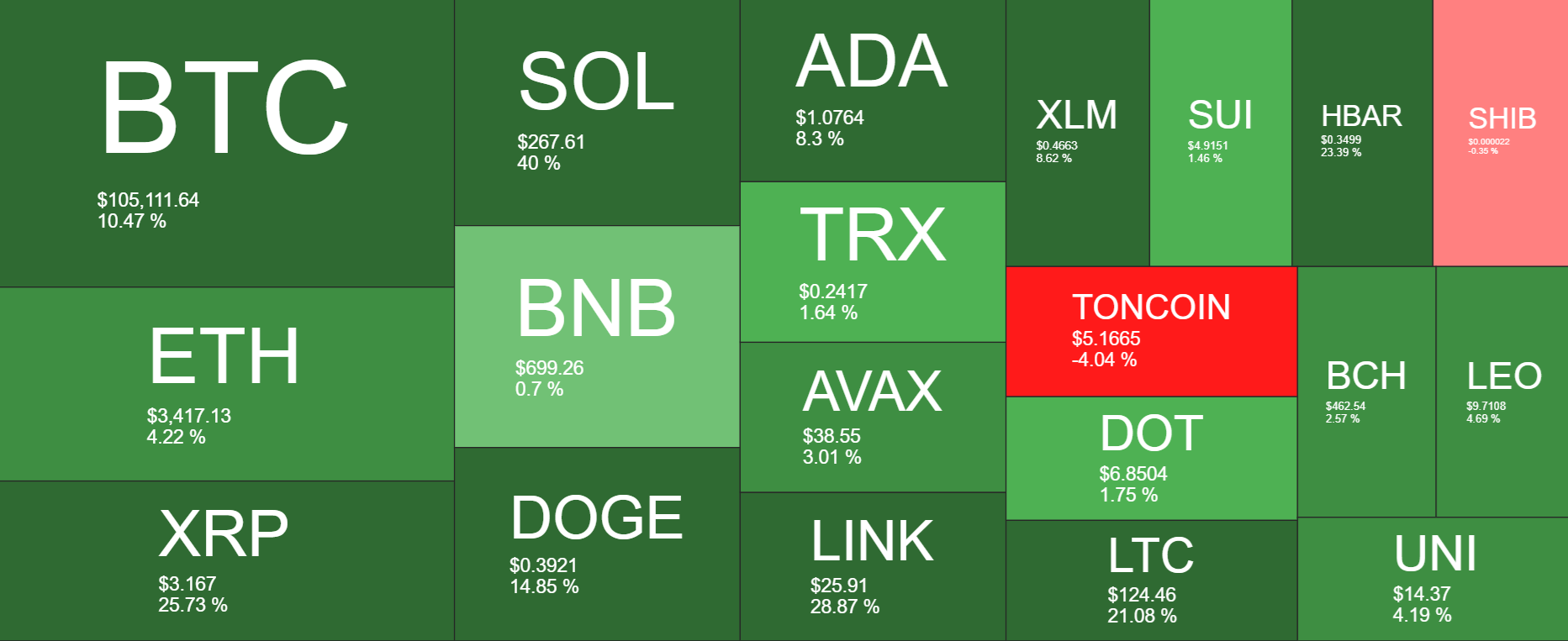

Bitcoin rallied an impressive 10% last week, marking its strongest weekly performance since the week following Trump’s election in November. The Bitcoin price started last week at 94.5K before falling sharply on Monday to a low of 89.2K. The Bitcoin price then recovered across the week, reaching a high of 105.8K this weekend and a new record high in early trade on Monday above 109K. Heightened volatility is expected at the start of the week.

The crypto space was a sea of positivity, with gains seen across the board last week. Ethereum rose 4%, underperforming Bitcoin. However, Solana jumped 40%, and XRP booked gains of 25% as these coins, along with other meme coins, outperformed the world’s largest cryptocurrency.

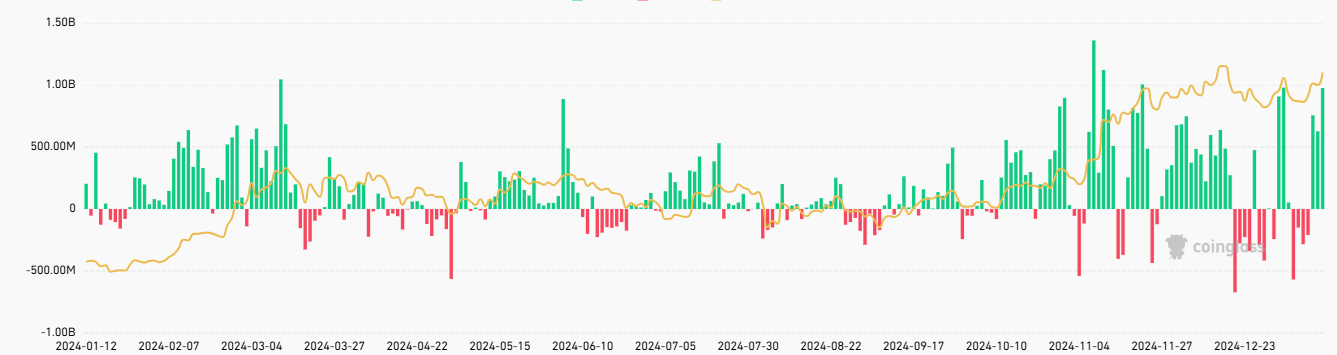

Bitcoin ETF flows

On a weekly basis, Bitcoin ETFs recorded the third straight week of net inflows. Bitcoin ETFs posted inflows of $887.15 million, more than double the $307 million in net inflows the previous week.

On a daily basis, Bitcoin ETFs posted net outflows at the start of last week before flipping to net inflows for the latter part of the week. On Friday, the BTC ETFs posted net inflows of $975 million, the second highest level of net inflows this year after $978 million of inflows were recorded on January 6. This highlights the pronounced demand from institutional investors ahead of Trump’s return to the White House.

Macro backdrop & fundamental drivers

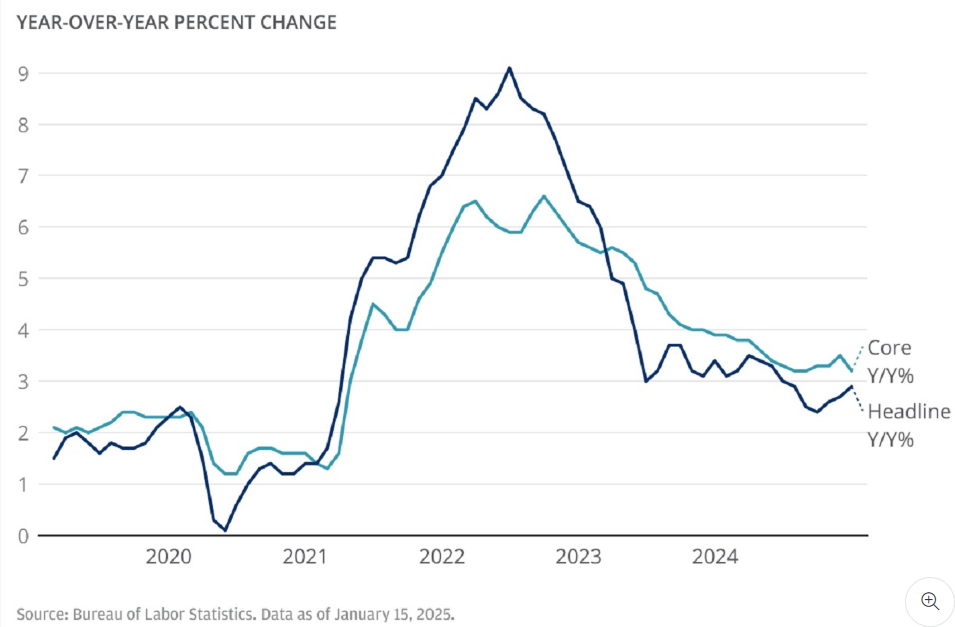

The crypto market posted substantial gains last week, primarily driven by macro factors ahead of Trump’s inauguration today and US data. This resulted in the market re-pricing Fed rate cut expectations. Due to the Federal Reserve’s data-dependent stance, markets surrounding key US data releases have been volatile.

Stronger-than-expected nonfarm payroll data earlier in the month added to inflationary worries, lifting treasury yields while causing the market to rein in rate cut expectations—Bitcoin and other risk assets fell.

However, in the past week, it was cooler than expected underlying inflation data, along with weaker than forecast in US retail sales and jobless claims, saw the market lower its inflation outlook and raise Fed rate cut expectations. Treasury yields fell, along with the US dollar, helping risk sentiment improve. The market went from pricing in just one Fed rate cut in December, at the start of last week, to two possible rate cuts in 2025, one likely in June and another at the end of the year.

However, it’s worth noting that Fed governor Chris Waller was more dovish last week. He said it’s reasonable to think that rate cuts could happen in the first part of the year and doesn’t believe that March’s rate cut can be completely ruled out, supporting crypto prices higher.

Trump’s inauguration

Attention is now squarely on Trump, with a heavy emphasis expected on fiscal issues and government policy following the inauguration. Reports that President-elect Donald Trump included crypto-related regulatory reforms in his list of 100 day-one executive orders helped boost Bitcoin at the end of the week and to fresh record highs on Monday.

This also suggests that crypto will be relatively high on the new administration’s agenda, which is likely to be increasingly positive for crypto and may not be fully priced. As a result, Q1 of this year could be constructive for the crypto markets.

At the same time, there is still uncertainty, particularly regarding the inflationary implications of some of Trump’s possible policies and what that might mean for Fed rate cuts going forward.

The SEC to change course

As Gerry Gensler’s last day as the SEC chair approaches, the crypto industry has flooded the Commission with a wave of ETF filings. On January 17th, at least four proposals were submitted as the crypto industry anticipates regulatory shifts on the incoming administration, which is expected to adopt a more crypto-friendly stance.

Pro shares applied for Solana futures ETFs and submitted filings for an XRP ETF. Other investment firms, such as Bitwise, Canary Capital 21 shares, and Wisdom Tree, have already submitted their spot XRP ETF proposals.

According to reports, the new SEC leadership will likely kick-start a crypto overhaul, potentially putting some enforcement cases on hold. This has helped XRP rally reach all-time highs.

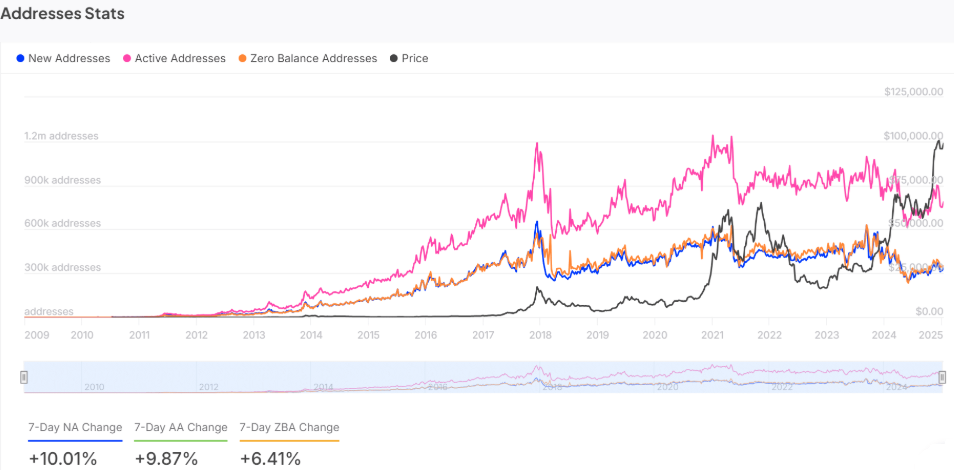

Bitcoin active addresses surge

Bitcoin’s active addresses have increased by 9.8% over the past seven days, showing growing interest in the crypto asset. This key indicator of market activity points to heightened transactional demand from both institutional and retail investors. A rise in the number of active addresses is often considered a measure of market confidence, and if this trend continues, it could help Bitcoin push to higher price levels.

Whale addresses reach a 7-year high

On-chain data has shown that whale addresses have reached levels not seen since December 2017, as the price rose last week. At the time of writing, the number of addresses holding at least 100 Bitcoin had surged to 17,799, its second-highest level since December 2017. This milestone also coincided with Bitcoin reaching a 2025 high. The steep accumulation pattern started in October 2020, when whale addresses were around 16,200, representing an 18% hike in large holder concentration in little over three months.

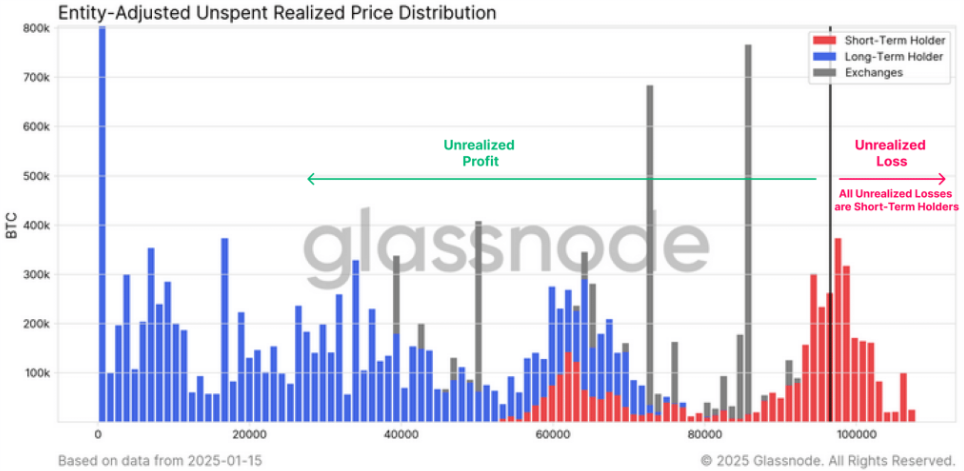

Adding to the bullish narrative is Bitcoin’s cost basis distribution, which showed that unrealized losses are exclusively concentrated among short-term holders who entered the position within the last 155 days, while long-term holders maintain significant unrealized profits.

The chart shows blue bars represent long-term holders, and short-term positions are amongst the red bars at higher prices. Meanwhile, grey bars represent exchange holdings showing underlying periodic spikes above 600,000 BTC, which is strategic institutional positioning.

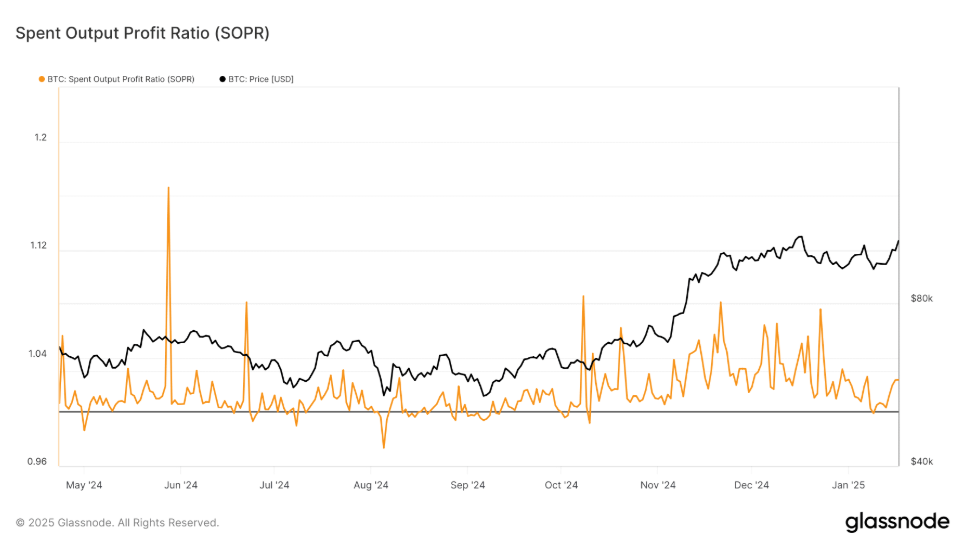

The spent output profit ratio adds another layer of confidence to the Bitcoin price, which has been maintaining levels above one since November. This indicates that most Bitcoin transactions have been realising modest profits without triggering mass selling.

Caution as Bitcoin reaches extreme greed

However, it is also worth noting that Bitcoin’s fear and greed index is 76, signaling extreme greed. FOMO is reaching new heights with both institutional and retail investors diving in. This is perhaps best illustrated by Trump’s meme coin $TRUMP, which surged after being created on Friday and gained $14 billion in market cap across the weekend.

However, the meme coin frenzy is draining liquidity from Bitcoin. The gains in Bitcoin are dwarfed by the $TRUMP surge. However, Bitcoin’s recent rally is also driven by a level of hype, with FOMO also pushing the price higher. The question here is what happens when the hype dies down. Many a meme coin has crashed as hype fades. Could Bitcoin be next? All eyes will be on Trump for further fundamentals to support this leg higher.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.