XRP has firmly established itself among the top cryptocurrencies as the native token of the Ripple payment ecosystem. With its focus on fast, low-cost cross-border transactions, XRP remains a coin of interest for investors and institutions alike. This comprehensive analysis examines XRP price predictions for 2025 through 2030, including a long-term forecast through 2050, and discusses the factors that could influence these outcomes. We’ll also review XRP’s historical development, technical outlook, unique value propositions, and a balanced investment perspective weighing its pros and cons.

XRP Overview

Today (28 February 2026) XRP (XRP/USD) is trading at $2.2492 per XRP, with a market cap of $131196061869 USD. 24-hour trading volume is $4835335342 USD. XRP price has changed by 1.6% in the last 24h. Circulating supply is 58394167593 XRP.

XRP Price Prediction 2025

Analysts generally anticipate XRP will gain value by 2025, building on post-lawsuit momentum and broader crypto market growth. However, predictions for 2025 vary from cautious to highly bullish. The table below summarizes several 2025 forecasts:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2025 | $4.60 | $2.84 | $1.07 |

Most estimates see XRP trading in the low single digits in 2025. On the bullish end, CoinCodex’s analysts project a range of $2.26 to $4.60 (average around $3.14) for 2025, which would imply XRP challenging or even exceeding its 2018 all-time high. Changelly’s forecast is similar – an average around $3.32 with a maximum near $4.5. These optimistic targets assume continued network adoption and a favorable market cycle. PricePrediction.net, using AI analysis, is a bit more conservative for 2025 with a predicted maximum of $2.88 (and approximately $2.50 average), basically assuming moderate growth but no new ATH yet by 2025. On the bearish side, DigitalCoinPrice’s model shows XRP mostly under $1.30 in 2025, which would imply only marginal upside – this may reflect an older dataset or a very cautious outlook.

Meanwhile, WalletInvestor (known for technical and demand-based forecasts) predicts XRP could reach about $2.57 at peak in 2025, roughly a 200% increase from 2023 levels, aligning with a view that XRP will rise but not explode.

In summary, the consensus for 2025 puts XRP roughly in the $2–$5 range. Hitting the higher end would likely require a strong crypto bull market or major Ripple adoption news (such as new partnerships or an XRP exchange-traded fund approval), whereas the lower end would correspond to sluggish performance or unresolved uncertainties.

XRP Technical Analysis: Support and Resistance Levels

As of early 2025, XRP’s price has experienced both a strong rally and a sharp correction, reflecting broader market volatility. A technical analysis reveals key support and resistance levels that traders are watching:

- Support Levels: In the short term, XRP had been holding a support around $1.70–$1.80. Analysts noted ~$1.77 as a critical support—breaching this level opened the risk of a drop to lower supports around $1.50 or even the $1.00 psychological level. Indeed, during a market sell-off in April 2025, XRP fell briefly to ~$1.61 before finding support. If $1.50 (a mid-2024 support zone) fails, $1.30 and $1.00 are eyed as deeper support floors. On the upside, the prior support at $2.00 (which was a long-held floor) has now turned into a resistance level after being broken.

- Resistance Levels: Immediate resistance is around $2.00–$2.10, the area of the breakdown. Above that, XRP faces significant resistance near $2.85–$2.92, which corresponds to the highs from late 2024 and previous support from early 2025. Notably, ~$2.90 was a consolidation low in February 2025, so it may act as resistance on any rebound. The next major resistance is around $3.30–$3.40, which represents the peak reached in January 2025 and is close to XRP’s multi-year high (and near the all-time high of $3.84 from 2018). Technical analysts often cite the $3.30–$3.84 zone as a major supply area – a successful breakout above $3.84 would mark a new record high for XRP. Beyond those, some analysts point to $5.00 as a psychological level, though that would likely require extremely bullish catalysts.

In summary, XRP is currently range-bound, with roughly $1.50 as strong support and ~$3 as strong resistance in 2025’s early trading. A break below support could lead to a deeper bearish phase, whereas breaking above $3–$4 could trigger a new bullish run. With these levels in mind, we turn to price predictions for the coming years.

XRP Price Prediction 2026

By 2026, many analysts expect Ripple’s initiatives (like expansion into new corridors and possibly central bank digital currency projects) to start reflecting in XRP’s price more substantially. The table below shows select predictions for 2026:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2026 | $8.64 | $5.82 | $3.00 |

Forecasts for 2026 generally point upward from 2025, though there’s a split between moderate and aggressive outlooks. Some conservative estimates see XRP in the $3–$4 range in 2026, meaning only modest growth from 2025. For instance, one forecast expects XRP could hover around $3.50 by 2026 in a steady growth scenario. In contrast, more bullish analyses envision 2026 as a breakout year. An aggregate analysis suggests a potential high of $8.64 in 2026 with an average price around $6.25. This implies XRP roughly 3× to 4× up from 2025 levels. Such growth might be driven by Ripple expanding ODL to more corridors, significant increase in transaction volumes, or a crypto market upswing. It’s worth noting that by 2026, Bitcoin’s next halving and a possible new bull cycle could lift all boats – XRP included. Most 2026 predictions fall in between these extremes. One algorithm likely forecasts XRP’s max around $4 in 2026 (continuing its gradual upward trajectory). In summary, low-to-mid single digit prices are anticipated, with $5+ only in the optimistic scenarios.

XRP Price Prediction 2027

Looking at 2027, forecasts start to widen as the time frame increases. This is where some models foresee XRP entering firmly into two-digit price territory, assuming continued growth and adoption. Below are a few 2027 predictions:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2027 | $12.25 | $8.93 | $5.60 |

By 2027, there is an expectation from several analysts that XRP could finally break above its long-held single-digit range. A commonly cited range for 2027 is $7 to $12. This bullish outlook is predicated on Ripple’s increasing domination in the payment sector – in other words, if by 2027 XRP is widely used for international settlements by banks, demand could drive the price into the tens of dollars. On the other hand, not all sources agree on such aggressive growth. One trend-based prediction was much lower – only about $2.62 as a high – but this appears to be a very conservative outlier. Most other predictions indeed cluster much higher. One AI forecast would put XRP’s 2027 average in the high single digits (perhaps $8) with a possible max in low double-digits ($7–$10).

In summary, if Ripple’s network growth continues, 2027 could see XRP in the high single to low double digits. A price around $10 by 2027 is a bullish but increasingly cited possibility. Reaching this would likely require that by 2027 the crypto market is in a strong uptrend and XRP has cleared past its 2018 high with authority.

XRP Price Prediction 2028

Forecasting out to 2028, the bullish scenarios continue to play out a narrative of accelerating adoption. Here are sample projections:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2028 | $22.00 | $16.80 | $11.60 |

By 2028, some models foresee XRP solidifying into a double-digit price asset. The composite forecast shows XRP averaging around $14.11 in 2028, with a low of about $11.3 and a high near $16.53. Such prices would have XRP’s market capitalization climbing dramatically (potentially into the trillions of dollars if supply is ~50 billion XRP by then), implying very widespread usage. Reasons given for this surge include XRP possibly becoming the second-largest altcoin by market cap and expanding use cases such as new dApps on XRPL and more tokenized assets or stablecoins on the ledger.

Essentially, by 2028, if XRP hasn’t achieved such integration, these high targets might not materialize, but if it has, $10+ could be the norm. One bullish source suggests XRP could even reach the $20+ range by 2028 in a global finance integration scenario. On the more tempered side, one algorithm might forecast something like $11–$14 as the range for 2028. Overall, 2028 predictions see XRP well above its historical highs, potentially in the $10–$15 range on average.

XRP Price Prediction 2029

As we approach the end of the decade, 2029 is seen by some as the year XRP could climb into solid double digits and perhaps approach the higher tens. Predictions for 2029:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2029 | $21.12 | $17.55 | $13.98 |

The composite prediction shows a fairly tight range, which suggests a leveling off of growth by that year. This aligns closely with what some algorithmic models suggest. In this scenario, XRP in 2029 could potentially peak around $20. Crossing the $20 threshold would be a monumental increase from today and would likely require XRP to be a backbone of international value transfer by that time, or another catalyst like a broad altcoin super-cycle. Some independent analysts are more cautious, citing a potential saturation point with tops around $15. Most long-term forecasts that far out are bullish, assuming continued network effects.

In sum, by 2029 many models put XRP in the teens of dollars, possibly touching $20 if all goes well.

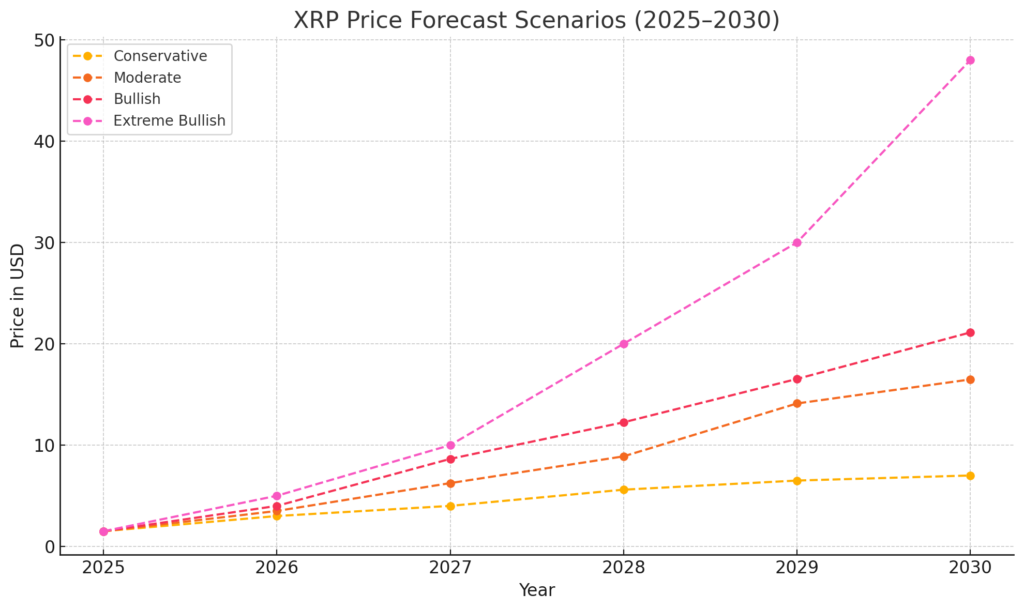

XRP Price Prediction 2030

The year 2030 is often treated as a milestone. Predictions vary extremely widely. Here are a few:

Minimum Price: ~$3.37

Average Price: ~$19.87

Maximum Price: ~$48.00

Algorithmic models suggest a range of roughly $17–$27 for XRP in 2030. One analysis sees an average of about $26.09 by 2030. These figures assume strong adoption – essentially that XRP would set a new all-time high and hold much higher value due to utility. An institutional outlook has a conservative $30 max by 2030. One optimistic source speculates a $48 average. Others have floated speculative ranges of $100–$500, arguing that if XRP became the standard settlement medium for global banks, such values could be reached. However, these scenarios are highly speculative. On the other hand, one pessimistic view predicts XRP will only be around $3.67 in 2030, possibly due to competition or regulatory hurdles. The consensus for 2030 among many analysts seems to place XRP somewhere in the $10 to $30 range. The higher end would imply XRP becomes one of the dominant platforms for global payments.

Long-Term XRP Price Projections (2040–2050)

Looking further ahead, price estimates are inherently speculative. Some examples:

A trend extrapolation projects about $40 by 2040 and $286 by 2050.

Another optimistic forecast envisions ~$146.86 in 2040 and ~$252.43 in 2050.

A moderate long-term scenario could place XRP in the $20–$50 range by the 2040s, assuming relevance and steady growth.

A pessimistic scenario suggests XRP could stagnate or fall to zero if it becomes obsolete or replaced.

In summary, long-term projections range from nearly zero to several hundred dollars, with middle-ground expectations placing XRP around $10–$50 by 2050. These forecasts depend heavily on widespread adoption, utility, and the resilience of crypto as a whole over decades.

What is Ripple (XRP)?

Ripple (XRP) is a digital asset and cryptocurrency that operates on the XRP Ledger, a decentralized blockchain technology. Created in 2012 by Ripple Labs, XRP was designed to facilitate fast, low-cost international money transfers and serve as a bridge currency in cross-border transactions.Unlike many other cryptocurrencies, XRP was not created to replace traditional financial systems but to complement and improve them. Ripple’s primary goal is to enable financial institutions to send money globally, instantly, and at a fraction of the cost of traditional methods.

Important facts about XRP

XRP utilizes a unique consensus mechanism called the XRP Ledger Consensus Protocol, which differs from the proof-of-work or proof-of-stake systems used by many other cryptocurrencies. This protocol allows for faster transaction confirmations, typically taking only 3-5 seconds. The XRP Ledger can handle up to 1,500 transactions per second, making it significantly more scalable than many other blockchain networks.

Another crucial aspect of XRP is its pre-mined nature. Unlike Bitcoin, which is gradually mined over time, all 100 billion XRP tokens were created at once. Ripple Labs holds a significant portion of these tokens in escrow, releasing them gradually to maintain price stability and fund development.

XRP also stands out for its energy efficiency. The XRP Ledger’s consensus mechanism consumes far less energy than proof-of-work systems, making it an environmentally friendly option in the cryptocurrency space.

What Gives XRP Value?

The value of XRP is derived from several factors. Primarily, its utility within the Ripple network for facilitating cross-border transactions gives it inherent value. Financial institutions using Ripple’s technology can leverage XRP as a bridge currency, potentially saving time and money on international transfers.

XRP’s limited supply of 100 billion tokens also contributes to its value. As with many cryptocurrencies, scarcity can drive demand and price appreciation. The gradual release of tokens from Ripple’s escrow helps manage this supply and potentially stabilize the price.

The growing adoption of Ripple’s technology by banks and financial institutions worldwide indirectly supports XRP’s value. As more entities use Ripple’s solutions, the potential demand for XRP as a liquidity tool increases.

Furthermore, speculative interest from investors and traders contributes to XRP’s market value. Like other cryptocurrencies, XRP is traded on various exchanges, and its price is influenced by market sentiment, regulatory news, and overall crypto market trends.

Lastly, the ongoing developments in the Ripple ecosystem, such as the introduction of smart contracts to the XRP Ledger, continue to expand XRP’s utility and potential value proposition. These technological advancements aim to position XRP not just as a transfer of value, but as a platform for broader financial applications, potentially increasing its long-term value and adoption.

Is Ripple (XRP) a good investment?

Ripple (XRP) presents an intriguing investment opportunity in the cryptocurrency market, offering both potential rewards and inherent risks that investors should carefully consider. As a digital asset designed to facilitate fast, low-cost international money transfers, XRP has garnered significant attention from both individual investors and financial institutions alike.

One of the primary attractions of XRP as an investment is its potential for widespread adoption in the global financial system. Ripple has established partnerships with numerous banks and payment providers worldwide, which could lead to increased usage of XRP for cross-border transactions. This real-world utility sets XRP apart from many other cryptocurrencies and could drive long-term value appreciation if adoption continues to grow.

Furthermore, XRP’s relatively low transaction fees and fast settlement times make it an attractive option for those seeking efficient digital payments. These features could potentially position XRP as a competitive alternative to traditional financial systems, especially in emerging markets where access to banking services is limited.

However, potential investors should be aware of the risks associated with investing in XRP. The cryptocurrency market is known for its volatility, and XRP is no exception. Price fluctuations can be sudden and significant, which may lead to substantial losses for unprepared investors. Additionally, regulatory uncertainty surrounding cryptocurrencies, particularly in the United States, poses a risk to XRP’s future prospects.

For those interested in investing in XRP, there are several avenues available. The most direct method is to purchase XRP tokens through cryptocurrency exchanges. This approach allows investors to own and control their XRP directly, but it requires a degree of technical knowledge and responsibility for secure storage.

Alternatively, investors can gain exposure to XRP’s price movements through various investment products available on our platform. These include cryptocurrency-based exchange-traded funds (ETFs) that include XRP in their holdings, as well as contracts for difference (CFDs) that allow investors to speculate on XRP’s price without owning the underlying asset. These products offer the advantage of easier access and management, especially for those less familiar with the intricacies of cryptocurrency wallets and exchanges.

For more risk-averse investors, our platform also offers cryptocurrency-focused mutual funds and index funds that provide exposure to a diversified portfolio of digital assets, including XRP. These options can help mitigate some of the risks associated with investing in a single cryptocurrency while still allowing participation in the potential growth of the digital asset market.

As with any investment, it’s crucial to conduct thorough research and consider your financial goals and risk tolerance before investing in XRP. Our platform provides comprehensive educational resources and market analysis tools to help you make informed decisions. We encourage you to explore these resources and the various XRP investment options available through our services.

Whether you’re a seasoned cryptocurrency investor or just beginning to explore digital assets, our platform offers a range of products and services tailored to your needs. Take the next step in your investment journey and discover how XRP and other digital assets can potentially enhance your portfolio. Visit our cryptocurrency section today to learn more about our offerings and start investing in the future of finance.

Conclusion: Will Ripple go up?

XRP stands at an interesting crossroads as of 2025. It has survived one of the toughest legal challenges in crypto history, emerging with a new lease on life in the U.S. market. Its technology continues to prove itself in real-world use, moving millions of dollars across borders in seconds for a fraction of a penny. The vision that Ripple and XRP could revolutionize the antiquated international payment system is closer to reality than ever before, yet significant work remains to be done to capture a sizable share of that multi-trillion-dollar market.

Price predictions for XRP through 2030 reflect this mix of optimism and uncertainty – ranging from a few dollars to possibly $20+ by 2030 in the most bullish analyses. By 2050, some foresee XRP as a globally adopted asset worth triple-digits, while others caution that unforeseen hurdles could cap its growth. The truth will likely lie somewhere in between, dictated by how well Ripple can drive adoption and how the competitive landscape evolves.

In the near to medium term, keep an eye on key catalysts: major bank integrations of XRP, expansion of ODL volumes, any announcement of an XRP exchange-traded fund, and macro factors like regulatory rulings or market rallies. Technically, watch the support and resistance levels identified (with $1 and $3 as inflection points in current trading).

For investors, XRP offers a bet on the future of fintech infrastructure – it’s a bet that the world’s value will flow as freely as information does today, with XRP potentially acting as a bridge for that value. It’s not a guaranteed bet by any means, but with high risk can come high reward. The coming years will be pivotal in determining whether XRP truly fulfills its promise as a “global settlement currency” or settles into a more modest role. As always, thorough due diligence and a long-term perspective are advised when evaluating XRP’s prospects in the fast-evolving crypto economy.

How high can XRP realistically go?

Realistically, XRP could reach between $10 and $30 by the end of the decade if Ripple achieves broad adoption in global payments. Extreme targets above $50 are speculative and depend on major financial system integration.

How much is XRP expected to rise?

Most forecasts suggest XRP could rise 3× to 10× from current levels over the next few years, with conservative estimates around $3–$5 and bullish cases reaching double digits.

How much will Ripple be worth in 2025?

By 2025, XRP is expected to trade between $2.50 and $5.00 in moderate scenarios, with optimistic predictions reaching $6 or more depending on market and regulatory developments.

What will Ripple be worth in 2030?

By 2030, XRP could be valued anywhere between $10 and $30 in most balanced forecasts, with some bullish analysts projecting up to $50 if global usage expands significantly.

What could XRP be worth in 10 years?

In 10 years, XRP may trade in the $20–$50 range if Ripple remains a key player in international finance. Under extreme adoption scenarios, prices above $100 have been speculated but remain uncertain.

Will XRP reach $10 dollars?

Yes, XRP reaching $10 is considered achievable in bullish but realistic forecasts, especially if Ripple continues expanding its payment infrastructure and demand for XRP rises.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.