Why experienced CFD traders are expanding into Crypto Futures

Markets change. Opportunities move with them.

Over the past two years, a growing number of CFD and Forex traders have started allocating part of their activity to Crypto Futures, not because cryptocurrency is trendy, but because volatility is higher and markets move faster.

The skills you’ve built trading Gold, FX, or stock indices carry directly over to Crypto. The difference is the environment. Crypto markets are younger, more volatile, and always open.

If you’ve built your trading around technical analysis, you’ll find Crypto Futures immediately familiar. The same chart patterns, indicators, and price action principles apply. And if fundamental analysis is your strength, it gets even more interesting. Crypto markets offer blockchain-based data that simply doesn’t exist anywhere else, giving you an analytical edge unique to this asset class.

Why Crypto Futures offer more opportunity

Crypto markets are still developing, which makes them less efficient than traditional CFD markets.

For active traders, that inefficiency can work in your favour. It often shows up as stronger price moves, clearer momentum, and more frequent technical setups.

It’s one of the reasons Crypto Futures tend to suit short-term and momentum-based strategies particularly well.

Trading involves risk.

How experienced traders analyse the Crypto market

Crypto markets react strongly to sentiment, positioning, and key events. Below are some popular tools traders use to anticipate market movements.

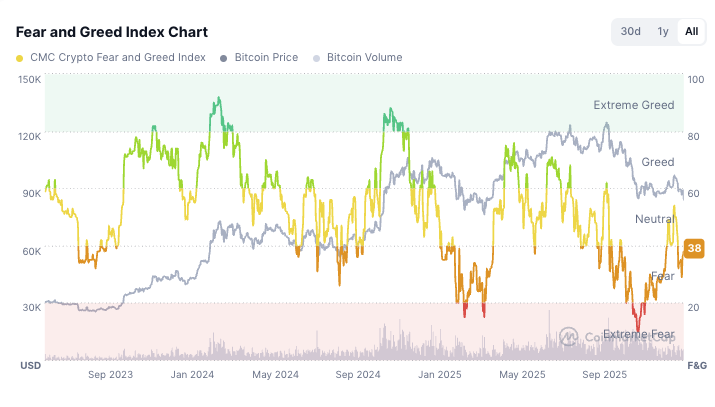

Fear & Greed Index

The Fear & Greed Index is one of the most widely followed indicators in crypto, measuring whether overall market sentiment leans towards fear or greed. Because crypto is heavily sentiment-driven, it can act as a useful leading indicator for price movements.

Historically, extreme fear has tended to appear near market bottoms, while extreme greed has often coincided with tops.

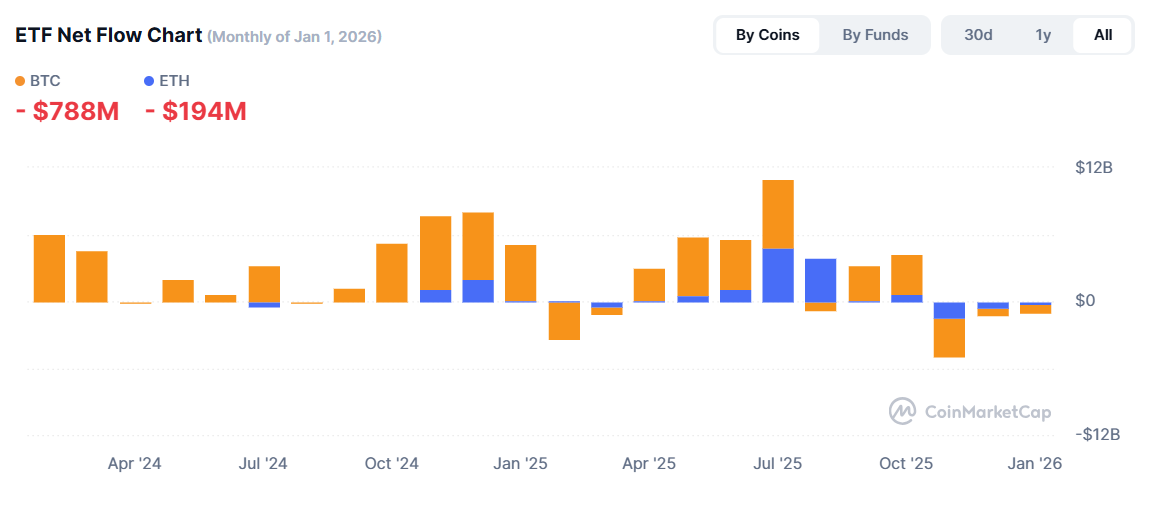

ETF inflows and outflows

Crypto’s total market capitalisation is still relatively low compared to traditional markets, which means institutional flows carry significant weight.

Large ETF inflows can drive strong upside momentum, with sustained outflows often signaling risk-off behaviour.

Tracking these flows helps traders understand where large capital is moving, and potentially where price is heading next.

The best part? This data is publicly available and updated each trading day, so you can monitor it and apply it directly to your own analysis.

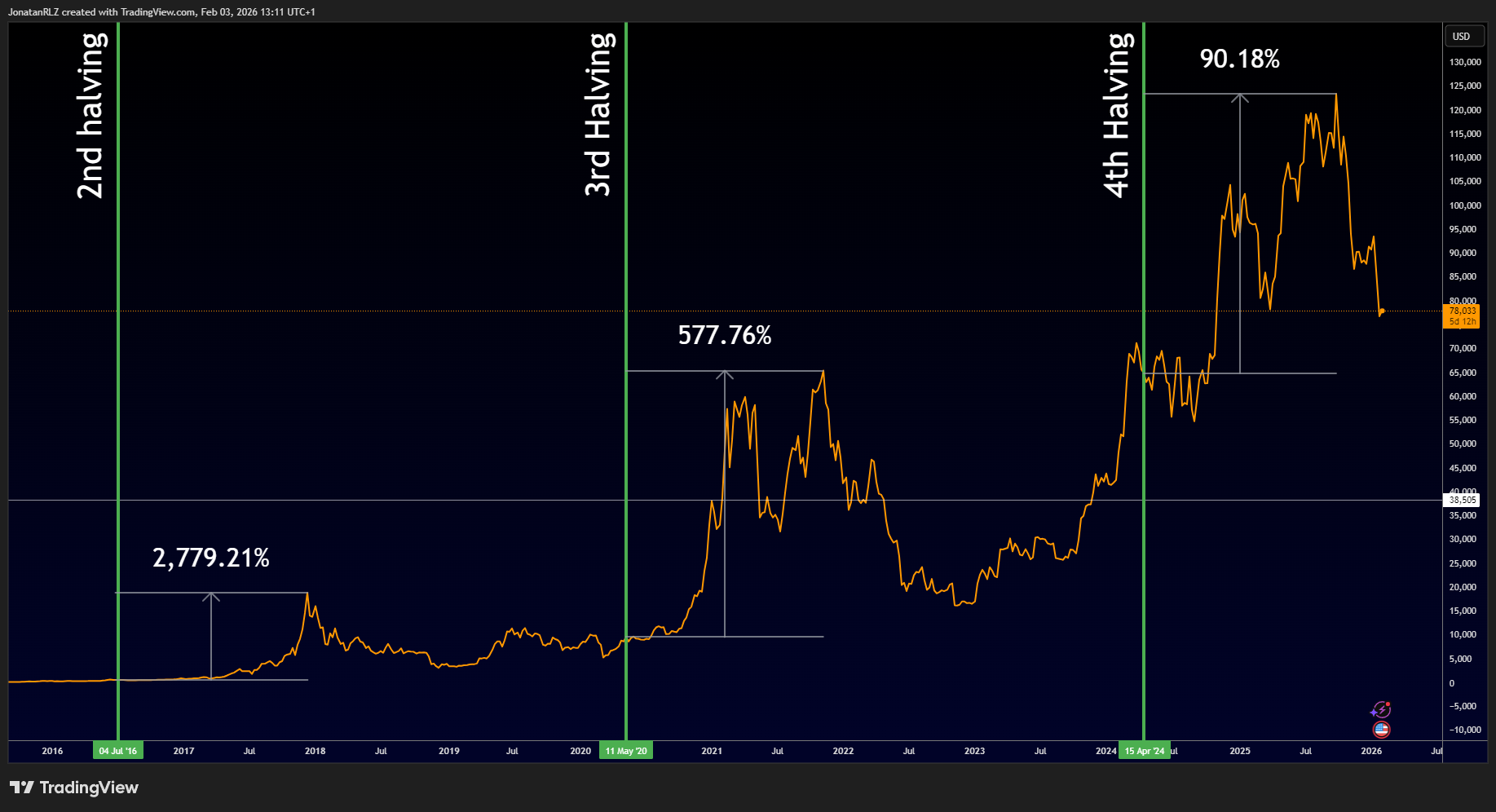

The Bitcoin halving

One of the most anticipated events in crypto.

Bitcoin’s halving reduces the rate of new supply entering the market. Historically, halvings have been followed by strong momentum phases, as supply tightens.

Understanding the halving cycle can help traders position for medium- and long-term trends.

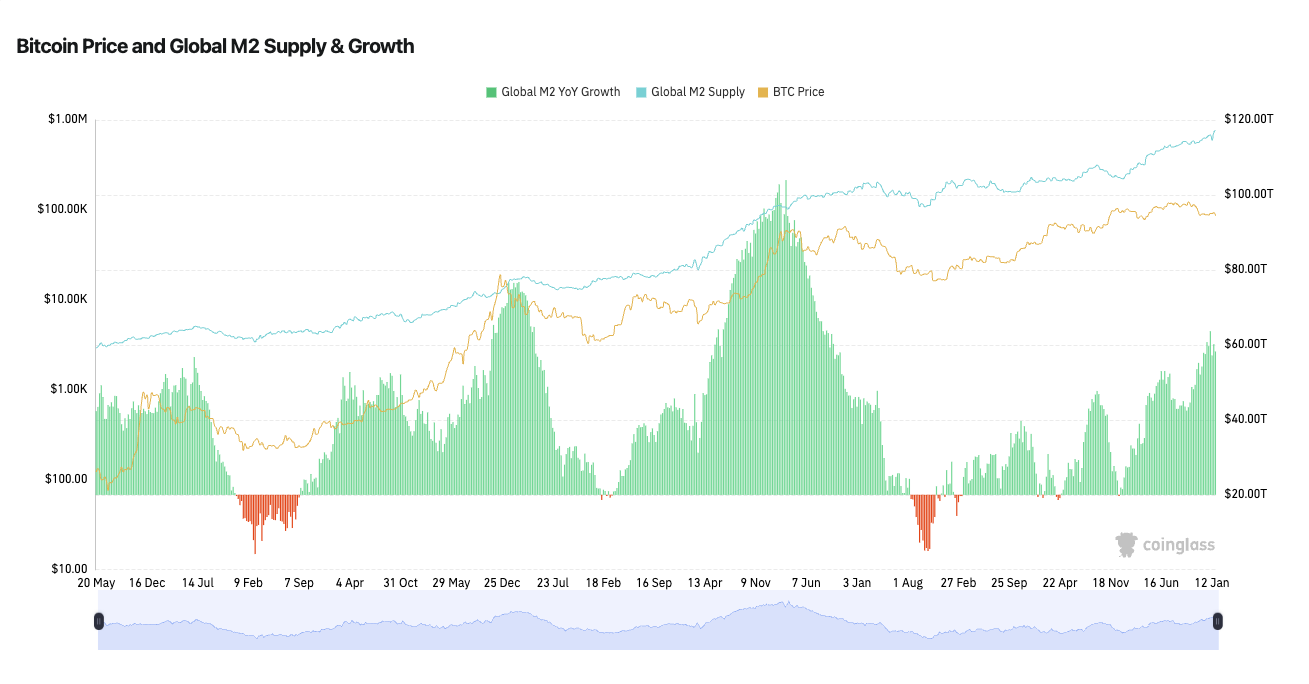

Bitcoin and global money supply

One of the key drivers many traders watch for Bitcoin is global money supply.

When central banks increase liquidity through rate cuts, stimulus, or balance sheet expansion, more capital enters the financial system. Historically, risk assets benefit from this, and Bitcoin has shown a strong tendency to react to these liquidity cycles.

More money in the system typically means higher demand for risk assets, and Bitcoin’s fixed supply can make it particularly sensitive to changes in liquidity. It’s why many traders track global M2 money supply as a macro indicator for Bitcoin.

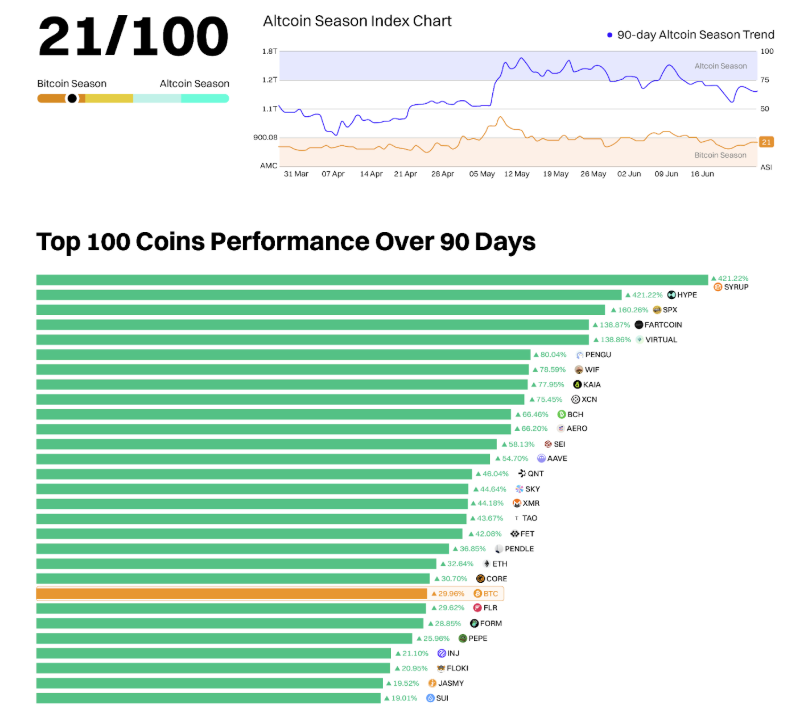

Altcoin Season Index

The Altcoin Season Index tracks periods when altcoins are outperforming Bitcoin, which can be useful for traders looking beyond BTC for higher-risk, higher-reward opportunities.

In previous cycles, early detection of these shifts has offered access to broad momentum across smaller tokens. Altcoin phases have historically delivered significant moves in short timeframes.

This tool helps you recognise when market focus is rotating away from Bitcoin and whether it might be worth broadening your exposure.

The tools and principles that work in traditional markets don’t disappear when you move into crypto. They adapt.

Technical analysis, risk management, and market timing all carry over. What crypto adds is a layer of transparency through on-chain data, ETF flows, and sentiment indicators that simply isn’t available in traditional markets.

For CFD and Forex traders, that’s a completely new potential edge.

Trading involves risk.

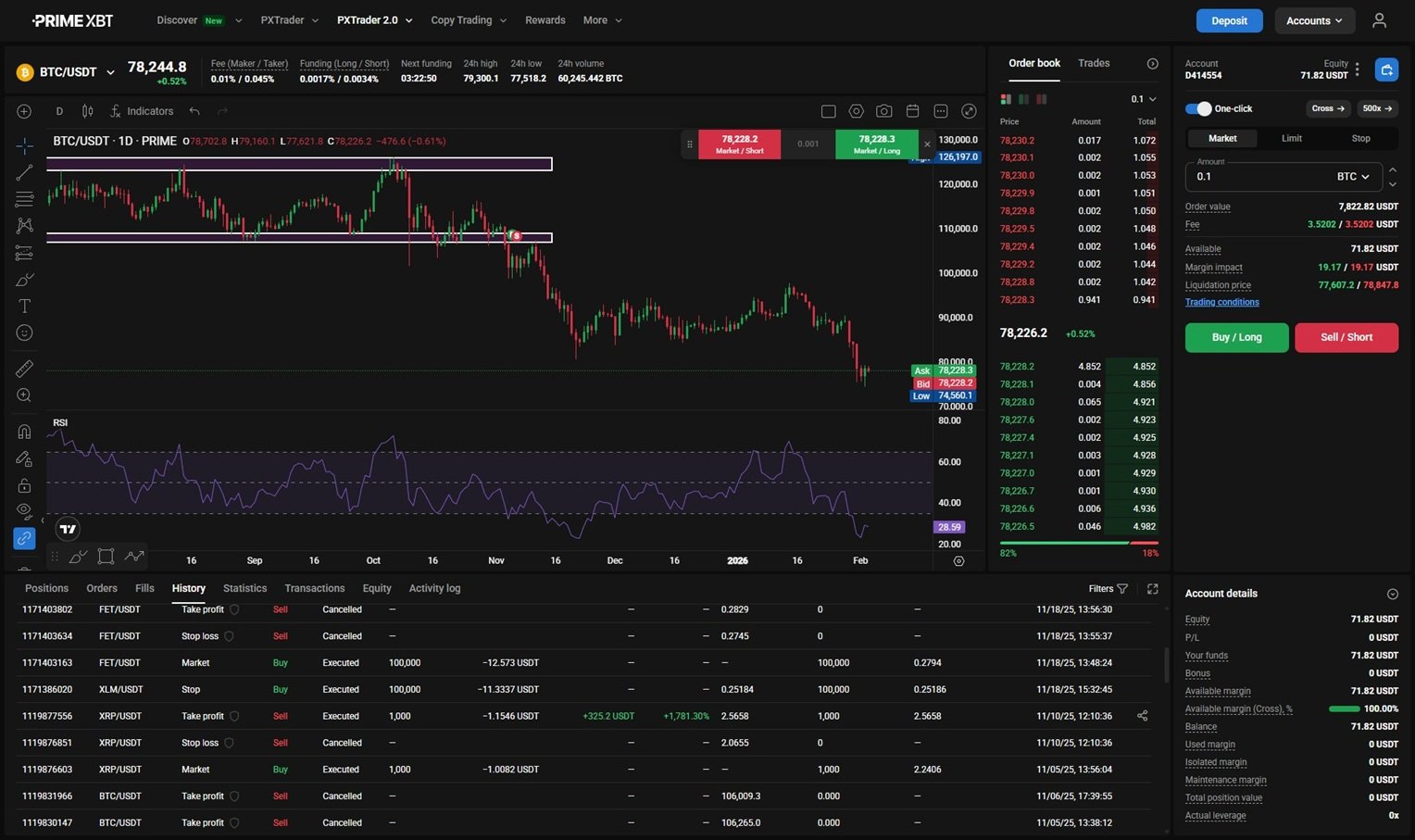

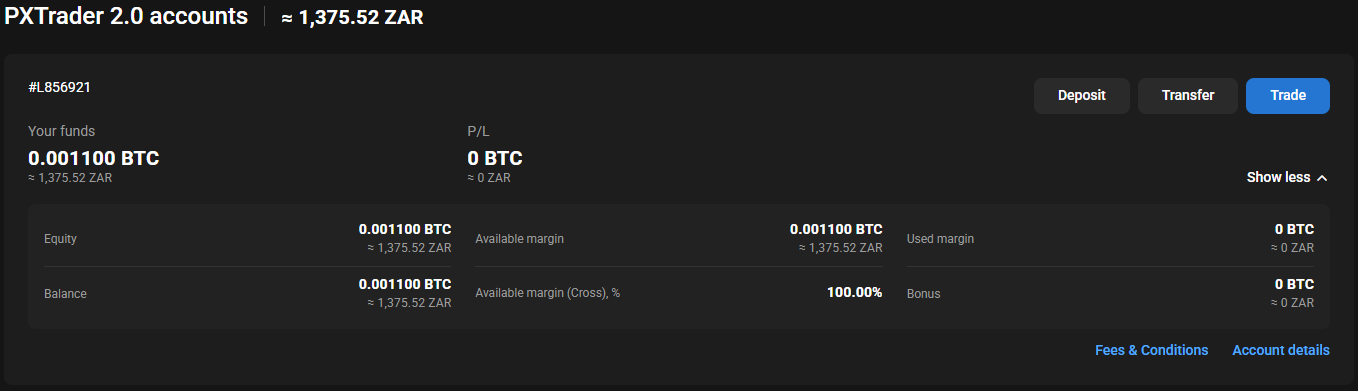

Trade Crypto Futures with PXTrader 2.0

PXTrader 2.0 is our professional trading platform, built for active traders while remaining intuitive enough for those just getting started.

We’ve designed it around speed, clarity, and control. The interface is clean and responsive, helping you read the market quickly, execute efficiently, and manage risk, even during high volatility.

Whether you are capturing short-term momentum or trading broader market moves, PXTrader 2.0 is built to help you react fast and stay in control.

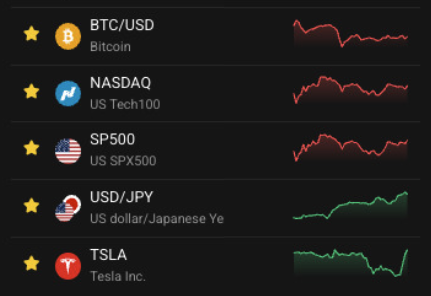

All markets in one platform

One of the key advantages of PXTrader 2.0 is multi-asset access from a single account, something many platforms don’t offer.

You can trade Crypto Futures, Forex, commodities like Gold and Oil, stock indices like the S&P 500, and individual stocks including Tesla and NVIDIA. All from one place.

No need for multiple platforms or accounts. You can move between crypto, forex, indices, and stocks seamlessly, depending on where the opportunity is.

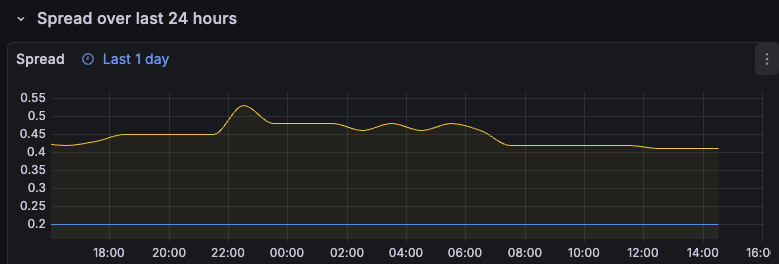

Low fees, stable and reliable pricing — 24/7

Fees and pricing quality play a critical role in long-term results, especially when trading with leverage.

High fees and unstable pricing can quickly erode profitability in volatile markets. That’s why we’ve built PXTrader with low fees, tight spreads, and reliable execution.

We connect to multiple Tier-1 liquidity providers, giving you stable pricing even during high volatility, reliable spreads across market conditions, and 99.98% uptime, 24/7, 365 days a year, with no downtime for weekends or holidays.

This infrastructure lets you focus on strategy, not execution risk.

Use Bitcoin or USDT as margin collateral

With PXTrader, you can use cryptocurrency as margin collateral.

Fund your account with USDT and trade directly, no need to convert to fiat.

You can also use Bitcoin as collateral, which lets you keep exposure to BTC’s long-term growth, trade Crypto Futures using Bitcoin as margin, and avoid selling your crypto just to access trading capital.

This gives you more flexibility in how you manage capital and exposure, especially for long-term crypto strategies.

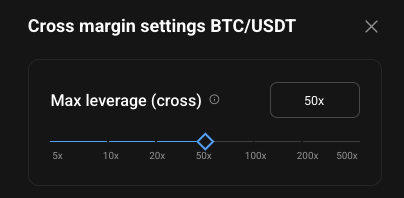

Customisable leverage

We give you full control over leverage on each instrument.

You can adjust it depending on your strategy, risk tolerance, and market conditions. For example, Bitcoin (BTC) can be traded with leverage ranging from 2:1 up to 500:1.

This flexibility lets you reduce leverage during volatile conditions, increase it for short-term strategies, and manage risk more precisely per instrument.

Leverage is a tool, and we put control fully in your hands.

TradingView charts

PXTrader is fully integrated with TradingView, giving you a powerful and familiar charting experience.

You get access to advanced drawing tools, a wide range of technical indicators, and multiple timeframes and chart types.

You can also trade directly from the chart. Placing, modifying, and managing orders visually without leaving the trading screen.

This integration helps you analyse, plan, and execute all in one workflow.

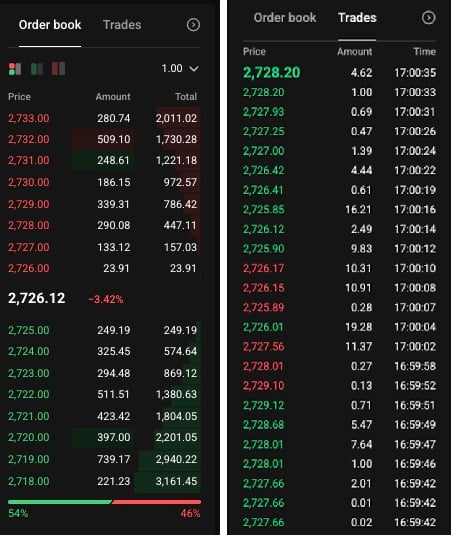

Order Book visibility

The Order Book shows market depth in real time, letting you estimate potential support and resistance levels, assess liquidity, and spot immediate buying or selling pressure.

This is especially valuable during high-volatility periods, when understanding market depth can help improve your timing and execution.

Built for active traders

We’ve built PXTrader 2.0 around what active traders need most: speed, stability, control, and flexibility.

Whether you trade Crypto Futures exclusively or combine them with global markets, the platform gives you the tools to capture volatility and manage risk effectively. And if you’ve traded CFDs before, the learning curve is minimal.

Ready to try Crypto Futures?

If you’re already trading CFDs, Crypto Futures use the same mechanics, just in a different environment.

You get 24/7 market access with no close, higher volatility than most traditional CFD instruments, momentum-driven price action, and customisable leverage from 2:1 to 500:1. The tools and execution feel familiar, but the market structure offers more frequent setups for active traders.

You can start by exploring Crypto Futures risk-free using a demo account and get familiar with all the features.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.