Earnings season is in full swing, and this week brings three of the most closely watched reports in tech. AMD kicked things off yesterday, while Google and Amazon report later today and tomorrow. Here’s what’s moving markets, and how you can trade the volatility.

AMD beat expectations but stock still tumbled, here’s why

Advanced Micro Devices (AMD) reported earnings after Tuesday’s close, posting earnings per share (EPS) of $1.53 against forecasts of $1.32. EPS measures a company’s profit divided by its outstanding shares, giving traders a quick way to gauge profitability. Revenue came in at $10.3 billion, well above the $9.67 billion Wall Street expected, representing 34% growth year-over-year.

The standout was AMD’s data centre segment, which hit $5.4 billion in revenue, up 39% from last year. Demand for EPYC processors and Instinct AI accelerators continues to surge, with CEO Lisa Su calling 2025 “a defining year” for the company.

Despite the strong results, shares fell over 10% on Wednesday. The problem? Forward guidance. AMD projected Q1 2026 revenue of $9.8 billion, which beat consensus estimates of $9.38 billion but disappointed investors who expected even stronger numbers given the ongoing AI infrastructure boom. It’s a reminder that in earnings season, beating expectations isn’t always enough, sometimes the market wants more.

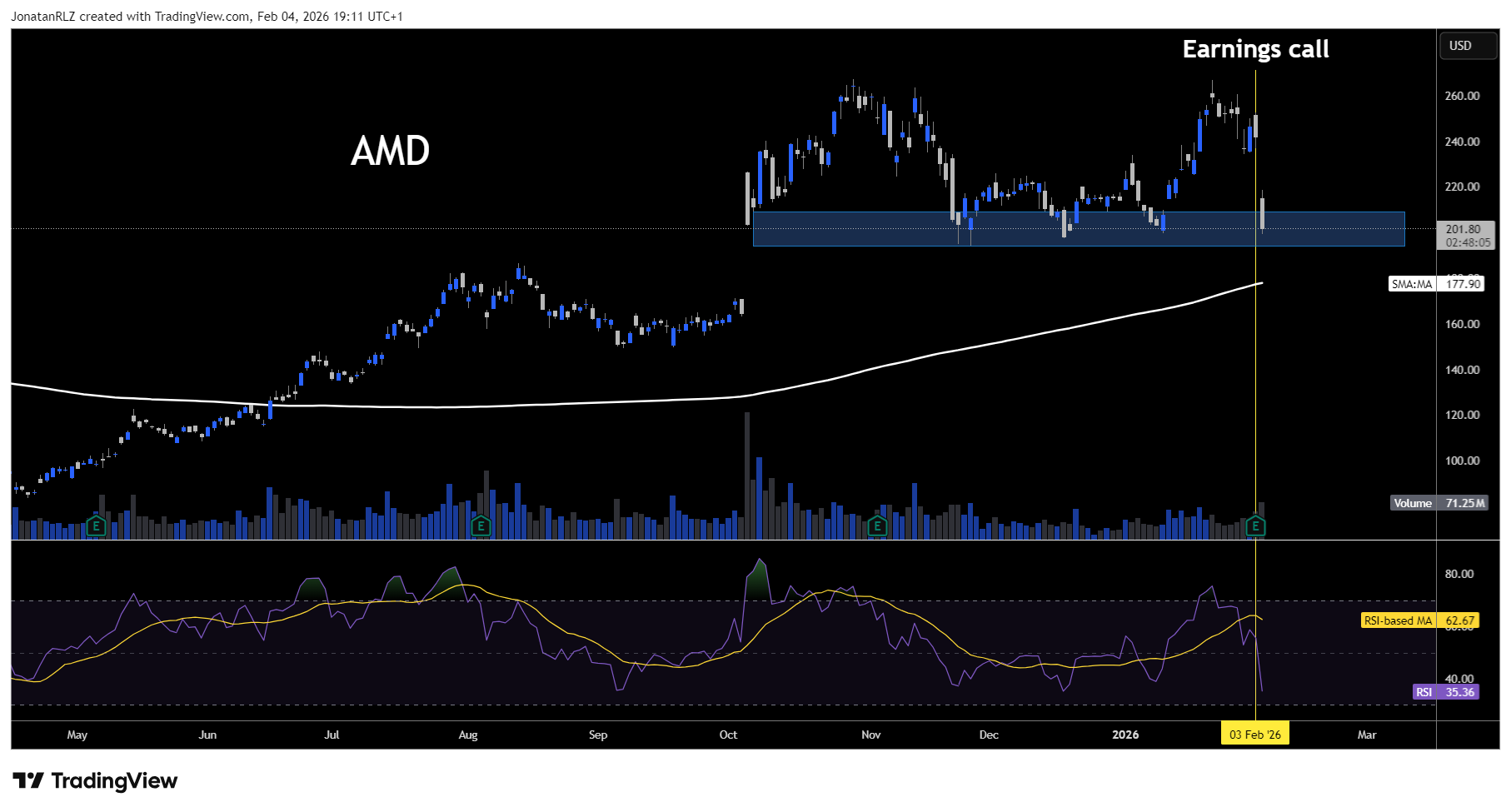

From a technical perspective, AMD’s post-earnings drop has pushed the stock into a key support zone around $200, a level that has held strong since October 2025. Volume spiked on the earnings reaction, confirming strong conviction behind the move. If this support zone fails to hold, the 200-day simple moving average (SMA) sits around $178, which could act as the next line of defence.

The Relative Strength Index (RSI) has fallen to 35, approaching oversold territory. Anything below 30 typically signals a stock may be due for a bounce. For traders, this sets up a clear decision point: either the support holds and AMD stabilises, or it breaks and opens up further downside.

Google reports today, AI and cloud in focus

Alphabet (GOOG) releases earnings after today’s close, with analysts expecting $2.64 EPS.

Traders will be watching AI integration across Search and Workspace, cloud revenue momentum, and any shifts in digital advertising spend. Google’s stock has been sensitive to AI narrative shifts lately, so expect sharp moves depending on management’s commentary.

Amazon closes out the week on Thursday

Amazon (AMZN) reports after Thursday’s close, with consensus EPS at $1.97.

The focus here is on Amazon Web Services (AWS) growth, e-commerce margin improvements, and how much the company is investing in AI infrastructure. AWS remains Amazon’s profit engine, and any signs of slowing growth tend to weigh on sentiment.

Why earnings season matters for traders

Earnings reports create some of the sharpest short-term moves in equity markets. A single earnings call can send a stock up or down 10% in minutes, and that volatility spells opportunity for traders who know how to manage risk.

With CFDs, you can trade the immediate reaction to results, position ahead of expected volatility, or use tight stops to manage risk around these events.

All three stocks, AMD, Google, and Amazon, are available to trade on PrimeXBT. For active traders, it doesn’t matter which way the stock moves, what matters is that it actually moves.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.