Bitcoin slumped for three straight days at the end of last week, dropping below 65,000 before recovering back to 68,000, where it is currently trading. Despite the rebound, Bitcoin remains 8% off its all-time high of 73,800 reached last week.

While Bitcoin bore the brunt of last week’s downturn, altcoins weren’t spared. Ethereum and Binance Coin lost over 10% in the selloff, and Dogecoin and Shiba Inu, popular meme coins, plunged by almost 20% and 30%, respectively.

What caused the sell-off?

Following two weeks of soaring cryptocurrency markets, which saw Bitcoin rise to record highs and other altcoins reach new peaks, a move lower is hardly unusual. Markets don’t just rise in straight lines, so this could have been a natural correction lower, especially given the speed at which the price had risen, possibly too fast for the market to price correctly.

The exact reason behind the deep selloff is unclear but could be a combination of several factors.

Slower ETF inflows

Soaring ETF inflows have been one of the main driving factors behind Bitcoin surging to record highs. However, ETF recorded one of their lowest net inflows of just £132 million on March 14, down 80% from March 13. The fall on Thursday marked a second straight day of declines as flows eased to $684 million, down 38% from Tuesday’s record $1.05 billion.

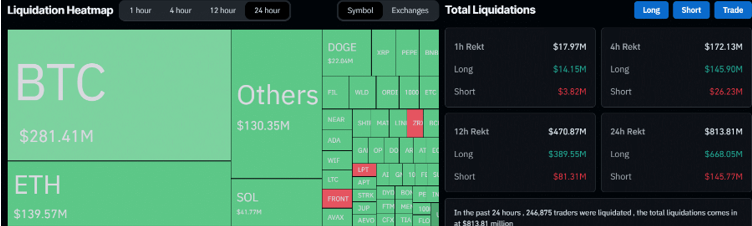

Liquidations

The Coinglass data revealed that the crypto market experienced substantial liquidations, which rattled the landscape. On Friday, $740 million worth of crypto positions were liquidated, and Bitcoin bore the brunt with a liquidation of $246.6 million, of which $195.61 million was concerned with long positions. This pointed to overleveraging by buyers who were caught off-guard by the sudden move lower. This compounded the sell-off as sell orders were triggered en masse.

Weaker sentiment

The selloff in Bitcoin coincided with a selloff in the US equities market, particularly the tech-heavy Nasdaq 100. The Nasdaq 100 fell just shy of 2% across the final three days of last week as risk appetite soured.

Hotter-than-expected inflation data last week, as CPI and PPI were higher than expected, raised bets that the Federal Reserve could keep interest rates high for longer. This not only lifted the USD, which traded 0.7% higher versus its major peers, but also hit demand for riskier assets such as equities and Bitcoin.

Bitcoin’s sudden fall from 73800, an all-time high, to a low of 64,500 wiped out $100 million in Bitcoin positions.

Where next for Bitcoin?

Bitcoin has risen from last week’s low but remains below 70,000. Looking ahead, there could be a level of caution this week ahead of the Federal Reserve interest rate decision on Wednesday, March 20th. The Fed is expected to leave rates unchanged between 5.25% and 5.5% but could adopt a more hawkish tone after last week’s sticky inflation, which may hurt risk sentiment.

However, more broadly, the outlook for Bitcoin remains bullish should ETF inflows hold up and ahead of the halving event next month, which will reduce supply, supporting the Bitcoin price.

Sources

https://coinpedia.org/news/why-bitcoin-price-crashed-today-here-are-the-top-reasons/

https://coingape.com/trending/why-crypto-market-has-crashed-today/

https://coingape.com/crypto-market-selloff-top-reasons-why-bitcoin-eth-xrp-ada-shib-crash-today/

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.