Bitcoin gained 5% last week, marking its second straight week of gains, which resulted in the price soaring 15% in just two weeks. The price started the previous week at 60k before falling to 57k early on and then powering higher to reach a peak of just over 64k on Friday. BTC/USD trades around 63.50 at the start of the new week.

The bullish market mood last week helped lift tokens such as Ether and Solana by 6%, BNB by 4.5%, and AVAX by 8%. However, not all altcoins performed well, with DOT, TON, and UNI booking losses across the previous week.

Bitcoin’s price rose alongside the S&P 500, which gained 1.5% last week after rallying 4.5% the previous week.

Bitcoin soars as the Fed cuts rates

The price of Bitcoin and other risk assets jumped following the Federal Reserve’s interest rate cut, which saw the US central bank reduce rates from a 22-year high. The Fed slashed rates by 50 basis points to 4.75%—5%, marking the first rate cut in four years. The Fed cutting rates appears to be a welcome development for Bitcoin bulls, as it signals looser financial conditions and, therefore, more liquidity.

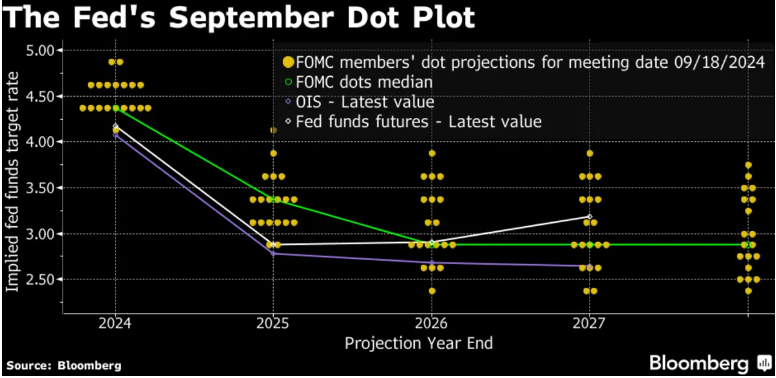

The Fed’s dot plot, which lays out where policymakers see interest rates going, pointed to a further 50 basis points worth of rate cuts this year, with a 25 basis point cut in November and a further 25 basis point cut in December. The market is pricing in 75 basis points worth of cuts this year. However, the Fed also warned that the neutral rate will likely be higher than it was previously.

While the Fed has said that it’s comfortable that inflation is cooling towards the 2% target level, Fed chair Powell also reassured over the health of the US economy and explained that the central bank opted for a larger rate cut in order to keep the US economy on track for a soft landing. Federal Reserve chair Jerome Powell’s words calmed any lingering recession worries.

However, should incoming data start to deteriorate, pointing to a hard landing, it could make investors nervous and quickly stoke five recession fears. This could lead to Bitcoin reversing lower even if rates are cut further.

Bitcoin & S&P 500 correlation remains strong

The cryptocurrency and the S&P 500 have seen similar price patterns over the past few months.

Both Bitcoin and the S&P500 have benefitted from the Federal Reserve cutting interest rates by a bumper 50 basis points, signaling the start of a rate-cutting cycle. Bitcoin has recovered from a low of 53k on September 6, jumping 17% and adding over $200 billion in market capitalization.

Meanwhile, the S&P500 has added nearly $3 trillion in market cap since its recovery from the September 6 low, with almost $1 trillion in market capitalization added since the Federal Reserve cut interest rates on September 18th.

The rising correlation could be traced to the increased participation of institutional players in the crypto market through the launch of Bitcoin and Ethereum exchange-traded funds. Furthermore, the correlation also suggests that macro factors are a key influence for crypto amid a lack of crypto-specific drivers.

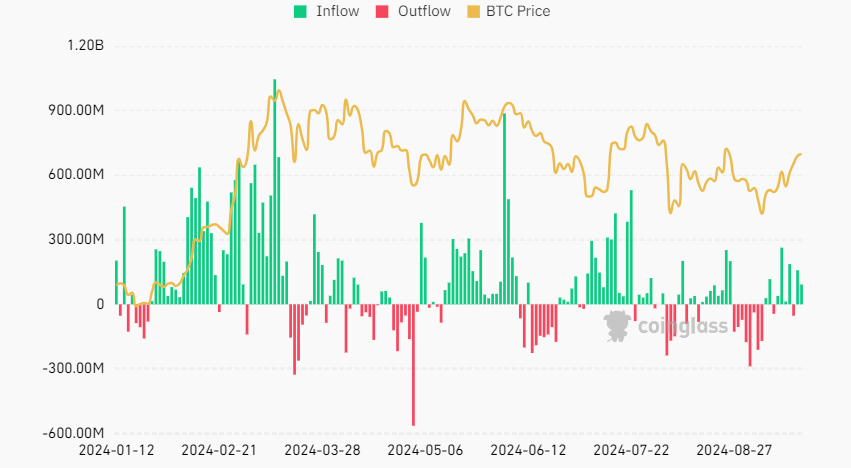

Bitcoin ETF inflows

Bitcoin’s positive price movement coincided with significant inflows into spot Bitcoin ETFs. According to Farside data, Bitcoin ETFs recorded $158.3 million inflows on September 19, one day after the Fed cut rates. Meanwhile, Bitcoin ETFs have set a high of $17.7 billion inflows year to date.

Bitcoin ETFs already make up 5% of Bitcoin’s total market cap despite only being approved nine months ago. This is compared to gold ETFs, which account for 1% of the total gold market cap despite existing for 22 years.

Moreover, on Friday, the US Securities and Exchange Commission (SEC) approved the listing and trading of options for asset managers BlackRock spot Bitcoin exchange-traded fund on the NASDAQ. This marks a significant milestone as it opens up new avenues for investors to trade in Bitcoin-based options through a regulated financial product. The decision will likely attract more liquidity, which in turn will attract larger players, particularly institutional players, into the market.

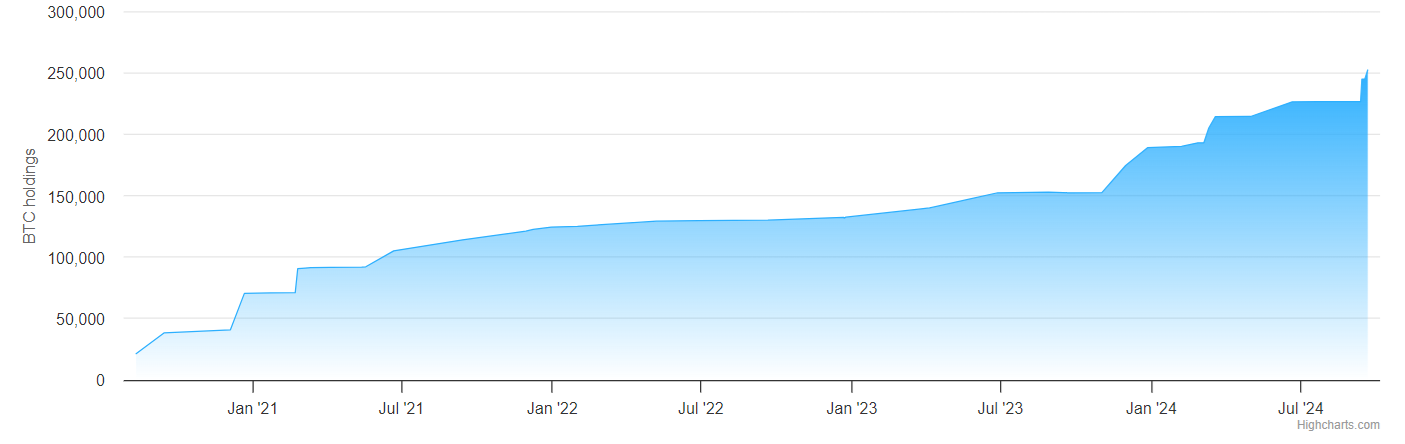

Micro strategy buys an additional $489 million worth of Bitcoin

MicroStrategy purchased an additional 7420 Bitcoin for approximately $489 million. This takes the company’s holdings to over 252,000 Bitcoins worth more than $15 billion, substantially increasing shareholders’ value. Since 2020, MicroStrategy has adopted a Bitcoin-focused corporate strategy to take advantage of Bitcoin’s potential as an inflation hedge and store of value.

MicroStrategy BTC holdings:

MicroStrategy has borrowed money by issuing convertible senior notes to fund its Bitcoin purchases. It recently raised over $1 billion through the note offerings, partly to acquire more Bitcoin. The company could reap huge benefits if Bitcoin continues to appreciate.

Week Ahead

After the Fed’s rate cut last week, this week’s focus will be on a key inflation measure, speeches from several Federal Reserve officials, Jerome Powell, and PMI data.

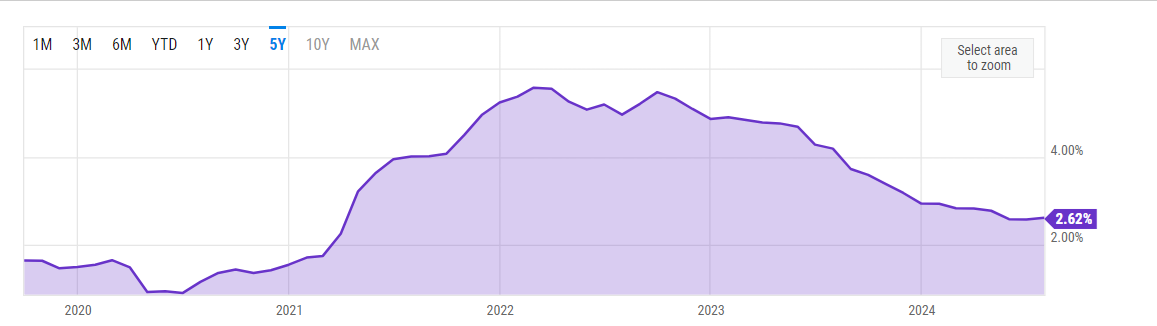

US core -PCE

US core PCE, the Federal Reserve’s preferred gauge for inflation, will be released on Friday, and the market will be keen to see if price pressures have continued to ease as the central bank starts to cut interest rates. Economists expect core PCE to rise to 2.7% YoY in August, up from 2.6%. According to the Fed’s projections, inflation is expected to ease to 2.3% by the end of the year and 2.1% by the end of 2025.

Source: Ychart

This week, the US economic calendar also includes the second reading of Q2 GDP, consumer confidence, durable goods orders, and PMI data.

Cooling inflation and upbeat data could boost demand for Bitcoin. However, any sense the US economy is slowing sharply could unnerve investors and pull Bitcoin and other risk assets lower.

Fed speakers

Comments by Federal Reserve officials in the coming days could shed more light on the central bank’s decision for an outsized rate cut last week. Federal Reserve chair Jerome Powell is set to speak on Thursday at the 10th annual U.S. Treasury market conference. New York Fed President John Williams and Vice Chair of Supervision Michael Barr will speak at the event.

Volatility

Bitcoin traded over 6% higher in September, a month that is traditionally bearish for Bitcoin. Bitcoin typically fares better after interest rate cuts and has rallied on optimism of a lower rate environment. However, if US data fails to support the view that the economy is heading for a soft landing, the recent market rally could be tested.

The market could also start to become more sensitive to the close election between Donald Trump and Kamala Harris. Recent polls show them virtually tied, which in itself creates uncertainty.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.