Bitcoin ended last week at approximately the same level it started, around 104.5k, despite wild swings in the price. The price started the week around 104.5k; it shot up ahead of Trump’s inauguration last Monday to an all-time high of 109.5K before falling sharply lower to test 100K on Tuesday. Trade was choppy the rest of the week before BTC steadied around 104.5K at the weekend. Bitcoin has fallen below 100k at the start of the new week, tracking tech stocks lower amid the emergence of a disruptive new AI offering from China.

While Bitcoin remained unchanged during the volatile week of trade, other altcoins booked losses. Ethereum fell 3.8% last week, while BNB also fell 3%, Solana dropped 6.5%, and XRP was down 2%. Elsewhere, DOGE fell 11%. A few coins, such as TRX and LEO, headed higher, although these were in the minority.

Solid institutional & corporate demand supported BTC

Institutional demand for Bitcoin remained strong last week, supporting the Bitcoin price. On a weekly basis, Bitcoin ETFs saw total net inflows of $1.76 billion, modestly down from the $1.96 billion seen the previous week but marking the fourth straight week of net inflows.

Breaking this down on a daily basis, Bitcoin saw net inflows every day last week and has seen net inflows for seven straight days. The recent capital influx could have helped Bitcoin’s price stay supported despite some uncertainty clouding the market. For Bitcoin’s price to continue to rally, BTC inflows must intensify.

News that MicroStrategy had acquired a further 11,000 Bitcoin helped the Bitcoin price recover from the 100K support and rise 3.8% on Tuesday. MicroStrategy purchased BTC worth $1.1 billion at an average price of $101,91. As a result, the company currently holds 461,000 BTC for $29.3 billion at an average price of $63,610 per Bitcoin.

On-chain analysis – Large investors increase holdings

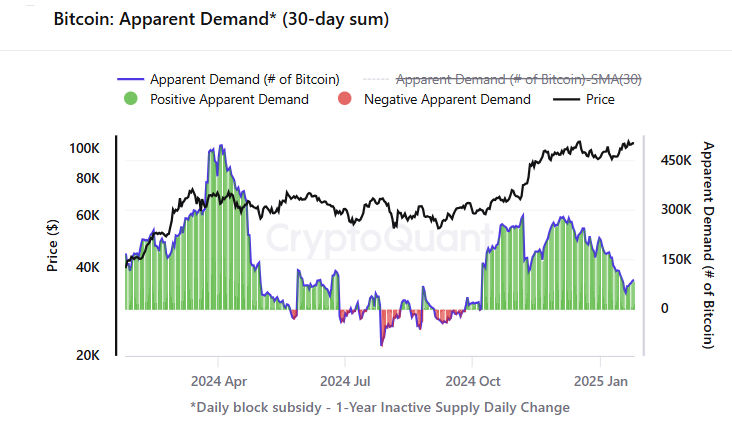

On-chain metrics provide a mixed picture. While demand from large investors has risen, apparent spot bitcoin demand growth has slowed considerably.

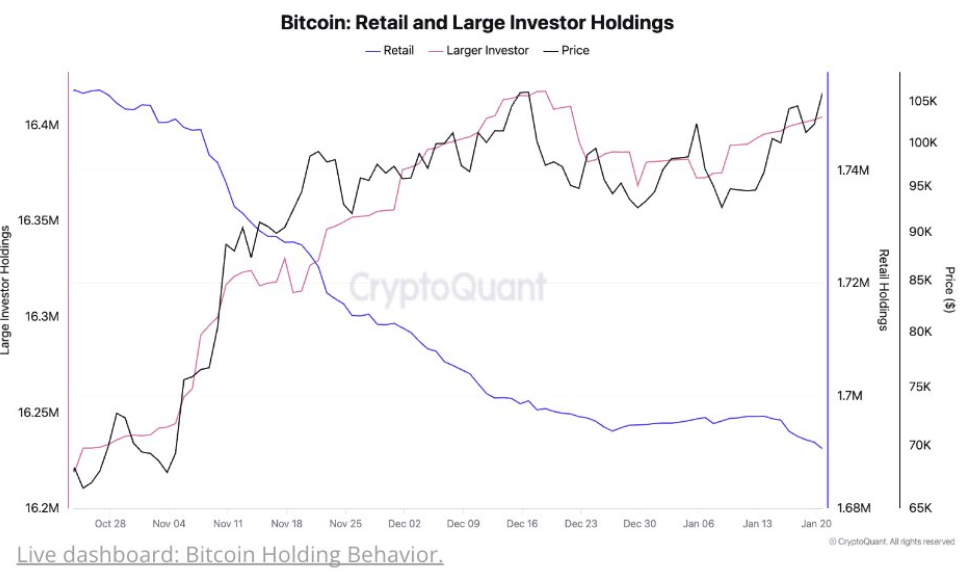

Since the US presidential election, large investors have notably increased their Bitcoin holdings from 16.2 million BTC to 16.4 million BTC. This significant accumulation highlights the growing dominance of institutional players across the market; meanwhile, retail investors have reduced their holdings from 1.75 million BTC to 1.69 million BTC. This could be a sign of caution following recent volatility.

Large investors are setting the pace, which could potentially drive BTC’s price momentum forward. Meanwhile, falling retail participation could limit the upside.

Bitcoin sees a surge in transactions

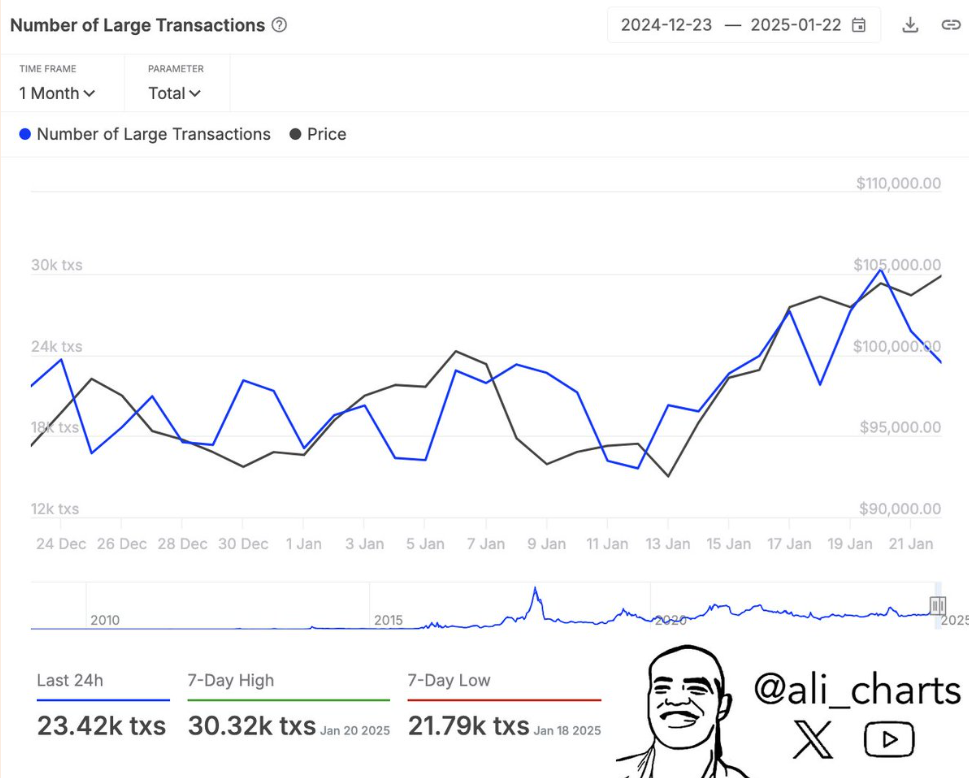

Adding to this view, the number of Bitcoin transactions exceeding 100,000 doubled in just one week, climbing from 15,620 to 32,320. This signifies heightened market activity, particularly with institutional or high-net-worth investors actively trading lists.

The seven-day transaction high of 30,320 also indicates growing confidence in crypto currencies’ utility for large-value transfers.

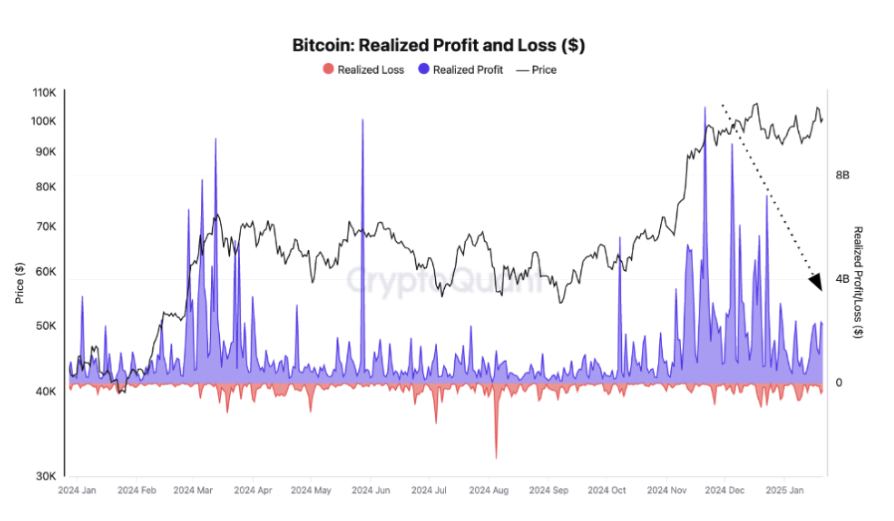

Meanwhile, according to CryptoQuant, Bitcoin sell pressure may have declined sharply after holders realized profits in December. The Bitcoin realised profits and loss indicator showed that holders realised daily profits as high as $10 billion as the BTC price approached $100 in December. However, daily realised profits fell to $2-$3 billion in January, suggesting market participants may have finished selling their Bitcoin.

But apparent spot bitcoin demand growth has slowed considerably. This needs to recover for Bitcoin’s price to make a comeback. Apparent demand has continued in expansion territory but at a slower pace. The expansion rate has slowed from 279k BTC in early December to the current rate of 75k BTC.

Trump news drives BTC moves

U.S. President Donald Trump mainly fueled last week’s choppy trade. Optimism ahead of Trump’s inauguration on Monday sent Bitcoin to a fresh all-time high before BTC quickly slipped 6.6% from its record to end the day at 102.2K. Crypto markets have been very active as investors weigh up the economic implications of President Trump’s early executive orders.

On Thursday, Trump signed his first crypto-related executive order, “Strengthening American Leadership in Digital Financial Technology. This order will create a cryptocurrency working group tasked with developing a crypto regulatory framework and evaluating the creation of a national digital assets stockpile. This represents a considerable step forward for crypto’s presence in the White House.

Regulatory updates

Trump appointed Mark Uyeda as acting Securities and Exchange Commission (SEC) chair before Paul Atkins’ confirmation. He immediately created a crypto task force with Commissioner Hester Pierce. The SEC has already repealed the SAB 121 policy, which made it infeasible for banks to custody crypto.

Developments are already coming through thick and fast. The Nasdaq filed a proposed rule change with the SEC to allow in-kind creation and redemption on the BlackRock Bitcoin trust. This process allows large institutional investors, called authorised participants, APs, to buy and redeem shares for the fund directly in Bitcoin BTC. This is considered a more efficient process as it allows these institutional investors to closely monitor the demand for the ETF and act quickly, buying or selling shares of the fund without cash being involved.

Hester Pierce has previously stated her hopes of revisiting questions about in-kind redemptions and staking in these vehicles.

Increased clarity regarding regulation and practical solutions could significantly improve the outlook.

On the listing side, markets already began pricing in the probability of Solana and Ripple CME futures based on leaks from the CME website. However, it has been noted that these were released in error and that no decision has been taken so far. Even so, it’s likely that these contracts will be under active consideration. Any such listing could then pave the way for multiple future ETFs to be SEC-approved.

Week Ahead

Over the past week, macro factors have taken a bit of a back seat to crypto-specific factors regarding market influence, partly because US inflation data for December was unremarkable and partly because President Trump’s inauguration produced more important headlines.

Trump headlines will continue to drive moves in Bitcoin and the broader market. Any more pro-crypto executive orders or comments could help lift demand. However, any sense that Trump is becoming more hostile again, particularly regarding trade tariffs on China, risk assets such as Bitcoin could fall.

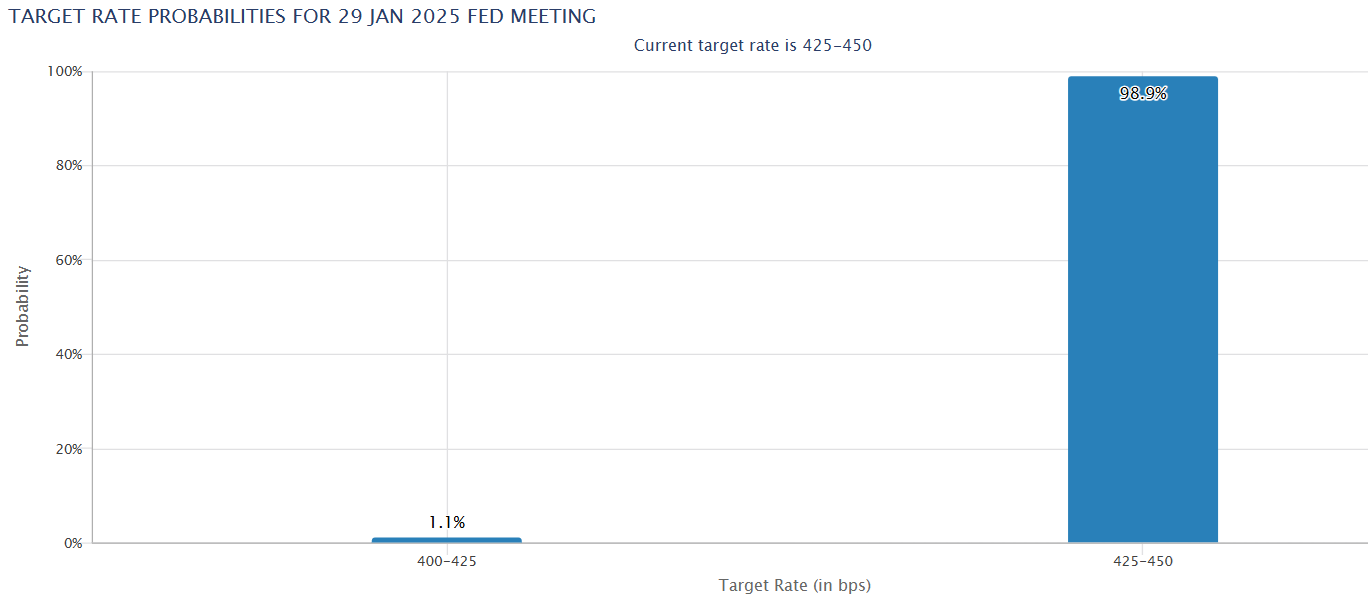

As well as Trump, this week’s Federal Reserve meeting is still very relevant even though no rate cut is expected. The Fed is widely expected to leave rates unchanged at 4.25% to 4.5%. However, it is worth remembering that Federal Reserve governor Chris Waller recently expressed a dovish tone, suggesting that rate cuts in the first half of this year are still possible.

Underlying US inflation eased by more than expected, and President Trump hasn’t applied universal tariffs in his first week. As a result, worries about the inflation outlook in the US have eased slightly, pulling the treasury yields and the USD lower.

While it is still early days, if the Fed adopts a slightly more dovish tone, Bitcoin and other risk assets could benefit.

US core PCE data are also due. However, these are likely to play second fiddle to the Fed.

AI jitters & tech earnings

Aside from Trump and the Fed, US tech earnings and AI news will also be in focus. BTC has fallen sharply at the start of the week after a new AI offering in China sent jitters across the market. Investors are assessing the implications of a Chinese startup, DeepSeek’s release of a rival to ChatGPT, which claims to be cheaper and, in some measures, better. How much of a threat this could be to its US rival is still unclear, but news has sent tech stocks and crypto falling.

Tech will remain in focus as Meta, Microsoft, Apple, and Tesla report earnings this week. Due to the close correlation between tech and crypto, these results could impact cryptocurrencies.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.