Bitcoin fell over 5% last week, falling from 115.5k at the start of last week before breaking below 110k to a low of 107.5k on Friday, a 7-week low. The price steadied below 110k over the weekend before falling back towards 108k at the start of the week.

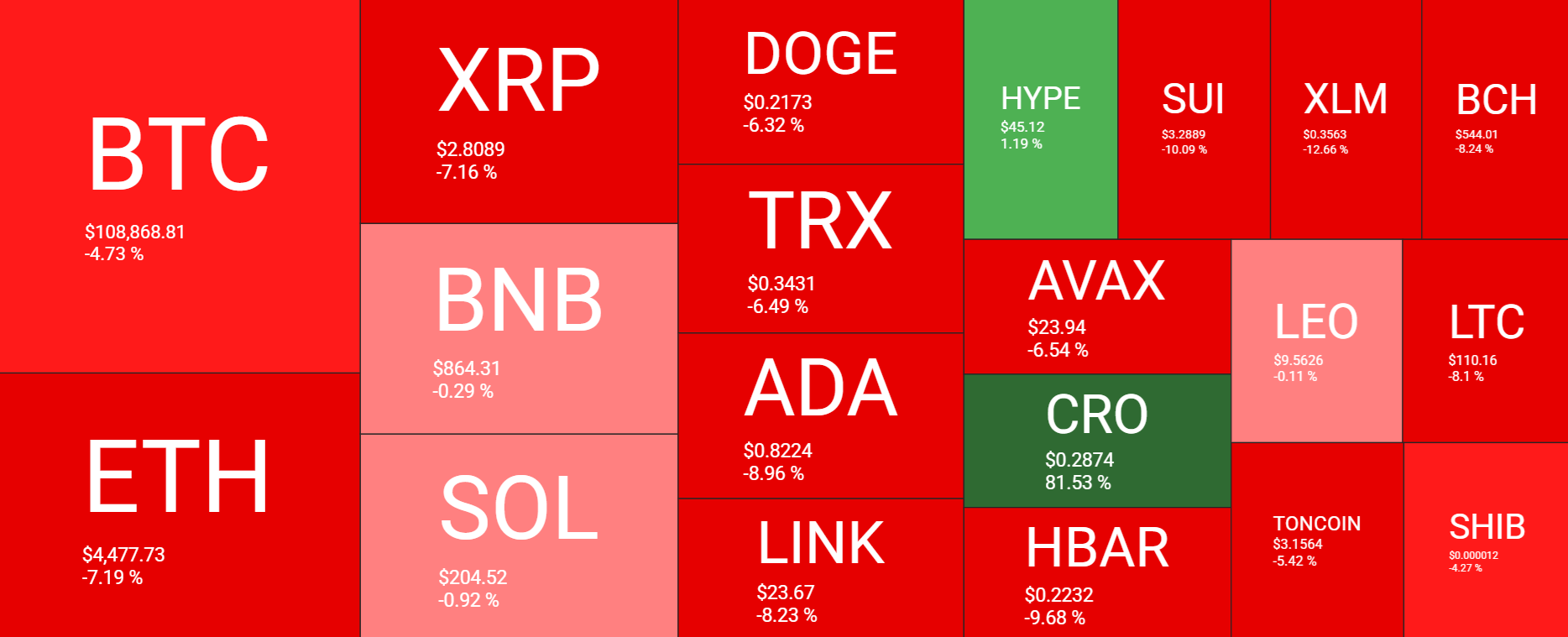

While Bitcoin suffered steep losses, larger altcoins were a mixed bag. Ethereum tumbled 7%, falling from its record high of $4,955 last Sunday to a low of $4,250 this weekend. Ripple also dropped over 7% while BNB and SOL showed resilience and ended the week almost flat. CRO was a notable outperformer, up 81% across the week.

The crypto market capitalisation has fallen from $3.95 trillion last week to $3.79 trillion at the time of writing, recovering from $3.76 trillion reached on Saturday, the lowest level on August 8. The total crypto market cap is considerably lower than the record $4.19 trillion reached on August 14.

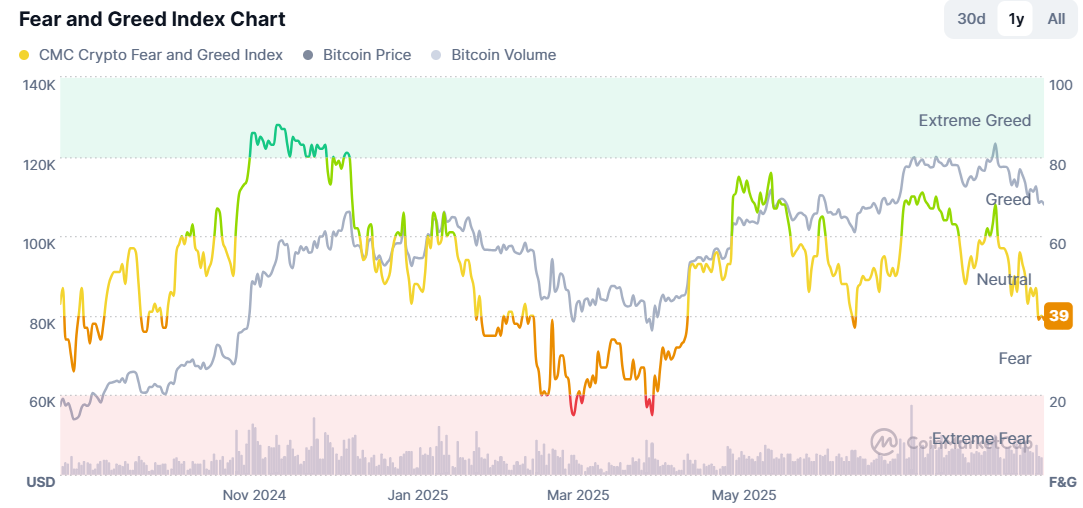

The Fear and Greed index, a barometer of investor sentiment in the cryptocurrency market, has also dropped sharply to 40 in Neutral territory, having briefly dipped into Fear (39) yesterday, down from Greed last month. Sentiment sitting on the Neutral / Fear tipping point reflects market uncertainty.

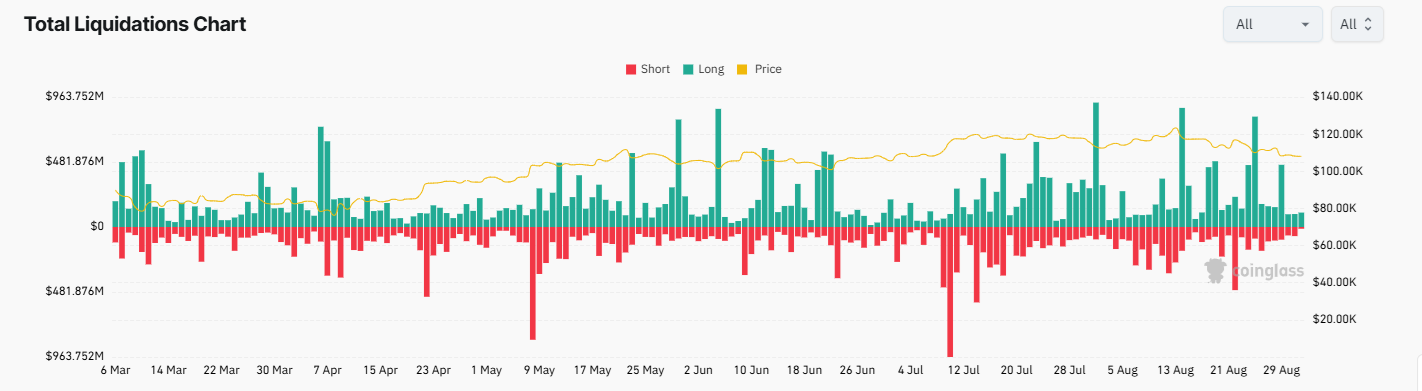

Liquidations

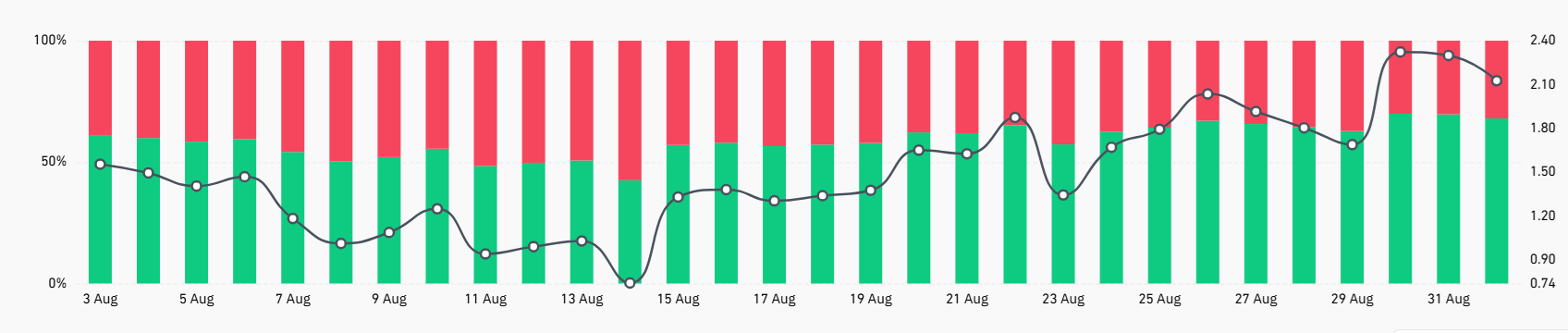

The price correction in the largest cryptocurrency by market cap, along with most altcoins, sparked a wave of liquidations across the market. According to CoinGlass’s Total Liquidation chart, the crypto market faced over $1.8 billion in liquidations last week, with more than 74% of positions being long, indicating overly bullish positioning.

Macro backdrop

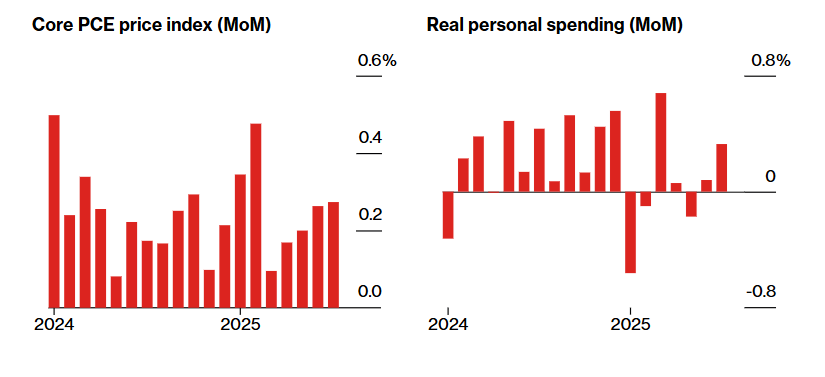

The drop in prices on Friday followed the release of the personal consumption expenditure index, the Fed’s preferred gauge for inflation, which showed that core inflation rose to 2.9% in July, in line with expectations, but up from 2.8% in June. Meanwhile, consumer spending rose in July by the most in four months, indicating resilient demand despite stubborn inflation. The data raises questions over whether the Fed will have room to cut rates in the September meeting.

The data came following Federal Reserve Chair Jerome Powell’s speech at Jackson Hole, where he adopted a more dovish stance.

Other macroeconomic data leaned slightly risk-positive, with the US GDP growth for the second quarter upwardly revised to 3.3% from 3.1%. At the same time, weekly initial jobless claims fell to 229,000 from 234,000, signaling resilience in the labor market.

This week, all eyes will be on Friday’s US non-farm payroll, which could provide further clues on whether the Federal Reserve will cut interest rates in September, which could drive a fresh direction for risk assets such as BTC. A major surprise in job growth could trigger sharp market moves – strong numbers may weigh on crypto as risk appetite falls. Weaker-than-forecast jobs data could lift demand.

ETH benefited at the cost of BTC

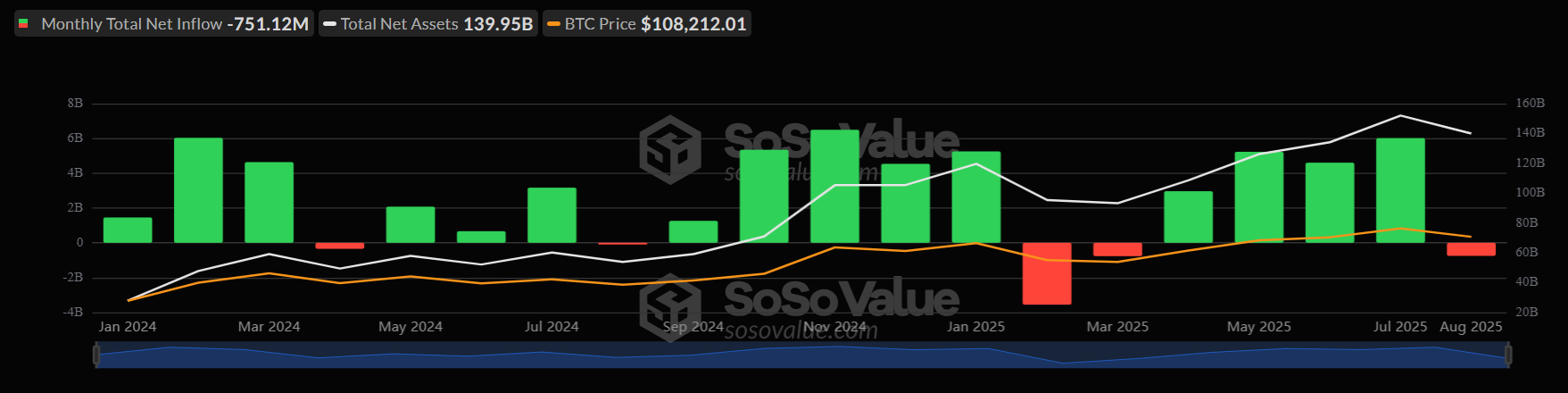

Bitcoin fell in August, in line with its seasonal pattern. Despite Fed Chair Powell shifting from a hawkish to a dovish stance and Bitcoin reaching a record high of $124,400, Bitcoin ETFs experienced monthly outflows, and the price of BTC fell 8% across the month. At just above 108k, BTC is down 13% from its record high as we head into September, wiping out the entire summer rally.

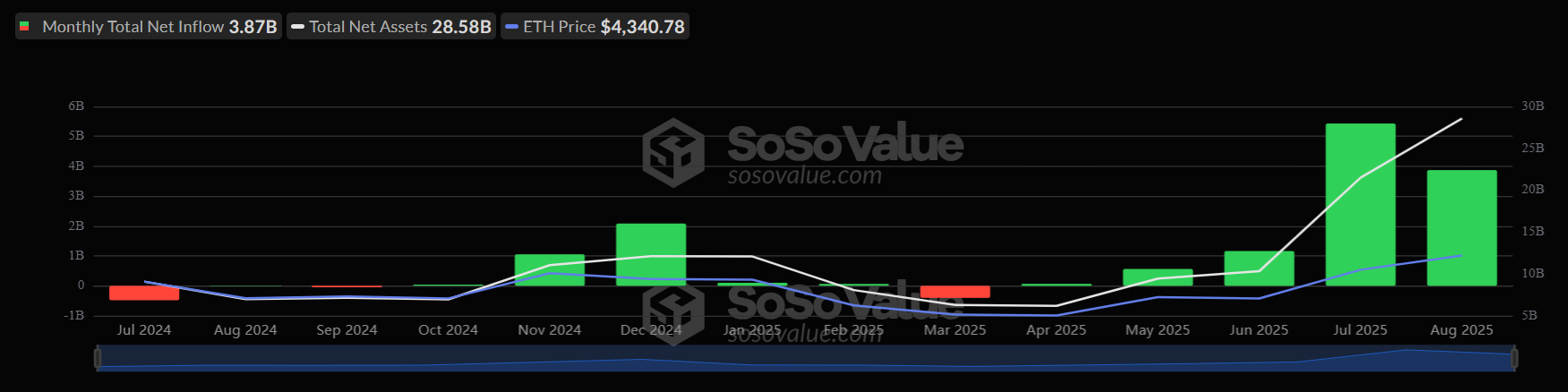

Bitcoin’s poor record came as Ethereum jumped 14% in August, outperforming BTC by a significant margin. Ether’s surge came as it attracted large amounts of capital via ETH treasury companies and ETH ETFs.

ETH ETFs saw $3.87 billion in inflows this month, compared to net outflows in BTC ETFs. That, on its own, is impressive, but when considering relative market caps, Ether’s $500 billion is less than 25% of BTC’s $2.1 trillion, making ETH ETF inflows far more impressive.

Whales rotate

The selloff in BTC last week was also driven by a series of significant Bitcoin whale sell-offs, which triggered the liquidation of leveraged positions. Early last week, a whale sold 24,000 BTC, liquidating its position on the Hyperunite platform before shifting much of the capital into Ethereum.

Over the weekend, another whale sold 4,000 BTC, worth approximately $435 million, to acquire 96,850 ETH. The whale deposited an additional 1,000 BTC into a decentralized exchange on Monday, potentially for further ETH purchases.

The figures in August suggest that capital remained tight and was directed to Ether, at the expense of BTC. Historically, the market has rotated from Bitcoin to Ethereum and then to altcoins.

Red September

Seasonality patterns suggest that September is often even worse for Bitcoin than August. According to Coinglas, over the past twelve months, dating back to September 2013, Bitcoin has declined by 8%. On the four occasions that BTC gained in September, those gains were modest. The average September over the past 12 years sees 3.77% of losses. However, it’s also worth noting that October and November often see significant recovery.

This could suggest that the recent selloff is more likely aligned with seasonality rather than a structural shift in the market.

Could Bitcoin correct further?

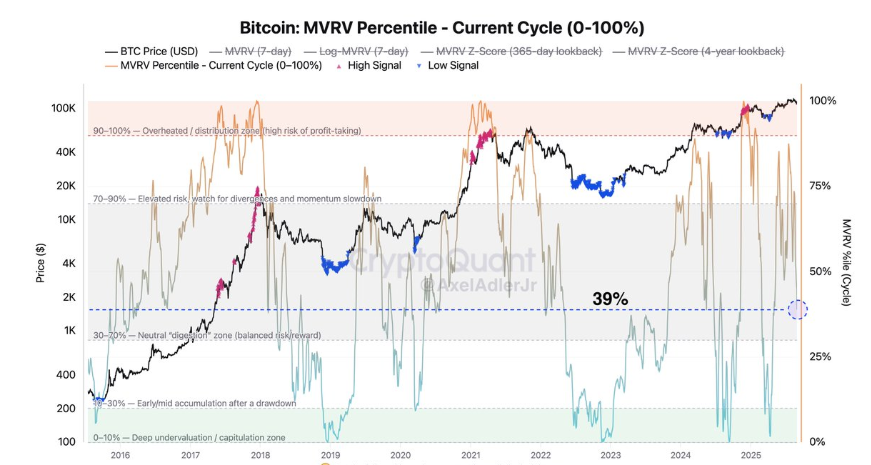

Bitcoin’s volatility-adjusted MVRV clearly indicates the market’s current standing. When the metric is near 100%, this aligns with an overheated extreme, while a reading close to 0% corresponds to complete capitulation. Currently, the metric stands at 39%, indicating that the market has cooled significantly. In other words, the explosive momentum that had boosted BTC to fresh record highs has transitioned into a consolidation phase with no extremes.

While the neutrality reduces the risk of an imminent crash, the lack of a bullish signal means there is no clear catalyst for a near-term surge.

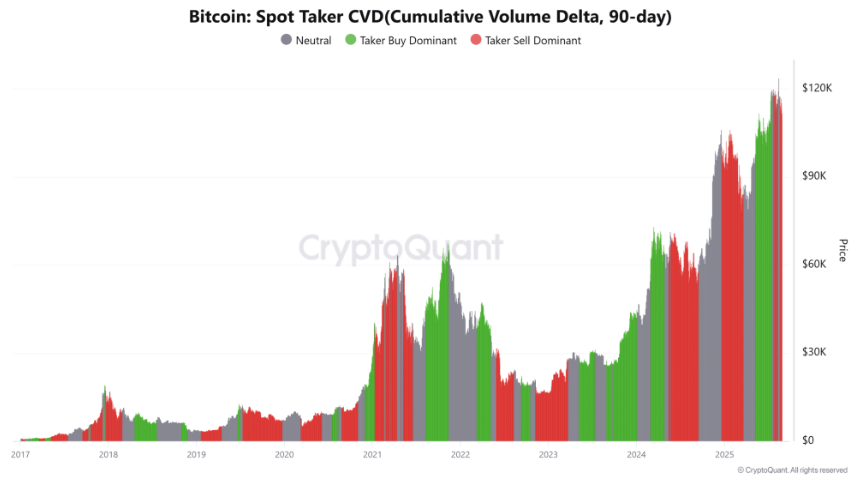

Spot Taker CVD over the past 90 days showed alternating control, with recent sessions tilting towards selling. This keeps pressure on spot markets, unchallenged, quick British reversals. Often, when spot flows lean heavily towards selling, rallies tend to face quick rejection.

If Taker Sell Dominance continues, Bitcoin could struggle to recover above resistance zones, with the market vulnerable unless buying pressure picks up.

Data from Binance showed 64.55% in long positions with shorts at 35.45%, resulting in a long-short ratio of 1.82, favouring bullish accounts. This represents a significant tilt towards long positions, indicating firm conviction among leveraged traders.

Technically, the 110 to 108 support zone is key, and Bitcoin’s outlook depends on this level being defended. An MVRV breakdown, Taker Sell dominance, and overextension in positions are reasons for caution.

Buy the dip chatter

There has been a rising number of “buy the dip” calls on social media after bitcoins 8% decline across the past week, which could signal more downside ahead for the crypto market.

Santiment has noted social media “buy the dip” mentions have increased significantly amid the crypto market downturn, which could be a warning sign for the market. A true market floor often coincides with widespread fear and a lack of interest in buying. Therefore, the tick-up in interest on social media could be a further reason for caution.

Levels to watch

BTC has broken below its rising trendline, its 50 and 100 SMA, as well as the 110k level. The price is finding support around 108k for now. The RSI below 50 supports further losses. A break below 105k, the Fib level of the 74.4 low, and the 124.4k high could see 100k tested.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.