Bitcoin fell 5.2% last week in its worst weekly performance in a month. The price started the week at 115.7k before falling sharply to a low of 108.6 on Thursday. The price has recovered to a higher level since clawing back above the 110k mark at the start of the new week, reaching 111.3k at the time of writing.

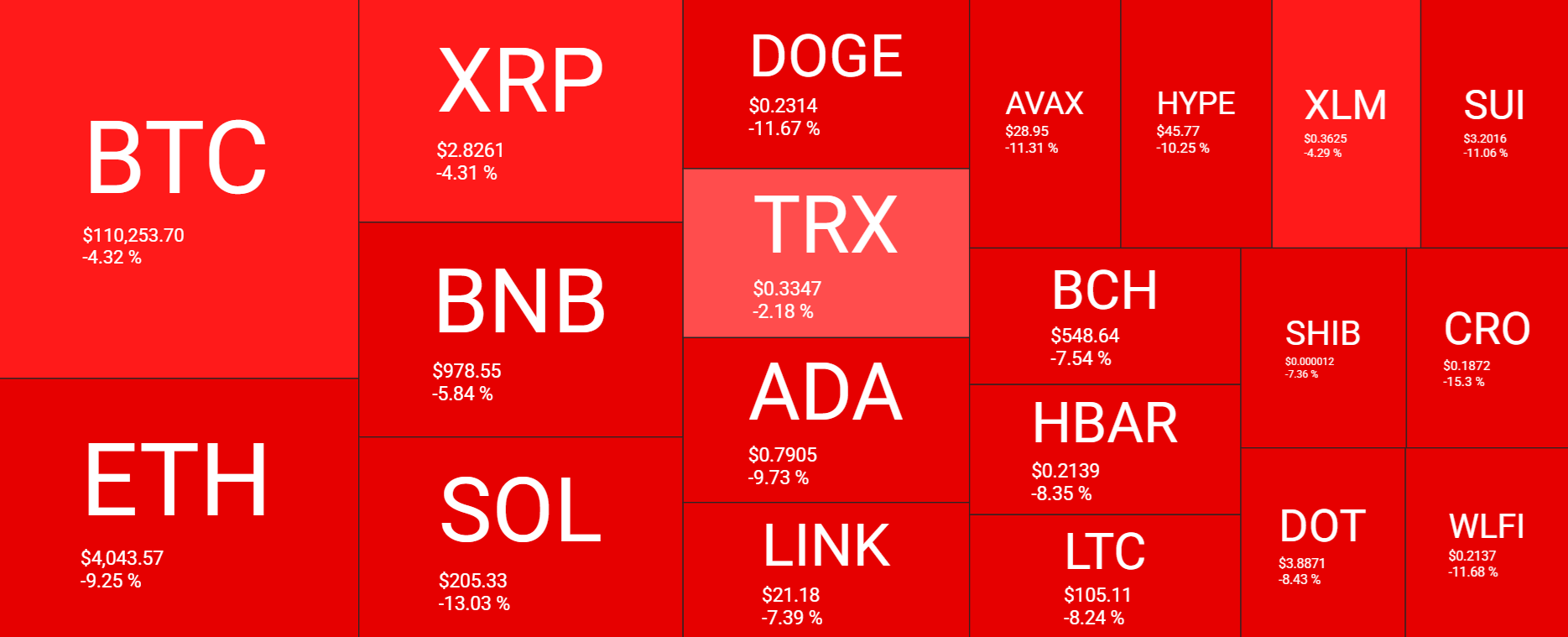

While Bitcoin fell sharply, altcoins were a sea of red. Ethereum dropped by almost 10% over the past 7 days, Dogecoin dropped 11%, and Solana tanked by 13%. Ripple and BNB fell 4% and 5% respectively.

The total cryptocurrency market capitalisation has fallen from $4.04 trillion a week ago to $3.81 trillion at the time of writing. While this represents a 5% decline, it marks a recovery from a low of $3.72 trillion on Thursday.

Sentiment analysis -Fearful conditions could present an opportunity?

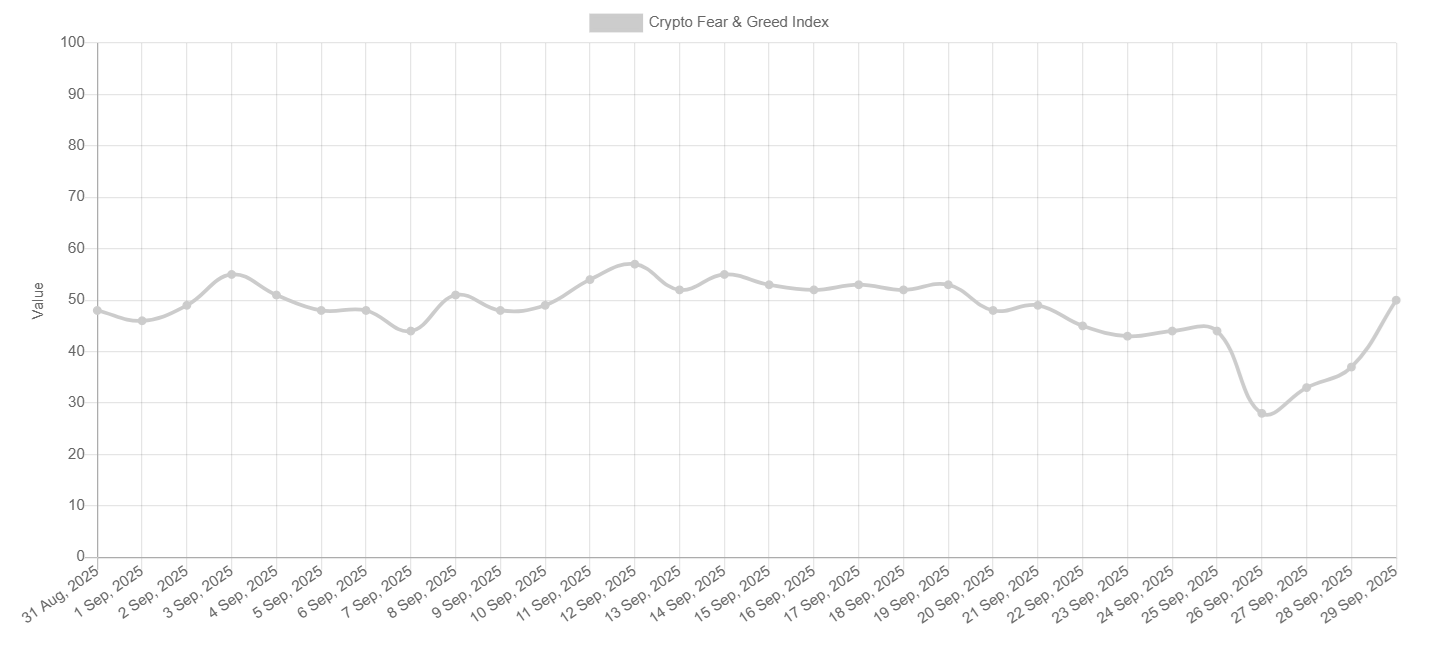

Sentiment analysis reveals a marked deterioration in the mood towards crypto before a sharp recovery from the weekly low. According to Alternative Me data, the Fear and Greed Index is at 50 Neutral, having recovered from a low of 28 (Extreme Fear) on Friday, its lowest level since March. The crash in the Fear and Greed Index shows just how quickly sentiment can reverse when key thresholds fail to hold.

While the fearful mood can lean towards a bearish stance, these conditions can provide an opportunity for long-term traders. Extreme Fear levels can typically appear before a significant rebound. The recovery in the Fear and Greed index has already reached 50, which could suggest that some trades are already positioning for a turnaround.

Liquidations

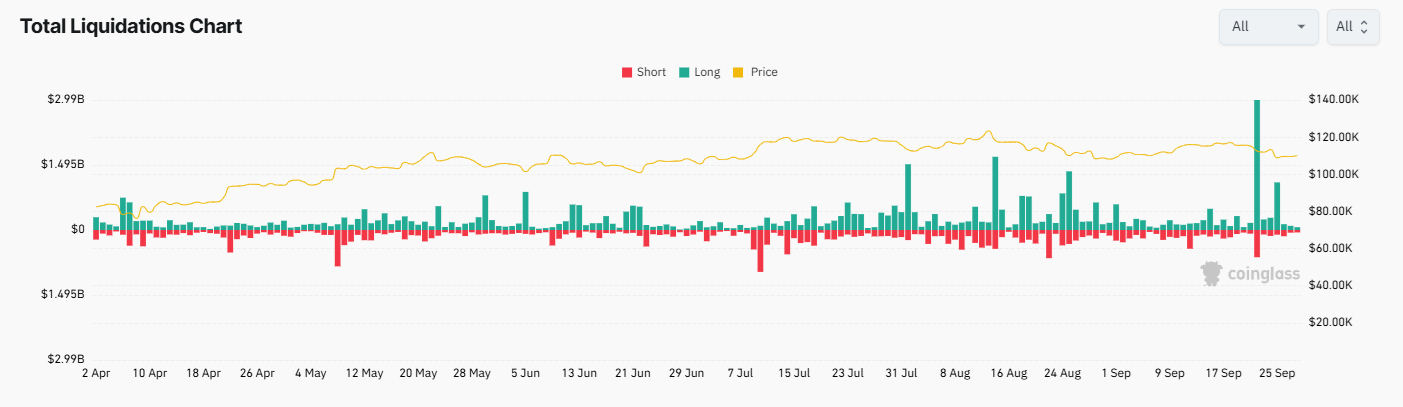

Bitcoin started the week on a negative note, dropping 2% and triggering the largest single-day liquidation event of the year, with $1.65 million in long positions compared to $145.83 million in shorts, highlighting excessive bullish positioning among traders. The sour market conditions continued after Monday’s massive liquidations. BTC dropped to $ 108.6k on Thursday, triggering another wave of selloffs worth $1.09 billion in long positions.

BTC leverage is close to a yearly high

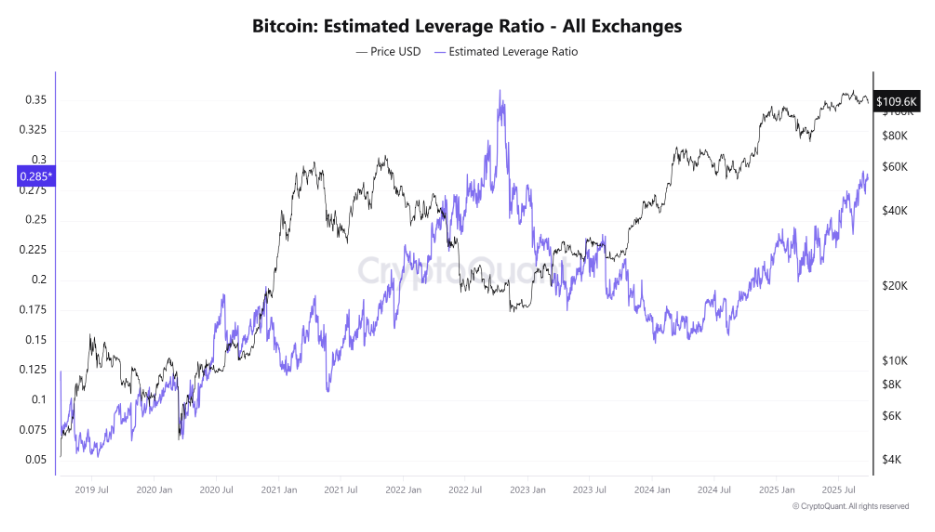

Despite these heavy rounds of liquidations, CryptoQuant’s BTC Estimated Leverage Ratio (ELR) was 0.285, close to its yearly high of 0.291 reached on September 11. However, this is still well below the record high of 0.358 recorded in 2011. This suggests that traders are still moderately overleveraged, but not excessively so.

A higher ELR indicates that traders are using more leverage relative to the BTC available on the exchange. Meanwhile, a drop in ELR after liquidations can mark a healthy reset, laying the ground for a more sustainable trend.

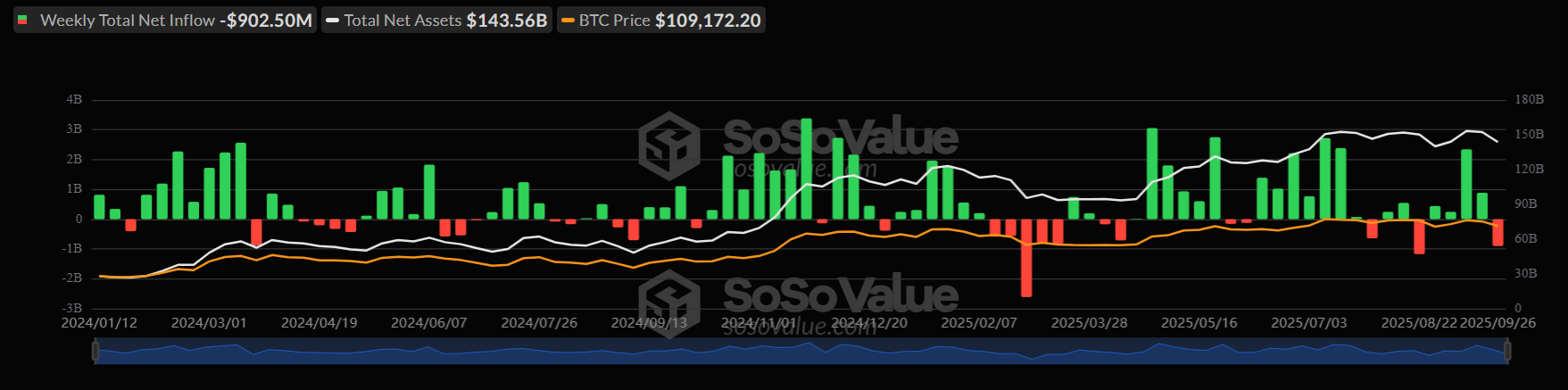

BTC institutional demand falls

The Bitcoin price correction this week came as institutional demand fell. According to SoSovalue data, BTC ETFs recorded $902.5 million in net outflows, marking the end of a four-week run of net inflows. If net outflows persist, BTC could come under further pressure.

It’s not just Bitcoin suffering redemptions last week; Ethereum also saw significant outflows of $796 million. After weeks of resilience, the coordinated withdrawal from the two top digital assets suggests a cooling in institutional crypto demand, indicating that risk appetite is waning.

However, it is worth noting that across September, BTC ETFs recorded net inflows of $2.57 billion.

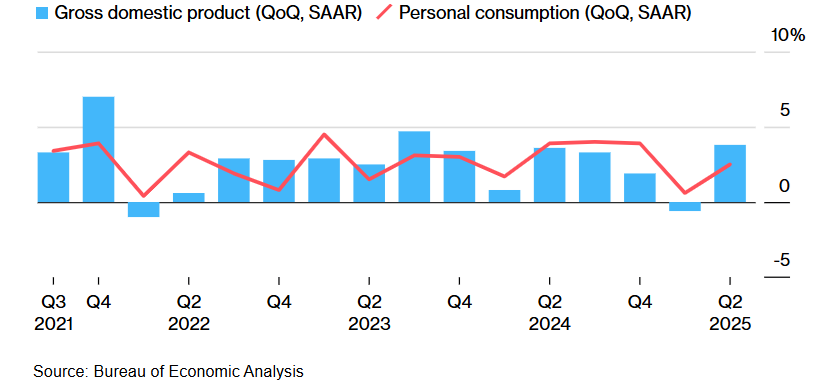

Macro backdrop – rate cut expectations

Stronger-than-expected data, combined with less dovish remarks from Federal Reserve Chair Jerome Powell last week, have raised questions about the Fed’s ability to cut rates aggressively and have supported the USD.

The third revision of Q2 GDP was lifted to 3.8% annualized, its fastest pace in two years, thanks to strong consumer spending.

At the same time, durable goods orders rebounded 2.9% MoM in August, and jobless claims fell to 218k, pointing to a labour market that is softening but not deteriorating to the same extent that other labour market data points have implied. All in all, these data point to stronger than expected growth and the labor market, weakening the case for rapid rate cuts while inflation remains sticky. Core PCE, the Fed’s preferred gauge for inflation, rose to 2.9% YoY in August, in line with expectations.

The market appeared to be pricing in the shift with the DXY rising to a 3-week high, tightening USD liquidity, while crypto pulled back. However, expectations for a 25-basis-point rate cut in October remain.

This week sees a plethora of US data cumulating on Friday with non-farm payroll data, which, if weak, could revive more aggressive Fed rate cut expectations, boosting riskier assets such as crypto due to the increase in liquidity.

In addition to the Fed outlook, risk assets are being affected by concerns about a potential US government shutdown this week. At the time of writing, there was still no agreement in Congress for funding the government and the Trump administration.

September patterns in play

BTC typically falls 3.39% in September, a traditionally weak month for the cryptocurrency. This September, BTC trades 2.4% higher, defying seasonality with just days to go until the end of the month.

Another interesting pattern emerges in September. Each post-halving year, Bitcoin tends to retest its 21-week moving average (MA21) around September before making a final push higher. This pattern is evident in the chart below, as seen in 2013, 2017, and 2021, each time leading to a cycle peak.

Ready for Uptober?

If the above runs true this cycle, then BTC could be preparing for a strong month, a solid October. Not only is the final quarter of the year typically the strongest for Bitcoin, but October is typically one of the strongest months for BTC performance.

The average return across Q4, dating back to 2013, is 85% compared to just 5% in Q3. Meanwhile, average returns for October are 21%, second only to November, which sees average returns of 46%.

Whales accumulate in the downturn

According to LookonChain, whales are accumulating during this latest market downturn. A newly created address, IF1neJ, withdrew 2,261 BTC from exchanges at the end of last week, worth approximately $247 million.

Large-scale moves by major holders often serve as key indicators for the broader crypto community, suggesting firm conviction despite recent market fluctuations. This recent move indicates that whales are in accumulation mode and could bring resilience to BTC.

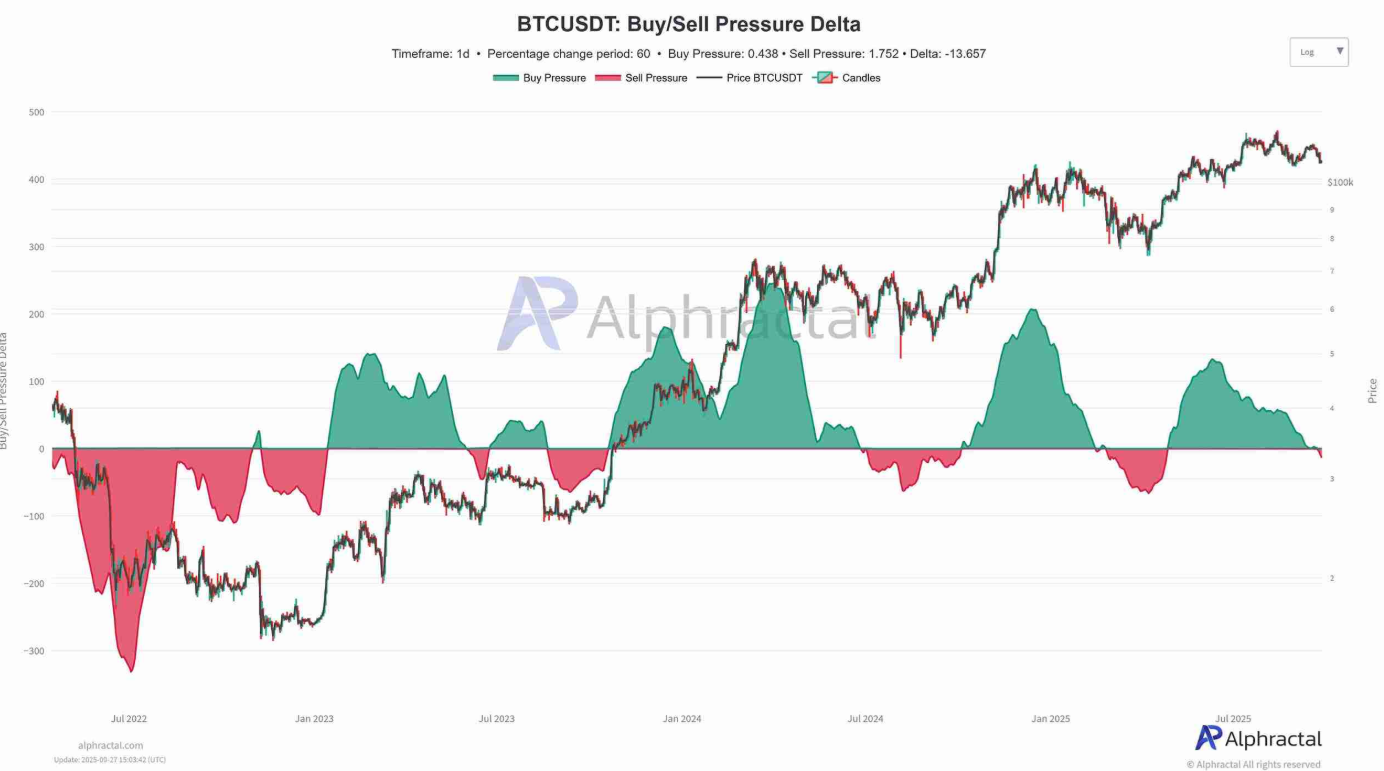

On-chain data support a reversal

Bitcoin’s 60-day Buy-Sell Pressure Delta data, a metric that gauges whether buying or selling pressure dominates, has entered an opportunity zone, where buyers could re-enter the market and support a possible rebound.

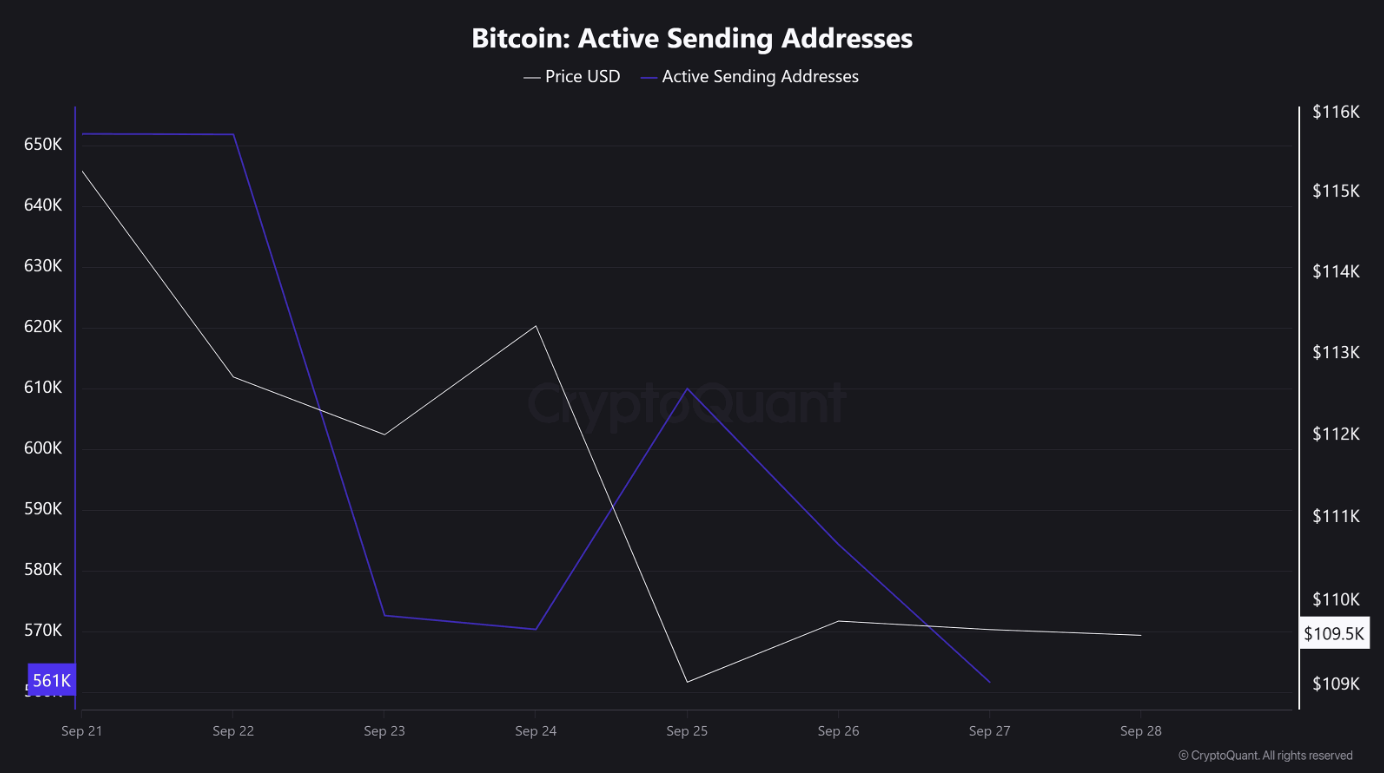

The Number of Sending Addresses, which are wallets moving BTC out, often for selling or transferring, has fallen sharply, according to CryptoQuant on-chain data. In previous instances, a decline in sending addresses typically indicates a decrease in the number of holders seeking to offload their coins. This reduces immediate selling pressure on the market.

While Bitcoin is at a critical juncture where bulls aim to re-establish momentum after its recent pullback, if bull/Sell pressure holds its course in the opportunity zone and on-chain activity continues to reflect easing selling pressure, BTC could recover towards 120k. On the downside, 107.4k is a critical level. A fall below here opens the door to deeper declines towards 100k.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.