Markets crumbled beginning last Monday after news that Russian President Vladimir Putin ordered the deployment of troops to two breakaway regions in eastern Ukraine after recognising them as independent on Monday, accelerating a crisis the West fears could unleash a major war. Indeed, those fears came to pass on Thursday when Russia launched a full-scale attack on Kyiv, the capital city of Ukraine.

The Russian Ruble and European shares tumbled the most as investors sold risky-assets in the face of war and as various new sanctions imposed on Russia could potentially cripple Russia’s economy and derail the economic recovery that major nations painstakingly made in the aftermath of COVID-19.

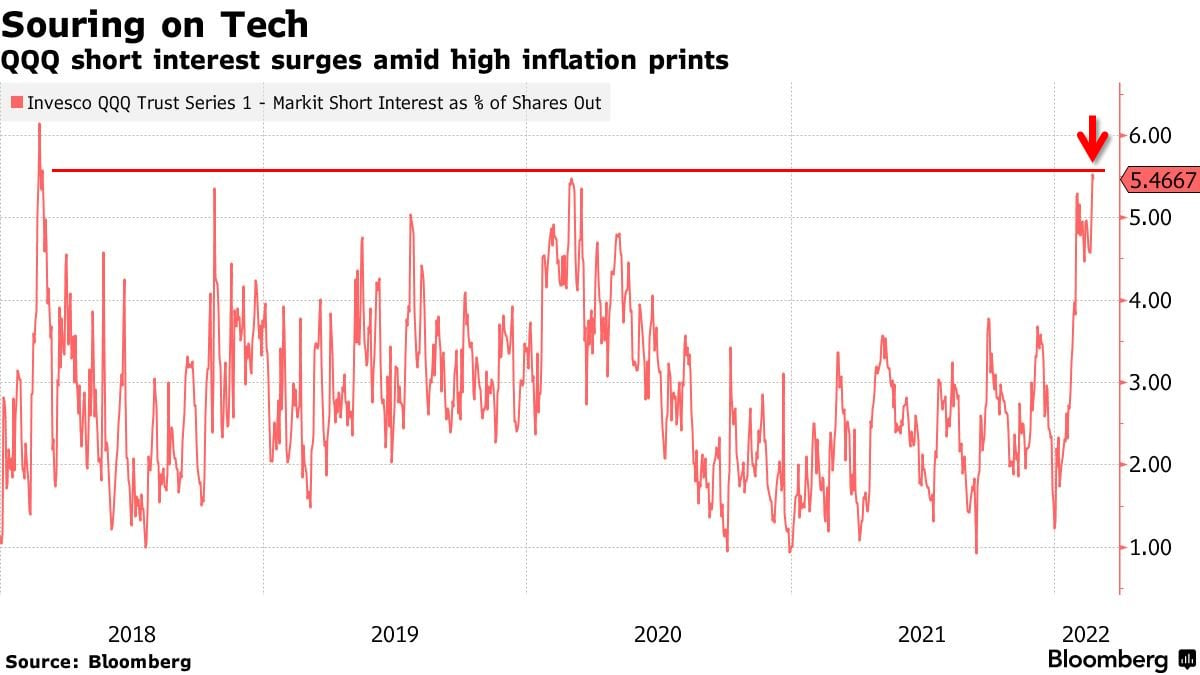

In the US, tech stocks were hard hit as panicked investors took to the futures market to open short positions in order to hedge their longs. Many traders also shorted the markets hoping for a quick profit. This resulted in short interest surging to levels not seen since 2018, even more than during the COVID-led selloff in March 2020.

As the war raged on, the lack of NATO’s direct assistance forced Ukraine to try and find a solution for itself, and by late Thursday, Ukraine President Volodymyr Zelenskyy had managed to secure a negotiation slot with Russia, which said that it was ready to send a delegation to Belarusian capital Minsk for negotiations with Ukraine. The markets liked this new development and US stocks even had once of its best days on Thursday after the Dow Jones Index recovered from intra-day loss of around 800 points to close higher on Thursday, and continued to post gains on Friday.

The stock market around the world thus closed off a roller-coaster week still slightly lower, with initial big losses early in the week, followed by equally large gains by the end of the week. The 3 major US stock indices lost an average 5% from early week through to the first half of Thursday, but the spectacular rally from the second half of Thursday even managed to lead indices into inking out gains for the week. The S&P 500 and Nasdaq finished the week up 0.8% and 1.1% respectively, while the Dow Jones was mostly unchanged.

Russia’s invasion of Ukraine is expected to have far-reaching implications for the energy markets given Moscow’s role as the second-largest producer of natural gas and as one of the world’s largest oil producers. As news broke about Russia’s invasion of Ukraine, Oil at one point on Thursday surged beyond $100 pb, gaining more than 10% on Thursday. Brent Crude surged to a high of $105.79, while WTI Crude Oil saw a high of $100.54 – highest levels in 8 years. The energy complex nonetheless retreated after US President Biden said that he has no plans to impose sanctions on Russia’s energy sector, dispelling fears of a serious supply disruption.

Precious metals performed their role as safe haven, gaining throughout the time that the stock market was under pressure early week, but succumbed to profit-taking after talks surfaced about a possible Ukraine-Russia negotiation. Gold initially surged 4% to a high of $1,974 early Thursday, before falling to $1,890 on Friday, while Silver gained 7% to a high of $25.64 before retreating to $24.28 at the close on Friday. Both metals have witnessed one of their most volatile weeks in recent times, with the volatility not expected to ease in the near-term as long as geo-political tensions around the Ukraine situation remains.

With the political situation in Europe being disrupted by the Ukraine war, the EURUSD fell severely from $1.13 to $1.11 on Thursday, before rebounding to $1.1270 on Friday, while the USD remains as the de facto safety asset, gaining 1.2% for the week.

Russia however, was the hardest hit, with the Russian stock index briefly falling 45% before recovering to close the main session 33% lower, while the Ruble tumbled to a record low against the dollar on Thursday. Both the stock index and Ruble regained some ground after the central bank of Russia intervened in the FX markets to stop the Ruble from free-falling.

Cryptocurrency prices also sunk lower, especially that of altcoins, which fell an average of another 20%. BTC initially fell 8% and broke below $35,000 on Thursday when the war broke, resulting in long liquidations of around $210 million in the early part of Thursday.

However, by Thursday afternoon US time, BTC rebounded strongly, mirroring the movements of the US stock market, which staged a phenomenal recovery. By the end of Friday, BTC had rebounded 15% off its low to a high of around $40,300, its highest level of the week, before stabilising at around the $39,000 in the weekend.

Excessive Bearishness Early Week Ended With A Bounce In Price

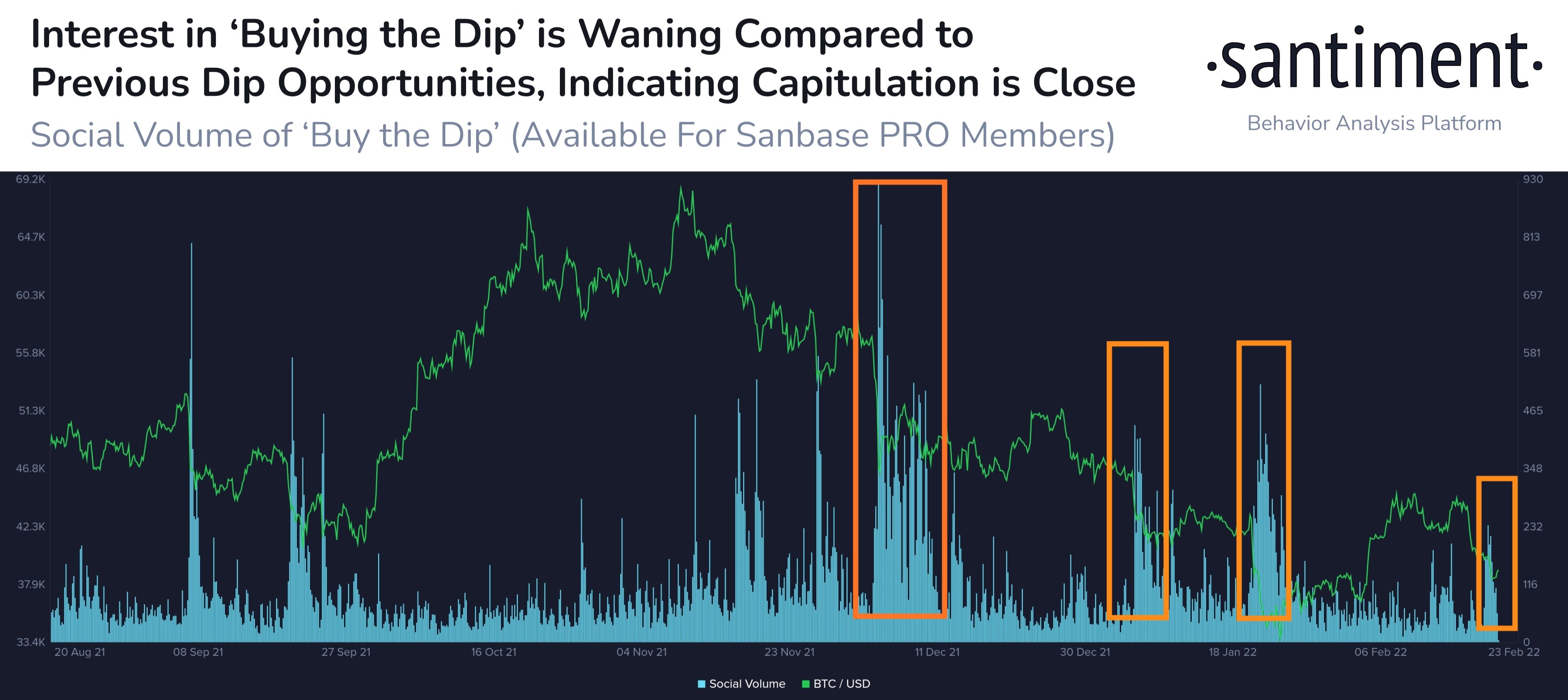

With the escalating geopolitical situation, interest in dip buying was seen to be waning at the beginning of the week, as can be seen in a decline in “Buying the Dip” mentions on social media.

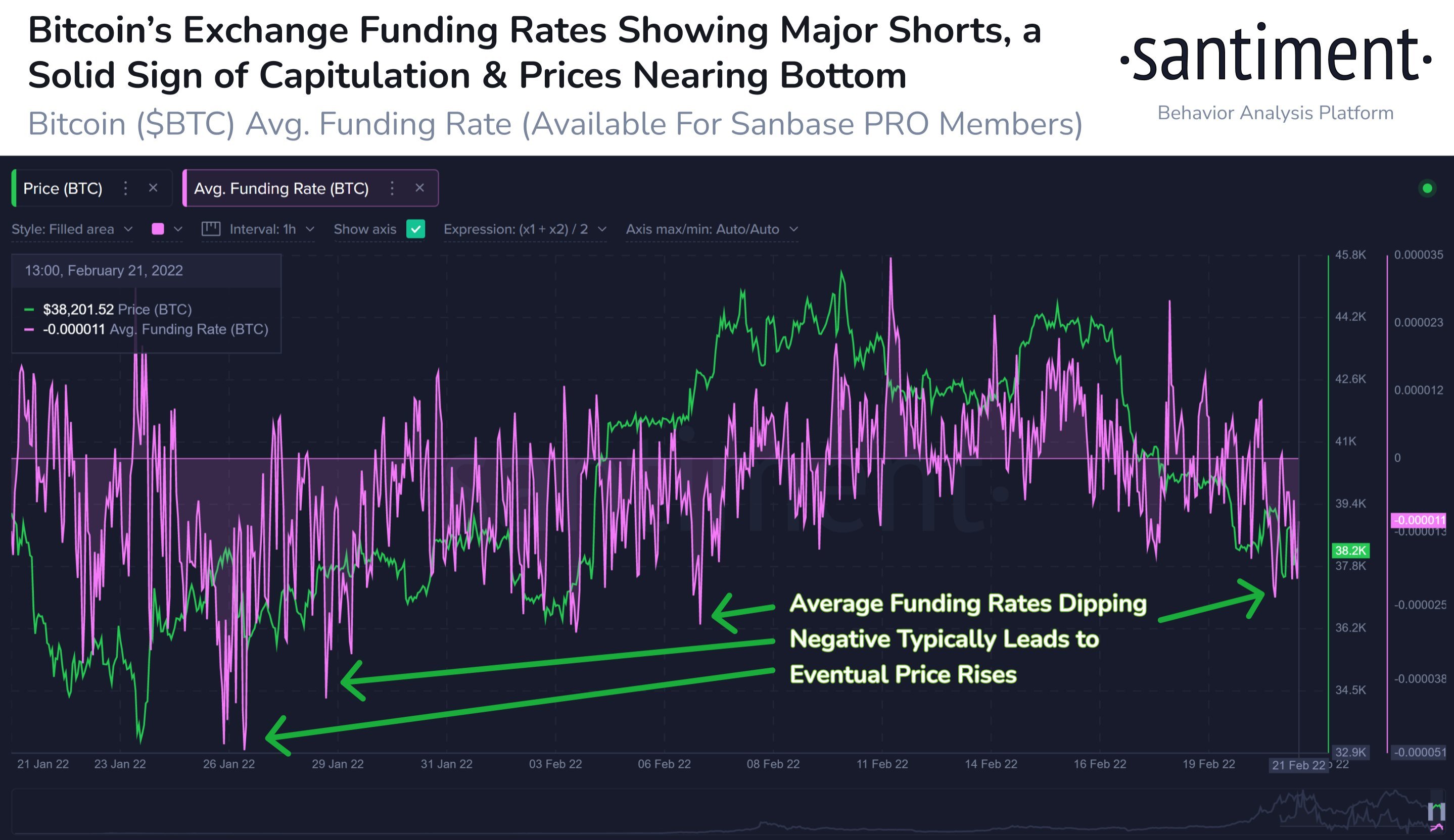

In fact, the crowd started to favor opening short crypto positions over long positions, with the funding rate for BTC futures dipping deeper into negative territory.

Such negative sentiment usually gives opportunity for a contrarian bounce to occur, which indeed happened on Wednesday when the price for BTC made a reversal and subsequently rebounded together with a turnaround in the global stock market.

In the first 12-hours when the price of BTC and the broad crypto market rebounded, a total of around $143 million worth in short positions were liquidated, with more than half of that on BTC alone. In total, more than $400 million worth of positions were liquidated between Thursday and Friday when the price of BTC and other crypto assets rebounded.

Some analysts say the price for BTC and cryptocurrencies could continue to climb as demand could mount in the coming days because they are seen as liquid assets. Further to that, sanctions involving the freezing of bank account and assets, and NATO’s removal of some Russian banks from the international banking messaging system SWIFT, has also contributed to the demand for cryptocurrencies due to its censorship resistant nature.

Cryptocurrency Demand Soars In Troubled Ukraine

The borderless and censorship resistant properties of cryptocurrencies were put in positive limelight as many Ukrainians took to twitter to reveal how holding cryptocurrencies have helped them preserve their wealth when banks were closed and Ukrainian credit cards were terminated during the crisis in the country.

On Wednesday, the National Bank of Ukraine began restricting cash, limiting Hryvnia withdrawals to 100,000 UAH ($3,353) per day, and banning cross-border foreign currency purchases and withdrawals outright.

People who were fleeing Ukraine, or who were based overseas, could not gain access to their fiat funds as online banking was not operational and ATMs were shut all over Ukraine. People were also not able to use their credit cards. This exposed the flaw of being dependent on fiat currency, while cryptocurrency triumphed as being the only liquid asset people could lay their hands on that can be sold to purchase goods and services. BTC was also singled out as the asset with the highest liquidity out of all assets, including gold.

When the Ukrainian currency Hryvnia dived to its new all-time low, trading volumes for cryptocurrencies surged four-fold at Ukraine’s cryptocurrency exchanges, as citizens tried to convert their now useless fiat into cryptocurrencies, to the point that BTC was trading at a 5% premium on Ukrainian exchanges over other exchanges overseas. The stablecoin USDT, which is pegged to the dollar, also saw demand soar and traded at a 10% premium over its $1 USD peg in Ukraine.

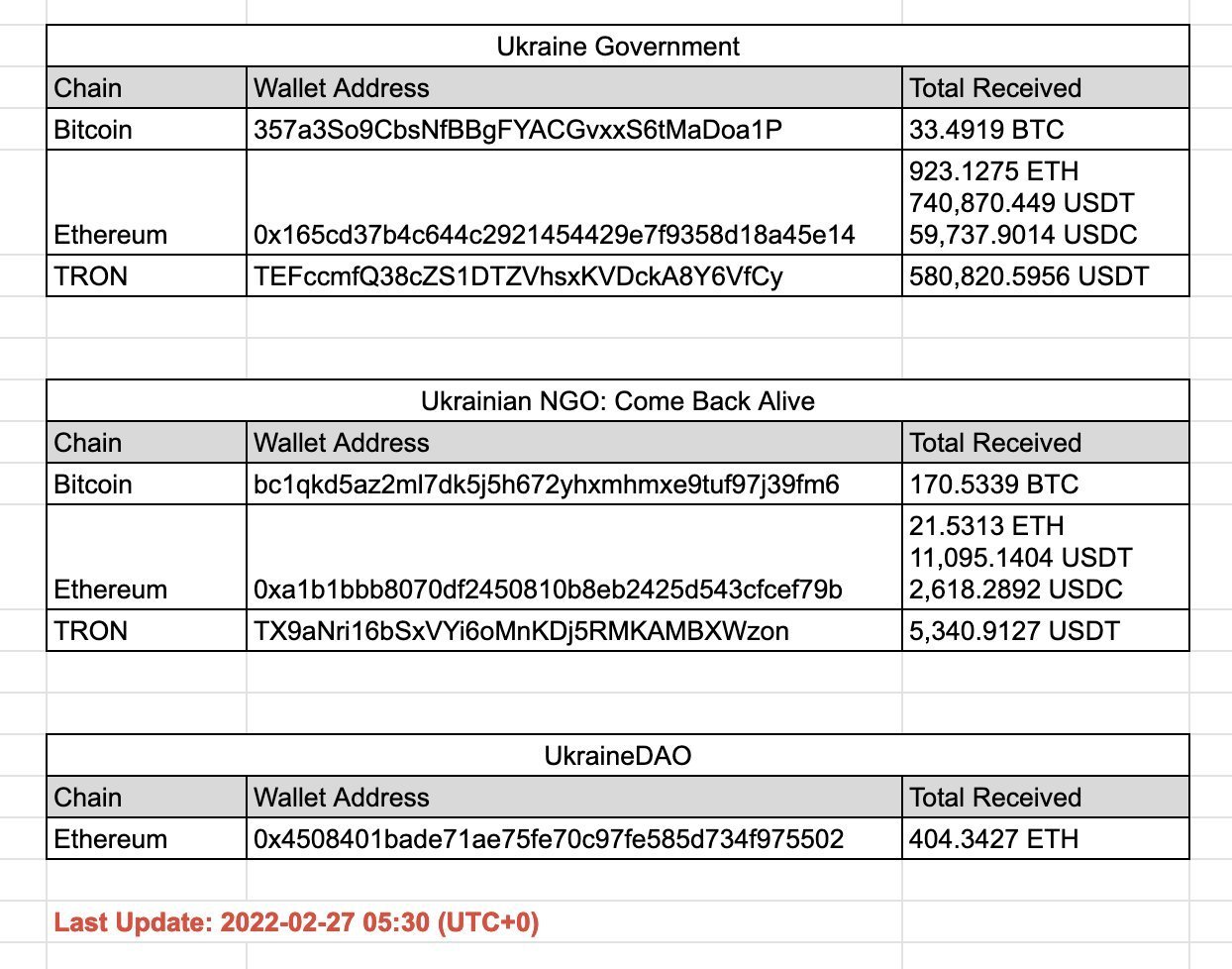

Many fund-raising efforts led by overseas care-groups were also done via cryptocurrencies. A Ukrainian NGO called Come Back Alive, received BTC donations worth more than $6 million at the time of writing, showing the world the utility of cryptocurrencies in times of crisis, when it would have been impossible to send fiat money to Ukraine since their entire banking system was shut.

Metrics Suggest BTC May Have Bottomed Out

With the swift rebound in prices, traders have been divided over what is to come this week. Hence, we take a look at two BTC metrics to make a clever guess as to where crypto prices may be headed to.

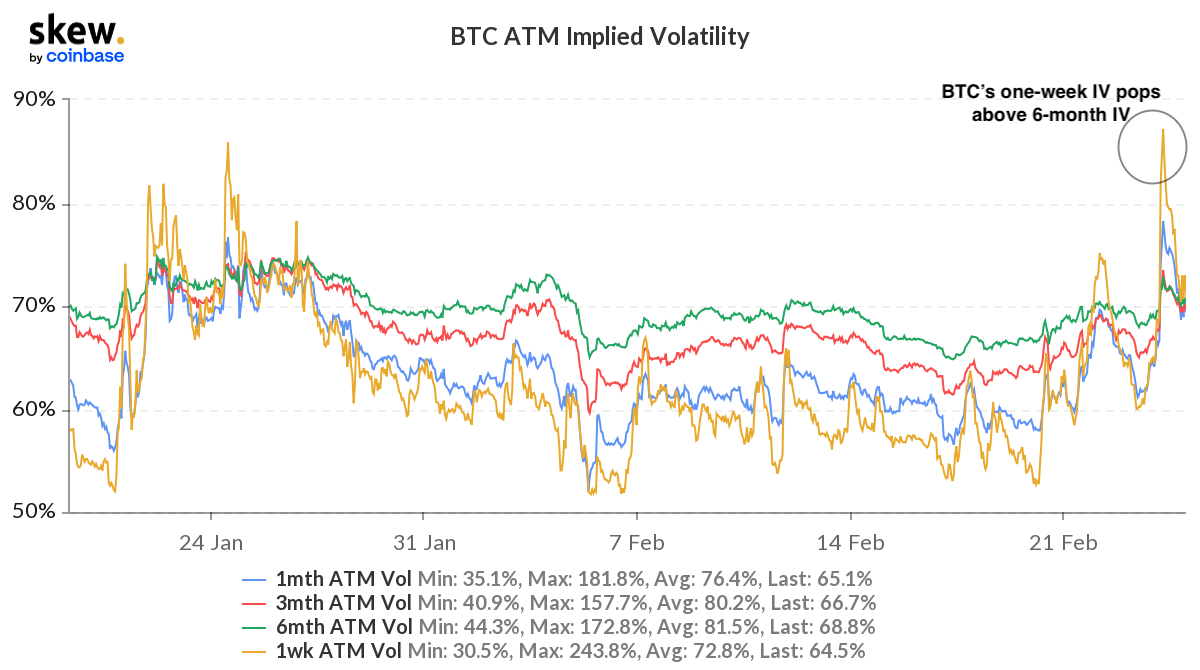

A check on the implied volatility for BTC, which is determined by the demand for BTC options, suggests that traders were actively hedging their positions in anticipation of heightened volatility last Thursday, when the metric jumped above its 6-month average. A pop in implied volatility is taken to represent uncertainty and an inverted structure, in which short-term implied volatility is greater than the longer-term gauges, signalling panic.

Historically, this inverted structure has often marked a price bottom, which would imply that the $34,300 low made by BTC last Thursday was the interim bottom.

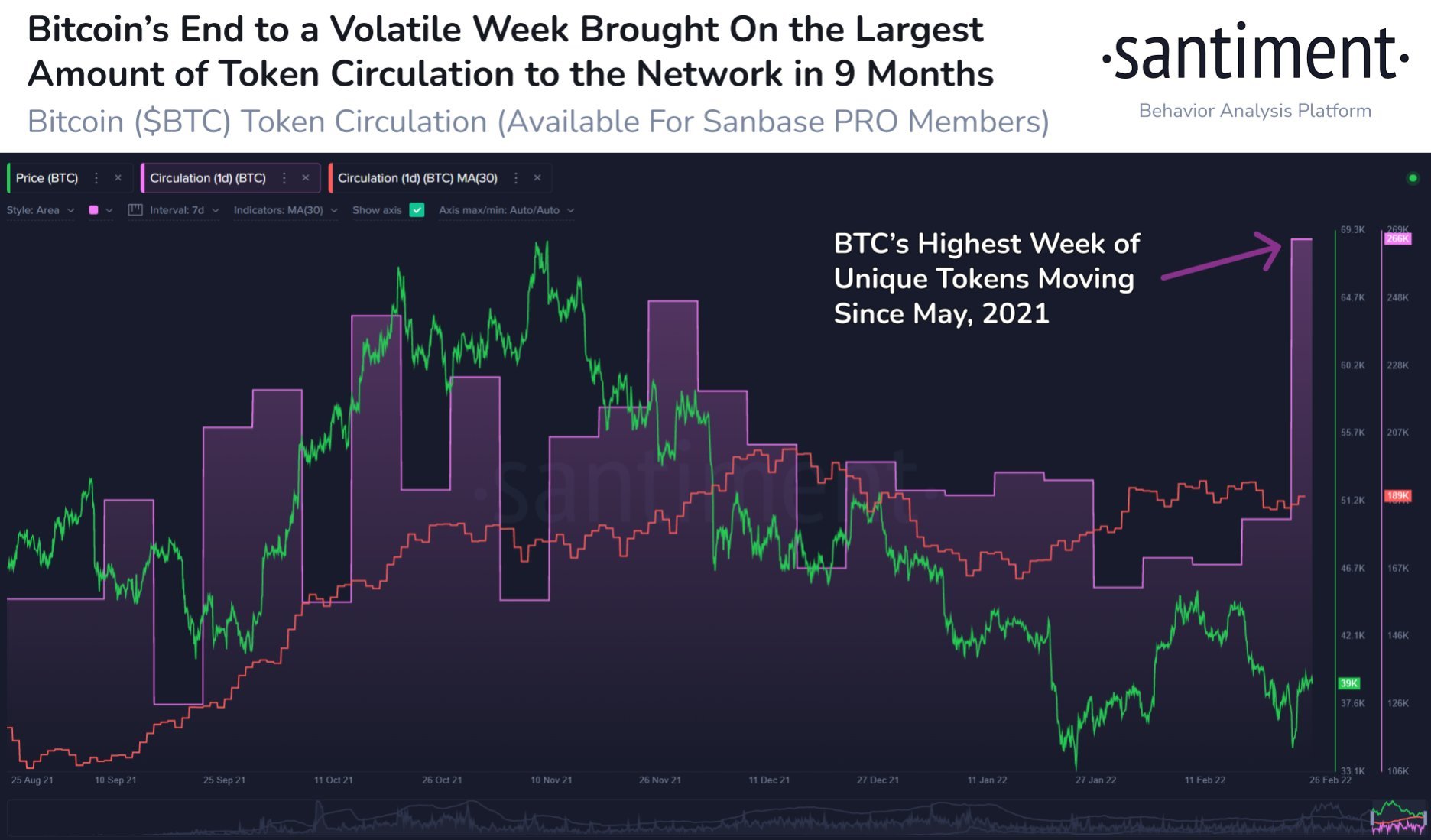

BTC token circulation also hit a 9-month high, revealing that whales have been actively sending and receiving BTC, a sign of the token changing hands. This could be a result of many OTC trades being done off the market, signalling active buying and selling amongst whales. This circulation spike was similar to March 2020, after which the price of BTC rebounded strongly after the COVID-19 crash. With a similar pattern surfacing currently, this may also signal that BTC could have seen its worst days in recent times.

While metrics appear to paint a more benign picture, events unfolding at Ukraine may continue to cause two-way volatility in the near-term.

The USA, Germany and some NATO countries had on Sunday, agreed to send ammunition and monetary aid to Ukraine, and imposing even more sanctions on Russia, including banning Russia civilian plans from flying across Europe, and banning Russia TV channels and journalistic publications. On the other hand, Russia and Ukraine delegates are currently holding peace talks in Belarus after a lot of deliberation of the side of Ukraine over the past few days.

In early Asian trading at the start of this new week, risky assets are selling off, with the US indices falling an average 2% on fears of new sanctions derailing economic recovery since parties on both sides are affected. Cryptocurrencies are also weaker, with BTC falling to the $37,500 level, while altcoins are off by between 5-10%. Oil is 5% higher, recovering after late last week’s profit taking.

With the situation still fluid, it is anybody’s guess as to how the situation will play out this week and how it will affect financial markets. However, an increase in volatility often brings with it great trading opportunities should traders be nimble and exercise responsible position management.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.