Bitcoin’s often testy relationship with the SEC is back in the spotlight after the regulatory body looked to be softening its view. One trading product that has been hot on the wish list for Bitcoin fans is an ETF, but these have mostly been battered away by the SEC.

However, the SEC last week approved an ETF for ‘Bitcoin Revolution Companies’, where companies involved in crypto — like Tesla and MicroStrategy, for example, are included. Many see this as the precursor to a full-on Bitcoin futures product in the near future, and as such, the markets have responded well.

Big buy orders have flooded in off of this news and it has seen Bitcoin first cross over the $50, 000 milestone and then further onto $56,000 and above. Additionally, and as seems to be the theme, institutional interest is still growing in Bitcoin, but so are the amount of Long term holders. Miners are also in an accumulation phase which all points to the possibility of some big price action on the horizon.

Looking towards the traditional markets, an impending deal in the debt ceiling, albeit a temporary one, helped keep optimism alive as stocks shrugged off a disappointing jobs report to close on a positive note on the last day of the week. Friday’s jobs report showed that the US economy added only 194,000 jobs in September, well below the consensus estimate of 500,000. Despite this, the major US stock indices all ended in the green for the week. The Dow rose 1.2% for its best week since June, the S&P 500 rose about 0.8% while the Nasdaq inched back around 0.1%.

The bright side could be that the bad jobs report may cause the FED to delay or reduce its tapering, which is expected by the end of this year, as markets enter the Q3 reporting season this week with positive expectations after the debt ceiling issue has been resolved. Washington reached a deal to raise the debt ceiling into December on Thursday.

Uncertainty around the debt ceiling had been a drag for the market all of last week, sending yields higher as the 10-year Treasury yield rose to a high of 1.57%.

The USD remained well-bid, with the NZDUSD not even able to rise after the RBNZ raised interest rates on Wednesday. Gold and Silver remained relatively unchanged for the week, with interest in Gold and Silver trading seemingly subdued as most of the action in traditional markers centered on Oil.

Oil prices surged after the US Energy Department said it has no plan to tap oil reserves despite rising demand from COVID reopening. With OPEC+ also not increasing supply production, the price of Oil surged 4% over the week, ending at $79.30, the highest level since Oct 2014. Despite a phenomenal rise last week, Oil is starting this week up 1.7% already, trading above $80 at the time of this writing.

The run-up in oil price has also been spurred by soaring European gas prices, which have encouraged a switch to oil for power generation. Instead of talking about oil prices falling into a bear market as anticipated by various analysts barely 3 months ago, the consensus now is for Oil prices to rise further into the winter.

However, all that action in the energy sector was no match for the cryptocurrency market as the price of BTC rose more than 10%, sending the prices of altcoins also soaring.

Front-running on BTC ETF Approval Sent BTC Ripping Above $50,000

In a softening of its stance, the SEC last week approved an ETF for ‘Bitcoin Revolution Companies’, where stocks who have an interest in the King of cryptos will be included. This includes the likes of MicroStrategy, Tesla and Twitter, among others. Market watchers see this as a prelude to its approval of a BTC Futures ETF by the end of this year, and the optimism has caused a rush to buy BTC as large orders, especially on the Futures Market, sent the price of BTC ripping above $50,000 and staying well above the level throughout the week.

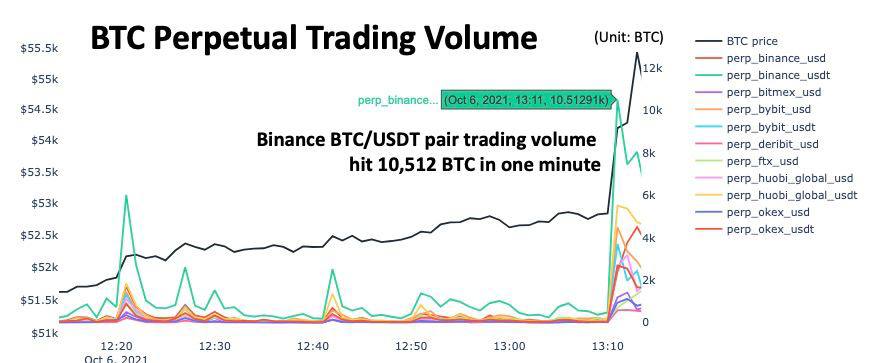

On Oct 6, in what was later thought of as a front-running of the SEC decision, large buy orders on BTC Futures sent the price of BTC shooting 10% from around $50,000 to $55,000.

The price of BTC subsequently rose to a high of $56,168 on Friday before consolidating between $53,000 and $56,000.

This surge comes as no surprise to seasoned market watchers as bullish signs have already emerged in several on-chain metrics.

Flight to BTC Safety As BTC-SPX Correlation Drops

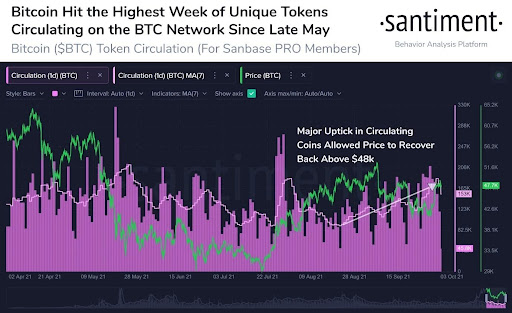

The number of unique tokens moving on BTC’s network hit its highest last week since May, prompting the price of BTC to surge above $48,000 even as the stock markets were crashing. This could mean that there may be a capital flight to BTC taking place people were sending BTC around in perhaps OTC or exchange transactions.

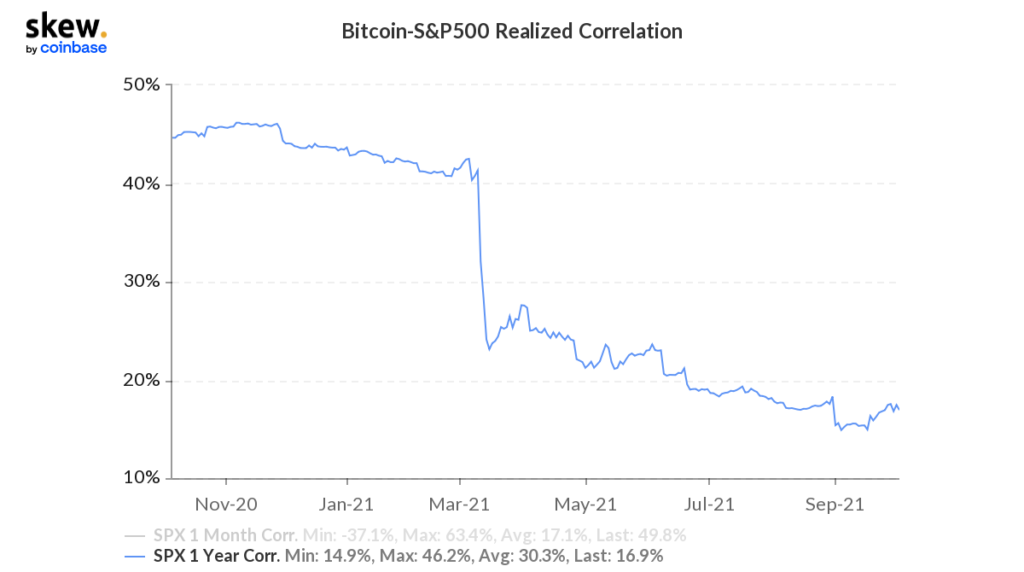

As more investors jump onto the cryptocurrency train at a time when the stock market is looking uncertain, the correlation between BTC and the S&P 500 has fallen to a more than one-year low of around 15% from its peak of more than 50% last year ever since the COVID pandemic started. This low correlation has actually been the norm up to the COVID pandemic where the price of BTC started being correlated to that of the stock market. Hence, as the adoption of crypto grows and investors start to worry about valuations in the stock market, BTC is returning to its de facto status as a safe haven asset cum inflation hedge.

BTC Supply Held by LTH Breaks ATH

Meanwhile, as new funds enter to buy BTC, existing Long-Term Holders have also added 2.35m more BTC to their stacks since they started reducing their stake from late last year. The number of BTC held by long-term holders is at its ATH of 13.26 million, up from the previous ATH of 12.65m just before the bull run started.

The 2.35m were accumulated over the past 7 months since it bottomed out in April, while in that same period, only 180,000 BTC were mined.

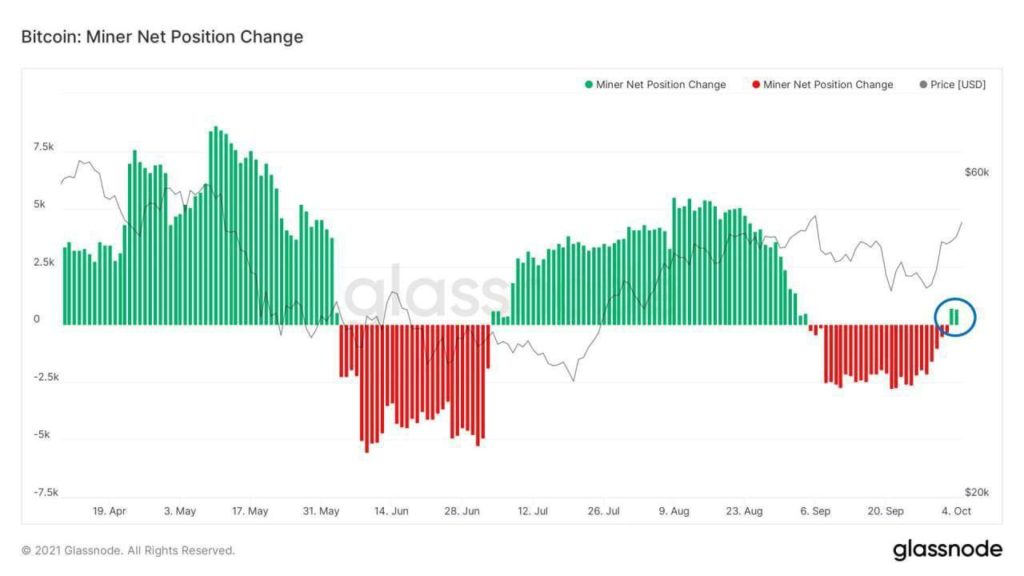

Miners have also started accumulating BTC again after a bout of selling in September.

In a report released last week, several publicly listed BTC mining firms in North America have collectively stockpiled over 20,000 BTC, worth over $1.1 billion at current prices.

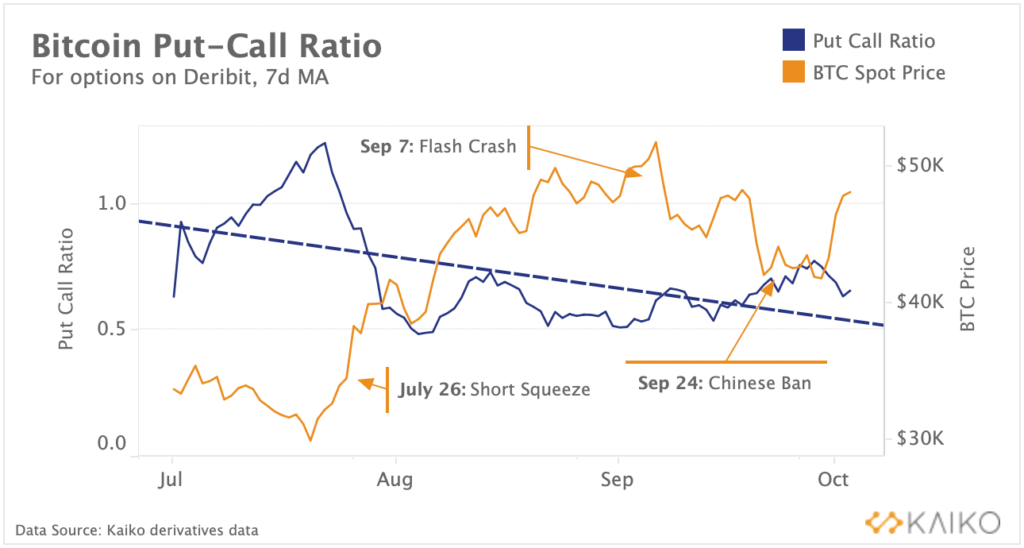

Options Market Bullish on BTC

Further optimism can be seen in the put-call ratio of BTC options. A rising ratio is viewed as bearish since it suggests that traders are purchasing more puts (bearish bets) than calls (bullish bets). Consequently, a falling put-call ratio suggests that traders are more bullish. The ratio has been declining ever since rising throughout September, suggesting that traders are turning more bullish as October gets going.

Institutional Interest Continues to Grow

More institutional adoption is happening as Soros Fund’s CEO and CIO Dawn Fitzpatrick has revealed that the family office owns “some” BTC.

Also, U.S. Bancorp, with nearly 70,000 employees and $559 billion in assets as of June 30, the fifth-largest bank in the USA, has launched its cryptocurrency custody services citing strong demand from institutional clients.

More research coverage from traditional firms is also taking place as the Bank of America released a 141-page bullish report on the digital asset ecosystem titled: “Digital Assets Primer: Only the first inning”, citing the prospects for digital assets is huge as it enters the mainstream. Despite regulatory concerns, BofA anticipates significant growth as use cases move beyond BTC’s store of value thesis to an industry characterized by product innovation.

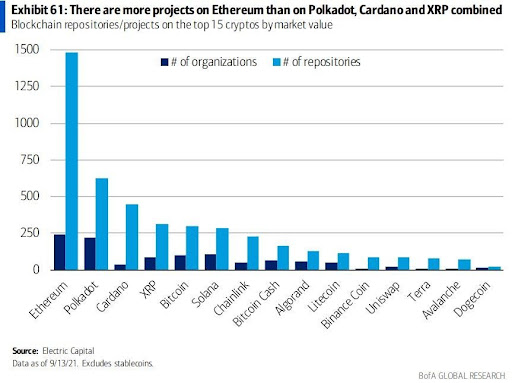

ETH Still The Undisputed Leader in Smart Contracts

BofA seems to like ETH, saying ETH is still leading the way in development regardless of the amount of competition it is getting. The number of repositories, or projects, on a blockchain is a good indication of developer interest and future demand for the blockchain’s native digital asset, and ETH still leads leaps and bounds in this category.

Indeed, even though there are complaints of expensive gas fees and stiff competition from other smart contract blockchains, the TVL on the ETH blockchain does not seem to be greatly affected and has recovered significantly. The TVL on the ETH blockchain is now only $5 billion shy of its ATH of $145.5 billion hit on Sept 6.

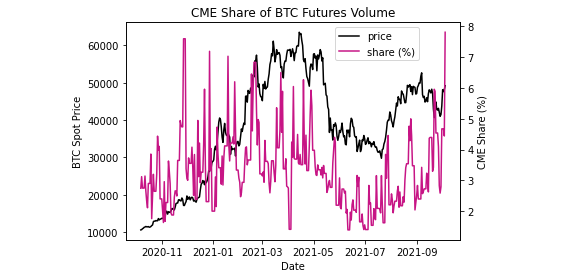

Following more research coverage on cryptocurrencies by traditional Wall Street firms, the institutional investor interest indicator, the CME Futures volume, saw a significant increase last week to ATH. This proves that there is a sharp rise in the institutional trading of BTC.

BTC Supply Shock Intensifying

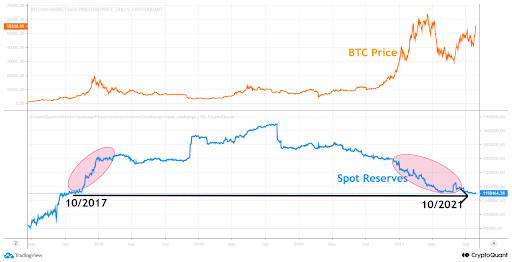

As more supply of BTC gets bought up by institutional investors, the supply shock narrative is back as BTC reserves on spot exchanges fall to Oct 2017 levels.

The key thing to note, however, is that while the supply of BTC on exchanges had been increasing since 2017, that trend reversed and the supply has been rapidly decreasing since 2020. This could mean that the supply shock is going to get a lot worse since demand has been rapidly increasing, especially from institutional investors who usually hold long-term term positions, thereby reducing the supply of BTC in the market.

Hence, the outlook is very bullish for BTC, which will prop up the rest of the crypto market as investors start to branch out into investing in other cryptocurrencies after they get more accustomed to the ecosystem.

Not only will demand from institutional investors increase but that from the retail player segment is also expected to increase by a big margin as Bakkt has just announced that it will partner with Google to introduce Digital Assets to millions of consumers. This will definitely springboard the adoption of crypto assets by mainstream users and raise the value of crypto assets further.

From what we can see, there seems to be a supply crunch play happening in the market, while it currently is within the energy market, there is a likelihood that this play rotates into the cryptocurrency market as there is a clear indication that the supply of BTC and ETH is getting tighter. The days of BTC challenging its ATH of $64,000 could be closer than we thought.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.