The world of finance is vast and varied. There is simple investing, actively managed funds, portfolios geared toward passive income, and much more. There is investing in stocks, the payment of dividends, ETFs, indices, cryptocurrencies, forex, commodities, metals, and more.

Going deeper, individuals can speculate on – a much riskier practice – the performance of financial markets and trade instruments like futures contracts, CFDs, and more. This approach lets margin traders turn what would otherwise be small profits into large sums with leverage.

Furthermore, there are speculative investments that combine a bit of everything mentioned above. This guide will highlight the similarities and key differences between investing vs speculating that allow the potential investors or speculators to decide for themselves what is the best method to suit their personal goals and risk appetite.

Introduction: Investing Vs Speculating Explained

There’s only a very fine line between investment vs speculation which we’ll explain throughout this guide. Any investment in essence is speculating that the price of the asset in question will increase, however, because of how diverse the world of finance is, the definition of each is also more specific.

What Is Investing And What Are The Risks?

Investing is the purchase of an asset, typically a stock, bond, cryptocurrency, or other instrument. Investing can also be made into businesses, projects, property, real estate, jewelry, art, wine and spirits, automobiles, and much more.

The goal of investing is typically to sell the asset later on for a return on investment (ROI). Investments can also provide dividend payments and other financial benefits, such as preparation for retirement and certain tax breaks.

Advantages Of Investing

The primary advantages in investing is that capital is grown at a slow and steady pace, with less overall risk associated compared to speculating or speculative assets.

So long as some fundamental analysis and technical analysis is completed, investments can be made generally safely and with only moderate risk. Remember to never invest more than you can comfortably afford to lose.

Another advantage to investing is the fact that there is less active management than with speculating or swing trading.

Disadvantages Of Investing

With investing, timing is everything. For example, someone who made a long term investment in Bitcoin in December 2017 would have waited four years before a new all-time high was made. Holding through bear markets can be long and arduous, and investors could watch their capital disappear during this time.

Investing also typically results in much slower and steady gains, and while that lowers risk, there are much more lucrative opportunities elsewhere in finance.

Examples Of Investing

Because Bitcoin is more of a speculative investment, in this area, we’ll supply several examples of more traditional investments.

The Stock Market

Investors in the stock market can buy shares of their favorite company, or invest in any of the stock indexes that represent the region or segment they’re interested in. These investors would purchase shares or make investments within funds with a very long investment horizon. Investors of this nature are often planning for retirement, to pass assets down to next of kin, and more.

Precious Metals And Gemstones

Investors can exchange cash for coins, bars, bullion, and or gold and silver jewelry. In the 1970s, gold was priced at around $30 an ounce. Today, it is around $2,000. This type of investment is a rare investment that you can also physically hold and even enjoy by wearing it.

Luxury Items And Art

All investments are purchased with the goal of their value appreciation in the long term. Luxury items and art characteristically don’t just retain their value, they grow in time. The more care and craft going into the item, the more valuable it could be. This is yet another type of investment that brings joy in addition to returns.

Real Estate And Property

Cars, condos, and apartment complexes also fall under the category of investments, as they can be sold for returns down the line. This type of asset historically has performed better than most, however, there is substantial maintenance and upkeep required.

What Is Speculation And What Is Speculative Trading?

Speculating meaning is defined as both “the forming of a theory or conjecture without firm evidence” and “investment in stocks, property, or other ventures in the hope of gain but with the risk of loss.”

For this guide, we’re referring to the second definition which highlights why we mentioned there was a fine line between investing and speculating. The word investing is included in the definition, making it even more confusing.

Therefore it is better to refer to speculation in this case as speculative trading. Speculative traders start out as investors, but as their skill-level and comfort grows they move onto more advanced strategies and become day traders, and short-term swing traders.

Advantages Of Speculation

Speculative strategies include short selling during bear markets, letting the trader profit from downtrends while investors can’t do anything but sell or take the unrealized loss.

Speculative trading allows for even more fine-tuning of trading strategies, such as pattern trading, day trading, swing trading, and much more – the flexibility is nothing like the strict parameters around investing.

Disadvantages Of Speculation

Speculative trades carry high risk compared to investing counterparts. For example, if the price falls too sharply and the speculative trader is in a long position, they will suffer unrealized losses until the share price turns around. A stop-loss order can be used to prevent losses from reaching too extreme, however, it takes a lot of skill and understanding of markets to utilize the tool correctly.

Speculative trading is also restricted in some regions by regulators or kept to only institutional traders who pass a certain set of financial requirements such as income levels, experience, etc.

Examples Of Speculation

Examples are somewhat less diverse when it comes to investing vs speculating due to the restrictions regulators provide. The most common ways to move from investing to speculating are through the following instruments.

Futures

Futures allow speculators to bet on the future price of an underlying asset, through a contract. For example, because commodities like soy or corn are impacted by environmental factors, speculators can bet on whether or not that a commodity’s price will rise or fall depending on the seasonal conditions.

Futures contracts are typically tied to an expiry and the buyer or seller is required to settle the contract on the expiry.

Options

Options are similar to futures in the sense they allow speculators to bet on the price of an asset based on an expiry, but as the name of the type of the derivative sounds, buyers or sellers aren’t required to settle the contract, but instead are given the option to do so. Options also require an up front fee called a premium.

CFDs

CFDs stand for contracts for difference and offer the same benefits of futures and options such as long or short positions, but with far more flexibility. At any time a trader can get in or out of CFD positions, with no expiry or requirements. Buyers or sellers settle the contract for the difference in price between when the contract was open and the time the position is closed.

Comparing Investing To Speculating: The Key Differences Between Investment And Speculation

As we’ve repeatedly reminded readers throughout this guide, speculating and investing are very similar. Speculating is a form of investing in a sense, and the official Oxford Languages definition even suggests as much. The table below much more clearly explains the differences between speculating and investing.

The key differences are related to the asset itself, which with speculating is less important as contracts allow speculative traders to access just about any instrument they want according to regulations.

| Investing | Speculating | |

| Risk | Moderate | High |

| Reward | Moderate | High |

| Requires active management? | No | Yes |

| Under strict regulations? | No | Yes |

What Does Speculative Mean And What Is A Speculative Investment?

In addition to investing and speculating, there is also a category of assets called speculative investments. Speculative investments are investments that have potential applications but are unproven and especially risky due to this.

Advantages Of Speculative Investments

The biggest advantages of getting in on speculative investments is that they are so early on that potential fortunes can be made. The best example of this are investors who bought Bitcoin back in the early days. The cryptocurrency was virtually worthless, and today is trading for more than $30,000 per BTC and it isn’t used as a currency yet at all.

Disadvantages Of Speculative Investments

The disadvantages related to speculative investments surround the volatility associated with the asset itself. Because these assets aren’t in heavy use and liquidity is often lower than in mainstream assets, price action can move in extremes. It isn’t unheard of for a speculative asset to rise a few thousand percent making people rich, but then later crashing by 90% or more and wiping out everyone’s gains.

Examples Of Speculative Investments

Cryptocurrencies aren’t the only type of speculative investment. Any type of investment that is very early and hasn’t yet been proven and widely used are especially speculative.

Cryptocurrencies

As mentioned, Bitcoin is probably the best example of a speculative asset today. The potential the asset has and the underlying network makes it possible to reach prices of millions per coin, but just as easily could fall to zero. Ethereum, and other altcoins are even riskier in this sense as they’re more unproven, but as adoption takes place these assets will become less speculative in nature. The fact that cryptocurrencies aren’t backed by anything makes them even more speculative than most asset classes as well.

Cannabis Companies

Cannabis is only recently being legalized globally and that could translate into big business. But who really knows? Only time will tell if the industry is disruptive enough to the tobacco industry, or if big tobacco and the stigma of being a classified substance keeps it industry from – no pun intended – growing.

Psychedelics Industry

There are incredible breakthroughs going on in the medical world after careful review of substances that once were classified as mind-altering drugs. Shark Tank alum and CNBC personality Kevin O’Leary says that this industry will crush Cannabis with its application to modern medicine. But investors could also be in for a trip if it doesn’t turn out.

Which One Is Best For You?

We’ve now gone into great detail of each type of way to get positioned in financial markets, but it is ultimately up to you to decide what is right for you. Be certain to review all the pros and the cons, advantages and disadvantages, as well as examples to decide which makes the most sense for your personal needs, risk appetite, and profit goals.

While this guide is comprehensive, it is always encouraged to do additional resources if you still aren’t ready to commit. Investing and trading isn’t right for everyone and it comes down if you want to take a risk in exchange for opportunity or not. How much risk and how much reward is also a factor in deciding which type of investment vehicle to get involved in.

Summary: Invest, Speculate, And Trade CFDs With PrimeXBT

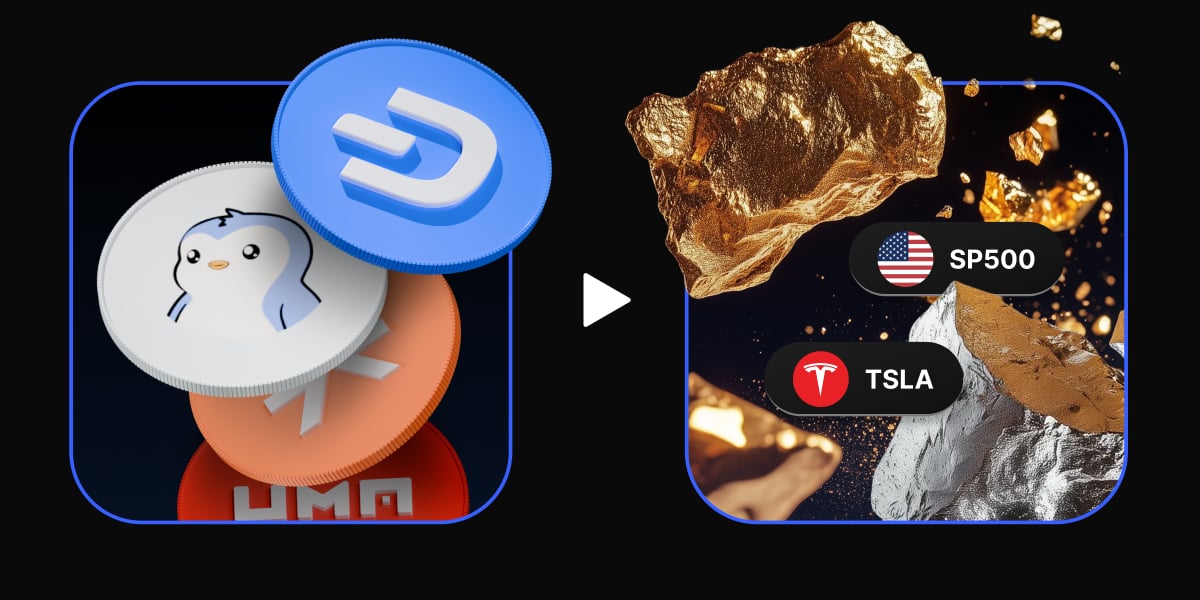

When you are ready to take the plunge into markets, do it with the award-winning margin trading platform PrimeXBT. PrimeXBT offers stock indices, commodities, forex, and crypto all under one roof. Using the PrimeXBT dashboard, speculative investors can buy BTC, ETH, ERC-20 stablecoins as an investment or to fund a margin trading account to get to speculative trading instead. The options for opportunity on the trading platform are nearly endless.

In addition to more than 50 different trading instruments, traders can long and short markets, access built in charting tools, and even copy the trades of more successful traders using the copy trading module.

With no minimum deposits for margin accounts and free registration, there is no risk associated with signup, and using the platform’s top notch trading tools like stop loss orders and more, investment risk can be minimized as well.

What Does Speculation Mean?

Speculation involves making an investment with the expectation of reward and the anticipation of some risk.

Is Speculation An Investment?

Speculation is not necessarily an investment in the regular sense, but any investment in essence is speculating that the price will hopefully increase.

What Is An Investment And Speculation?

An investment and a speculation are very similar, except one involves more short-term speculative trading and a higher degree of risk associated with the practice.

Is Investing Better Than Trading?

Investing isn’t better than trading unless minimizing risk and keeping things simple is the goal. Trading is a more effective strategy in the right hands.

Is Trading More Profitable Than Investing?

Trading is significantly more profitable than investing, especially when speculative trading on margin using speculative investments.

What Type Of Investment Makes The Most Money?

Speculative investments like Bitcoin tend to make the most money, but because they offer so much upside reward, the risk to the downside is equally extreme.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.