Bitcoin rose over 4.5% last week, rallying to a fresh all-time high of 111.9k. The price started last week at 106.5K breaking out of range and above the previous record high of 109.5K to 111.9K on Thursday before falling 4% on Friday and extending losses over the weekend back below 107k. The price is rising at the start of a new week, heading towards 110k.

Altcoins have also fallen sharply in recent sessions, giving up modest gains at the start of last week, putting many altcoins in the red over the past 7 days. XRP briefly rose to 2.65 before falling 6.3% across the past 7 days, ETH only rose to 2.7k, matching the earlier May high before falling, and SOL spiked to 187, its highest level since mid-February, before falling 3.3% over the past 7 days. There were also some notable outperformers, including HYPE, which surged 39%, and XMR, 19.5%.

The total crypto market capitalisation rose to $3.53 trillion last week before falling back to current levels of $3.37 trillion. The Fear and Greed Index has risen to 67, in Greed territory, up from 66 last week and up from 52 last month, which was neutral territory.

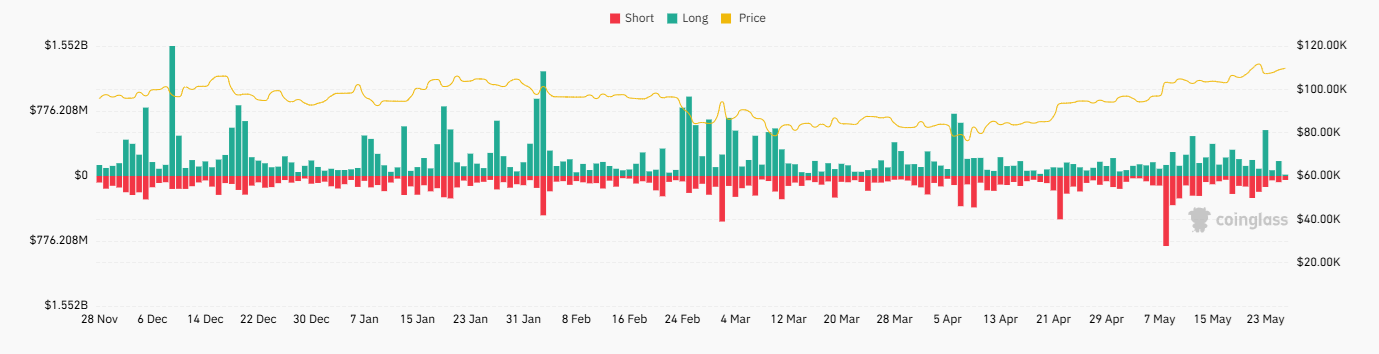

After grinding higher to the ATH, Friday’s sharp 4% sell-off sparked a wave of liquidations. $679 million of cryptocurrencies were liquidated on Friday, $548 million of which were long positions.

Investors pile into BTC ETFs

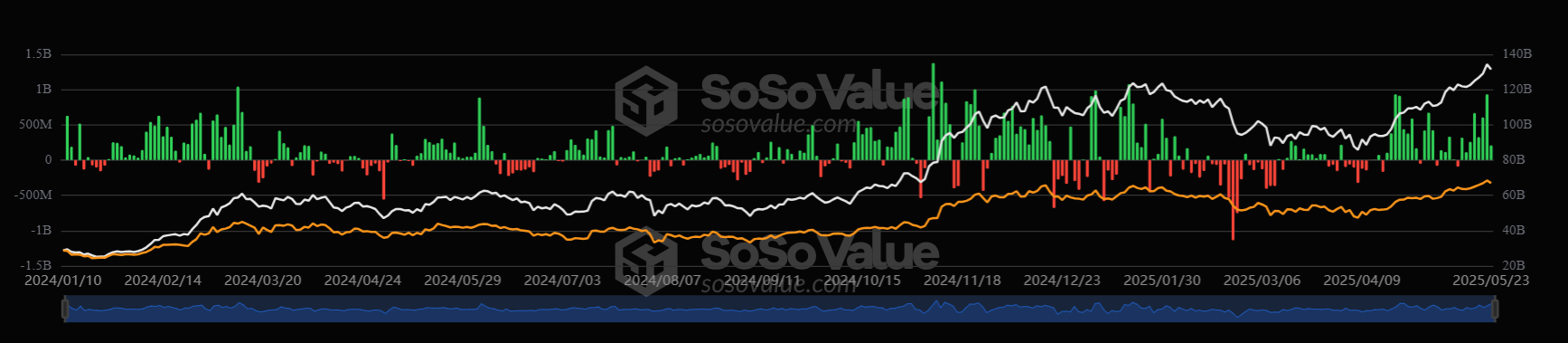

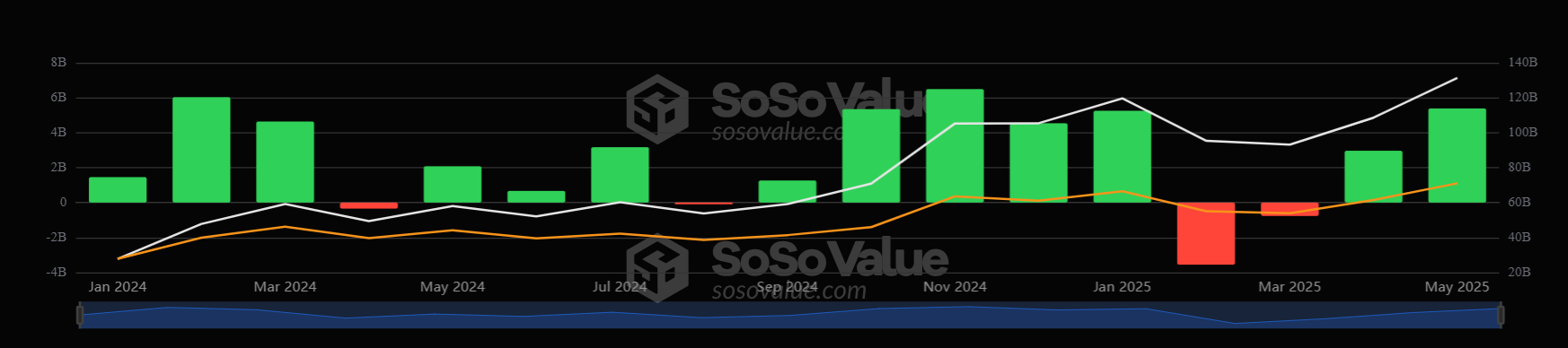

Bitcoin ETF demand surged last week, reinforcing the Bitcoin rally. The third-highest weekly net inflows ever were recorded at $2.754 billion, marking the sixth straight week of net inflows. Breaking this down on a daily basis, BTC ETFs booked eight straight days of net inflows and have only seen three days of net outflows since April 17.

On a monthly basis, BTC ETFs have seen $5.39 billion in net inflows. This marks the third strongest month for net inflows, with only February 2024 and November 2024 recording higher net inflows.

Should BTCs continue to see strong inflows, this could help drive the BTC back up towards 120k.

Macro backdrop

Concerns over the US fiscal position and favourable regulatory developments helped drive Bitcoin to a record high on Thursday. However, Trump sharply shifted attention to tariffs on Friday, hitting sentiment and pulling Bitcoin and global stocks lower.

Moody’s lowered the US sovereign credit rating from its previously perfect rating, citing concerns over the mounting debt pile in the US. During the week, the House of Representatives also approved Trump’s “Big, Beautiful Bill”, which economists believe will add $3 to $5 trillion to the already $36 trillion debt, due to unfunded tax cuts. The passage of the bill added to market concerns over the fiscal outlook for the US, reviving the sell America trade.

The S&P 500 fell 2.1% while the USD fell 2%, and investors also sold out of treasuries, sending the yield on the 30-year treasury above 5%.

The breakdown of treasuries and the USD as safe havens boosted demand for BTC. However, the peak was short-lived, with Trump threatening 50% trade tariffs on the EU, quickly bringing attention back to trade policies and their impact on the US and global economy.

Despite a sell-off at the end of last week, the latest reports suggest the EU and US could be working towards a deal. Trump pushed back 50% EU tariffs to July 9, which helped BTC recover at the start of the new week. This volatility shows that the market is still focused on trade developments.

Regulatory developments add support

Regulatory developments have been a tailwind for the Genius stablecoin act. Major U.S. banks, including JP Morgan, Bank of America, Citigroup, and Wells Fargo, are eyeing a joint stablecoin venture amid a potential massive shift in crypto regulation following the advancement of the Genesis Act in the Senate. The advancement marks a monumental step towards achieving the first comprehensive federal regulatory guidelines for payment stablecoins.

Sell-pressure is subdued

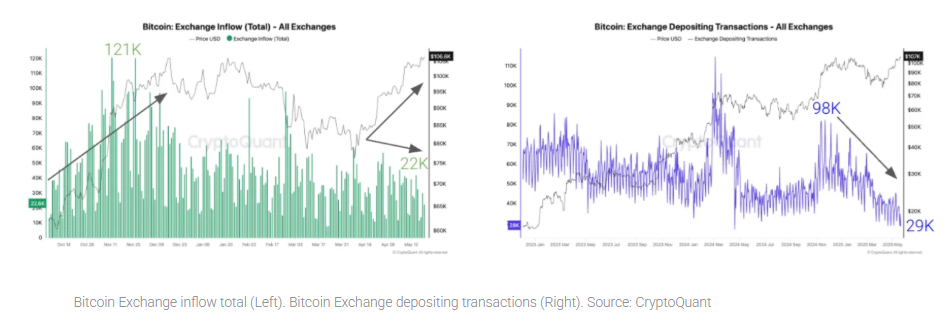

As Bitcoin’s price has risen to record highs, investors have not rushed to realise their profits. According to CryptoQuant, exchanges are seeing a large decline in inflows and deposits for Bitcoin, suggesting that investors are more intent on holding than selling.

When BTC rose to above 100k in November, the number of Bitcoins on the exchange was 121k. This time, as BTC rose to a record high of 111.9k, the Bitcoin inflows to the exchange plunged to 22k BTC. Lower exchange flows signal reduced intent to sell. Meanwhile, the number of individual platform deposits tanked from 98k in November to 29k currently. This shows that investors aren’t selling despite the rally in prices.

While the crypto market remains buoyant, inflows of Tether into exchanges have continued to grow. The total USDT in exchanges has hit an all-time high of $46.9 billion. This signals increasing liquidity, which is often supportive of the crypto process.

Further factors support BTC’s rally

While Bitcoin has risen to record levels, its MVRV ratio remains significantly below peaks recorded in previous cycles, such as 2013, 2017, and 2021. In these periods, MVRV often exceeded 3.5.

This could be largely due to rising Realised Caps, which suggest that more coins are now held by strong hands at higher costs.

As a result, typical profit-taking behaviour seen in previous MVRV spikes hasn’t occurred, potentially reflecting deeper market maturity and indicating that new capital is absorbing supply at higher prices.

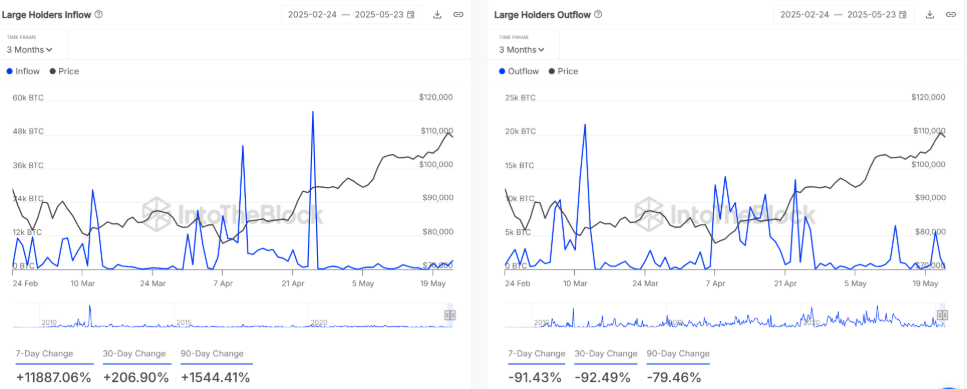

Whales are accumulating as outflows vanish

Large holder behaviour has also shifted over the last week as inflows surged 11,800%, whilst outflows dropped by more than 91%. This contrast points to a net accumulation phase where big players move assets into holding wallets, reflecting strong conviction, while reducing the likelihood of near-term sell pressure. Furthermore, the absence of corresponding outflows points to these whales not rotating capital between exchanges but are accumulating for long-term exposure.

Exchange reserves have fallen by 2.14%, dropping to 262.3 billion, signalling that fewer coins remain on centralised platforms, which reduces sell-side pressure.

When reserves fall in line with rising prices, it typically suggests that holders opt for self-custody rather than planning to sell.

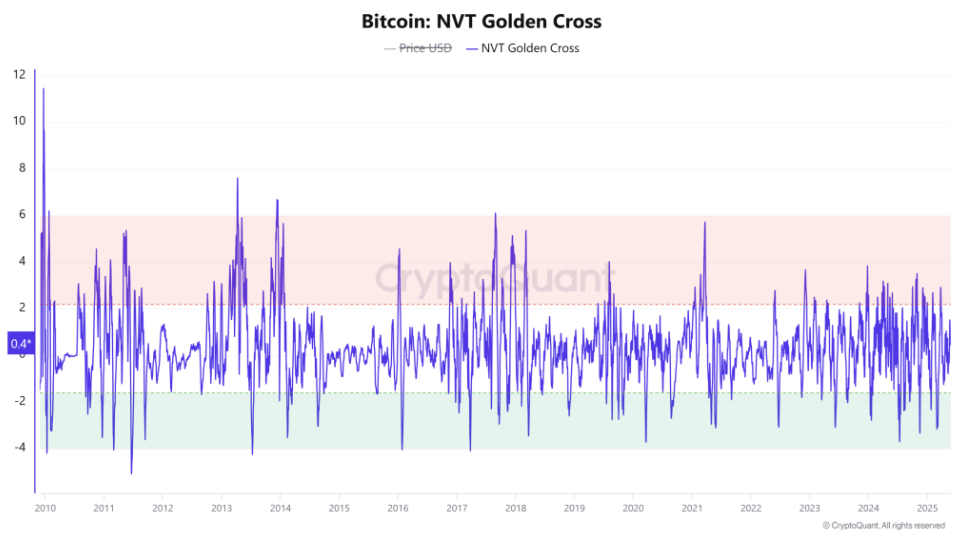

Bitcoin’s BTC NVT golden crosses dropped over 12% to 0.43, indicating that valuation aligns well with network activity, a combination of supply contraction and healthy utility paves the way for a sustainable rally with fewer signs of speculative overheating.

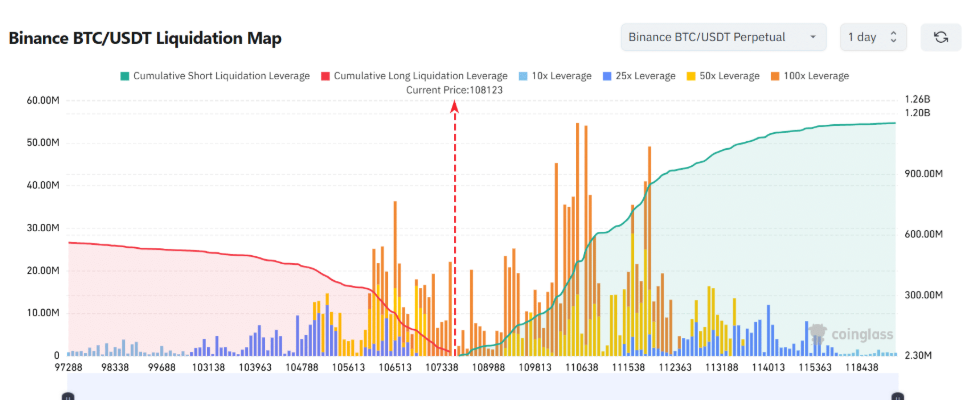

Leveraged traders resetting?

According to the BTC Binance liquidation map, there was a concentration of shorts liquidations above 108K and significant liquidation clusters between 111K and 114K. Further upside could trigger cascading exits. Open interest has dropped by 5.26%, suggesting that speculative pressure is easing. This reset could flush out overleveraged traders and reduce the chances of sudden reversals.

This rebalancing potentially lays the ground for a period of refinancing and a more established bullish momentum ahead.

BTC’s Golden cross

This week the 50 SMA crossed above the 200 SMA in a golden cross bullish signal. The golden cross has historically led to major rallies with a 45% -60% gain seen in previous example.

However, the indicator is not a guaranteed strategy. In February 2020, the Golden Cross preceded a 62% price crash as the pandemic hit. Therefore, it should always be used in combination with other price, on-chain or fundamental analysis.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.