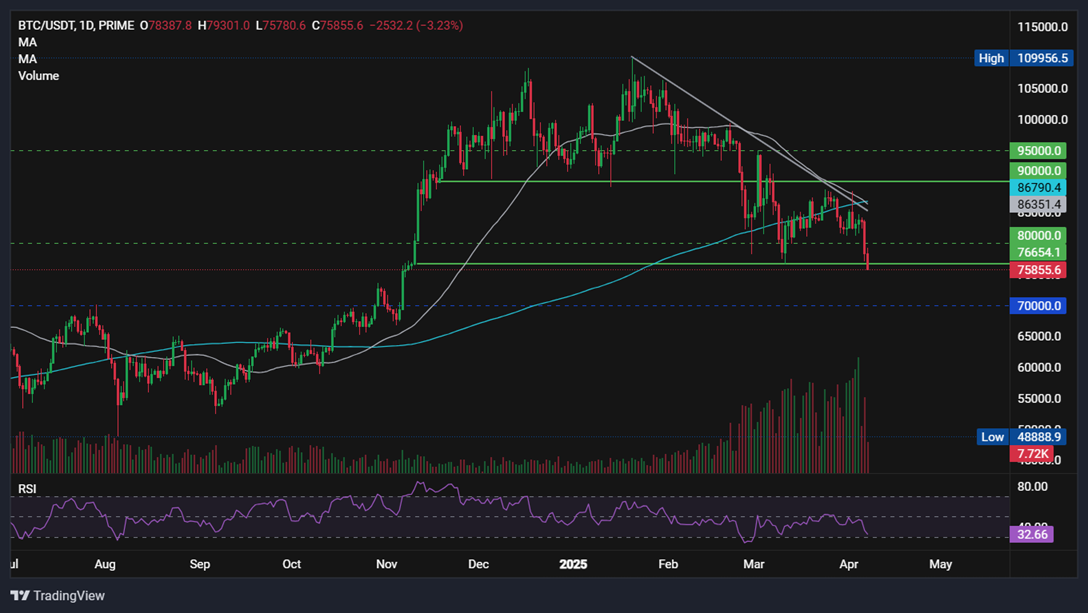

After showing resilience last week, Bitcoin has plummeted 5% below 80k as the market prepares for a Black Monday rerun.

Bitcoin has traded in a relatively tight range for most of the previous week, stabilising around 83k. The price moves were broadly capped on the downside by 81.2k and on the upside by 85k, except for a brief spike to 88.8k mid-week. However, the price plunged to 76k at the start of the new week.

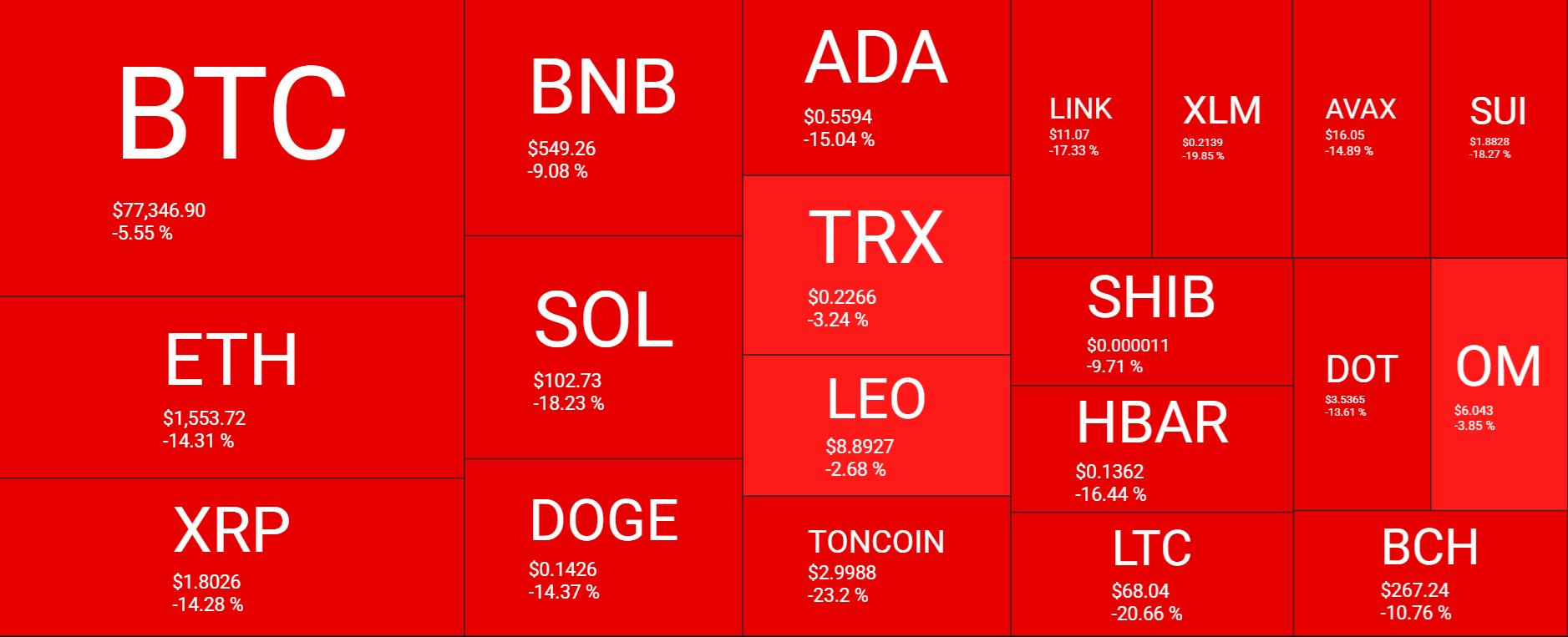

Altcoins are also a sea of red. Over the past 7 days, ETH has dropped 14%, as have XRP and DOGE. Meanwhile, SOL has tumbled 18%, ADA has dropped 15%, and TON has fallen 23%.

The total crypto market cap declined from $2.65 trillion on Monday, March 31, to $2.45 trillion on Monday, April 7, and has collapsed 8.35% in the past 24 hours alone.

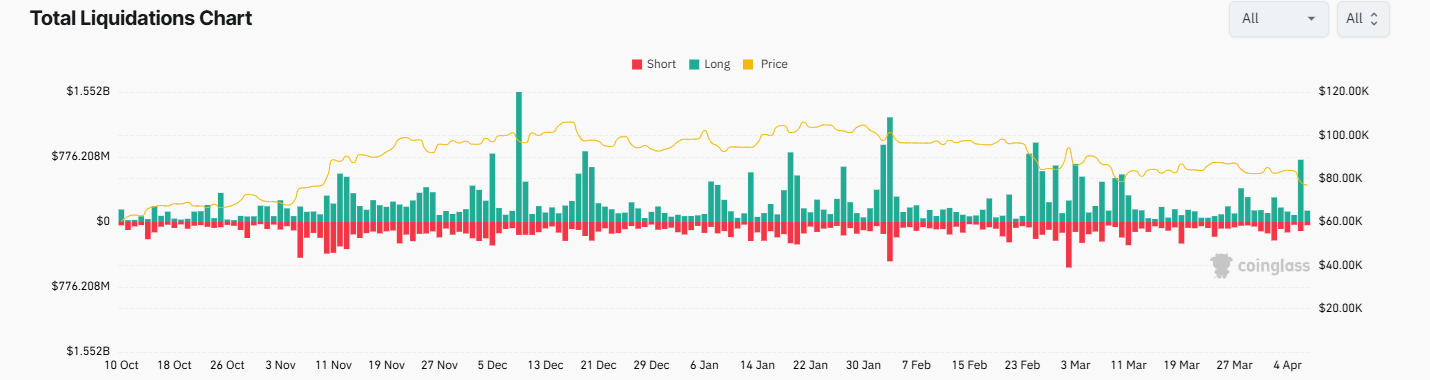

Crypto liquidations hit $1 billion

Total crypto liquidations have surged to $1.01 billion over the past 24 hours, with long positions taking the biggest hit. Long liquidations totaled $870.7 million over the past 24 hours, compared to $140.2 million in short positions. The surge in liquidations coincides with the price tumbling to a monthly low. Massive liquidations like this can spark Fear, Uncertainty, nd Doubt (FUD) among investors and increase selling pressure, resulting in further price declines.

Bitcoin ETFs post weekly outflows

Bitcoin ETFs experienced modest outflows of $192 million across the week, snapping a two-week winning streak and signaling weakness in institutional demand. Breaking this down on a daily basis, BTC ETFs experienced modest outflows of $64 million to $157 million each day, except on April 2, when $220.7 million in inflows were recorded.

Macro backdrop- Trump’s tariffs rattle the market

On April 2, President Trump announced reciprocal tariffs aimed at reducing the US trade deficit. Trump announced a universal 10% increase in tariffs on all imports, effective April 5, as well as additional tariffs on 57 trading partners based on their existing trade barriers, which would take effect on April 9. These came in addition to a 25% tariff on all autos entering the US, which took effect on April 3.

Regarding reciprocal tariffs, Trump announced a 34% increase in tariffs on China, bringing the effective tariff to 54%. Other countries in Southeast Asia were also affected by high tariffs, including Vietnam at 46%, Indonesia at 32%, and Thailand at 36%. Meanwhile, the European Union has been hit with a 20% tariff and Japan with a 24% one.

Regardless of how Trump’s administration arrived at these levels, the focus has now turned to the economic impact that they could have in the months ahead and the potential market reaction.

These trade tariffs were worse than expected going into the event, and various concerns over potential retaliatory measures from other countries made the investment landscape still decidedly uncertain. China retaliated on Thursday with reciprocal 34% trade tariffs on US imports, moving the world closer to a full-blown trade war.

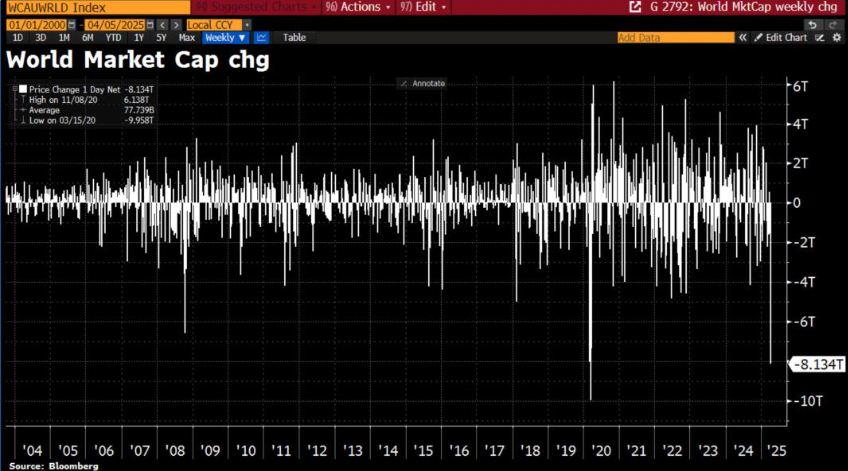

US equities plunge – Nasdaq Falls into a bear market

Notably, both events triggered volatility and sharp downward moves in US equities. The S&P 500 fell 9% across last week, dropping well into correction territory. Meanwhile, the Nasdaq fell over 10% last week, tipping the tech-heavy index into bear market territory, which marks a 20% fall from its recent high. Trump’s trade tariff announcement has seen $8.2 trillion wiped off the stock market’s value —more was lost than in the worst week of the financial crisis.

This was in stark contrast to the more muted moves seen in crypto last week, reflecting the direct impact of tariffs on corporate earnings, particularly for companies that rely on global supply chains. However, the global stock market is opening sharply lower again on Monday, fueling fears of another Black Monday, and Bitcoin’s resilience has faded at the start of the week.

The Hang Seng is down 10% as trading kicks off on Monday, and US futures are down 3.5%-4.%. BTC is plunging in line with risk assets, testing its 2025 low at 76.6k at the time of writing.

Recession fears rise

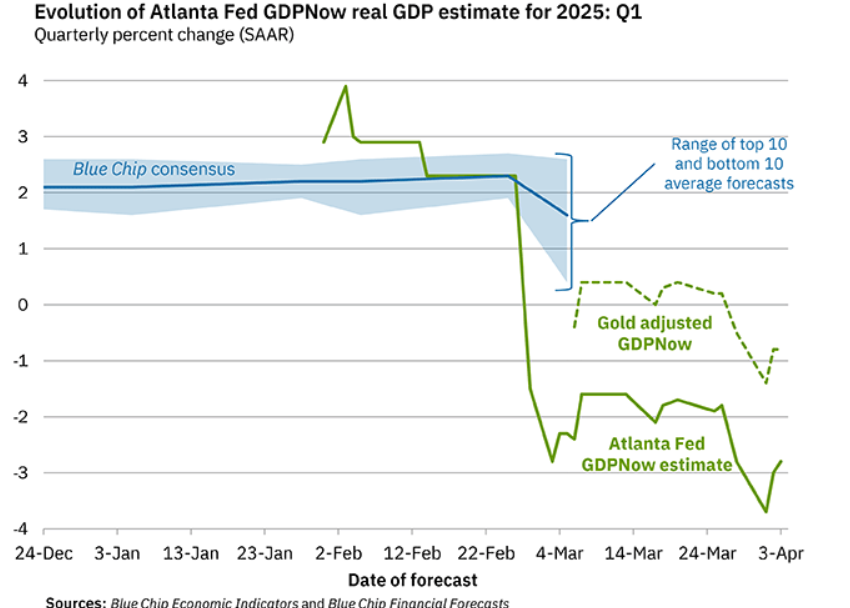

While Bitcoin hasn’t fallen as hard as stocks, it’s difficult to see a strong recovery in crypto whilst traditional risk assets remain so deeply underwater. Expectations are for quarter-on-quarter GDP contraction in Q1. The GDPNow forecast from the Atlanta Fed is currently showing a -2.8% contraction for Q1 2025. Should this remain negative for Q2 2025, it would mean two consecutive quarters of negative economic growth, indicating a recession. Investment bank JP Morgan is now seeing a 60% probability of the US falling into recession over the coming 12 months.

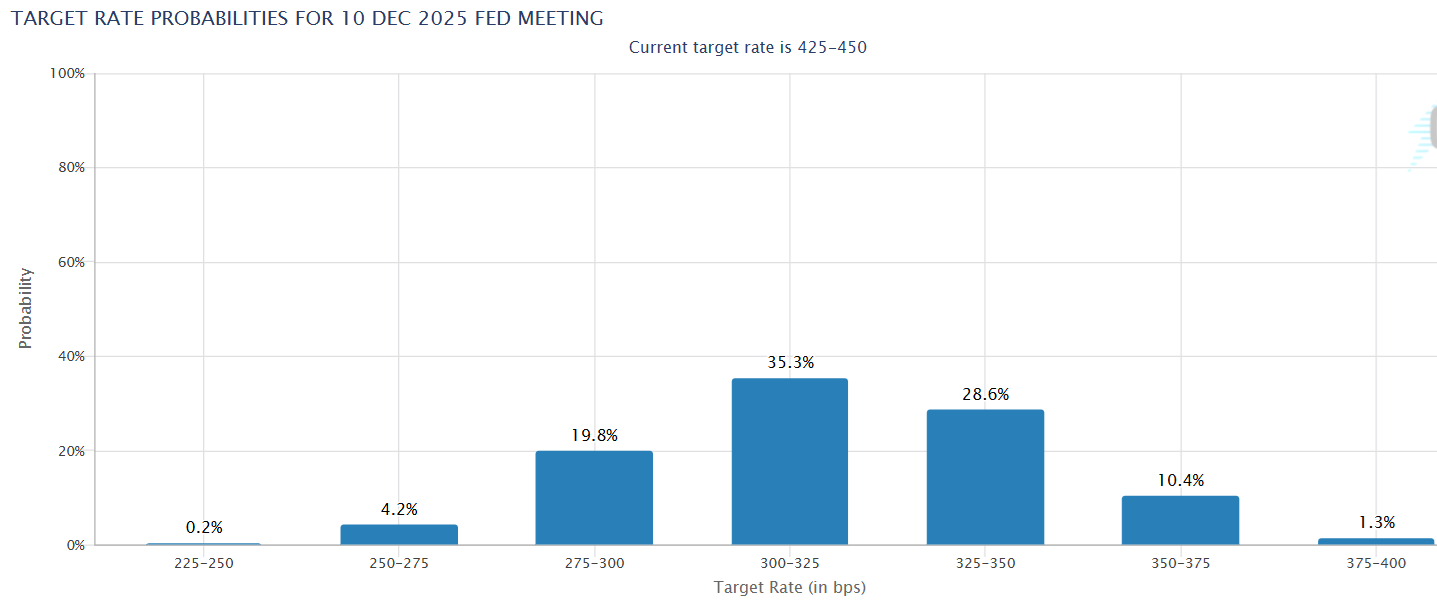

As a result, the policy remains uncertain, as the market is now pricing in additional rate cuts this year, with four 25-basis-point rate cuts expected, up from three just a few weeks ago. This increase in rate cut bets rank is down to economic weakness rather than inflation control. The US 10-year Treasury yield fell to its lowest level in five months, below 4%, which doesn’t lend itself to a risk-on environment. As a result, cryptocurrency could experience high levels of volatility, and any bull market recovery looks less likely for now.

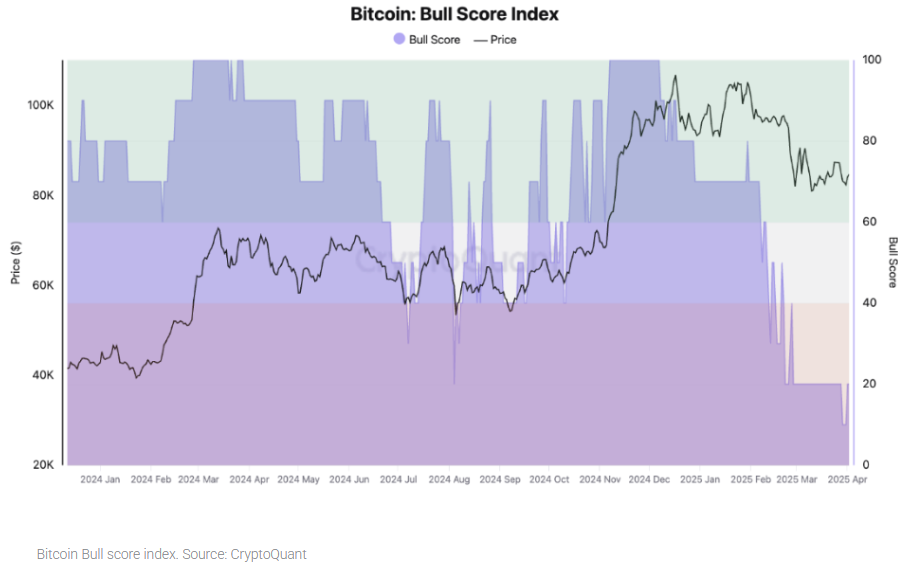

Bitcoin Bull Score remains depressed

The Bitcoin Fear and Greed Index has fallen to 17, down from 27 yesterday – in Fear territory. Below 15, the index is in Extreme Fear. Meanwhile, CryptoQuant’s bull Score index is at 20, which is considered a bearish signal and reduces the likelihood of a bullish rally in the near term. If the index, which measures market sentiment for Bitcoin, remains below the critical threshold of 40 for an extended period, it could signal continued bearish conditions.

Bitcoin tests the 50-week SMA – is a bear market coming?

Technically, BTC is at a key junction. On the weekly chart, BTC is testing the 50-week simple moving average. This is considered by some the dynamic support that separates a bull and bear market for Bitcoin. Should the price break below the 50 SMA, this could suggest that Bitcoin has fallen into a bear market, with more losses likely. However, should this key support hold, a recovery in the price could be possible.

Meanwhile, the daily chart is flashing bearish signals as the 50 SMA crosses below the 50 SMA in a death cross pattern. A meaningful break below 76k could signal a deeper correction towards 70k.

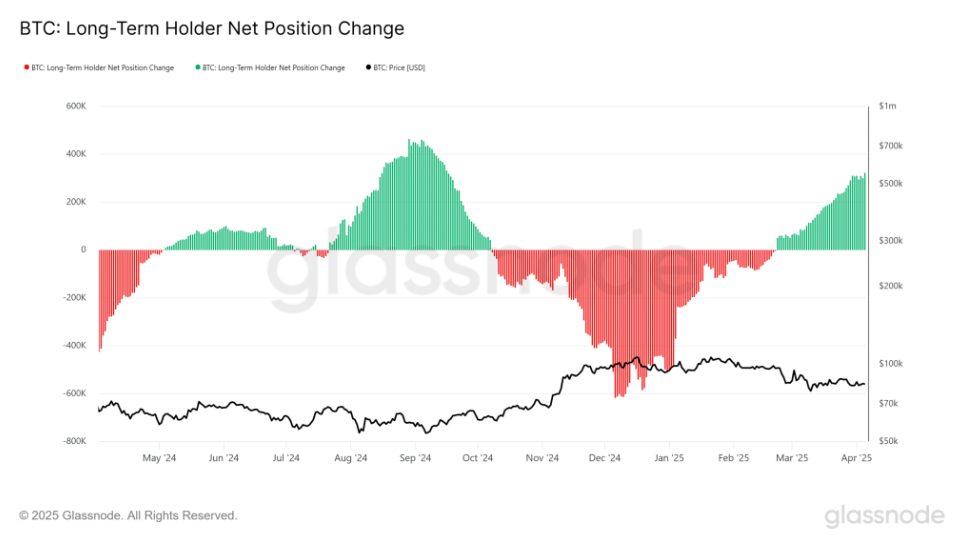

Long-term holders accumulate

In times of high volatility, it’s worth keeping in mind that Bitcoin is a long-term play. Its value is in decentralisation and its finite nature. Its seen extreme volatility in the past and will likely see it again in the future.

Short-term holder supply (less than 155 days) has fallen to a 2-month low of 3.7 million BTC, reflecting approximately 3 million BTC in realized losses amid Bitcoin’s retracement from its $109k all-time high. Meanwhile, long-term holder supply expanded across the same period. The Net Change metric indicates aggressive accumulation at an average cost basis of $ 84,000. This signals conviction.

Persistent LTH accumulation, if combined with a decoupling from US equities, could be critical for BTC to reclaim 90k.

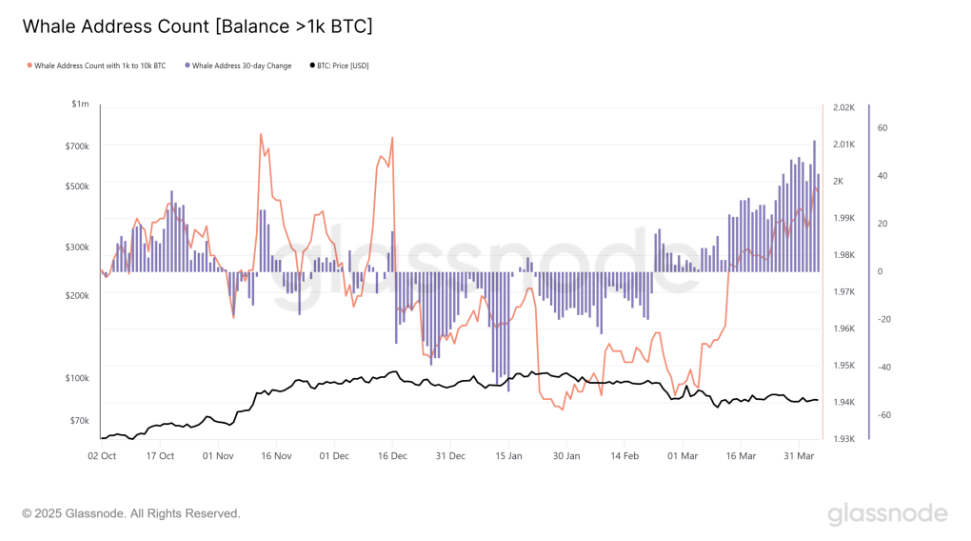

Over the past three weeks, whale cohorts (more significant than 1,000 BTC) have aggressively accumulated, pushing holdings to a two-month high.

These signs of accumulation will be closely monitored this week and must be maintained if Bitcoin is to recover in the near term.

Fundamentally, a recovery will depend on how the rest of the world responds to Trump’s trade tariffs, whether the US administration can lay out a plausible long-term plan, and what the Federal Reserve does to address current instability.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.