Bitcoin fell sharply lower in the previous week and extended those losses at the start of the new week. Bitcoin opened the previous week at 64k and edged higher to a peak of almost 65k before falling sharply to book losses of 8% across the week. The world’s largest digital asset fell 6% on Tuesday alone, dropping to a low below 58k, where the Bitcoin prices remain at the start of the new week.

The sell-off was evident not just in Bitcoin but across altcoins. Ether fell over 10%, Solana dropped 16%, and BNB dropped almost 10%. There were pockets of optimism as crypto traders sold out of positions indiscriminately.

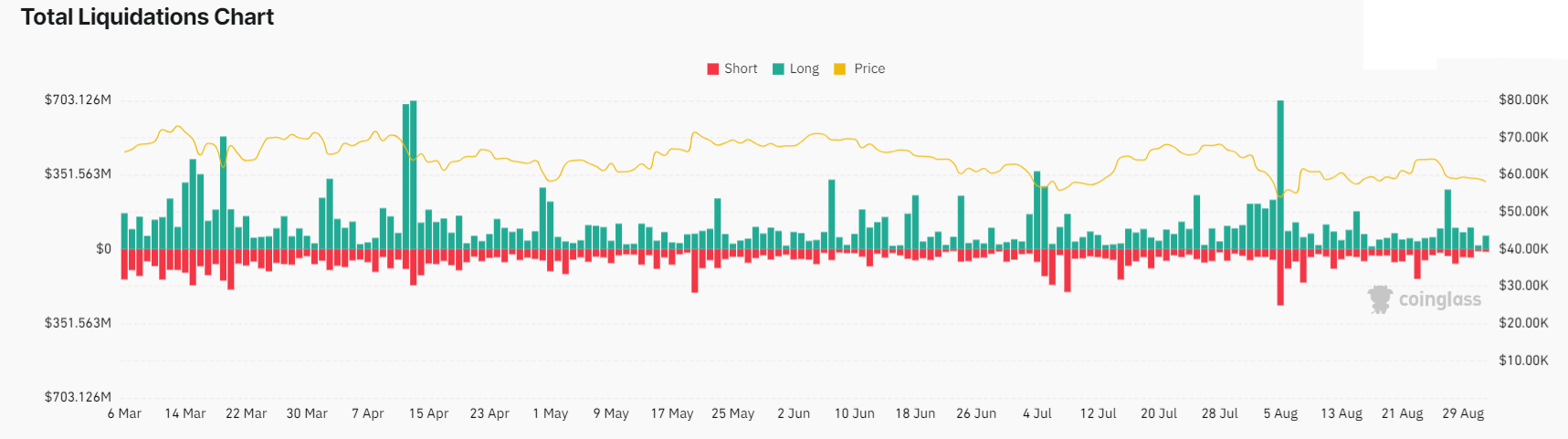

The biggest plunge in cryptocurrencies was on Tuesday, as the Bitcoin price fell from a high of 63k to just above 58k. The dramatic plunge triggered a wave of liquidation.

According to Coinglass data, on Tuesday, crypto assets sustained more than $313 million in liquidations. Bitcoin long liquidations reached $85 million, a level last seen on August 5th.

Stocks rally, Dow hits an all-time high

Interestingly, crypto markets haven’t performed as well as U.S. stocks and other assets in the last few weeks despite the macro backdrop becoming more favorable to risk assets, such as Bitcoin. The Dow Jones rose almost 1% last week, reaching a record high above 41k.

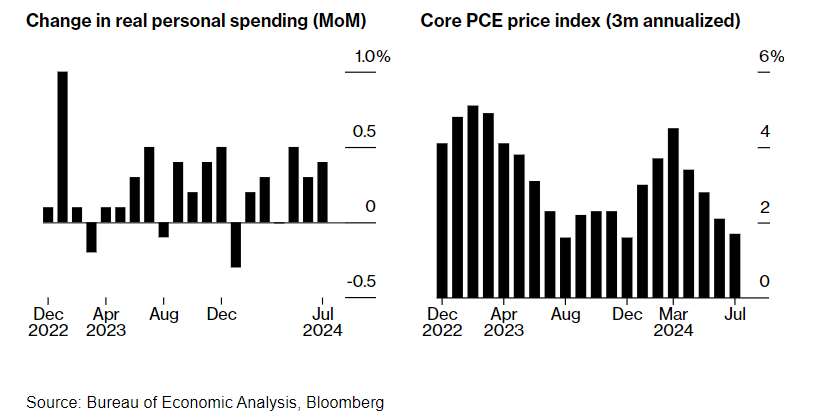

Last week’s data supports the view that the Federal Reserve will start cutting interest rates this September. US PCE inflation data ticked lower to 2.5% YoY in July from 2.6%. Core PCE, the preferred gauge for inflation, rose with expectations to 2.7% from 2.6%. On a monthly basis, inflation held steady at 0.2% MoM. The data showed that price growth remains on track towards the Federal Reserve’s target of 2%, supporting the case for cutting interest rates next month. Meanwhile, personal spending rose, easing recession fears.

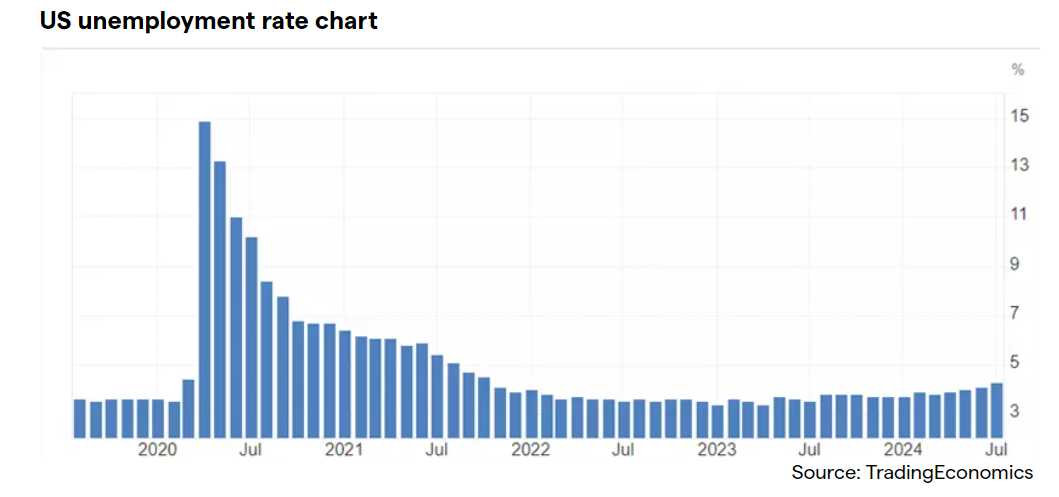

Meanwhile, US Q2 GDP data showed that the US economy grew at a slightly stronger pace than initially expected in the second quarter of the year. Q2 GDP was revised higher to 3% from 2.8%. The slightly stronger-than-expected growth helped to calm recession fears, which had been sparked after July’s US nonfarm payroll report on the 3rd of August was weaker than expected. Meanwhile, US jobless claims data also showed that the US labor market was resilient with low layoffs, falling to 231,000, a decrease from 233k previously.

The market is 100% certain that the Fed will start cutting rates next month but is still uncertain about the size of the Fed rate cut. The market is pricing in a 32% chance of the Fed cutting interest rates by 50 basis points rather than just 25. We see a base case scenario of the Fed cutting by 25 basis points rather than 50 basis points on September 18.

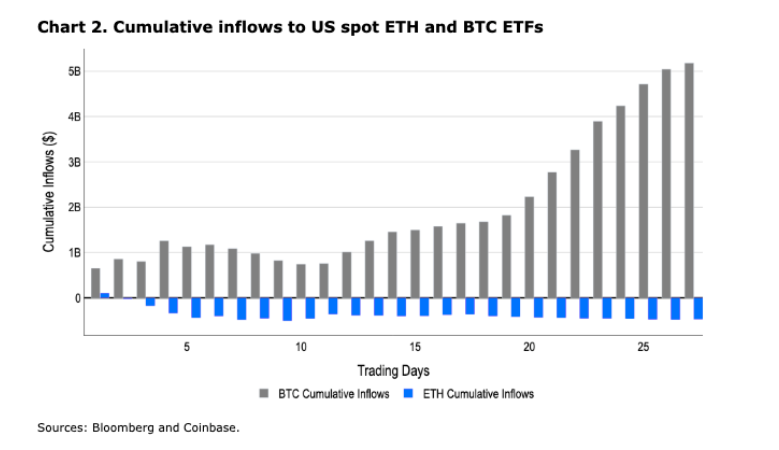

Two factors could explain the difference in performance between US stocks and Bitcoin. Firstly, inflows into US spot Bitcoin ETFs that had supported Bitcoin’s strength in the first half of the year were heavily frontloaded. They slowed significantly in August compared to previous months.

The second reason could be the Bitcoin-specific supply overhangs, such as Mt Gox repayment and the US government selling, which continued to weigh on sentiment. However, the market should steadily be processing and get over these factors. According to Arkham Intelligence, the amount Mt Gox rehabilitation trust has only another 44.9 K Bitcoin after distributing about a third of the original amount. It’s not clear how long the trust could take to repay these Bitcoins, as distributions have been for those purposes, specifically to those looking for early payouts. As a result, this could mean that the supply-demand environment could start improving later this quarter.

Another possibility is that market players are concerned about a more inhospitable crypto regulatory environment, particularly following the news that Telegram founder Pavel Durov was arrested in France on August 4th (and has now been released in custody). This news has had a hard negative impact on Telegram’s TON coin as well as on the crypto asset class more broadly.

BTC vs ETH

Even among the crypto majors, there have been some differences in performance. Ether has continued to underperform Bitcoin, with ETH/BTC falling to a fresh year-to-date low. This difference appears to be in divergence in net buyer interest in US spot ETF inflows.

Bitcoin ETFs had continued to see strong gains, with 12 of the past 14 days seeing positive inflows. Meanwhile, ETFs tracking the second largest cryptocurrency, Ethereum, have seen a disappointing performance. Despite a ton of hype at the launch of the ether ETF, it failed to attract substantial demand and has been in the red for 11 of the 14 days that they have been available for trading. Meanwhile, even more worrying is the lack of volume. Last week, there was minimal trading activity, and according to the Farside data, there were 0 flows on Friday. The week ended with $12.4 million in net outflows, which comes as the ether price fell 10% last week with the value below $2500.

In fact, spot ether ETF has seen $4.76 billion in net outflows since launching, a sharp contrast to Bitcoin’s $17.8 billion in inflows to date. Furthermore, Bitcoin’s US ETFs never reached a point of net outflows.

Week ahead

Things might be a little bit slow kicking off this week, given the US public holiday on Monday. However, things will soon pick up with plenty of data gearing up towards jobs data on Friday.

1. Nonfarm payrolls

With inflation cooling and the Fed expected to start cutting interest rates for the first time in years, the attention is turning to the health of the US labour market. At the Jackson Hole economic symposium, Federal Reserve Chair Jerome Powell signaled that it was time to start reducing interest rates, adding that the Fed was comfortable with inflation cooling towards the 2% target. Instead, Powell highlighted risks to the labour market.

Signs of weakness in the labour market could revive recession fears. Let’s not forget that the weak July non-farm payroll report in July sparked recession fears, sending the markets crashing lower than at the start of August.

Ahead of Friday’s nonfarm payroll report, several updates over the week could help set expectations for Friday’s NFP. Jolts job openings, ADP data, and jobless claims figures are all leading indicators for the NFP due to be released this week.

Should the non-farm payroll report come in weak, it could fuel recession fears. A strong jobs report is unlikely to knock the Fed off course from a rate cut in September and could help ease recession fears, which could be beneficial for riskier assets such as Bitcoin stocks.

2. BoC rate decision

The BoC is widely expected to deliver its third rate cut when it meets on Wednesday. The bank has already cut interest rates twice since June, bringing its rate to 4.5%. The market is pricing in two more rate cuts this year.

Data on Friday showed the Canadian economy grew at a slightly faster pace than expected in the second quarter of the year, although June’s growth was flat. Canadian inflation has cooled to the BoC’s target, and persistent weaknesses in the jobs market support another rate cut.

With the market expecting the Bank of Canada to cut rates to 3.75% by December, there is little room for a dovish surprise. If there is a surprise from the central bank, it could be a less dovish than expected one.

USD/CAD has fallen to its lowest level since March.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.