Bitcoin rose 1.5% last week, marking the second straight weekly rise. The world’s largest cryptocurrency rose from 93k at the start of last week to a six-month high of 97.9k on Friday before easing lower across the weekend to 95k on Monday. The price is back within the familiar range that it traded in across the latter half of April.

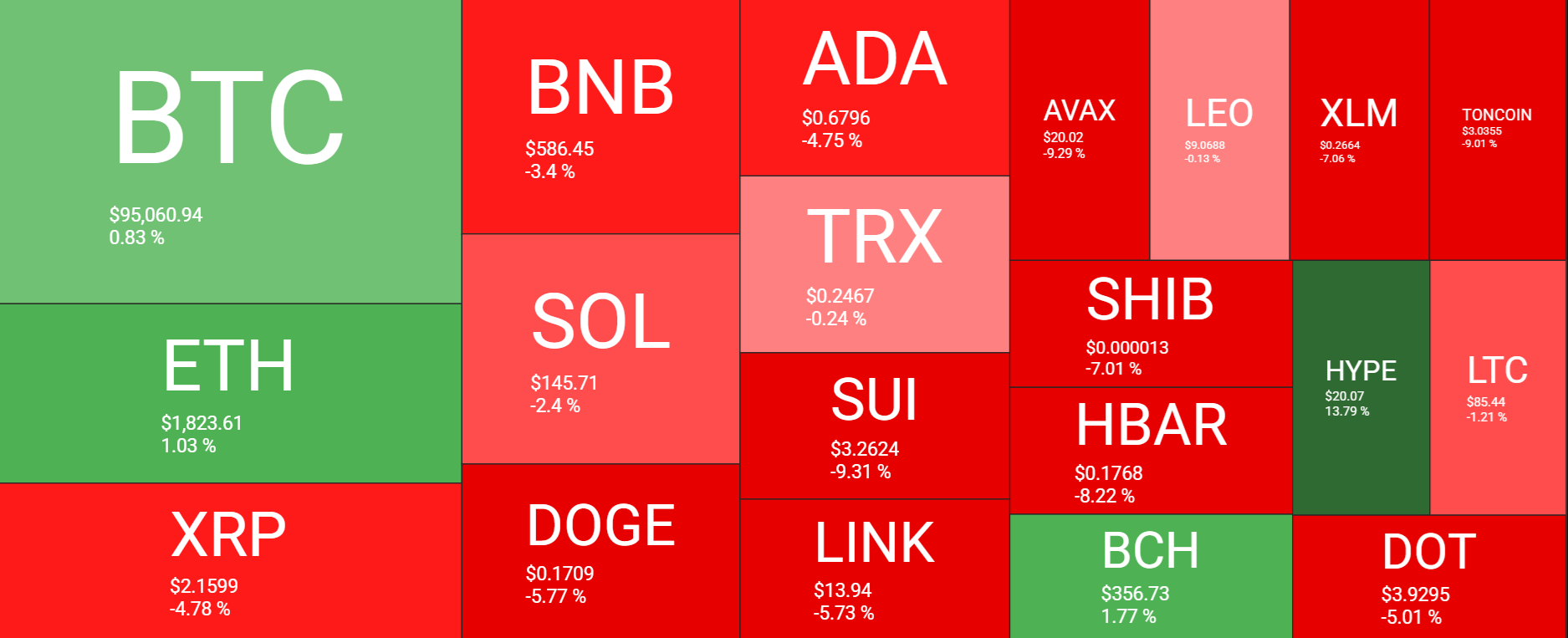

While Bitcoin and Ethereum booked gains last week, the picture was less upbeat across other cryptocurrencies. XRP fell 4.7%, SOL dropped 2.4%, and DOGE fell 5.7%. TON fell almost 10%, and HYPE outperformed with gains of 13%.

Bitcoin ETF net inflows

Bitcoin’s ETFs booked the third straight weekly rise, with $1.81 billion in net inflows, following $3.06 billion in the previous week. Bitcoin ETFs recorded net inflows on 4 of the past 5 days and 11 of the past 12 days. Should net inflows remain persistent, this could help support BTC’s price higher.

Spot Bitcoin ETFs bought nearly six times as many Bitcoins as were produced by miners over the past week. The funds bought 18,644 Bitcoin, while only 3,150 were mined for the period. This represents accumulation by institutions and ETF issuers at almost six times the amount of the asset miners produce, creating scarcity, which supports the higher price.

Corporate demand

Signs of corporate demand for Bitcoin also strengthened across the week. Strategy raised another $21 billion to buy more Bitcoin, while MetaPlanet issued $24.7 million in interest bonds, which are also likely to be used for purchases.

Strategy Q1 earnings posted a loss of $4.2 billion as BTC fell from its all-time high of 109.5K in January and closed at around 82.5K in March. Given its plans for further purchases, the firm is showing no signs of slowing its pace of BTC acquisitions.

Macro Backdrop

Trade headlines still drive sentiment

Despite diverging from risk assets recently, crypto rallied in sync with broader risk assets last week amid an upbeat market mood. President Trump rolled back some of his initial tariffs on cars and auto parts, and as Commerce Secretary Lutnik announced a historic trade deal crossing the line. Meanwhile, big tech earnings were broadly encouraging, adding to a positive market mood. The Nasdaq 100 gained 3.7% last week, while Gold fell 2.3%, marking its second straight weekly decline, the first two weeks of losses booked since mid-December.

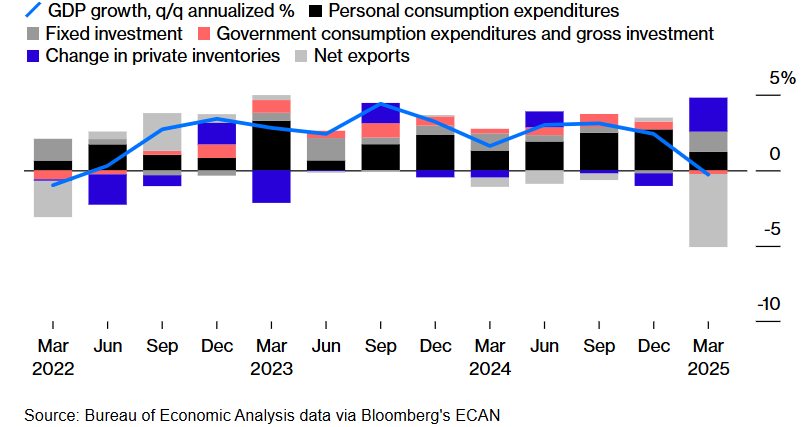

Bitcoin rises despite weak GDP data.

Economic data showed that the US economy contracted by -0.3% in Q1 and struggled even before Trump’s Liberation Day. This could suggest that a technical recession is emerging. However, delving deeper into the figures, the contraction appeared to be owing to importers trying to front-run Trump’s tariffs. Meanwhile, consumer spending, the dominant part of the US economy, slowed to 1.8%, the slowest since Q2 2023, but it is not terrible.

Friday’s jobs data showed weakness had not yet seeped into the labour market. The non-farm payroll report was solid at 177k, ahead of the 130k forecast, although vacancies fell sharply to 7.2 million.

Should a technical recession emerge, it’s not clear how this could impact market behaviour. Typically, recessionary indicators are a drag on equities, and crypto may not be immune if spending takes a hit. However, due to the tariff-related nature of any emerging technical recession, and the potential for fiscal stimulus through tax cuts and deregulation, these could be offsetting factors that may set crypto up for Q3 in a better place.

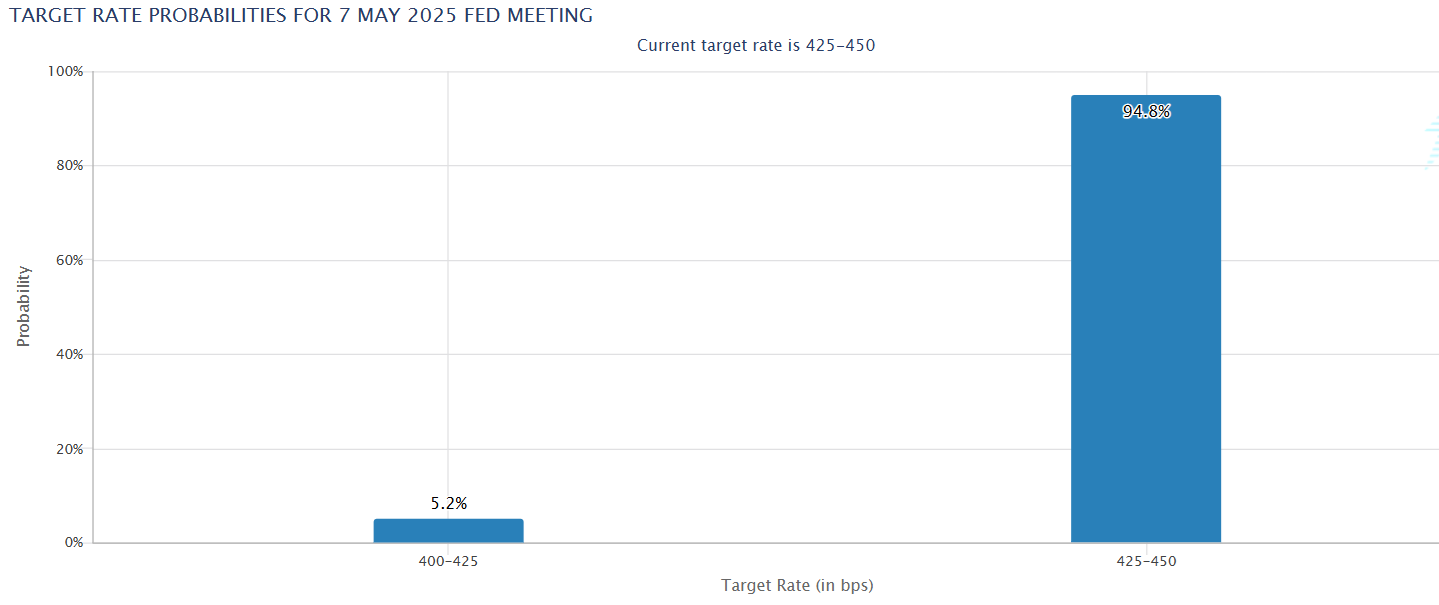

The market is pricing in low odds of a rate cut on May 7. According to the CME Fed Watch tool, the market is pricing in a 96.5% probability that the Fed will leave rates unchanged at 4.25 – 4.5%.

Regulation environment tailwind

With regard to regulation, the Federal Reserve made an important shift amid the withdrawal by the Fed, Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency of two joint statements regarding bank-related crypto activity. This continues a trend of unwinding onerous chokepoints and allows banks to engage in permissible crypto asset activities.

In other words, it allows banks to do more in the crypto space without seeking approval. This could be more important than it initially looks, as it removes significant institutional barriers for banks that had been effectively prevented from developing crypto custody solutions, crypto asset platforms, and payment networks. This also coincides with financial institutions Charles Schwab and Morgan Stanley announcing plans to offer crypto trading to their clients in the coming year.

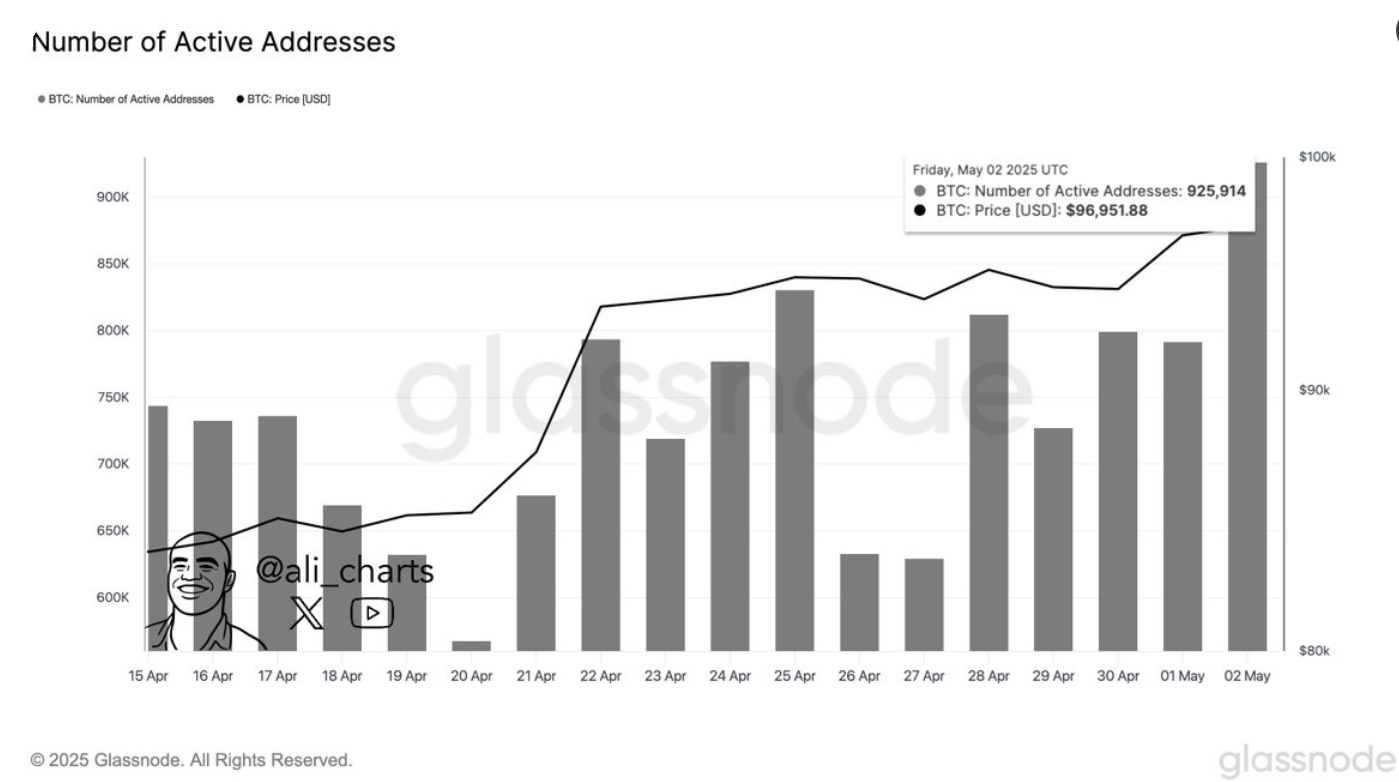

On-chain data – active addresses hit a 6-month high

Bitcoin active addresses rose to the highest level in over six months. 925,914 BTC addresses were active on a signal day, a notably high level of engagement. The chart from Glassnode shows how the surge follows a gradual increase that started in the final week of April. The increase in Bitcoin activity coincides with the recent rise of the BTC price above 95k.

Short-term holders realised price

Bitcoin’s short-term holders’ realised price is the metric that calculates the average price at which short-term investors purchased BTC. These holders tend to be more sensitive to price fluctuations and capitalize on short-term moves. Bitcoin STH’s realised price is just over 93k. BTC is holding above this level, which could help propel the price towards 100k. However, a fall below could trigger a correction in BTC.

Bitcoin in May

Bitcoin’s monthly return for April was higher than average, rising over 14% after two straight months of below-average returns. According to data from Coinglass, Bitcoin typically sees returns of 7.5% in May.

Ethereum in focus ahead of the Pectra upgrade

Ethereum has risen 12.5% over the past two weeks, although it remains trapped below 1900. However, the path towards 2k may not be that long, with ETF inflows and internal upgrades happening behind the scenes, which could help send ETH into recovery mode.

Ethereum’s market price continues to trade at a discount relative to on-chain transaction volume, pointing to a misalignment between its market value and realised value (MVRV).

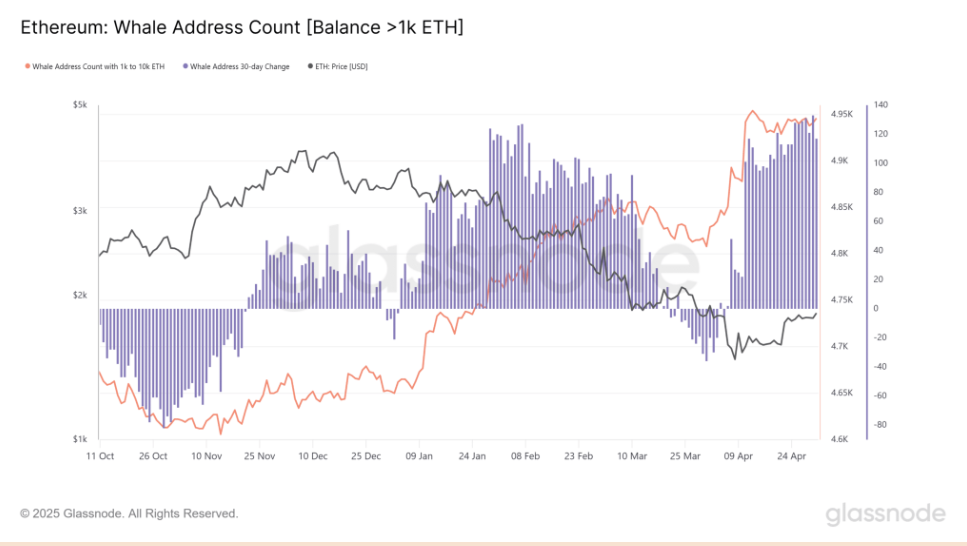

In other words, Ethereum could be fundamentally undervalued, and smart money could already be repositioning. Supporting this view, the 30-day active whale address count -those addresses holding between 1010 thousand and 117 ETH also rose to 117.

Institutional capital is entering with the Ethereum ETF, seeing $6.5 million in net inflows in the past week, marking the second straight week of net inflows after 10 consecutive weeks of net outflows. Should ETH ETF net inflows continue, ETH price could rise further towards the 2k target.

The US Securities and Exchange Commission approved VanEck’s Ethereum ETF ticker ETHV, which offers investors dual benefits of exposure to Ethereum’s price fluctuations and up to 5% annual staking rewards, raising institutional interest.

The Pectra upgrade could set the stage for further gains. It is scheduled to go live on May 7 and could introduce some important changes to Ethereum, prioritising usability, scalability, and staking efficiency. The Pectra changes address pain points for institutional clients while simultaneously streamlining operations between the execution and consensus layers.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.