Understanding and capitalising on market volatility is an essential skill for active traders and investors. Volatility measures how dramatically prices move over a period of time. Financial markets with high volatility see intensified price change, while low volatility environments experience more condensed trading ranges.

Many sophisticated strategies have evolved to trade market volatility itself as an asset class. Additionally, a trader can gauge the volatility of an asset to understand how price action might unfold in the future for risk management and performance purposes.

Here we explore the foundational concepts around volatility trading, to help put you on the path towards effectively deploying these types of approaches.

What is volatility trading?

Volatility trading refers to strategies designed to profit from increases or decreases in the magnitude of price fluctuations across markets. Rather than betting on a market’s direction, a volatility trader aims to take advantage of the scale of unpredictable daily up and down oscillations. This unique tactical approach requires assessing multiple complex factors driving volatility shifts across assets to time entries and exits in trades effectively.

Several ingredients compose well-constructed volatility trades:

- Fundamental thesis on why current volatility levels seem mispriced for a given market

- Quantitative indication that volatility appears poised to expand or contract

- Instrument selection with defined risk/reward profiles sensitive to volatility

- Disciplined trade management rules and risk mitigation protocols

Getting these elements right allows traders to generate gains during tumultuous markets as well as compressed ranges. Volatility essentially becomes the asset itself, traded by speculating on its future increases or contractions. Common instruments include Futures, ETFs benchmarked to volatility indexes, and Options structured to benefit from intense or subdued price action.

Sophisticated volatility strategies demand specialised knowledge given the intricacies around quantitative indicators, Option Greeks, and advanced derivatives. But fundamentals around volatility’s core drivers, risk management imperatives, and psychological discipline still form the foundations underpinning trading success. Let’s explore essential volatility trading concepts and best practices.

How to trade volatility

Understanding market conditions

Numerous factors drive shifts in volatility. Understanding which is critical for timing proper entry and exit points in volatility-centric trades. At the heart of most volatility movements are changes in market participants’ collective emotions such as fear, uncertainty, or greed and euphoria. News events, economic data releases, geopolitical turmoil, corporate earnings announcements, and other developments can spark trader reactions that ignite extended price moves.

Technical price patterns and indicators may also foreshadow a pending storm or calmer times. For example, tightening Bollinger Bands hint volatility may be set to expand, while a sharp surge in the Chicago Board Options Exchange Volatility Index (VIX) flags a potential spike in the S&P 500’s volatility. Even phenomena like seasons and times of day see differing volatility conditions. Having an informed top-down view of these driving dynamics sets the stage for prudent volatility trading.

When establishing volatility trades, define both the market context and your timing rationale. Are you expecting an explosive short-term move or betting on a longer-term shift in the prevailing volatility environment? Will news events, earnings, economic data, or technical indicators serve as your trigger? Outlining the premise behind your setup cultivates conviction and discipline around entry and exit timing.

Also, carefully determine which instrument will serve as your trading vehicle. Options on major market Indexes, ETFs tracking volatility benchmarks, and Futures like the VIX give flexibility. Outline risk/reward profiles in advance, and scale position sizing appropriately to limit downside. Ongoing review of rewarded risks and losing trades also helps refine strategy.

Setting up a trade

When establishing volatility directional trades or spread positions, follow structured workflows to promote discipline. First and foremost be sure to select a volatile market. Outline the rationale and market view driving the trade concept, along with upside target and downside risk points. Are you expecting a lower price, or higher prices?. Survey fees and margin implications of prospective instruments like Futures, ETFs and Options to select efficient vehicles.

Calculate position sizing according to account risk tolerances, based on defined stop-losses and upside projections, to appropriately scale volatility exposure. Input structure specifics into platform analytics to verify favorable theoretic profits/losses, through projected volatility moves. Set alerts to prompt execution when technical indicators or volatility indexes align with strategy triggers.

Closely monitor trades once initiated, tracking P&L fluctuations against management thresholds. Assess if original assumptions still apply or if shifts in market conditions or volatility levels necessitate adjustments. Exit with predetermined profits as upside objectives hit. Adhere strictly to stop-loss discipline if losses breach defined downside risk limits.

Risk management

The intrinsically volatile nature of volatility strategies demands robust risk governance to avoid catastrophic losses. Always use stop-losses for directional volatility trades, capping maximum losses below danger thresholds even if volatility moves violently against positions. Execute spread positions with defined, fixed maximum loss amounts to contain possible damage.

Appropriately scale positions to avoid margin excess and account wipeouts. Consider your portfolio’s overall Greeks exposure when adding volatility trades to understand incremental risk impacts. Diversify volatility positions across diverse instruments and expiration dates rather than over-concentrating in similar assets.

Analyse and follow Greeks like vega that quantify volatility risk when using Options, ensuring additional exposures don’t spike overall account risk. Adopt portfolio-level hedges that offset losses during adverse volatility shifts. Maintain trading plans detailing strategy-specific risk protocols and loss limits mandated before closing positions.

The crucial but often overlooked risk management element lies in emotional discipline. Volatility’s rapid oscillations often prompt panicked over-reactions incongruent with predefined plans. Commit to adhering to entry/exit thresholds, strategy adjustment rules, and stop-losses detailed in trading plans, regardless of intrinsic instincts, even as volatility moves precipitously.

Strategies for volatility trading

Long volatility strategies

When anticipating spikes in volatility, traders use instrument like call Options, long Futures positions, and volatility-tracking ETFs and ETNs to benefit from upward price surges. This directional exposure allows you to capture intensified daily price swings. If the market falls, long volatility trades offset losses.

One common long volatility trade uses VIX call Options contracts to benefit from equity market turbulence. A call Option bets on You purchase VIX calls betting on volatility expansion, with defined risk capped at the premium paid. Correctly timing entry when Options are cheap magnifies upside. Exit if the VIX drops below key thresholds rather than expiration.

Complex long volatility strategies combine Options contracts and volatility derivatives. One method uses ratio call spreads on the S&P 500 combined with long exposure to VIX Futures or VXX ETNs. Market slides produce substantial gains thanks to directional futures positions and accelerated time decay in short options.

Short volatility strategies

When indexes grind within condensed ranges or volatility appears poised to decline, short volatility trades aim to capture time decay and falling volatility values. Instruments like put Options, inverse volatility ETFs, and short VIX Futures provide inverse exposure. These benefit from falling volatility but lose value in turbulent conditions.

A common short strategy utilises put Options contracts on volatility products. A put option on volatility products bets on lower volatility ahead. For example, during placid markets you might short SVXY puts anticipating sideways VIX moves and erosion of Option time premium. Defined and limited risks make short put positions appealing. Choose conservative strikes below current price allowing volatility room to fall further.

For aggressive short exposure, complex Option spreads like put ratio spreads on the VIX trade inverse volatility while controlling risk. Here substantial inverted exposure generates gains when volatility drops, hedged with long puts limiting damage if turbulence erupts. Note these sophisticated trades require experience to manage, especially during volatile markets.

Neutral strategies

When a clear volatility trend is uncertain, neutral approaches aim to extract profits during both rising and falling volatility moves. These adaptable strategies use spread instruments to isolate exposure to time decay or shifting volatility regimes over directionality.

Iron condors and butterflies centering strikes near current volatility levels provide defined risk profiles. As VIX prices rise and fall across middle bands, decays in opposing Options generate profit. Appropriate structure, sizing and timing allows capturing volatility oscillations.

Calendar spreads on the VIX and volatility-themed ETFs like VXX also offer neutral exposure. Here longer dated long calls or puts are paired against short-term short calls or puts. The divergence in time decay and volatility sensitivity between legs produces gains during different volatility environments.

The crucial element for these neutral strategies is correctly gauging the anticipated volatility range rather than outright direction. Approaches must be actively managed, shifting positioning as volatility evolves. Strike distances from market levels, risk/reward profiles and position sizing all demand adjustment.

Key indicators and tools

Volatility indexes

Volatility indexes like the VIX quantify expected shifts in the market, serving as key indicators for volatility exposure. The VIX tracks real-time estimates of coming 30-day volatility in the S&P 500 calculated from index Option prices. VIX levels above 20 signal elevated volatility expected in the Equities markets and may hint at turbulence ahead. Readings below 12 flag placidity. Traders examine VIX moves, especially extreme intraday spikes or plunges, to isolate volatility entry and exit signals.

Meanwhile currency, Treasury, Commodity and country-specific volatility indexes like the OVX aid in assessing volatility across asset classes. Various factors impact these unique asset classes differently.

Technical indicators

Beyond indexes, numerous technical indicators also evaluate volatility. The Average True Range (ATR) plots historic daily price oscillation ranges. Expanding ATR signals rising volatility, while contracting ranges suggest lowering volatility ahead.

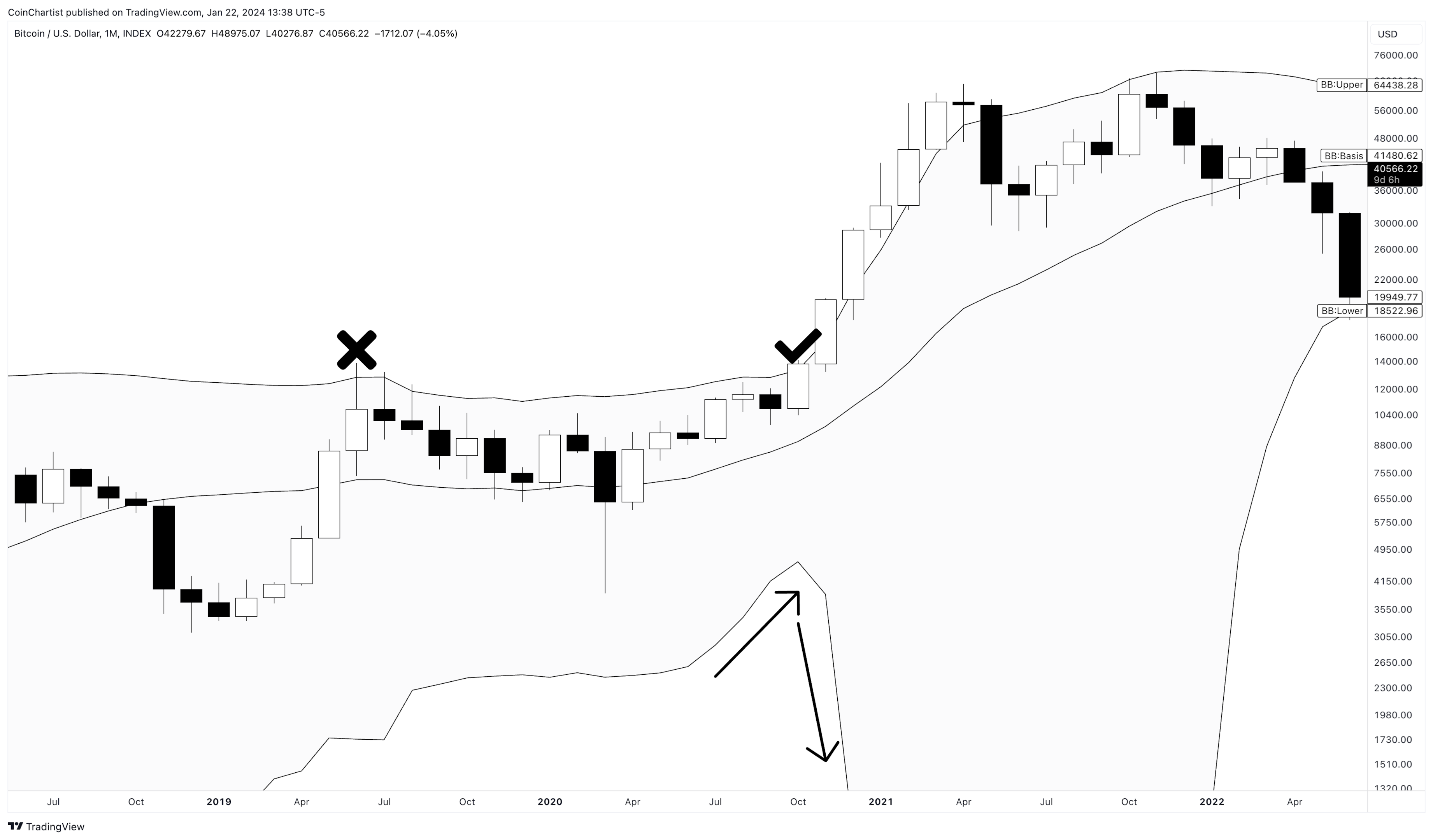

Bollinger Bands study overbought and oversold levels along with volatility. Tightening bands often foreshadow pending volatility expansion, as prices consolidate before explosive moves. Traders can use the contracting and expanding nature of the Bollinger Bands to build a trading plan. That way, they only place trades before volatility increases and avoid sideways markets.

The above example demonstrates how to use the Bollinger Bands as part of an effective trading strategy and anticipate volatile markets like professional. The Bollinger Bands tighten to an extreme, showing that there is a distinct lack of price movements and low volatility state. Even though there is a sharp rise early on in the chart in percentage terms, the price fails to break above the upper Bollinger Band, marked with an X. The check mark shows when price breaks above the upper Bollinger Band, the price rises rapidly from there. The Bollinger Bands then expand to show the stocks’ sudden high volatility.

Donchian and Keltner Channels build bands around prices using recent highs and lows. Prices breaking out of channels flags volatility potential. The Relative Volatility Index (RVI) compares current and past price volatility using standard deviation, moving higher with expanding volatility.

Implied volatility vs historical volatility

Historical Volatility (HV) measures actual realised trade volatility of past price changes over fixed periods, using statistical standard deviation calculations. Metrics like a Stock’s 30-day HV quantify genuine price oscillations already witnessed.

Implied volatility attempts to forecast future expected volatility based on current Option contract premiums. Using a pricing model, IV derives expectations for impending volatility priced into Options during market trading. Rather than observe actual volatility, IV extracts estimates of future volatility anticipated by the options market.

Comparing historical versus implied volatility often proves insightful:

- Extreme IV expansion beyond historical norms may signal traders overpricing future volatility. This hints at pending volatility compression fueling short volatility trade opportunities once premiums normalize closer to HV.

- Major gap downs between IV and HV arises during extreme volatility spikes. This flags potential mean reversion allowing long volatility positions if IV converges back towards historical precedent.

- HV trending higher while IV holds steady prompts chance to exploit lagging IV underestimating brewing volatility. Buying Options or long volatility positions can capitalize on expansion after breaks higher.

The interplay between actual and expected volatility through changing market conditions provides helpful metrics. Savvy volatility traders continually assess both historical and implied volatility measures to better time entries and exits deploying long, short or neutral trading strategies. The nuanced relationships between the volatility types assists in positioning as regimes shift.

Trading platforms and tools

Online Stock trading platforms and analytics software provide invaluable data and functionality for analysing positions and managing volatility trading strategies. Charting and screening tools quickly compare current to historical volatility across diverse markets using technical measures like ATR, Bollinger Bands, Donchian Channels, Moving Averages, and RVI.

Robust trading platforms also allow efficiently implementing and adjusting sophisticated option and volatility derivative strategies. Advanced analytics packages even feature backtesting capabilities to refine strategy performance through various turbulence regimes.

The crucial element is actually utilising these powerful fintech innovations rather than just accessing them. Traders should commit to thoroughly learning platforms, practicing strategies via paper trading, setting up actionable screeners and alerts for entry/exit timing, and reviewing performance data to continually optimise.

Explaining Options trading

Options contracts are a strategic financial instrument designed to structure directional or neutral volatility trades and manage risk. Call Options confer right to buy underlying asset at predefined “strike” prices by the Option expiration date. Puts provide rights to sell underlying assets at set a strike price by expiration. These volatility-sensitive leveraged vehicles allow controlling large positions with relatively low capital outlays.

Factors like the underlying Stock market price relative to the Option strike, time until expiration, and volatility environment all heavily influence Options valuations. Deep in-the-money Options have underlying security prices substantially above the call strike or below the put strike. These have high intrinsic values reflecting greater likelihoods of finishing in-the-money at expiry.

Deep out-of-the-money Options exhibit strike prices dramatically above (for calls) or below (for puts) security market values. Limited chance of reaching profitable in-the-money positions means minimal intrinsic value and high risk of expiring worthless at expiration. However, sizable price swings in the underlying security triggered by shifting volatility conditions can still render these Options valuable for speculative traders.

The interplay between these dynamics necessitates active strategy management. For example, multi-leg Option spreads like iron condors combine both long and short positions across put and call Options to benefit from constrained volatility environments. Appropriate strike laddering while optimising net credit/debit spreads boosts probability of profit zones between bands.

A straddle strategy is an Options strategy that simultaneously buys call and put Options at the same strike, benefiting from substantial underlying asset price movements in either direction. The dual exposure allows capturing intensifying volatility expansion.

To profit from falling volatility expectations, volatility skews offer effective vehicles. These positions are simultaneously selling out-of-the-money Options at strike prices expected to expire worthless, while buying closer to at-the-money Options to hedge risks if volatility rises. Skews efficiently target time decay, a key factor when volatility compresses.

Challenges and common mistakes in volatility trading

Despite diverse tactics to trade market turbulence, volatility strategies pose substantial challenges. The inherently unpredictable nature of volatility itself leaves effective timing and positioning difficult. Strategies demanding precision in volatility forecasts can quickly lead to mistakes and losses if actual conditions deviate severely from expectations.

Traders also commonly overcomplicate approaches, deploying excessively complex Options structures with theoretical benefits but real-world management difficulties. Erroneous structure assumptions, improper position sizing, and emotional trading errors can escalate the risk of losing positions.

Meanwhile, the intrinsically higher costs of hedged and exotic volatility derivatives like VIX Options erode upside potential relative to simplistic directional positions. This drives a need to minimise expense ratios through careful product selection, trade timing and structure efficiency.

By concentrating on sound risk practices, traders can overcome many of these hurdles. Maintaining defined and limited risk profiles, appropriate position sizing, balanced Greeks, and disciplined trade entry and exit rules all support navigating diverse volatility regimes. Adopting an emotionally detached perspective, managing exposures through various turbulence scenarios, and focusing on expanding strategic knowledge also helps overcome common trading volatility pitfalls to achieve lasting success.

Conclusion

While trading volatility presents substantial challenges, the potential rewards legitimise the inherent complexities. Developing expertise across the considerations covered here facilitates consistently benefiting from shifting volatility cycles across any market.

Master assessing driving volatility forces, deploying long, short and neutral volatility strategies, and effectively leveraging key indicators and platforms. Adhering to structured risk management best practices helps avoid common mistakes that exacerbate volatility’s unpredictable nature.

Internalise these comprehensive volatility trading strategy foundations, and you position yourself to profitably ride the turbulence ahead.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.