a small charge to the broker for facilitating the trade.

What Are the Advantages of Shorting Dogecoin?

One of the most apparent advantages of shorting Dogecoin is that it has been collapsing for so long. That being said, there are a multitude of reasons to do so.

- Long-term trend: The long-term trend in Dogecoin has been very negative at the time of writing this guide, but you will notice that cryptocurrency tends to move in 3 to 4-year increments. When it is in a bear market, this allows you to profit from falling prices.

- Questions of viability: There are questions about whether or not Dogecoin has any real value. After all, it’s an inflationary coin, as an unlimited amount is being printed over the long term.

- It’s a “meme coin”: Even the designer of Dogecoin admits that it has no actual use. However, it does make wild swings based on the latest social media noise. In other words, it’s a great way to take advantage of unsophisticated positions.

What Are the Disadvantages of Shorting Dogecoin?

Even though there has been a lot of money made shorting Dogecoin, you cannot say that it’s something that comes without risk.

- It’s a “meme coin”: Ironically, one of the most significant drawbacks to Dogecoin is one of the biggest concerns for short-sellers. A random social media event can have the market skyrocket suddenly.

- Shorting is always more dangerous: Although there are ways to protect yourself when you short something, there is, at least in theory, the possibility that your losses could become unlimited. That’s a bit of a stretch, but it is theoretically possible. Dogecoin is especially a stretch because there are no constraints to the amount of Dogecoin printed.

How to Short Dogecoin

The most convenient way to short Dogecoin is using the CFD market. The contract for difference markets frees up many unnecessary headaches of dealing with futures markets and their inflexible nature. It also frees up many unnecessary issues when borrowing the coin from someone else.

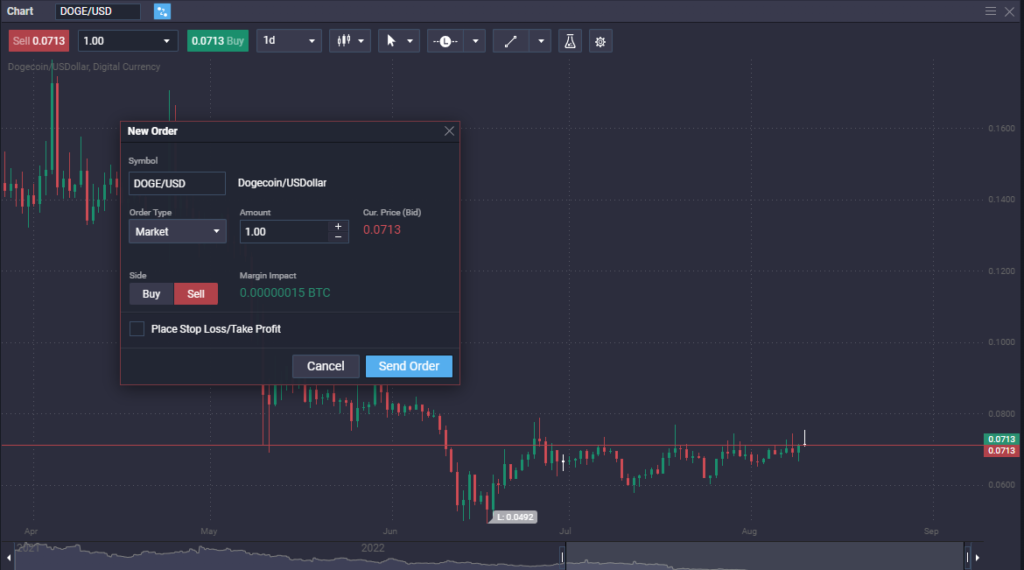

Doge being shorted on PrimeXBT platform

Step 1

The first step in shorting Dogecoin is to open up your account at PrimeXBT. You can open up your account quickly with a few basic questions and confirmations. You will wish to deposit Bitcoin, as PrimeXBT accepts Bitcoin for deposit.

Step 2

Click on your account dashboard’s “Global Markets” tab to open up the trading platform. This allows you to open up various charts and technical indicators, as well as monitor all of the available markets. DOGE/USD is the market you will be looking for to short Dogecoin. You can either click the “Trade” button in the market review window or “Sell” in the left-hand corner of the chart for DOGE/USD. Both will open up the “New order” box.

Step 3

At this point, you determine the amount of Dogecoin you want to short and if you wish to do it with a market order or with some pending price. Click the “Sell” button, and then click the “Send Order” button to execute the trade. That’s it; it is that simple to short Dogecoin on the PrimeXBT platform.

How to Analyze Dogecoin’s Price Movements

Dogecoin can be analyzed either through technical or fundamental analysis. Most people try to approach a typical market using both, but the reality is that Dogecoin doesn’t have a lot of fundamental analysis in the traditional sense.

This is because most of what drives Dogecoin is simply hype. A random Tweet, mentions on Instagram, or other social media platforms have seen Dogecoin react violently, even though adoption is extraordinarily minimal. In fact, as of 2022, there are less than 500 places on the planet where you can spend Dogecoin.

Because of this, you are better off using classic technical analysis because it can give you an idea of where fear and greed come into the market. Simple trend lines or moving averages are often used, along with basic support and resistance.

As far as any breaking news, it should be noted that when new companies are willing to accept Dogecoin, which is substantial, it tends to elevate prices for the short term. However, these are typically shorting opportunities once the hype has calmed.

Tips For Shorting Dogecoin

Dogecoin is, without a doubt, one of the more volatile assets in the crypto world. That being said, shorting it makes much more sense than buying it from a longer-term standpoint, as adoption of crypto, in general, has been very slow, let alone a coin with an unlimited supply.

- Position size is crucial: Position sizing is vital when making any trade, but that’s especially true when you are betting against something volatile. Make sure not to risk too much on any particular trade.

- Keep abreast of social media: Social media is a significant driver of what happens with Dogecoin, so you need to be aware of the latest trends on Twitter, Instagram, Reddit, and more.

- Learn to take profit: One of the more difficult parts of shorting an instrument is taking a profit. Understand that the market will bounce occasionally, so be sure to take profit on extended runs lower. There are always opportunities to reenter.

Why You Should Short Dogecoin with PrimeXBT

PrimeXBT offers an excellent way to short Dogecoin and other cryptocurrencies. This is because you do not have to worry about all the extra headaches when it comes to trading, as you do not have to borrow anything. Some of the most obvious examples of superior conditions with PrimeXBT are the following:

- Ease of transaction: PrimeXBT allows the trader to benefit from the falling price of Dogecoin and other assets without taking custody. This means no need to borrow or worry about finding the asset to borrow like you would with traditional finance.

- Leverage: Trading at PrimeXBT allows for leverage, meaning that you can take a small amount of trading capital and control a larger position than you usually can.

- World-class platform: One of the most significant advantages of trading at PrimeXBT is that you get an automatically updated world-class platform.

- Wide breadth of markets: Do not limit your trading to just Dogecoin when you can trade multiple assets at PrimeXBT is simple and can be done from the same platform.

Conclusion

When it comes to Dogecoin, we have seen wild swings from time to time, and over the last couple of years, it’s been mainly to the downside. Keep in mind that Dogecoin is highly sensitive to social media, which has been the significant driver of Dogecoin in the past to the upside. After all, Dogecoin has rallied based on tweets from Elon Musk and Mark Cuban.

You must understand that institutional money is not moving this market in this environment. Therefore, the possibility of significant price drops will always be there. Because of this, you need to be as interested in the short side as you are in the long side of this market.

It will be much easier to trade in the CFD market than in the futures market because you do not have to worry about a standardized contract size. You will also find that the leverage and the CFD market are much more manageable and user-friendly. Furthermore, you don’t have to go out and “borrow” anything. CFD markets are going to be by far the superior choice.

Can Dogecoin have a short squeeze?

Highly unlikely because of the structure of the crypto market and the unlimited supply of Dogecoin. Any short squeeze would be a very short-term phenomenon.

Can DOGE be shorted?

Yes, through the CFD markets offered at PrimeXBT, Dogecoin can be shorted quite easily with a click of a button.

What are the resistance levels for Dogecoin?

They are dynamic and constantly changing. Using proper technical analysis will be crucial to determining the current resistance level.

Does Elon Musk like Dogecoin?

He claims to. However, it’s worth noting that what Elon Musk says and what he does are quite often two different things. For example, he continues to sell Tesla stock every time it rips higher.

Can Dogecoin reach $10000?

No. This is because Dogecoin has no limit to the amount being printed. It would literally take over the financial world at that price.