Bitcoin rose by 4.5% last week, reaching a record high above 105k. After starting the previous week at 97k, the price rose and hovered around the 100k level mid-week before recovering to an all-time high of 106.5k at the start of the new week. The price has gained over 50% since the US elections.

While Bitcoin and ETH posted gains, most altcoins showed signs of cooling off after substantial gains the previous week. XRP and SOL fell around 5%. Meanwhile, DOGE and XLM were down 11% across the week. The selloff in altcoins meant that the altcoin season failed to meaningfully start, with the altcoin season index once again back below 75.

BTC and ETH showed resilience last week with the size of the drawdowns softening, as opportunistic buyers were keen to buy the dips. BTC has risen to a record high, and ETH remains near a yearly high despite last week’s largest single day of liquidations since 2021. BTC and ETH ETFs have continued to see net inflows.

Trump Cheers Boosts BTC to a record high

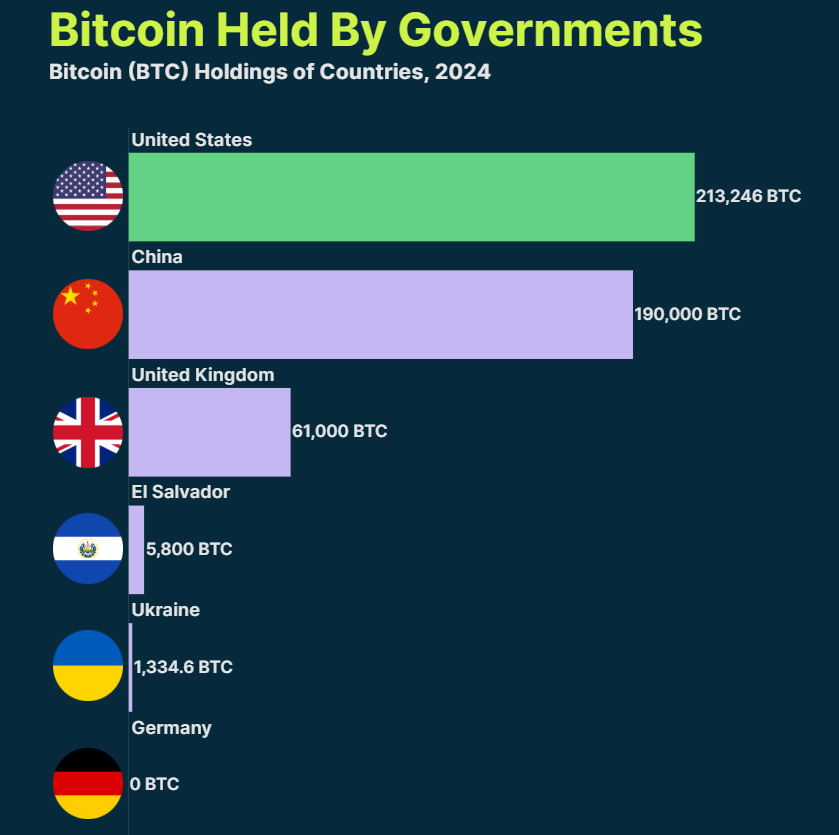

Bitcoin rose to a record high on Monday, boosted by the prospects of a Strategic Bitcoin Reserve under incoming President Donald Trump. Trump told CNBC in an interview he planned to build a crypto reserve similar to the Strategic Petroleum Reserve. Trump reiterated his plans to make the US a global crypto leader. Exactly how far Trump’s crypto plans could go isn’t clear, as any crypto reserve would need to be funded by higher fiscal spending, which could be a challenge to pass. However, the government could turn its confiscated crypto assets into reserves through Congress. According to CoinGecko, the US government has over 200k coins.

Source CoinGecko data August 2024

The prospect of a crypto-friendly Trump administration has helped crypto soar since its pre-election level of 66k.

MicroStrategy joins the Nasdaq 100

MicroStargey has joined the Nasdaq 100 index, the top 100 non-financial stocks on the exchange, in its annual rejig. This will now lead to passive vehicles benchmarked to the Nasdaq purchasing the stock, sending the share price higher and meaning around $1 billion in new money with an indirect exposure to Bitcoin.

MicroStrategy has been buying Bitcoin at a rapid pace in recent months and now owns 423,650 tokens worth around $43 billion. It has hinted at making purchases of the coin above 100k, suggesting that it sees the price continuing to rise. The share price has rallied 500% so far this year.

BTC & ETH ETFs

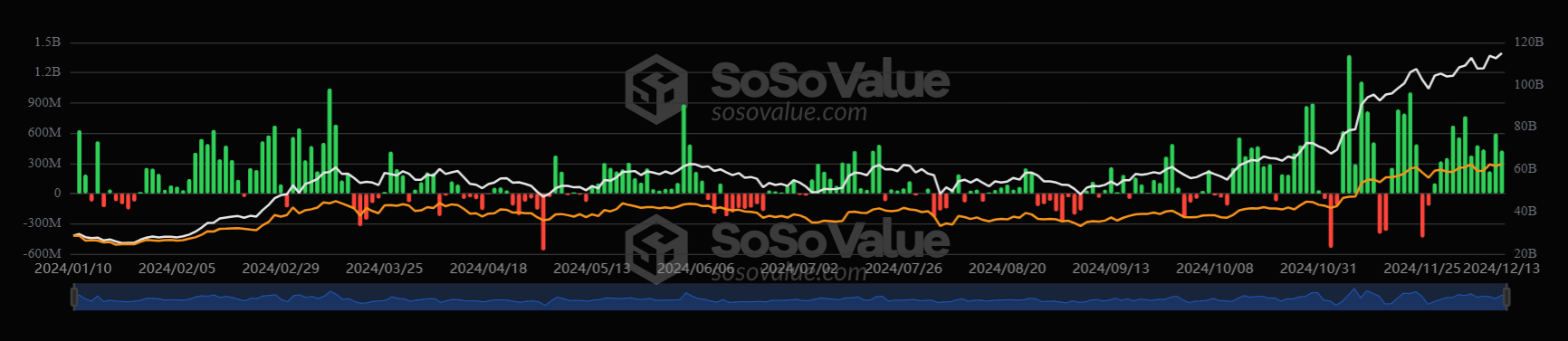

Bitcoin ETFs continued to see net inflows throughout the week, booking 11 straight days of inflows. After seeing record inflows across November, the Bitcoin ETFs have seen $4 billion in combined inflows since the start of December. BlackRock and Fidelity contributed strongly to the flows, with no outflows and consistently strong inflows of over $100 million. This pattern suggests strong demand even as Bitcoin trades around its record high.

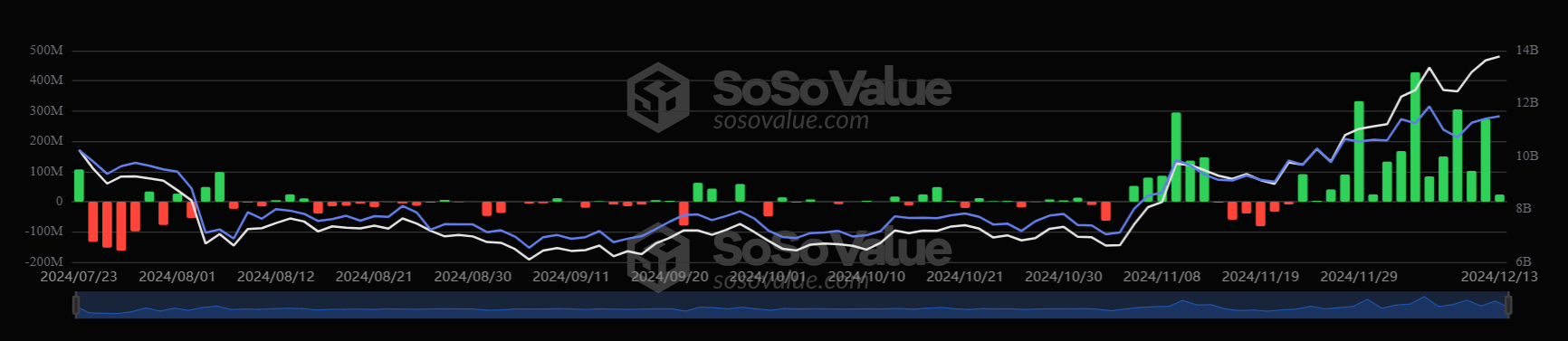

In particular, ETH ETFs’ inflows are experiencing strong inflows. Until recently, ETH ETFs lagged behind BTC ETFs; ETH ETFs have experienced a record run of 14 straight days of net inflows, over double the 6 days of inflows seen in November. ETH ETFs recorded $854.8 million in inflows this week, a record week. Meanwhile, this month’s net inflows of $1.4 billion to ETH ETFs are proportionally much larger than the $4 billion into Bitcoin ETFs. Institutional inflows point to a strategic shift in the perception of Ethereum and the rising promise for it as a regulated financial asset.

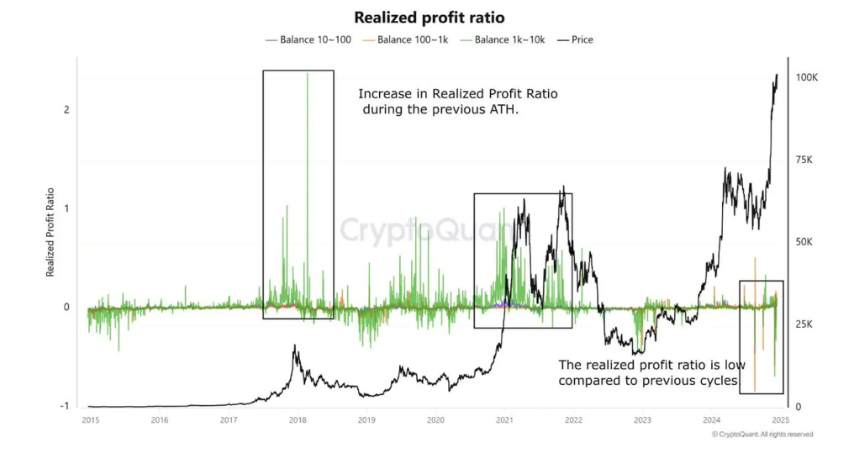

Whales see further BTC gains

Interest in Bitcoin has surged again, with whales playing a key role in the recent price increase. On-chain data showed that large Bitcoin holders saw a flurry of activity over the weekend. These large holders moved hundreds of millions of Bitcoin off exchanges and into private wallets. Whale Alert showed at least 27,000 Bitcoins worth $2.8 billion were moved off major exchanges over the weekend. This means there is a limited supply of Bitcoin on exchange, which often points to higher prices.

According to CryptoQuant, Bitcoin Whales’ realized profit ratio suggests the potential for further price increases. Realized profits have not started in earnest with Whale wallets, which can be interpreted as meaning whales do not see the price at a peak yet and are waiting for further gains.

Whaletracker reports that Tether (USDT) has seen an additional $1 billion, signaling more liquidity into the system. This surge in liquidity, which is almost becoming a weekly occurrence, reflects the growing demand for USDT, which participants are likely to use to acquire crypto. With Bitcoin the likely benefactor, particularly after moving away from altcoin season, this could support the gain in BTC.

Macro Backdrop

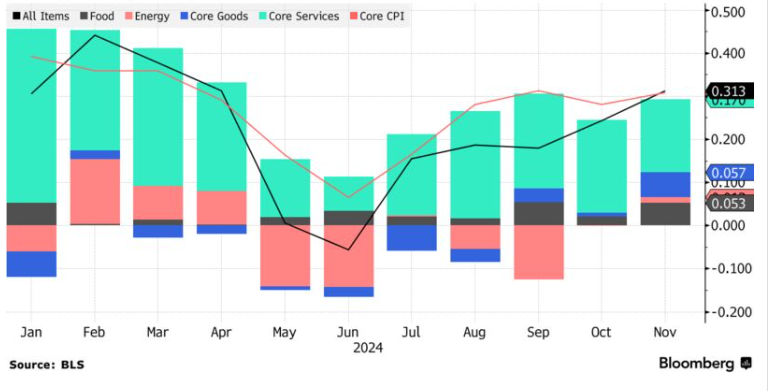

The macro backdrop remains supportive of crypto as we head towards Q1 2025. US inflation data kept December rate cut hopes alive.

US inflation data showed that consumer prices rose 2.7% YoY in November, up from 2.6% in October. Core inflation, which discounts more volatile items such as food and fuel, remained unchanged at 3.3%. Whilst the report showed a smaller uptick in inflation, it aligned with forecasts and cemented expectations that the Fed will cut interest rates next week.

According to the CME Fedwatch tool, the market is pricing in a 95% probability of a 25 basis point rate reduction by the Fed next week, up from 85% before the data release. A lower interest rate environment favors risky assets such as Bitcoin and equities. The Nasdaq100 rose to a fresh all-time high this week above 21k.

While the Fed is all but certain to cut rates next week, the outlook beyond that is less clear. Given Trump’s expected inflationary policy measures, we expect the Fed to continue cutting rates but at a slower pace than initially expected. Even so, this should be enough to support the risk sentiment.

China’s looser monetary policy stance

Meanwhile, China pledged to increase its economic stimulus measures at the Central Economic Work Conference on December 12. These measures include lowering interest rates and a looser overall monetary policy stance in 2025. The shift to “appropriately loose” marks the first move away from the current “ prudent “ stance since 2010. These shifts could provide more liquidity and improve confidence in China, which is good news for risk assets, including Bitcoin.

Week Ahead

Will Bitcoin be able to build on its record high? This may depend on the Fed. This week’s primary focus will be on the US Federal Reserve’s interest rate decision. The Fed is expected to cut rates by 25 basis points. Should the Fed adopt a much more cautious tone towards rate cuts in 2025, this could impact demand for Bitcoin.

In addition to the Fed rate decision, US core PCE data will also be focused on. The market will be keen to see whether US inflation continues to trend lower. More recently, there have been signs that inflation is becoming sticky amid strength in the US economy. Hotter-than-expected inflation could also pose a risk to Bitcoin’s rally.

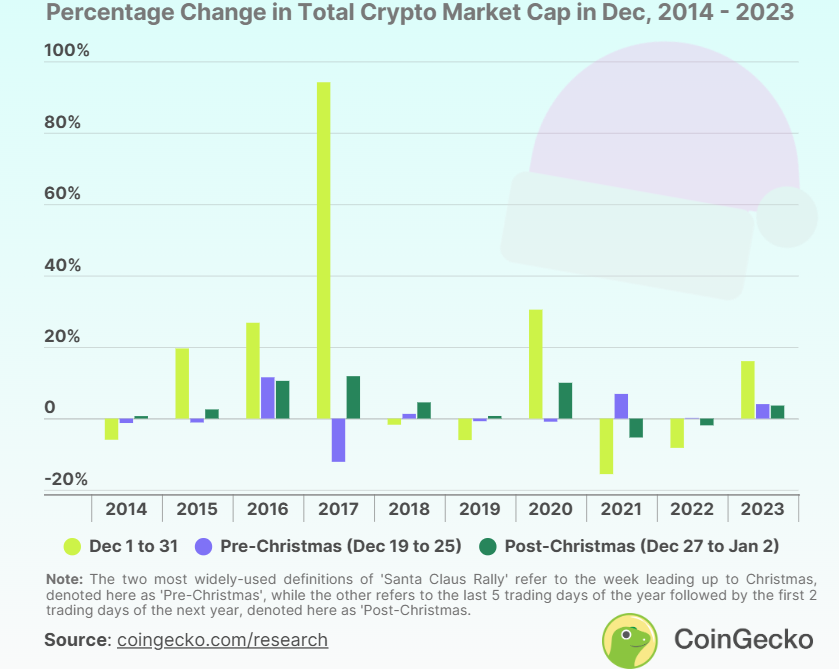

Will Bitcoin see a Santa Rally?

As we head towards the final few weeks of December, the prospect of a Santa Rally could keep Bitcoin buoyant. According to data from CoinGecko, Crypto experienced a Santa rally from December 27 to January 2, eight out of the past ten times. These gains were between 0.69% and 11.87%.

On the other hand, crypto has experienced a rally leading up to Christmas in just five of the past ten years. These gains ranged from 0.15% to 11.56%.

Past performance is not indicative of future performance.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.