It has been a good week for the stock market as the Covid-19 relief package, set to top $1.2 Trillion, has helped the markets flourish. Not only that, inflation pressure is said to be only temporary, according to FED Chair Jerome Powell.

All this good news has seen all time highs being reached in the stocks, especially in the S&P 500 which topped 4,281 points. The Dow and NASDAQ are also up, and as is Oil and even Gold and Silver have managed to climb a little higher, but are still struggling after other Fed interference.

In the cryptocurrency markets, things have been in a bit of a downward spiral as again news surrounding China sent prices falling. It was China news a few weeks back that caused a slip towards bearish tendencies, and it has happened again, although not nearly as badly.

News from the rest of the world is helping Bitcoin and the likes grow, and at least consolidate, with MicroStrategy happy to buy more discount Bitcoins during this dip.

A Week Of Recovery

Stocks started a week of recovery after comments from FED Chair Jerome Powell during a Congressional testimony on Tuesday reiterated that inflation pressures should be temporary, which managed to soothe market jitters.

By Thursday, stocks were trading at new ATHs again, with the S&P reaching a new record high after President Joe Biden declared that the White House struck a $1.2 trillion infrastructure deal with a bipartisan group of senators.

By the close of the week, the S&P had climbed 2.7% to another record high of 4,281, led by bank shares after the annual bank stress tests revealed that banks were in a good financial condition to withstand a hypothetical downturn.

The Dow gained 3.4% for the week for its best week since mid-March, while the Nasdaq advanced 2.4%, erasing all the losses inflicted the week before. The 10-year Treasury yield remained calm at around 1.52%, a sign that either the market does not think that rates are going to rise, or that the market is no longer afraid of a rate increase due to the recently released better economic numbers.

The inflation trade has turned into a reflation trade of late, with investors betting on stocks that will benefit most with an economic recovery.

Oil resumed its rally as the new Biden package helped brighten the demand outlook for oil. Crude oil, which is more reflective of USA demand, rose back to close near $74.00 after mildly pulling back mid-week. Oil starts the new week unchanged.

Gold and Silver prices retraced a bit higher last week, albeit still reeling from the FED-driven drop the week before. Both metals are starting the new week resuming their weakness, with Gold down 0.5% to $1,773 and Silver giving up even more ground, losing 1% to $25.90 on the back of some strength in the USD possibly caused by news of US air-strikes in Iraq and Syria early Monday Asian time. As a result, Asian stock markets are starting the new week a tad lower, with the Nikkei 225 down 0.2%.

The currency market activity centred on GBP last week as the Bank of England met on Thursday to decide on monetary policies. However, the meeting failed to provide the anticipated volatility as the MPC turned in a somewhat similar narrative to its previous meeting, remaining more dovish than what many traders had hoped for.

The GBPUSD lost around 0.3% post meeting and subsequently finished the week at around $1.3890 while the EURUSD retraced its big drop the week before to close the week higher at $1.1938. AUDUSD is the main casualty in the slight risk-off mood early Monday morning, down 0.15%.

China-FUD Once Again Sends BTC and Crypto Lower

China-FUD once again took limelight as scary news out of China once again sent traders scrambling for the exits. On Monday, The People’s Bank of China (PBOC) told the country’s major financial institutions to stop facilitating virtual-currency transactions, spooking the already nervous traders who were still trying to digest news about the Sichuan power cut that forced 26 mining facilities to unplug and move out of China.

Now, China again reiterates its stance by issuing warnings to banks to not provide products or services such as trading, clearing and settlement for crypto transactions. Banks also have to identify virtual-currency exchanges’ and over-the-counter dealers’ capital accounts, and cut off the payment link for transaction funds in a timely manner. While sounding dire, the impact of this initiative remains unknown as China has already banned such transactions since 2013.

Not All Is Bad As News Out Of America Is Positive

Over at the other side of the world though, the good news keeps coming.

MicroStrategy, who recently issued a junk-bond worth $500 million to buy BTC, made its purchase last week. In a twitter post, CEO Michael Saylor announced that they had bought an additional 13,005 BTC for $489 million in cash at an average price of $37,617. After this purchase, the firm now holds 105,085 BTC acquired at an average price of $26,080 per BTC.

While Bitcoin’s recent dip below $30,000 made even some of the most ardent bulls panic, famous tech hedge fund investor Cathie Wood’s ARK Investment Management bought the dip. ARK Investment’s Next Generation Internet ETF revealed that it has purchased 1,046,002 shares of Grayscale Bitcoin Trust (GBTC) on Tuesday. This purchase even managed to bring the price of GBTC shares from a double-digit discount to NAV into a single digit discount to NAV. Currently, the GBTC is trading at around a 6% discount to NAV.

Meanwhile, still on Ark Investment, its CIO Cathie Wood has been invited to speak at a public discussion on BTC on 21 July. This public discussion, named “The B Word”, has been organized by Twitter boss Jack Dorsey to encourage institutional investment into BTC. The key highlight of this event is that Elon Musk has also agreed to participate in it to discuss BTC. This event will be very keenly followed by everyone in the investment circle, not just folks from the crypto-verse, and could potentially bring even more institutional investment funds to BTC.

BTC Metrics Also Showing More Bullishness

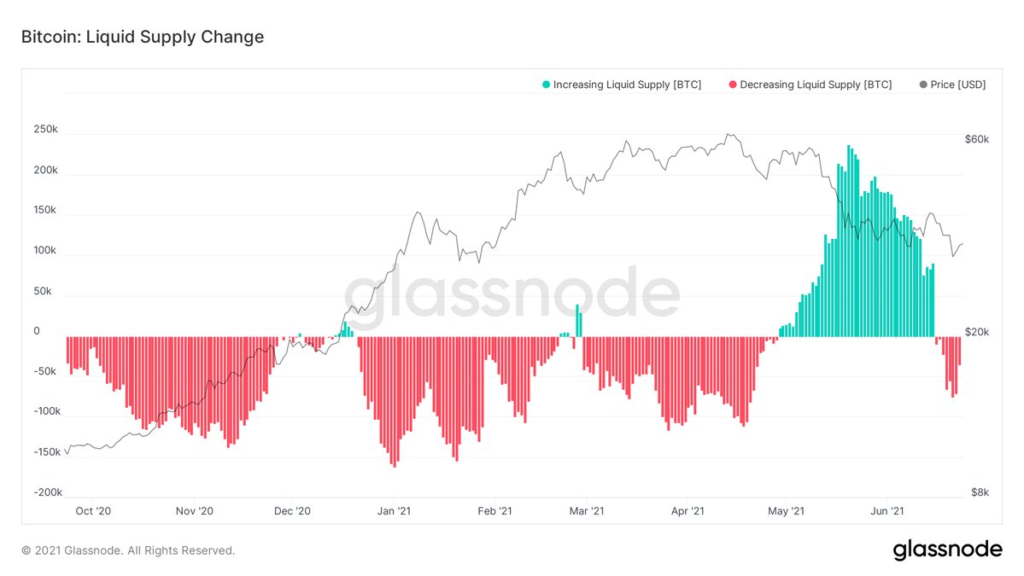

With more sophisticated investors moving in to purchase BTC, the liquid supply of BTC in the market is drying up once again after May witnessed more BTC supply added to the market.

The BTC liquid supply change has moved into negative territory after being hugely positive ever since May, peaking on May 19 and decreasing steadily until mid-June. This shows that BTC had been flowing into the market for sale since May and this amount peaked on May 19 during the big crash. The figure back into negative territory suggests that BTC is no longer being added into the market for sale, but rather, is being removed from liquid supply, an indication that more BTC is being bought than sold now.

The amount of BTC relative to stablecoins at exchanges is also showing bullish signs. The Stablecoin Supply Ratio (SSR) Oscillator seems to have bottomed and has been trending up in recent weeks, indicating that capital has been flowing back from stablecoins into BTC.

This accumulation of BTC is highly likely to continue in 2H21 as more traditional investment funds are expected to come into the crypto space, with Andreessen Horowitz launching the biggest-ever crypto venture fund of $2.2 billion, and Citigroup also entering the foray by forming a unit called Digital Assets Group to allow its customers to invest in cryptocurrencies.

ETH Price Hit By A Fall in Transaction Volume

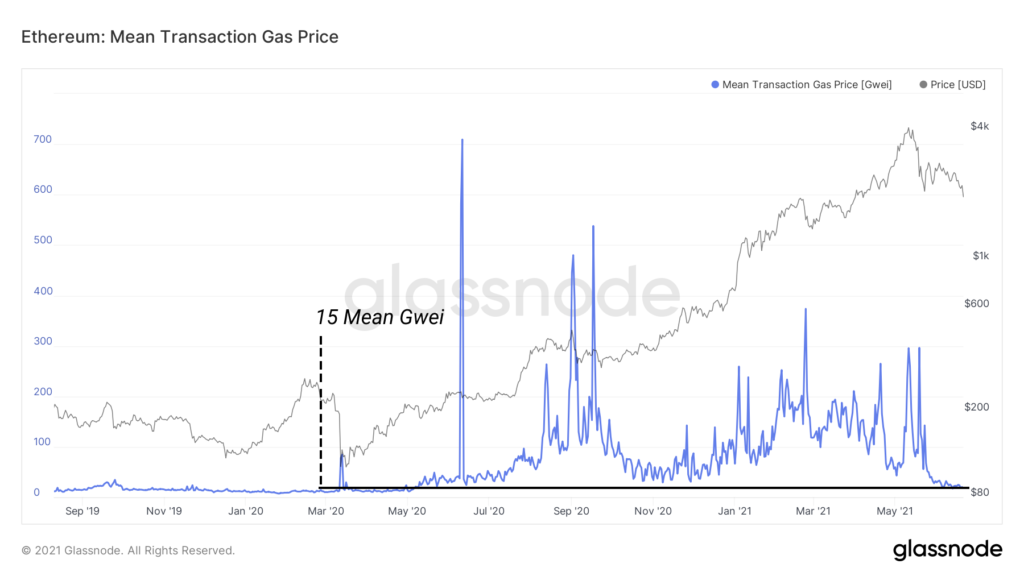

While BTC has been regaining some lost ground, the price of the second largest cryptocurrency ETH, seems to be suffering from the recent exploits in the DeFi space and has seen its gas fee drop 95%, back to levels not seen since the middle of last year before DeFi Summer took off.

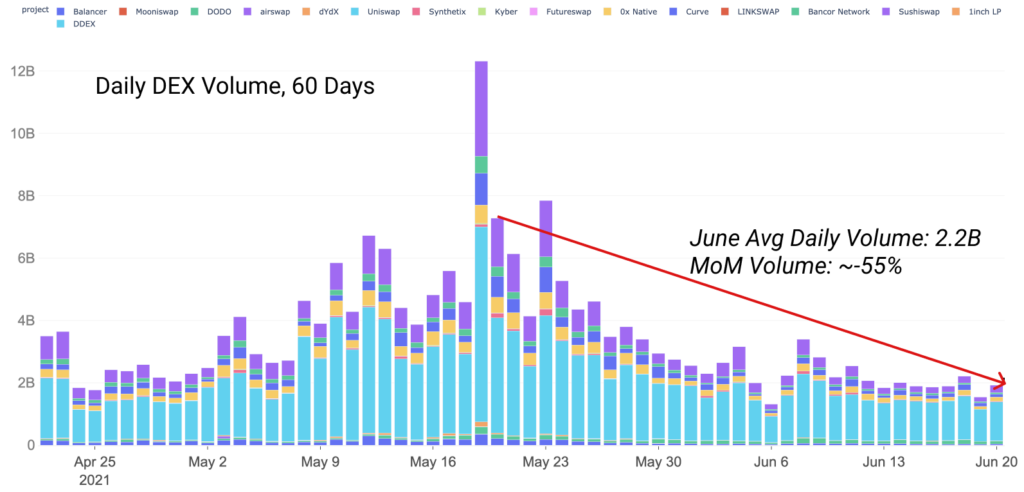

Transaction volume on the ETH network has also fallen, albeit not as bad as the fall in gas fee. Overall volumes on DEXes, which are the main route of entry to the DeFi space, has fallen 55% from the mid-May high, while Total Value Locked (TVL) on ETH-based DeFi platforms also saw a fall of around 35%.

ETH Price Fall Could Be Overdone

However, the price of ETH seems to be a tad too bearish as its price has fallen some 57% from its peak. With ETH EIP-1559 being deployed onto testnet on Friday, EIP-1559 mainnet appears to be on track to meet its 14 July scheduled launch date. This upcoming development could support the price of ETH as we move forward, especially when the liquid supply of ETH continues to decline, with more and more ETH being locked-up in ETH2.0 staking.

Last week saw a surge in ETH deposits at the ETH2.0 contract address, with a total of more than 100,000 ETH already staked there. This represents around 5% of ETH circulating supply, implying that these ETH has been locked-up and cannot be sold for at least 1-year since ETH2.0 has stipulated that the ETH staked cannot be removed for at least 1 year.

Altcoin Market Continues Languishing, DOGE Upgrade Sets Off Price Recovery

Meanwhile, with the leading altcoin ETH still in the doldrums, other altcoins also did not perform particularly well, with most coins still in consolidation mode after the capitulation selling mid-week. However, there are some pockets of bullishness in some altcoins that are beginning to see some recovery post selloff, the most notable being DOGE, which saw a price recovery of 100% from a low of $0.16 to almost $0.30.

DOGE lead developer Ross Nicoll posted some updates about the success of a network fee reduction upgrade that was proposed by Elon Musk just last month. Further to the upgrade news, Ross also confirmed that developers for DOGE and ETH are working on the much-anticipated ETH-DOGE bridge. This exciting news brought new whales to accumulate DOGE, making DOGE the only coin to fully recover from its loss sustained during the mid-week market crash.

To determine if altcoins can manage to stage a recovery this week, the movement of BTC has to be closely watched. Should BTC muster a gradual move upwards, much needed life could flow back into the altcoin space very soon. However, should BTC break below $30,000 again, expect the altcoins to suffer even more brutally just like we have seen last week.

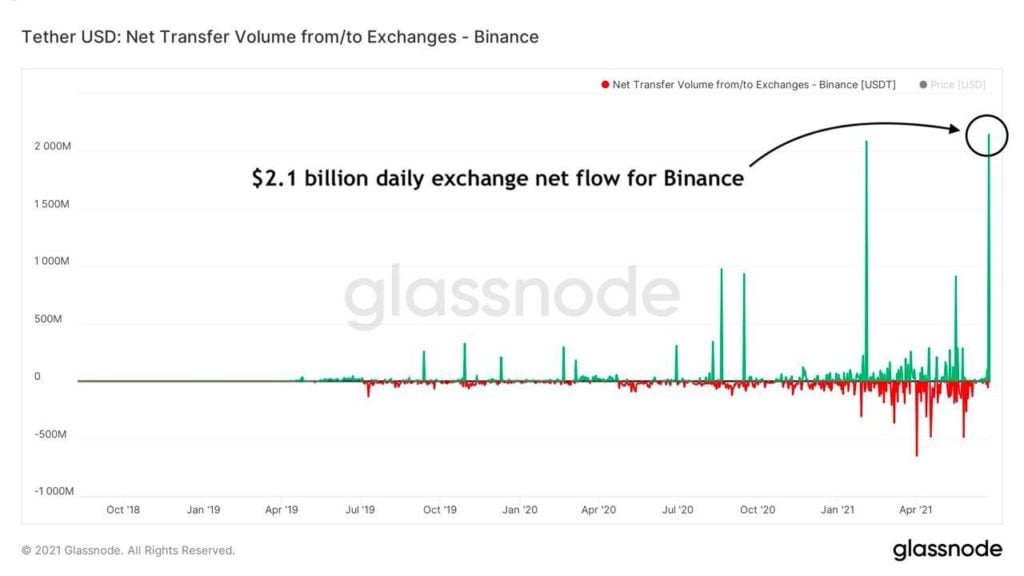

However, a recovery seems likely as a large inflow of $2.1 billion worth of USDT to the world’s largest spot exchange, Binance, has been observed in the early hours on Sunday morning. An inflow of stablecoin usually precedes an uptick in price as buyers who wish to make purchases of crypto will usually send stablecoins into an exchange in order to make crypto purchases.

The $2.1 billion is the largest inflow ever for Binance and exceeds its previous largest inflow of almost $2 billion. While some traders have speculated that this was an internal transfer, crypto prices have nonetheless bounced by a good 10% after this inflow was observed. Will the bounce have legs and extend into a more bullish trajectory this week?

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.