The FTX debacle took more casualties with it, this time with Genesis having to suspend redemptions and new loan originations. The firm faced withdrawal requests that exceeded the current liquidity at Genesis Global Capital, the firm’s lending arm. Genesis has hired advisers to explore all possible options. As a result of Genesis’s problem, Gemini Earn has also paused operations because Genesis was their primary partner. Even though more industry participants are starting to reveal their conditions post the FTX scandal, the market does not appear to be negatively impacted as most traders have already expected contagion to hit. As the problem lies with custodian firms and not with blockchain or crypto itself, selling does not appear to be the main theme last week, with investors busy withdrawing their coins from different custody services to their own private wallets rather than selling their cryptos.

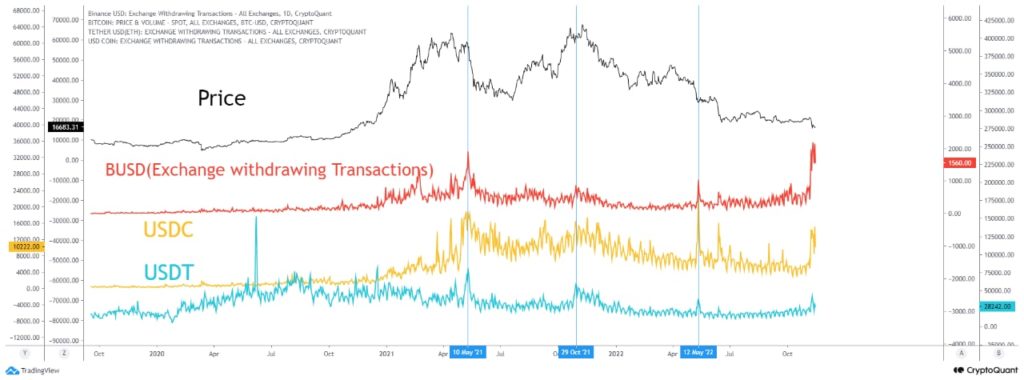

This can be seen in stablecoin withdrawals, which has spiked to one of their highest levels. The result of this could be two-fold; one, that there is now less buying power in the market, however, the flip side of the equation holds equally true, that there is less selling pressure also as traders no longer have stablecoins to put up as collateral to short the market.

This could result in a huge decline in market volume, which may not necessarily translate to lower volatility. Whales could take advantage of the lower volumes to pump or dump coins using less money, which could mean that the chance of high two-way volatility is still there.

BTC LTH MVRV Near 2018 Bottom

One possible reason for the lack of selling pressure could be that holders are already in too deep losses and do not want to sell and realize the loss. According to the long-term holder’s market value vs realized value (LTH MVRV), long-term holders are holding an average of 33% in unrealized losses. At the lowest point of the 2018 bear market, this loss went to as low as 36% before the market rebounded. This could thus imply that we are nearing the bottom.

One reason for some residual faith to remain in the market could be related to a crypto industry recovery fund set up by Changpeng Zhao, commonly known as CZ, the founder of Binance. His initiative has been supported by Justin Sun of Tron and many other industry players. The crypto market stabilized in the middle of last week after CZ revealed about setting up the fund.

Further to this, Justin Sun has also started an initiative to buy 1 BTC every day beginning on Friday, after the President of El Salvador pledged to buy 1 BTC every day. Some other crypto proponents have also said that they would join in the movement, with Justin Sun suggesting that every person on the planet buy $1 worth of BTC per day.

PrimeXBT Most Trusted Crypto-Asset Trading Platform

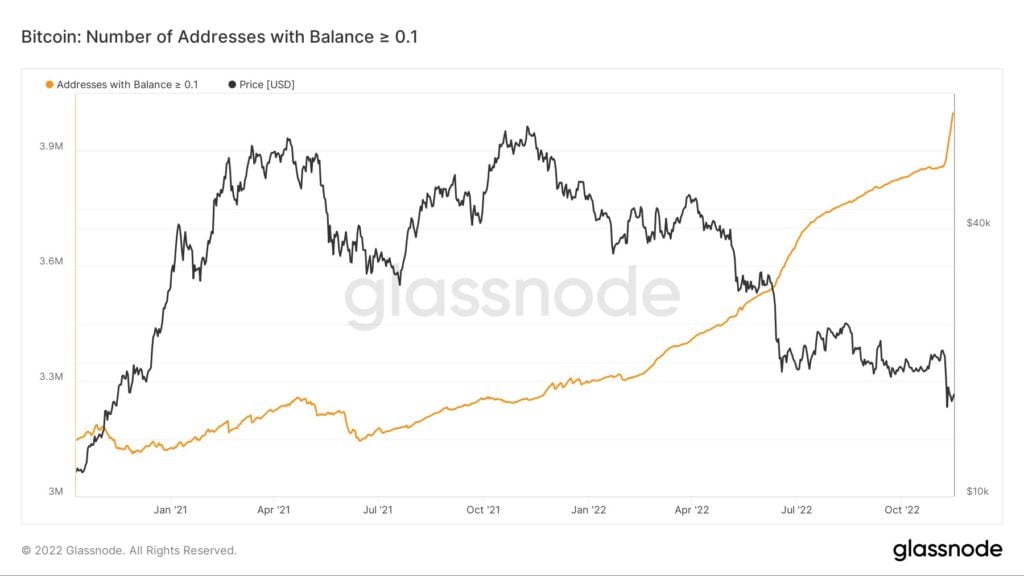

Small BTC Buyers Having Been Increasing

Indeed, this spate of market decline has brought about an influx of small BTC buyers. According to data, ever since the FTX scandal started, BTC has recorded a large increase in the number of addresses holding between 0.1 to 100 BTC.

Since November 7, the number of such BTC addresses grew by 9%, with more than 125,000 wallets holding between 0.1 to 100 BTC created out of 3.3 million such wallets in total. This shows that investors remained unperturbed by BTC and what crypto represents as they understand that the FTX failure is a result of poor management and is not a crypto problem.

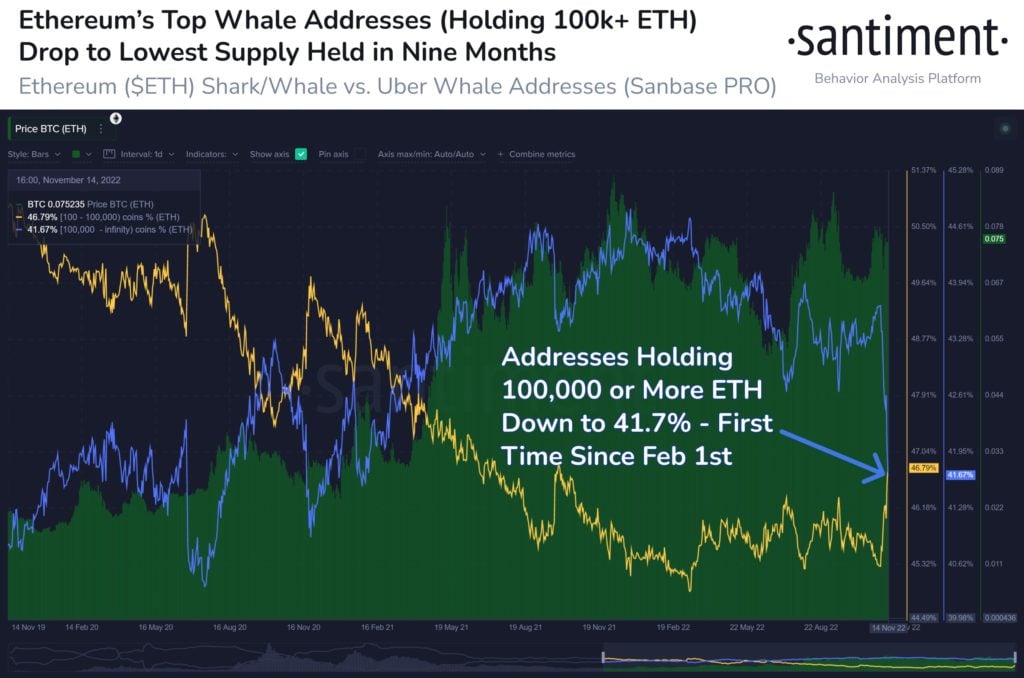

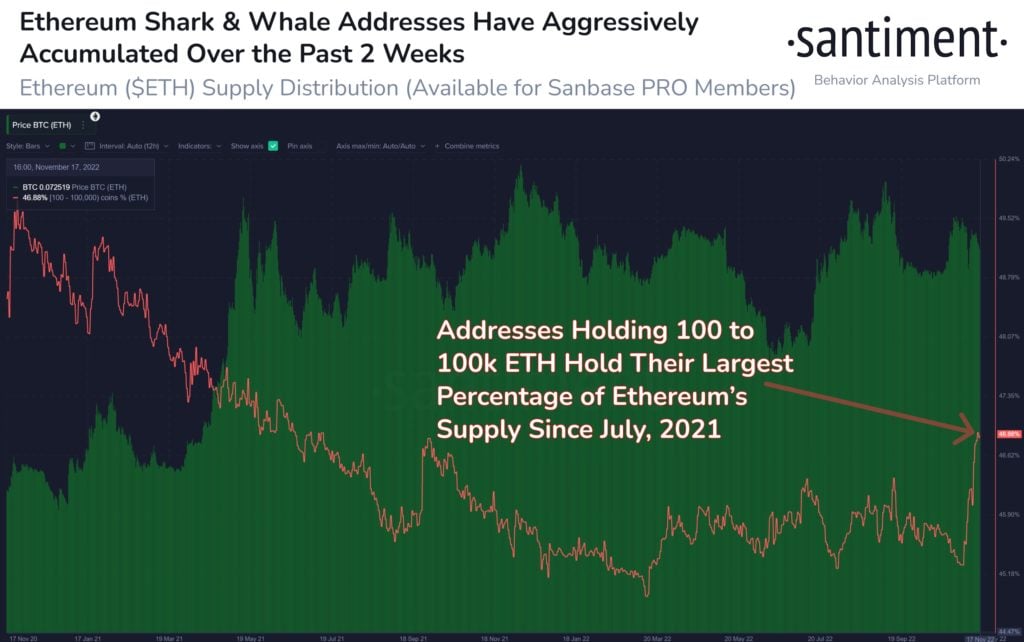

ETH Whale Wallets Drop to Lowest in Nine Months

Following news that the FTX hacker had stolen more than $600 million worth of coins from the beleaguered exchange and converted them into ETH, the price and whale holdings of ETH has been declining, a sign that ETH investors are selling out as worries about the hacker dumping his newly acquired 228,000 ETH mount. The worry is justified as this hacker has now become one of the largest holders of ETH. Holders with more than 100,000 ETH have declined from 45% to 41.7% of total supply since November 4 when the FTX saga first started to play out.

However, it must be said that there is a high possibility that these wallets with more than 100,000 ETH could be crypto exchanges, and the decline could simply be a result of users withdrawing their ETH from exchanges into self-custody.

This could be supported by the fact that smaller whales holding between 100 to 100,000 ETH have been increasing in numbers. The number of such whales increased their holdings by 3.52% in just the past 12 days, which could be a result of coins moving from exchanges into these wallets.

Of course, it could also be a case of these smaller whales aggressively accumulating ETH during the dip.

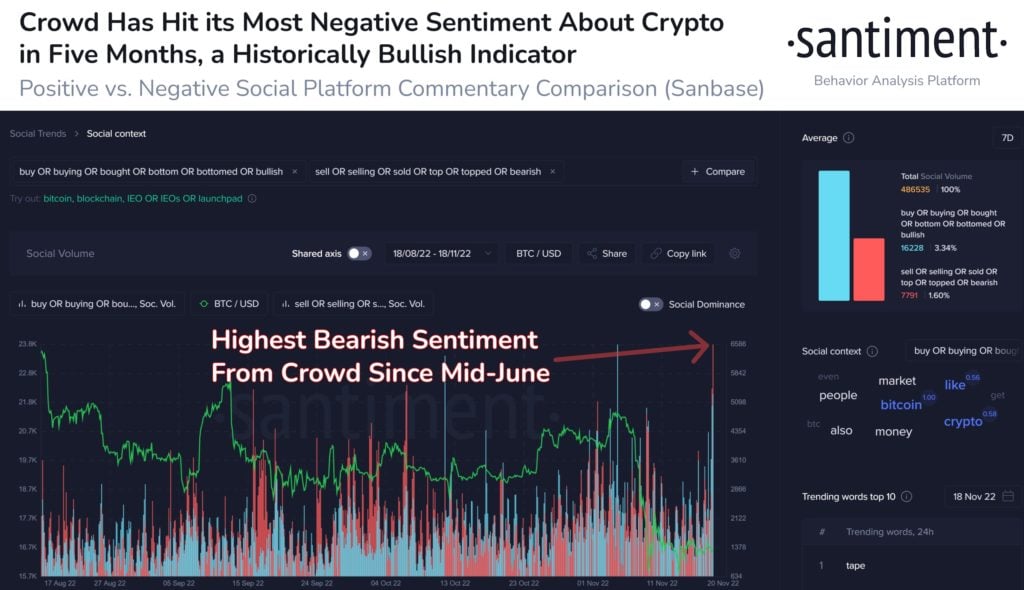

Most Bearish Sentiment on Crypto Since June 2022

With a series of contagion news starting to come forth, bearish sentiment on the crypto market has reached the level last seen in June during the LUNA collapse.

Conversations relating to current market conditions across different social media platforms like Twitter, Reddit, Discord, and Telegram have all been exceptionally bearish. This historically increases the probability of prices to surprise on the upside since crowd sentiment is usually a contrarian indicator.

Traditional Markets: Oil Falls on Price Cap Reveal

In another sign of inflation easing, the US PPI released on Tuesday came in lower than expected, rising 0.2% from last month instead of 0.4% as anticipated by the market. On a year-over-year basis, PPI rose 8% compared to an 8.4% increase in September.

The US economy, however, still appears to be strong, with the Empire State Manufacturing Survey for November registering a reading of 4.5%, much better than the estimate for a -6% reading. Retail sales and unemployment claims turned out better than expected, while the Philly fed manufacturing index came in far worse than expected, with a reading of -19.4 vs expectation of -6.

With economic numbers beginning to weaken, stocks eased back from the exceptional gains made since early November, with all the major averages posting slight losses for the week. The Dow ended 0.01% lower, the S&P lost 0.69%, while the Nasdaq weakened by around 1.57%.

St. Louis Federal Reserve President James Bullard’s comments on Thursday that “the policy rate is not yet in a zone that may be considered sufficiently restrictive” also added some concerns to bulls, as he suggested that the appropriate zone for the federal funds rate could be in the 5% to 7% range, which is higher than what the market is pricing.

In the UK, inflation continues to soar, hitting a 41-year high of 11.1% as food and energy prices continue to rise even as the country faces the longest recession on record. Finance Minister Jeremy Hunt announced on Thursday tax hikes and spending cuts as he seeks to plug a gaping hole in public finances and restore Britain’s economic credibility. The pound, however, was caught in a lockstep as it tries to balance the effect of a tighter monetary policy against a weaker economy.

As the USD recovered a bit of lost ground after Bullard’s hawkish comments, Gold and Silver also gave back some gains made in the tamer-than-expected CPI rally. Silver lost 4.5% while Gold gave back 1.6%. Both metals are starting the new week a tad lower.

Oil clocked its second consecutive week of decline, with Brent losing almost 8% and WTI dropping 10% as G7 nations are set to announce this week the fixed price cap on Russian oil that is exported through certain Western routes. The plan involves a ban on the provision of certain services, such as maritime routes, insurance, and financing, to buyers of Russian oil unless it is sold at or below the cap.

According to the G7, the cap is intended to limit Russia’s ability to fund the war in Ukraine, while at the same time, also protecting consumers and households from sky-high energy prices. While the price cap will take effect from December 5, the level has not yet been announced and the fact that it could finally be revealed this week is weighing on oil prices.

With a major holiday like Thanksgiving this coming Thursday, trading activities in all markets are expected to quieten down as traders traditionally like to extend this into a long weekend. Economic data out of the USA is also relatively quiet this week, with only the Services PMI and Fed minutes on Wednesday that are the known events that could add volatility to the markets.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.