Technical trading can often mean the difference between growing one’s capital quickly or licking one’s wounds after a string of losses. Learn all about technical analysis below!

Interested in learning about technical analysis and want to know just how accurate is technical analysis? This detailed guide will explain all the ins and outs of technical analysis to get a new trader started, as well as advanced methods to improve an experienced trader’s chances of success in the world of finance.

Everything from an explanation of trendlines, candlesticks, chart patterns, and more are included, as well as a comparison between fundamental and technical analysis that should remove any lingering confusion.

Technical Analysis Definition

Technical analysis is one of the most important tools in any trader’s arsenal and can help predict the direction and even level at which a price will move, trend changes, and much more. By definition, it’s a discipline that involves using a variety of statistics, patterns, trendlines, indicators and more, in order to make educated and effective decisions before entering or exiting a position or making an investment. After that trade has been made, technical analysis can ensure a trader is prepared for any sudden market turns and allow them to profit whichever way the market is moving.

Technical analysis can be performed on any type of asset, traditional, such as commodities, forex, stock indices, and more, as well as digital assets such as Bitcoin and other cryptocurrencies.

History of Technical Analysis

Technical analysis was first introduced by Charles Dow in the 1800s, and the most prominent stock index, the Dow Jones Industrial, is named after the man who popularized the discipline. Since Dow, several important figures have since contributed to the study and designed a number of tools, indicators, theories, and practices.

Other famous technical analysts and traders include Jesse Livermore, who popularized the Livermore Accumulation Cylinder, billionaire investor George Soros, Steven Cohen, Ray Dalio, or the legendary trader William Delbert Gann, who used astrology to famously and accurately time the tops and bottoms of market cycles.

Fundamental Analysis Versus Technical Analysis

Technical analysis varies greatly from fundamental analysis, but both are extremely important and helpful tools for traders to use when considering investing or taking a trade position in any financial asset.

Whereas technical analysis involves charts, trendlines, and timeframes, fundamental analysis typically starts with a financial statement and takes a long-term approach to analyzing an asset’s potential performance.

Fundamental analysis also takes into account an asset’s overall impact on the economy, or the political issues facing the region in which the asset is derived. Fundamental analysis tells analysts if an asset is viable in the long term in the overall financial world, while technical analysis is used to understand short- and long-term price movements.

Facts About Technical Analysis

Here are the most important facts about technical analysis. Traders should focus on these key areas to learn how to do technical analysis on their own, and develop the analytical eye necessary to forecast price movements ahead of time.

Price Considers Everything

Price action is driven by a variety of factors, such as the basic balance between supply and demand, the emotional state of traders, news, rumors, and more, as well as external actors such as politics, weather, and others.

These factors will cause the price of an asset to rise or fall, depending on how the market participants react to certain events and changes in the overall market landscape.

Price Movement Delivers The Trend

Regular increases or decreases in a market form a trend, and the price typically follows in that trend direction until something significant occurs that changes the said trend. A dramatic news event, a major disruption to supply and demand, and other factors often suggest a trend change is possible.

Once a trend change is confirmed, traders should look to alter their technical analysis and trading strategies accordingly. The trend is your friend.

History Repeats Itself

Markets are also cyclical, and history often repeats itself. Many traders include time, and important dates into their technical analysis. There’s a theory called the Halloween effect that urges traders to buy up an asset in anticipation of an increase occurring during the winter months, while the term “sell in May and go away” speaks to assets typically in decline during the wearer summer months when market interest wanes. Markets also go through bear and bull cycles, and much more.

Technical Analysis Tools

Using a few basic principles and tools, anyone can learn technical analysis and in no time become an expert themselves. Familiarizing oneself with the meaning of the below terms will be an important first step.

Trend Lines

Trend lines are lines drawn on a price chart of an asset, just under or over the asset’s local pivot highs or lows, to indicate that price is following a particular direction. These lines exist based on the natural placement of buy or sell orders by market participants, and the raising or lowering of stop loss levels, or where natural profit-taking may occur.

A trend line typically is required to have multiple touches to be considered valid, and traders are recommended to watch for a break and close above or below trend lines, before taking any action. However, trendlines can also be used to help a trader make a decision even before the trendline has been breached and is no longer valid.

These trendlines also represent helpful guides for where a trader or investor may be interested in opening or exiting a position to maximize gain and minimize risk.

Support and Resistance Levels

Support and resistance levels can either be horizontal, or diagonal. Trendlines often rise and fall, and represent diagonal support or resistance. Horizontal resistance or support are often prices that represent a historic level or are a significant rounded number.

Support is a level on price charts in which price has typically rebounded from in the past and could provide yet another bounce if the price gets there and buyers step in.

Resistance is a level on price charts in which price has typically been rejected from, representing an area of interest for sellers to begin taking profit.

Moving Averages

Moving averages are an indicator layered over price charts that represents the average price of an asset across a certain time period. Moving averages can be short- or long-term, across daily, weekly, or even longer timeframes.

Investors and traders typically use moving averages not only to find levels that may act as support or resistance but to understand if a trend in an asset class is changing.

When short term moving averages cross below or above a longer-term moving average, the event is called either a death cross or golden cross, named for the corresponding price action that typically follows. Death crosses are bearish, and often indicate that the asset will soon fall into a downtrend, while golden crosses are bullish and represent the wealth that investors are likely to generate from the trend that follows such an occurrence.

Trading Volume

Trading volume is another extremely important tool for traders to use to determine interest in an asset. Volume typically proceeds price action, and keen-eyed technical analysts can often spot trend changes in the price of an asset by watching trading volume.

Trading volume also is used to confirm the validity of a movement. Oftentimes, an asset will break down or up, but volume doesn’t follow, suggesting buyers or sellers are hesitant and uncomfortable with taking an actionable position. However, if the same movement occurs with strong volume, chances are that much higher for the move to be valid, and not result in a fakeout.

Chart Patterns

One of the most helpful tools a trader can use when performing technical analysis is to watch for certain patterns to appear on price charts before taking a position. Using trend lines, technical analysis can draw triangles and other geometric shapes on price charts.

If an asset trades within one of these patterns, detailed statistical analysis has been performed that suggests certain patterns will break in one direction over another, providing traders who spot such patterns an advantage in the market.

In addition to knowing which way a pattern might break, oftentimes these patterns can also tip traders off as to the target of the ultimate price movement that occurs, allowing traders to prepare in advance and ensure take profit levels are determined ahead of time.

Common bullish price patterns include ascending triangles, falling wedges, inverse head and shoulders, and more. Bearish price patterns include descending triangles, rising wedges, double tops, and head and shoulders patterns.

Candlesticks

Japanese candlesticks were introduced to assist technical analysts and traders in getting tipped off of upcoming price movements. Depending on how a candlestick opens, closes, and the price action within each candle can cause a candlestick to close in a particular shape or pattern.

These shapes or patterns of candlesticks can also be used to predict future price movements. A Doji, for example, is a type of candlestick pattern that often tells analysts that there is indecision in the market, and a trend change could soon occur.

While candlesticks aren’t always effective in and of themselves, combining the analysis of candlesticks with chart patterns, moving averages, trading volume, and more can have a dramatic effect on increasing a trader’s success rates.

Fractals

Fractals are repeating patterns that play out on price charts, oftentimes on increasingly lower timeframes. Fractals add validity and credence to the idea that markets are cyclical, and each cycle is a direct impact of the emotional state of traders. These emotions lead to repeating patterns on price charts, that if spotted well enough in advance, can tip a trader off as to how the price action may unfold.

Indicators

In addition to volume, other helpful indicators have been developed to add to a trader’s arsenal and offer even more changes to determine future price movements before they occur.

Commonly used indicators include the Stochastic Oscillator, Bollinger Bands, the Acceleration Deceleration indicator, and the MACD – the Moving Average Convergence Divergence indicator.

Technical Analysis Examples

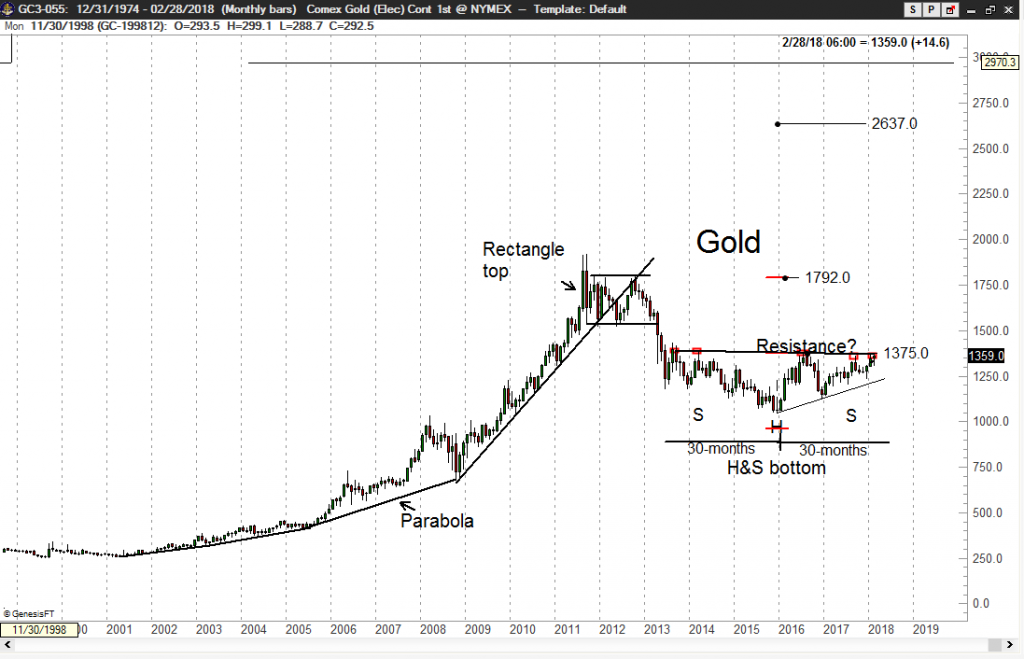

Gold Market, Peter Brand

In the below technical analysis from career trader Peter Brandt, the experienced trader uses chart patterns, trend lines, and support and resistance levels to chart out the performance expected within gold markets.

Fast forward to today and Peter’s charts played out perfectly with gold closing back in on its previous all-time high. If resistance at $1792 can be breached, by measuring the pattern, a target of $2637 can be expected.

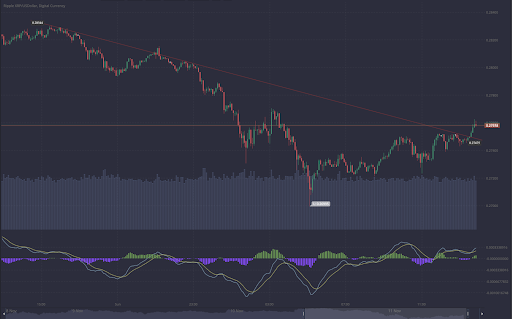

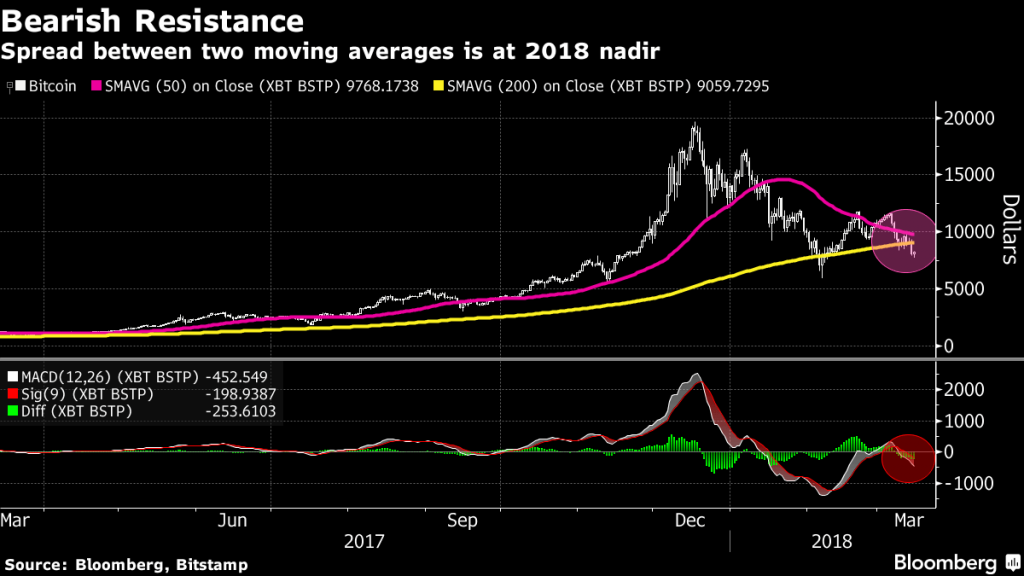

Bitcoin Market, Bloomberg

In the chart offers by Bloomberg reviewing two important moving averages on Bitcoin, and the MACD, a bearish trend could be spotted before a further fall ever occurs. The chart, from early 2018, was able to call for the eventual bearish breakdown of Bitcoin, to as low as $3,000 before it rebounded.

Tips for Traders

Trading can be extremely lucrative and rewarding, for those willing to take the time to learn the ins and outs of trading, find a reliable trading platform with the right tools, and develop the skills and emotional state necessary to find successful trading strategies.

Remove All Emotions

Among the most critical things a trader can do to improve the success rate of trades, is to completely remove emotion from their trading activities. Panic selling, FOMO-buying, or even revenge trading can all result in extreme losses if a trader’s emotional state isn’t carefully contained. These sort of trader can often lead to a streak of losses, as the trader seeks to recoup losses.

Develop a Plan Before Taking a Position

Traders are advised to always have a full plan, complete with entry point, and take profit levels before entering a position. Stop losses can be set to avoid further losses if a position goes in the opposite direction the trader expects. Having a plan in place ahead of time ensures that emotions don’t get in the way and convolute the strategy set in motion by the trader, and result in either loss or less profitable trade.

Finding the Right Platform

One of the most important aspects of trading is finding the right platform to trade on. Not only must this trading platform provides access and exposure to the asset the trader is interested in, but the platform must also provide tools that allow for proper use of technical analysis, advanced order types to manage positions, and offer an extremely reliable trading engine. Additional aspects such as customer support, reputation, and privacy should also be considered.

PrimeXBT offers up to 1000x leverage on a variety of assets, including cryptocurrency assets like Bitcoin, EOS, Ripple, Ethereum, and Litecoin, as well as traditional financial assets like commodities, stock indices, the world’s most popular forex currencies, and spot contracts for precious metals gold and silver.

What is technical analysis in trading?

Technical analysis is a method used by traders to predict future price movements by analyzing past market data, including price charts, patterns, and trends. It helps traders make informed decisions on when to buy or sell assets.

How does technical analysis differ from fundamental analysis?

While technical analysis focuses on price trends and patterns to forecast short- and long-term movements, fundamental analysis evaluates an asset's intrinsic value based on economic indicators, financial statements, and external factors like politics.

What tools are commonly used in technical analysis?

Key tools include trendlines, support and resistance levels, moving averages, candlestick patterns, chart patterns like triangles or head and shoulders, and indicators such as MACD and Bollinger Bands.

Can technical analysis be used for all types of assets?

Yes, technical analysis is versatile and can be applied to various assets, including stocks, forex, commodities, and cryptocurrencies like Bitcoin.

Why is technical analysis important for traders?

Technical analysis helps traders identify trends, determine entry and exit points, and make data-driven decisions, increasing their chances of success while minimizing risks

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.