Bitcoin is holding at just above 109K after rising 1% last week, marking the second straight week of gains. The price briefly rose above 110k to a peak of 110.7k on Thursday. Buyers continue to watch the key 110k level, which the price has probed seven times over the past few weeks.

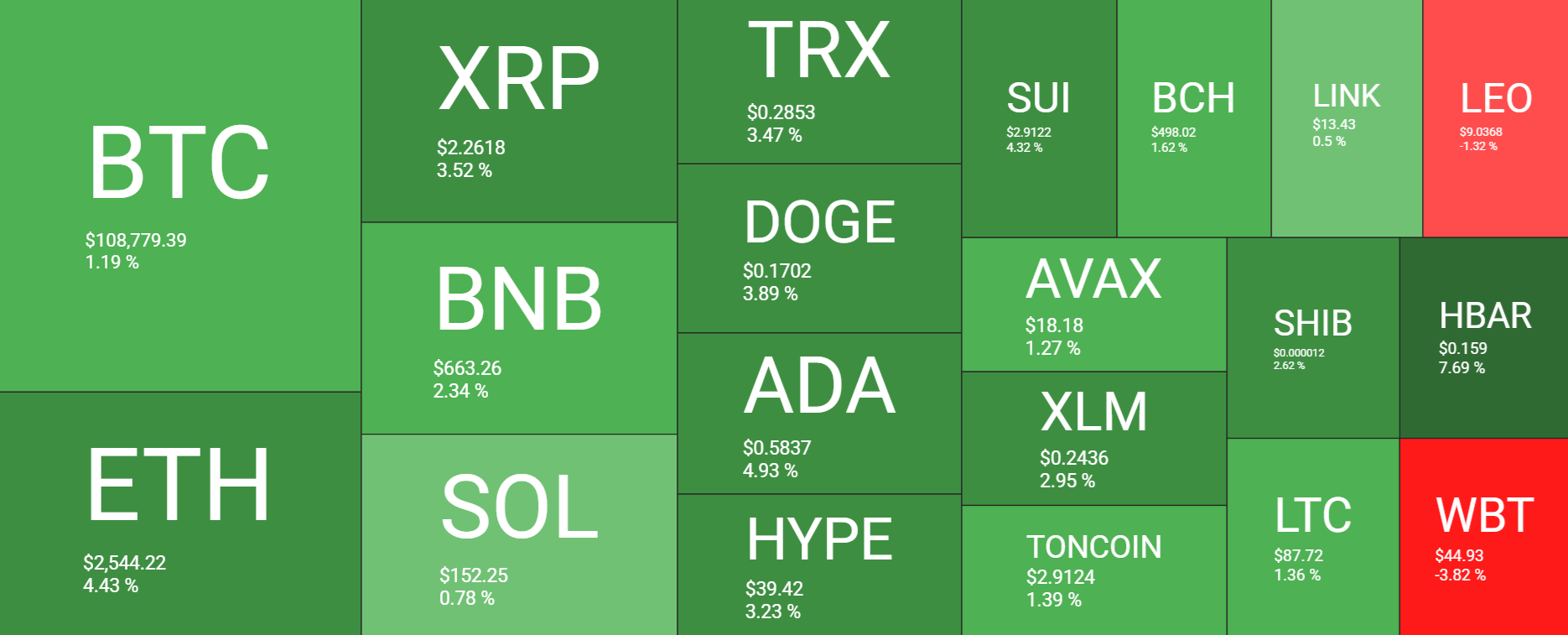

While Bitcoin gained around 1% over the past week, Ethereum outperformed, rallying almost 4.5%, while XRP also gained 3.5%. Smaller altcoins also performed well, with ADA up almost 5%, DOGE gaining 3.9%, and HYPE coin increasing by 35%.

The total crypto market capitalization has increased modestly across the week, rising from $3.33 trillion a week ago to $3.36 trillion at the time of writing. This was down slightly from a high of $3.41 trillion on Thursday.

Meanwhile, the Fear and Greed index, a tool that measures market sentiment, remains firmly in neutral territory at 50, almost unchanged from this time last week and up very slightly from a neutral reading of 49 a month ago.

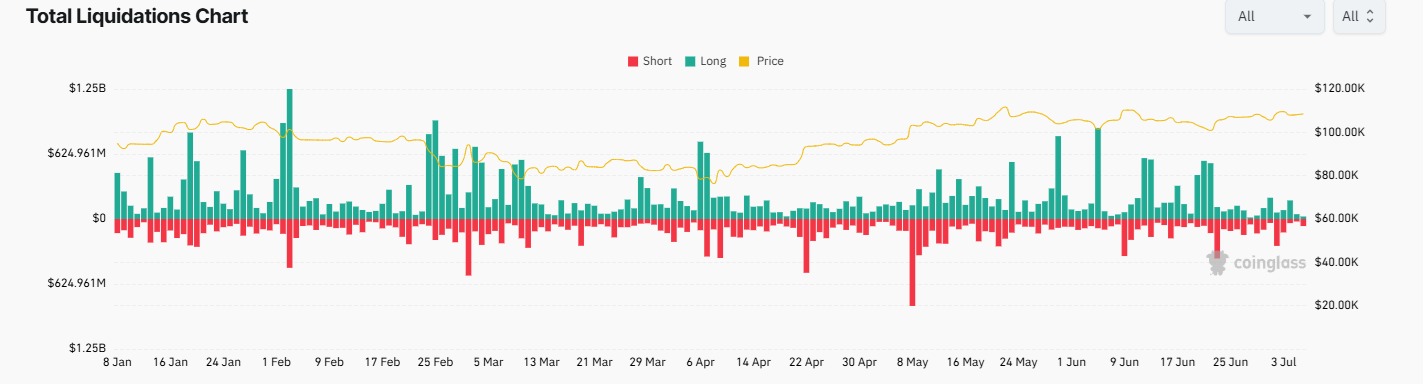

Liquidations were relatively low across the crypto market last week. A 2.5% rise in Bitcoin on Wednesday and Thursday sparked a $2.58 million liquidation of short positions in the crypto market, marking the largest short position liquidation since June 23, when $379 million in short positions were liquidated.

Bitcoin ETFs

Bitcoin ETFs booked a fourth straight week of net inflows last week, totaling $769 million. Breaking this down, BTC ETFs saw net inflows of over $600 million on Thursday, the biggest single-day total in over a month, as investors piled into crypto products amid renewed optimism in risk assets.

In June, a US-based spot Bitcoin ETF attracted $4.6 billion in net inflows compared to $5.2 billion in May, bringing their total market cap to almost $75 billion. BlackRock’s iShares Bitcoin Trust ETF has now surpassed its flagship S&P 500 ETF in annual fee revenue generation, despite being only one-eighth the size of the S&P 500 ETF.

Spot ETH ETF inflows also gained traction in June, with $1.16 billion in inflows highlighting greater institutional participation in the CME basis trade. The basis yield on offer for CME ETF futures versus spot increased from 6% in February to 8-9% in May and June.

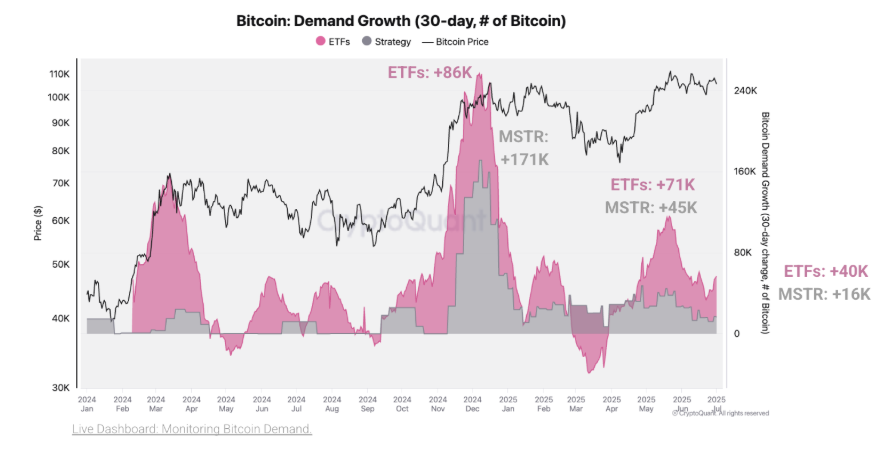

ETF & (Micro) Strategy’s demand growth slows

According to Crypto Quant, Bitcoin purchases from US-based ETFs and (Micro) Strategy have decelerated so far this year compared to November and December 2024. Bitcoin purchases made by ETFs in the past 30 days have declined from 86k BTC on December the 7th, 2024, to 71k BTC on May 18, 2025, and 40k BTC today, representing a 53% decline in this period.

Meanwhile, (Micro) Strategy’s purchases have declined to 16k Bitcoin in the last 30 days after peaking at 171k Bitcoin on December 7, 2024, marking a 90% decline. This could explain why BTC is struggling to reach record highs.

Macro backdrop

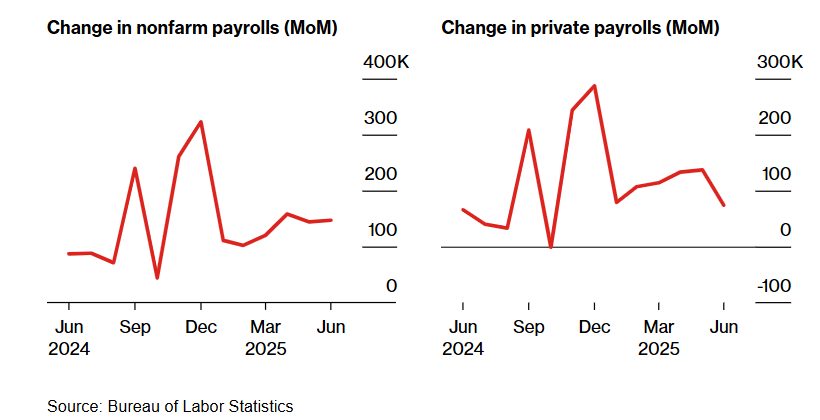

US non-farm payrolls

US non-farm payrolls came in well ahead of estimates with 147K jobs added in June following May’s upwardly revised 144K. Meanwhile, the unemployment rate unexpectedly dropped to 4.1%, well below the expected 4.3%, and average hourly earnings fell to 0.2%, down from 0.4% previously. The data brought a big sigh of relief in the markets after a poor ADP private payrolls reading on Wednesday. Following the release, the market no longer expects a rate cut in July and has lowered its expectations for a rate cut in September.

With the payroll number out of the way, market attention will shift away from monetary policy to concentrate on fiscal policy and trade tariffs. Particularly, the signing of the tax cut in the spending bill, Trump’s One Big Beautiful Bill Act, which could act as a positive market catalyst following approval by Congress on July 3 and the end of the 90-day pause on reciprocal tariffs on July 9, which could create some volatility.

Trump’s Big Beautiful Bill: A BTC Tailwind?

While no major crypto tax amendments were included in the bill, more broadly speaking, the asset class will likely be supported by the bill, given that it promises to unlock more liquidity. Combining $1 trillion additional Federal spending with sweeping tariffs on over 500 categories of imports can trigger an inflationary spiral. Furthermore, the bill is expected to add $3.4 trillion to the US debt over the next 10 years. This could ultimately lead to higher taxes, reduced government spending, or increased money printing.

Over the long run, more debt means more money printing, which will likely benefit Bitcoin’s store of value qualities. Long-term bond yields are edging higher, oil prices are rising, and gold and Bitcoin, two assets that thrive on fears of monetary debasement, are once again in demand.

This, combined with strong institutional and corporate demand, is also behind the constructive outlook for Q3 2025.

On-Chain data – Mid-sized holders resume accumulation as SOPR rises

After weeks of the BTC price moving sideways, on-chain data suggests that it could be gearing up for a significant move. On-chain data indicate a resurgence of mid-sized account accumulation and a rare uptick in the spent output profit ratio, fueling speculation about a possible breakout.

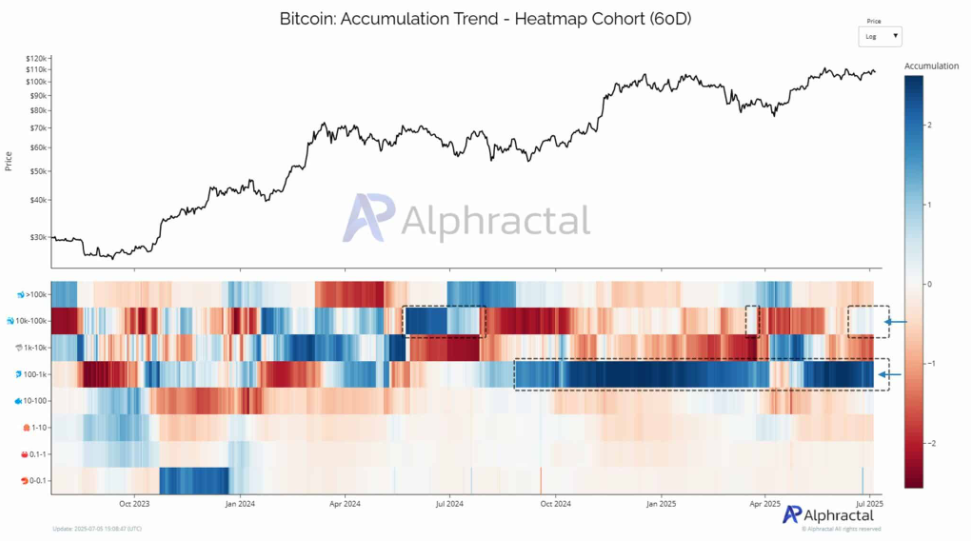

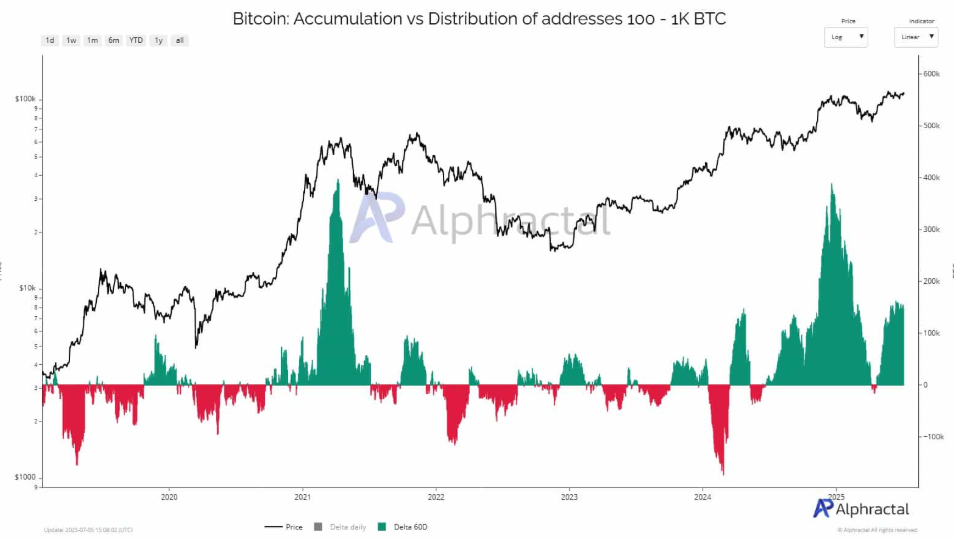

After a long period of distribution, the BTC accumulation landscape has shifted. Those holding between 10k to 100K BTC are accumulating for the first time since March 2025 and July 2024, ending nearly a year-long trend of sell-side pressure.

Meanwhile, dolphin wallets, which hold between 100 and 1,000 BTC, have been accumulating for weeks, with the heat maps showing a consistent green patch, a sign of buying activity.

However, retail size addresses those with less than 10 BTC, and mega whales, those over 100k, continued to distribute.

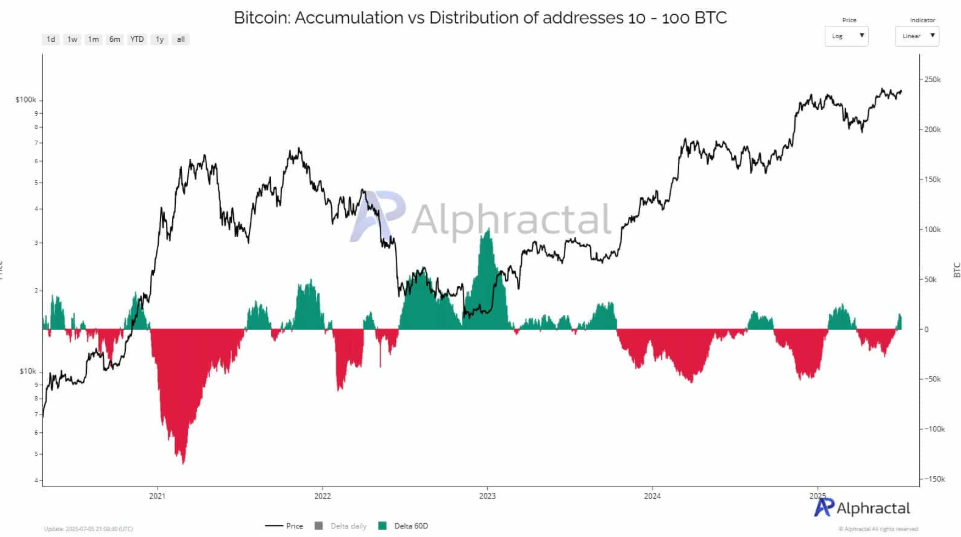

Those holding between 10 and 100 BTC, which had previously been net distributors, have flipped into accumulation territory, a positive signal indicating improving sentiment among mid-sized holders.

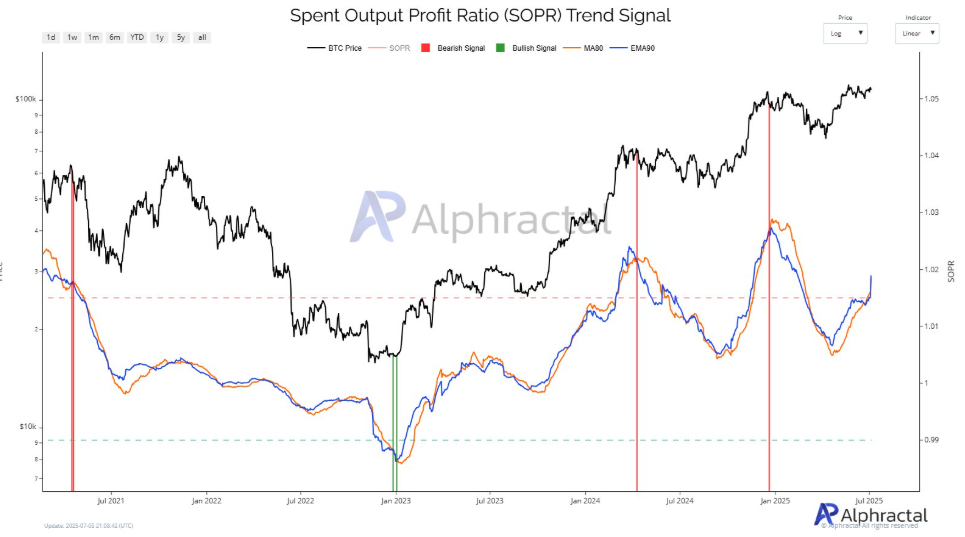

The spent output profit ratio, or SOPR, is on the rise for an unprecedented third surge within the same bull cycle. Historically, a sustained SOPR uptrend indicates confidence and a healthy distribution phase as LTH take profit. This third leg higher remains unbroken by a bearish crossover, as depicted by the blue line crossing below the orange, indicating persistent profitability among BTC holders.

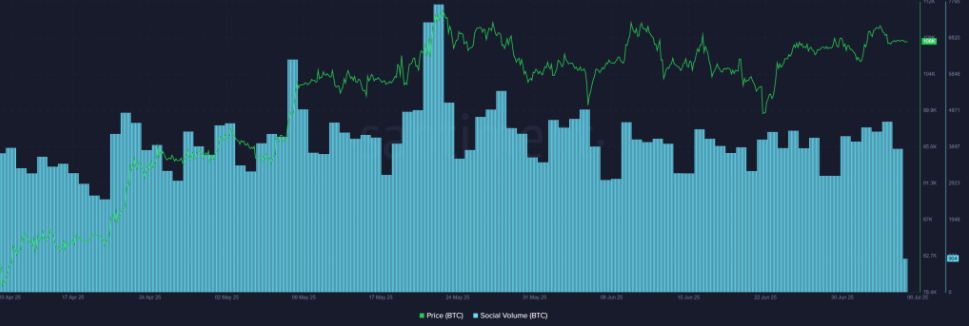

Despite the SOPR, there hasn’t been great sentiment. The SOPR is flashing green, but sentiment data shows a sharp dip in social volume. In other words, holders are profitable, but the social crowds don’t appear to care yet; any signs of euphoria remain elusive.

BTC quiet conviction

Other on-chain data also indicate that investors are becoming increasingly confident in Bitcoin’s long-term position.

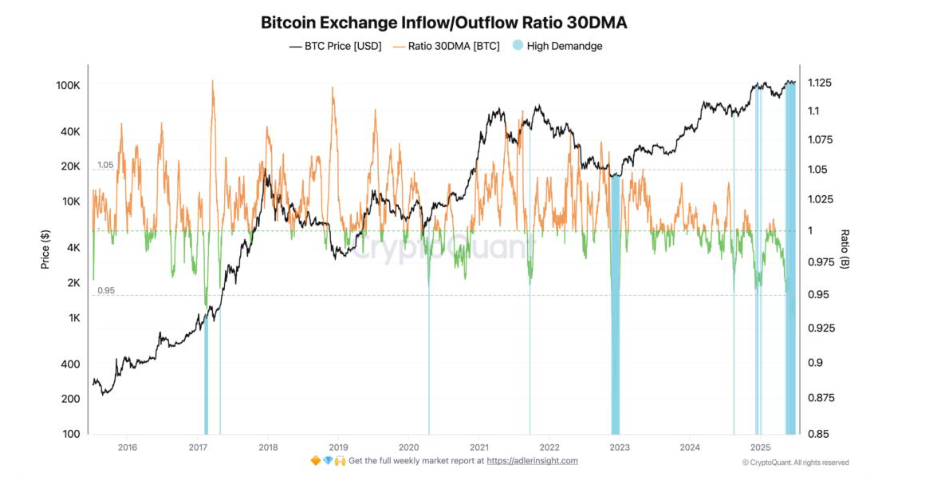

CryptoQuant data shows that Bitcoin has continued to flow out of centralized exchanges over the past few months, a trend that reflects growing investor confidence.

The Bitcoin exchange inflow-outflow ratio 30 DMA measures the volume of BTC flowing in and out of centralized exchanges over a period of 30 days. A high ratio (>1) indicates more inflows than outflows into exchanges, signalling increased selling pressure. On the other hand, a low ratio (<1) implies that more coins are flowing out rather than into centralised exchanges. A low inflow-outflow ratio suggests that investors are accumulating and holding their coins long term.

The Bitcoin monthly inflow-outflow ratio recently fell to 0.9, its lowest level since the 2023 bear market. With the metric now under the 1 threshold, this means Bitcoin exchange outflows are dominant, reflecting a strong and sustained demand on the spot market. This is a sign of confidence in Bitcoin’s long-term promise, supporting the view that it’s evolving into a store of value.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.