As PrimeXBT’s user base grows, so does the demand for more assets to be added alongside our already large list of traditional and digital assets, which include everything from Bitcoin to gold, to forex currencies, stock indices, commodities, and more.

The variety of assets has been a major differentiating factor for PrimeXBT, providing the greater trading community and unparalleled value by offering so many options and opportunities for profit under one roof.

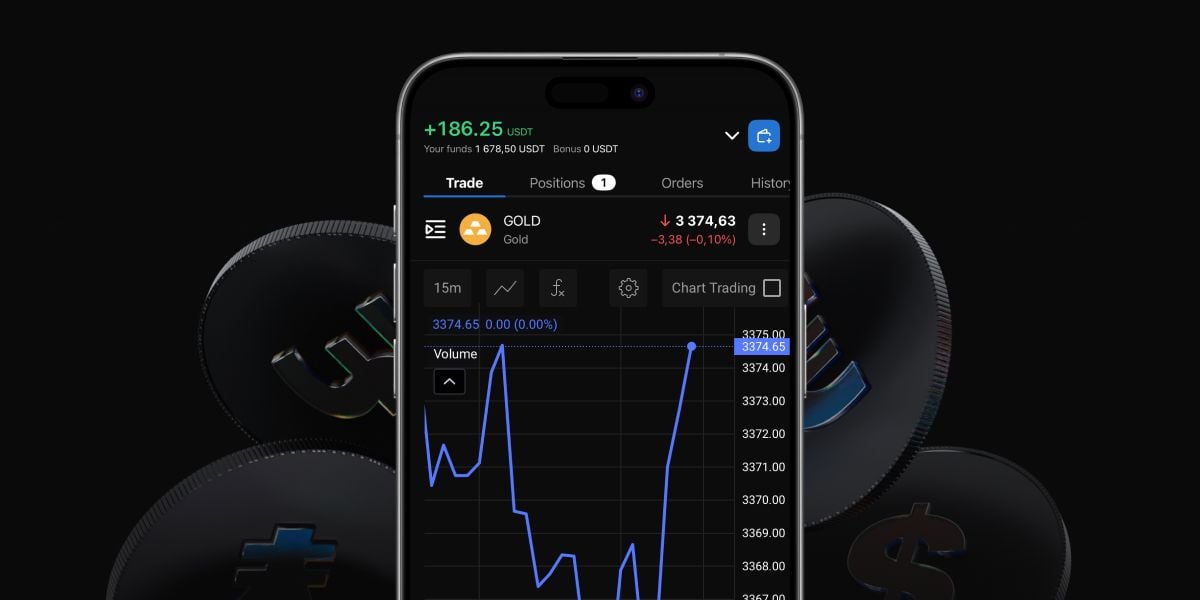

With our built-in charting tools, advanced order types, and much more, there are so many ways for a trader to grow their revenue. Further expanding on that, PrimeXBT is proud to reveal that we’re adding a total of 19 exciting, new trading instruments, now available for trading with up to 1000x leverage.

Here is the full list of new assets coming to PrimeXBT, along with a helpful description of each new instrument and why it matters to trades on our platform.

New Stock Indices Include The World’s Leaders

A stock index is an aggregate of publicly-traded companies in a specific region or sector. These stock indices are typically tied to specific nations and are often considered a barometer of a nation’s overall economic health.

Stock indices provide an opportunity for traders to profit from the natural price fluctuations driven by factors such as the strength of each nation’s economy, the strength of its currency, its political leadership, and the performance of the companies listed in each index.

The newest stock indices to join the likes of the NASDAQ, SP500, and many more listed on PrimeXBT.

Europe 50

The Europe 50 trades on PrimeXBT under the symbol EUR50 and is a weighted stock index representing 50 different stocks from the most successful companies in various sectors across 18 different European nations, including – listed in alphabetical order – Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

France 40

The France 40, also known as the CAC 40 or Cotation Assistée en Continu is a capitalization-weighted stock index based on the top 40 stocks listed on the Euronext Paris securities market. Only the most actively traded stocks are selected by the independent Index Steering Committee and are reviewed quarterly. The France 40 trades on PrimeXBT under the symbol FRANCE.

Spain 35

The Spain 35, also called the IBEX 35 or Índice Bursátil Español (translates to Spanish Exchange Index) trades on PrimeXBT under the symbol SPAIN. The Spain 50 is a weighted benchmark stock index based on the 35 most liquid stocks traded on the Madrid Stock Exchange. The companies listed are reviewed twice annually.

Wall Street 30

The Wall Street 30 trades on PrimeXBT under the DOWJ symbol and is also referred to as the Dow 30, Dow Jones Industrial Average, or just the Dow Jones. The Wall Street 30 was created by Wall Street Journal editor Charles Dow and named after Dow himself and his business partner Edward Jones. The stock index represents a combined price of 30 of the largest publicly-traded companies in the United States.

New Currencies & Even More Forex Currency Trading Pairs Added

The forex market is the most highly traded and liquid market in the world and features the trading of the official national currencies of the world’s most prominent economies. These currencies have an important impact on the overall global economic climate, and their values can ebb and flow with the environmental issues, political factors, and much more making forex currencies an ideal asset for traders.

With even more options now available on PrimeXBT, traders have even more opportunity to profit from the forex market than ever before.

New Currencies and Available Trading Pairs

New Zealand Dollar (NZD)

The New Zealand dollar is the official native fiat currency of the island nation of New Zealand the Cook Islands, the Ross Dependency, Tokelau, the Pitcairn Islands, and Niue. It is the tenth most traded currency in the world and is sometimes referred to as the kiwi.

The New Zealand dollar is available for trading under the following currency trading pairs:

- NZD/CAD

- NZD/CHF

- NZD/JPY

- NZD/SGD

- NZD/USD

- AUD/NZD

- EUR/NZD

Singapore Dollar (SGD)

The Singapore dollar is the official native fiat currency of Singapore, and despite its relatively small size as a nation, due to the country’s economy, it is the 13th most traded currency on the foreign exchange market.

The Singapore dollar is available for trading under the following currency trading pairs:

- USD/SGD

- EUR/SGD

- GBP/SGD

Turkish Lira (TRY)

The Turkish lira is the official native fiat currency of the country of Turkey and was first introduced in 2005, replacing the previous Turkish lira. Until 2009, the currency was referred to as “New Turkish lira.” It is the 19th most traded currency in the world.

The Turkish lira is available for trading under the following currency trading pairs:

- USD/TRY

Russian Ruble (RUB)

The Russian ruble or rouble is the official native fiat currency of the country of Russia, issued by the Bank of Russia, and representing one of the world’s largest economies. The Russian ruble is the 17th most traded currency in the world.

The Russian ruble is available for trading under the following currency trading pairs:

- USD/RUB

New Trading Pairs On Existing PrimeXBT Currencies

We’ve also added new trading pairs across our existing currencies, including new pairs for the Canadian dollar, the Japanese yen, and the Swiss franc. These trading pairs include:

- CAD/CHF

- CAD/JPY

- CHF/JPY

Reduction In Minimum Order Size Across All Trading Instruments

In addition to 19 new instruments being listed on PrimeXBT, we are also lowering the minimum order size across all assets listed on the platform. This allows traders using the platform to take positions with much less capital and access markets they otherwise would have previously been unable to.

For example, the minimum order for a Brent oil contract prior to the update was 100 barrels or roughly $8,000. Now, after the change, the minimum positions requirement is just 1 barrel, or roughly $80 USD.

This low barrier to entry provides even more opportunities for profit across many more trading instruments, including the 19 new instruments just added to PrimeXBT.

Summary

The additions to PrimeXBT’s ever-expanding list of assets available for trading with leverage introduce traders to a wide variety of new instruments and exposes them to more opportunities for profit than ever before.

Combined with cryptocurrencies, commodities, and the already existing stock indices and forex currencies offered by the platform, these new instruments can be added to a well-rounded trading or investment portfolio, providing a value that isn’t found on any other trading platform.

We’re always reviewing additional instruments, and in the future will continue to add exciting new instruments to ensure we cater to a broad and diverse range of traders.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.