Bitcoin gained over 7% in the previous week. The world’s largest cryptocurrency kicked off last week at 59.4k and remained relatively unchanged until Friday, when the price shot up over 6%, reaching a peak of 64,830. Bitcoin trades around this level heading into the start of the new week.

Substantial gains were seen not just in Bitcoin but also across most of the altcoin marketplace, with Ethereum rising 4.2% and Solana jumping almost 10%. Meanwhile, LINK gained 19% and AVAX rose 26%. However, there were some pockets of weakness, with TON coin dropping 14%.

Meanwhile, the U.S. stock market also saw solid gains across the week, with the S&P 500 rising 1.75%, its second straight weekly advance. Like Bitcoin, most of those gains came on Friday, when risk assets across the board were boosted by Federal Reserve chair Jerome Powell’s speech at the Federal Reserve’s annual Jackson Hole economic conference.

Jerome Powell signals rate cuts at Jackson Hole

At the Federal Reserve’s annual economic symposium in Jackson Hole, Fed chair Jerome Powell confirmed expectations for an interest rate cut at the central bank’s next gathering. He said, “The time had come for policy to adjust.” Cementing bets that the Fed will cut rates. While the direction of travel is clear, the timing and pace of rate cuts will depend on incoming data and the economic outlook.

Powell confirmed that policymakers are more confident that inflation is on its path back to the Fed’s 2% target but also acknowledged a natural cooling in the labour market.

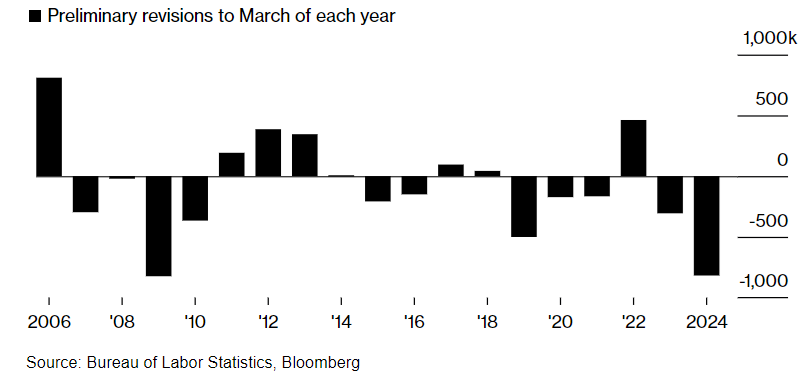

Data earlier in the week revealed that US payrolls were downwardly revised by 818,000, meaning that the US labour market was weaker than initially reported. The data comes after the July non-farm payroll report, which was softer than expected, sparking recession fears that caused a big sell-off in risk assets at the start of August.

For now, the market has pushed aside any concerns regarding weakness in the labour market and is fully focused on the Fed starting to cut interest rates in the coming meeting. The market is pricing in a 100% probability of the Fed cutting rates, though there is some debate still around this size. The market is pricing in a 25% chance over 50 basis points right now.

What is for sure is that the market’s concern over the cooling labour market leaves us highly data-dependent. While the direction for the Fed’s monetary policy is clear, with interest rates expected to start falling next month, there are still some questions about the speed and intensity of these rate cuts.

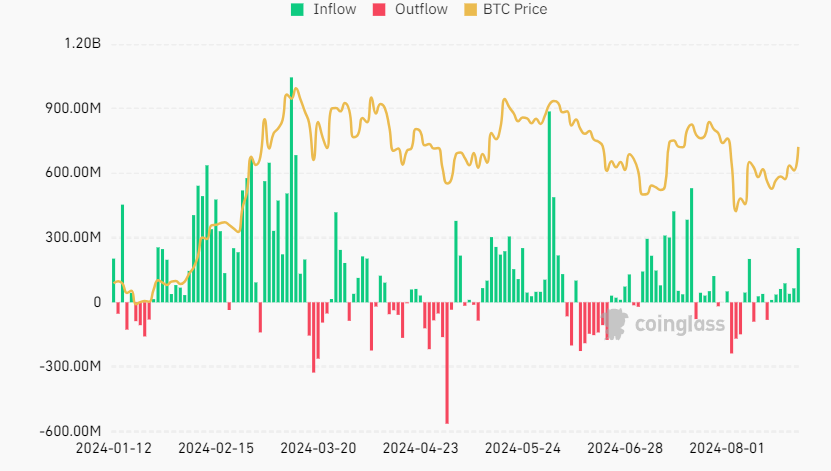

Bitcoin ETF inflows at a monthly high

The US-based spot Bitcoin ETFs reached its highest value so far in August, $58.4 billion, following a seven-day streak of positive inflows. Friday saw the highest inflows since the streak began, logging $252 million, the largest net inflows since July 22nd.

Unsurprisingly, the largest book Bitcoin ETF by total asset value was Blackrock IBIT, which extended its lead over other funds by experiencing net inflows of $87 million. Fidelities BTC experienced inflows of $64 million, while Grayscale’s GBTC logged out plays of $35 million.

Meanwhile, spot ether ETF is on a streak of net outflows, the inverse of Bitcoin’s winning streak. On Friday, spot ETH ETF saw outflows of $5.7 million from funds, bringing outflows since that losing streak began on August 15th to nearly $99 million. Despite these outflows, the total net assets of the combined funds are at the highest level since August 2nd thanks to fluctuations in the Ether price.

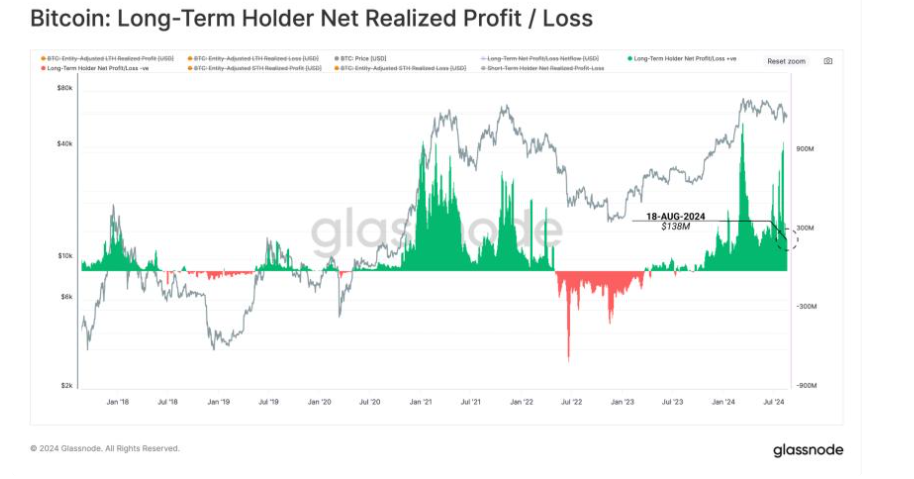

Long term holders

According to data from Glassnode, long-term holders of Bitcoin are locking in consistent gains of $138 million in profit per day. This consistent locking-in of gains over the past few months comes even as the market has experienced uncertainty and volatility. According to the Bitcoin Long-Term Holder Net Realized Profit/Loss chart from Glassnode, LTHs are currently selling Bitcoin at a rate of about $138 million per day.

This selling pressure serves as a benchmark for the market, showing the amount of new capital that needs to flow into Bitcoin on a daily basis to counterbalance the setting and stabilise the price. Should daily inflows of Bitcoin come in below $138 million, the price could potentially face downward pressure.

Week ahead: Nvidia earnings & inflation data

The recent rally in the US stock markets will be tested this week when Nvidia earnings, US inflation figures, and inflation figures from the eurozone and Australia are released.

Nvidia earnings

Investor enthusiasm for AI it will be tested this week when Nvidia reports earnings after the close on Wednesday. Earnings, together with management guidance, will provide further insight into expectations surrounding corporate investments in AI.

Nvidia trades up over 150% year-to-date, accounting for around 1/4 of the S&P 500’s 17% year-to-date rise. Since the stock has driven the AI rally and strong gains in the broader index, investors will want solid fundamentals to support the lofty valuations.

US core PCE

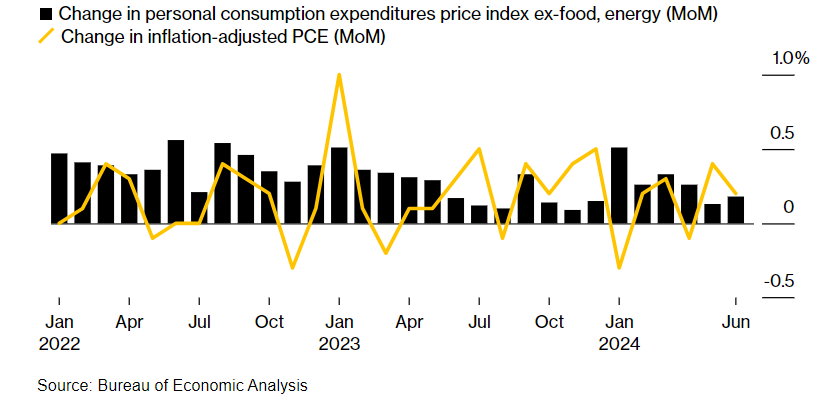

The key focus on the economic calendar this week will be the core Personal Consumption Expenditure (core PCE) price index, which is the Fed’s preferred gauge for inflation. While core PCE remains above the Fed’s 2% target, the US central bank is confident inflation will continue to cool, which will help support the view of a soft landing. Core PCE is expected to be 0.1% on a monthly basis. Should core PCE fall below 0% and consumer spending also drop sharply, this could raise recession fears, although we don’t see this scenario as probable for now.

Eurozone & Australian Inflation

Inflation data from the eurozone is also due for release on Friday and could be pivotal in shaping ECB rate decision expectations for September. The data is expected to show that inflation cooled again after a small uptick in July, highlighting the challenge the central bank faces in bringing inflation under control. On Friday, an ECB governing member, Olli Rehn, said he sees cooling inflation and slowing growth as reasons to cut interest rates again in the September meeting. The market is pricing in a 90% probability of a 25 basis point rate cut on September 12. A cooling inflationary environment could limit gains in EUR/USD, which trades at a 2024 high and could lift European stocks higher.

Australian inflation numbers are also in focus and are expected to pull back into the RBA’s 2% to 3% target band for the first time in three years. Cooling inflation could raise questions about the central bank’s stance, as it is an outlier for its reluctance to cut rates.

Escalating geopolitical tensions

Rising tensions in the Middle East could weigh on market sentiment should we see a further escalation in tensions. Over the weekend, Israel and Hezbollah clashed, raising fears that Iran, Hezbollah’s backer, could be drawn into the conflict, which could impact oil prices.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.