Bitcoin rose over 9% in the previous week, reaching a 3-month high. The largest cryptocurrency started the week at 63.2k before jumping to a high of 68k by Tuesday and reaching a peak of 69.5k over the weekend. The price is hovering just below 69k at the start of the new week. Bitcoin remains the largest cryptocurrency by market value, but it’s also now managed to secure its top spot among monetary assets. According to companies’ market cap, Bitcoin now ranks as the 10th largest monetary asset globally.

While Bitcoin posted strong gains, the picture was more mixed across the altcoin market. The larger altcoins, such as Ether, Solana, BNB, and XRP, booked solid gains. However, the smaller altcoins showed some gains and some losses. For example, DOT and LTC booked solid gains, while AVAX, TRX, and UNI fell across the previous week.

Bitcoin ETF inflows

According to SoSoValue data, Bitcoin spot ETFs saw over $1.85 billion in inflows last week. On Friday alone, Bitcoin ETFs collectively posted $470.48 million in gains. Cumulative net inflows into spot Bitcoin ETF have exceeded the $20 billion mark for the first time since its launch in January. To gain some perspective on this, it took gold ETFs about five years to reach the same number.

Bitcoin ETF holds 64.06 billion in Bitcoin or 4.84% of its market cap. Black Rocks IBIT was on top yet again last week with a massive $309 million in inflows on Friday; IBIT has drawn over $780 million in net inflows across the week, raising its cumulative total to $22.77 billion.

This level of interest from institutional investors is a strong indicator of confidence in Bitcoin’s price prospects. As more capital flows into these ETFs, it provides upward momentum to Bitcoin’s price, encouraging retail and institutional investors to join the rally.

Bitcoin whales

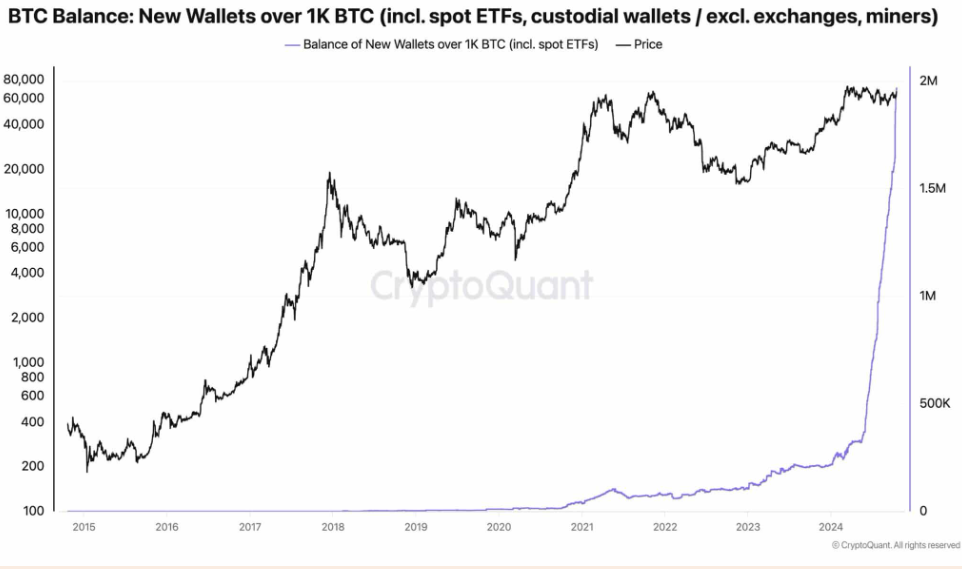

A growing interest in Bitcoin is also being reinforced by the action of Bitcoin whales, individuals, or entities holding large amounts of Bitcoin. According to CryptoQuant, new whale wallets now hold 1.97 million Bitcoin, representing a massive 813% increase year to date. Whales’s aggressive accumulation is seen as a positive sign for Bitcoin’s price trajectory. However, it’s also worth remembering that large sales from these whales can lead to price corrections depending on market conditions.

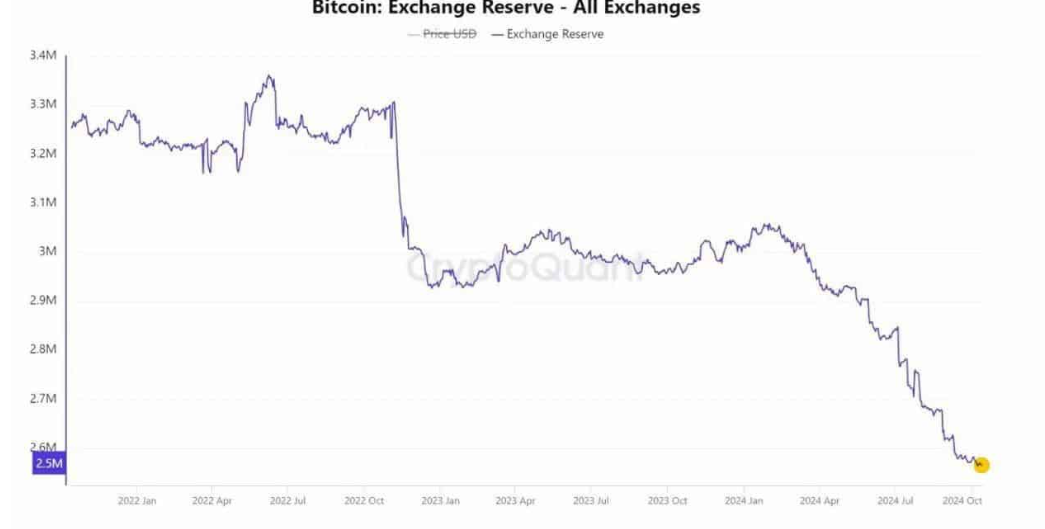

Bitcoin supply on centralized exchanges falls to a record low

As the price of Bitcoin moved above 68k, Bitcoin Reserves on centralized exchanges (CEX) reached a new all-time low with only 2.6 million Bitcoin available. The significant decrease in reserves could point to a supply shortage or a supply squeeze. This occurs when the amount of Bitcoin available on exchanges decreases drastically, reducing accessible supply for potential buyers and can lead to a rapid increase in the Bitcoin price. Recent data shows that Bitcoin reserves on exchange dropped from more than 3.3 million Bitcoin three years ago to 2.6 million. This reflects the continued accumulation of Bitcoin by long-term holders.

There are several factors contributing to this decline. First, many holders prefer to hold their assets in private wallets for increased security. Second, the growing interest in Bitcoin-based financial products such as ETFs has contributed to the fall in reserves.

Historically, such events have been followed by price increases and could also signal a period of increased volatility.

Macro backdrop

Last week was a quieter week for global macroeconomic developments. The main focus was on Thursday’s European Central Bank’s widely expected 25 basis point rate cut. With eurozone inflation below the central bank’s 2% target, ECB president Christine Lagarde indicated a renewed focus on growth. The weaker economic outlook suggests the central bank could continue cutting rates from here.

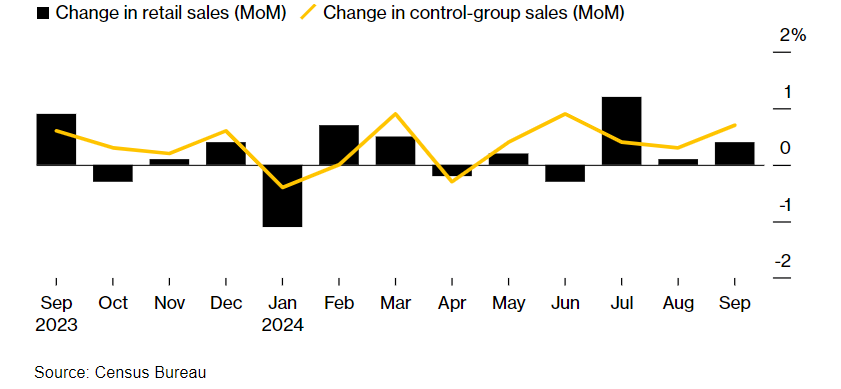

In the US, a solid retail sales report boosted risk sentiment even if it means that the Federal Reserve may not cut interest rates as aggressively in the coming year. The strong data adds to evidence that the US economy is still on track for a soft landing. Since Bitcoin still trades primarily as a risk asset, strong growth in the underlying economy is a bullish factor, especially when combined with expectations that the Federal Reserve could continue to cut rates even if gradually.

US elections

The 2024 presidential election polls and betting markets have shifted toward favoring Republican candidate Donald Trump, considered the more pro-crypto candidate. Trump’s promises to create Bitcoin strategic reserves and strong statements, such as making the US the powerhouse of crypto, have strengthened investor confidence in Bitcoin should Trump win.

This, combined with the fact that Trump is expected to bring a larger budget deficit. The nonpartisan committee for a responsible Federal budget projected $7.5 trillion growth in the national debt over the next decade if Trump wins versus $3.5 trillion under Kamala Harris. This means a Trump victory could be considered a bullish scenario for Bitcoin and the border cryptocurrency market. However, there is an argument to suggest that even a Kamala Harris win can now be considered British for crypto. The odds of Trump’s victory increased to 60% in the Polymarket.

Sentiment

The sentiment gauge crypto fear and greed index rose to 73 last week, among the highest readings since July. This contrasts sharply with the 32 fear level seen just over a week earlier and points to a potential near-term bullish extreme that could be on the cards as a renewed sense of optimism among traders is becoming more evident.

Looking Ahead

The event risk calendar is lighter this week, which could result in a greater focus on US election risk, ETF flows, and Bitcoin’s technical picture.

With just 15 days to go until the US election, traders may need to decide if it’s the right time to start placing election trades with greater conviction. Should Trump continue to hold the lead in the polls and odds markets, this could be considered positive for Bitcoin.

Technical picture

The technical picture for Bitcoin is extremely important right now. For weeks, Bitcoin has been waiting for a breakout at the channel top near 68,000 to shift the medium—and longer-term biases back in favour of the bulls, and that’s exactly what we appear to have seen last week.

Some bulls could remain cautious while the cryptocurrency remains at 73K, but the technical picture is undoubtedly more bullish than it has been for months. A reversal back into the seven-month bearish channel could question the bullish bias.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.